Schaeffler Confirms Group Guidance, Adjusts Division Forecasts

19 September 2018 - 8:21AM

Dow Jones News

By Nathan Allen

Schaeffler AG (SHA.XE) confirmed its guidance for 2018 at group

level on Wednesday, while making some adjustments to forecasts for

individual divisions.

The German automotive supplier expects revenue growth of between

5% and 6% on a constant-currency basis, and free cash flow before

mergers and acquisitions of around 450 million euros ($525.7

million). The margin on earnings before interest and taxes and

before special items should be between 10.5% and 11.5%, Schaeffler

said.

Schaeffler cut the revenue growth forecast at its automotive OEM

division by around 1.5 percentage points to between 4.5% and 5.5%

to reflect lower demand in China and Europe.

However, the group also said it now expects revenue at its

industrial division to grow by between 8% and 9%, compared with a

previous estimate of 6% to 7%.

The restatement comes in the wake of a profit warning from

fellow automotive supplier Continental AG (CON.XE), which lowered

its guidance for the second time this year, citing softer demand

for cars in Europe and China and higher costs.

Schaeffler Chief Executive Klaus Rosenfeld said the group was

operating in a challenging environment but that it could still hit

its targets.

"This is possible because we are both an automotive and an

industrial supplier," he said.

Write to Nathan Allen at nathan.allen@dowjones.com

(END) Dow Jones Newswires

September 19, 2018 02:06 ET (06:06 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

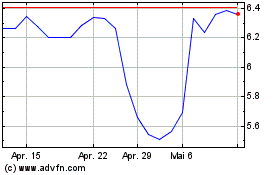

Schaeffler (TG:SHA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

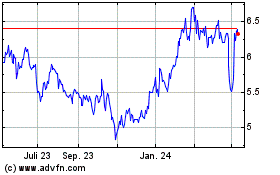

Schaeffler (TG:SHA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024