U.S. Dollar Mixed After U.S. Retail Sales Data

15 November 2018 - 10:19AM

RTTF2

The U.S. dollar came in mixed against its key counterparts in

the European session on Thursday, after the release of nation's

retail sales data for October, which advanced more than economist

expectations.

Data from the Commerce Department showed that U.S. retail sales

advanced 0.8 percent in October following a revised 0.1 percent dip

in September.

Economists had expected retail sales to climb by 0.5

percent.

Data from the Labor Department showed that first-time claims for

U.S. unemployment benefits increased slightly in the week ended

November 10.

The report said initial jobless claims inched up to 216,000, an

increase of 2,000 from the previous week's unrevised level of

214,000. Economists had expected jobless claims to edge down to

212,000.

Separate data showed that U.S. import and export prices both

rose more than expected in the month of October.

The import prices climbed 0.5 percent and export prices rose 0.4

percent in October.

The currency declined against its major counterparts in the

Asian session, excepting the franc.

The greenback held steady against the pound, after having risen

to a new 2-week high of 1.2751 at 5:15 am ET. At Wednesday's close,

the pair was worth 1.2985.

Data from the Office for National Statistics showed that U.K.

retail sales declined for a second straight month in October,

defying expectations for an increase, amid a sharp decrease in

sales of household goods.

Sales volume including automotive fuel dropped 0.5 percent from

September, when they fell 0.4 percent, revised from a 0.8 percent

slump. Economists had forecast a 0.2 percent increase.

The greenback rose to 1.1271 against the euro, from an early

6-day low of 1.1351, and held steady thereafter. The pair closed

yesterday's deals at 1.1307.

The greenback retreated to 1.0047 against the franc, from an

early high of 1.0077, and moved sideways thereafter. The currency

had already set a weekly low of 1.0039 at 3:30 am ET. The

greenback-franc pair was worth 1.0057 at yesterday's close.

Extending early decline, the greenback slipped to an 8-day low

of 113.26 versus the yen. The greenback finished Wednesday's

trading at 113.61 against the yen. If the greenback drops further,

112.00 is seen as its next support level.

The U.S. business inventories for September are set for release

at 10:00 am ET.

Federal Reserve Governor Randal Quarles will testify on banking

supervision and regulation before the Senate Banking Committee in

Washington DC at 10:00 am ET.

At 11:30 am ET, Federal Reserve Chair Jerome Powell will speak

about Hurricane Harvey recovery efforts at an event hosted by the

Federal Reserve Bank of Dallas in Houston.

Atlanta Fed President Raphael Bostic is scheduled to speak about

monetary policy at the Global Interdependence Center in Madrid at

1:00 pm ET.

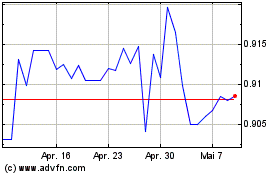

US Dollar vs CHF (FX:USDCHF)

Forex Chart

Von Mär 2024 bis Apr 2024

US Dollar vs CHF (FX:USDCHF)

Forex Chart

Von Apr 2023 bis Apr 2024