Pound Climbs As U.K. Jobless Rate Falls To 43-year Low

14 August 2018 - 8:31AM

RTTF2

The pound spiked up against its major counterparts in the

European session on Tuesday, after a data showed that the nation's

jobless rate unexpectedly fell to a 43-year-low in the three months

to June.

Data from the Office for National Statistics showed that the

jobless rate fell to 4 percent in the three months ended June, down

from 4.2 percent in the three months ended May. The rate was the

lowest since February 1975.

The figure matched economists' expectations.

The number of people in work increased by 42,000 to 32.39

million. Economists had forecast employment growth of 93,000.

The employment rate stood at 75.7 percent in the three months to

June, the highest since comparable records began in 1971.

The currency has been trading higher against its major

counterparts in the Asian session, with the exception of the

euro.

The pound appreciated 0.6 percent to a 4-day high of 1.2827

against the greenback, from a low of 1.2753 touched at 5:00 pm ET.

The pound is poised to challenge resistance around the 1.30

mark.

The U.K. currency climbed to a 4-day high of 142.47 versus the

yen, after having fallen to 141.08 at 8:00 pm ET. The pound is seen

finding resistance around the 145.00 level.

Preliminary figures from the Ministry of Economy, Trade and

Industry showed that Japan's industrial production decreased less

than initially estimated in June.

Industrial production dropped a seasonally-adjusted 1.8 percent

month-over-month in June, faster than the 0.2 percent fall in the

previous month. That was slower than the 2.1 percent decline in the

flash data.

The pound added 0.6 percent to hit a 4-day high of 1.2729

against the franc, following a decline to 1.2656 at 5:00 pm ET. The

pound is likely to test resistance around the 1.30 mark.

The U.K. currency spiked up to 0.8896 against the euro, its

strongest since August 6. Next key resistance for the pound is seen

around the 0.87 region.

Survey data from the Centre for European Economic Research

showed that Germany's economic confidence improved more than

expected in August.

The ZEW Indicator of Economic Sentiment climbed notably to -13.7

in August from -24.7 in July. Looking ahead, at 8:00 am ET, German

final CPI for July will be out.

In the New York session, U.S. import and export prices for July

are scheduled for release.

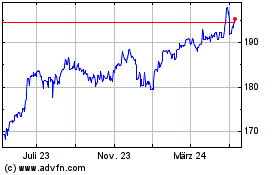

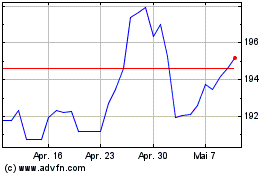

Sterling vs Yen (FX:GBPJPY)

Forex Chart

Von Mär 2024 bis Apr 2024

Sterling vs Yen (FX:GBPJPY)

Forex Chart

Von Apr 2023 bis Apr 2024