By Barbara Kollmeyer, MarketWatch

Asian stocks tumble, with techs bearing the brunt

U.S. stock futures tumbled Thursday, with selling so intense at

one point that circuit breakers were triggered, after the arrest of

a Huawei executive reignited trade worries that helped drag

equities to their worst session since early October on Tuesday.

The market was closed

(http://www.marketwatch.com/story/what-george-hw-bushs-funeral-means-for-stock-market-bond-traders-commodities-2018-12-03)

Wednesday to mark a national day of mourning for former President

George H.W. Bush, who died Friday at 94.

How did the benchmarks fare?

Futures for the Dow Jones Industrial Average were down 332

points, or 1.3%, at 24,715, while those for the S&P 500 index

were off 34.20 points to 2,667.50, a loss of 1.3%, while Nasdaq-100

futures tumbled 117.25 points, or 1.7%, at 6,686.25.

On Tuesday, the Dow sank 799.36 points, or 3.1%, to 25,027.07,

while the S&P 500 index dropped 90.31 points, or 3.2%, to

2,700.06. The Nasdaq Composite Index tumbled 283.09 points, or

3.8%, to 7,158.43. All three benchmarks had their worst day since

Oct. 10.

Read:The worst-performing stocks on 'Tariff Man' Tuesday

(http://www.marketwatch.com/story/here-are-the-worst-performing-stocks-on-tariff-man-tuesday-2018-12-04)

What drove the market?

While regular trading was closed Wednesday, there was a

shortened session of electronic trading for stock-index futures

that showed Dow futures bouncing 100 points. When futures reopened

Thursday, the drop was so severe on S&P 500 futures that the

Chicago Mercantile Exchange triggered circuit breakers

(https://www.fxleaders.com/news/2018/12/06/es-futures-crash-on-reopen-cme-intervenes/)

to avoid worse losses. Those futures spiked down to 2,659, a drop

of 1.9% before the CME stopped trading briefly to try to calm the

market, said Chris Weston, head of research at Pepperstone.

Already jittery investors were rattled further by news that the

Canadian authorities had arrested Meng Wanzhou

(http://www.marketwatch.com/story/huawei-cfo-arrested-in-canada-at-us-request-for-allegedly-breaking-iran-sanctions-2018-12-05),

the chief financial officer of Huawei Technologies, at the request

of U.S. authorities for allegedly violating sanctions against Iran.

The arrest, which was made on Dec. 1, comes as the U.S. has taken

several steps to restrict the Chinese technology giant, trying to

persuade international allies to do the same.

China authorities reacted furiously, with the spokesperson of

the Chinese Embassy in Canada demanding the release of the Huawei

executive (http://ca.china-embassy.org/eng/sgxw/t1619426.htm). "At

the request of the U.S. side, the Canadian side arrested a Chinese

citizen not violating any American or Canadian law," said a

statement on its website. Huawei itself said it was "unaware of any

wrongdoing by Ms. Meng," in a statement released on Twitter.

(https://twitter.com/Huawei/status/1070491220441423872)

The latest development comes amid an already shaky backdrop for

trade relations between the U.S. and China. Doubts surrounding the

weekend trade moratorium at the G-20 summit between the two sides

and ominous developments in the bond market drove sharp losses for

stocks Tuesday.

Investors are also facing a heavy load of economic data Thursday

and the start of a two-day OPEC meeting. That data batch includes

ADP employment for November that will be released at 8:15 a.m.

Eastern Time, followed by weekly jobless claims, the October trade

deficit and third quarter productivity and unit labor costs, all at

8:30 a.m. Eastern.

The Institute for Supply Management's nonmanufacturing index for

November will be released at 10 a.m. Eastern, along with October

factory orders and the quarterly services survey for the third

quarter.

What are strategists saying?

"The timing of the arrest is key here. Markets are already

incredibly nervous over slowing economic growth thanks to the

inverted U.S. yield curve. Relations between the U.S. and China

were supposed to be on the mend after a productive G-20. However,

the arrest has the potential to shatter very fragile U.S.--Sino

relations which will weigh further on global trade and growth

concerns," said Jasper Lawler, head of research at London Capital

Group, in a note to clients.

And "despite recent heavy selloffs, the bottom isn't in sight

and the markets have further to fall. The big swings of late are

representative of a very jittery market," added Lawler.

Read: December historically is the most wonderful time of the

year for stocks

(http://www.marketwatch.com/story/december-historically-is-the-most-wonderful-time-of-the-year-for-stocks-2018-12-03)

What are other markets doing?

Asian stocks fell sharply across the board

(http://www.marketwatch.com/story/asian-markets-plunge-led-by-tech-stocks-after-huawei-execs-arrest-2018-12-05),

with the bulk of losses hitting tech stocks, and the Hong Kong Hang

Seng Index bearing the brunt of losses, dropping nearly 3%. FTSE

100 futures were also pointing to a 1% opening drop.

Benchmark U.S. crude lost 1.2% to $52.25 a barrel. Brent crude ,

used to price international oils, declined 0.8% to $61.09, as

traders awaited clarity on a possible, but far-from-assured, output

cut by major producers gathering in Vienna

(http://www.marketwatch.com/story/oil-prices-slip-as-jitters-persist-around-opec-production-meeting-outcome-2018-12-05).

OPEC will hold its official meeting on Thursday, with another

key meeting between the group's members and nonmember allies to be

held Friday.

Gold prices traded steady, along with the ICE Dollar Index .

(END) Dow Jones Newswires

December 06, 2018 02:16 ET (07:16 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

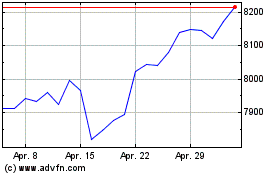

FTSE 100

Index Chart

Von Mär 2024 bis Apr 2024

FTSE 100

Index Chart

Von Apr 2023 bis Apr 2024