LONDON MARKETS: U.K.'s FTSE 100 Ends Lower As Turkey Worries Hit Travel Industry's Stocks

13 August 2018 - 6:27PM

Dow Jones News

By Victor Reklaitis, MarketWatch

TUI, Thomas Cook shares lose ground

The U.K.'s main stock index closed in negative territory Monday,

joining a global downdraft that has been attributed to worries

about Turkey's precarious financial condition.

Travel-related shares with exposure to Ankara were among the

worst performers.

How markets are performing

The FTSE 100 fell 0.3% to end at 7,642.45, after tumbling 1% on

Friday

(http://www.marketwatch.com/story/ftse-100-pulled-down-as-turkey-contagion-concerns-grow-2018-08-10)

as concerns over Turkey escalated.

The British blue-chip gauge is showing a drop of 0.6%, for the

year to date.

The pound was buying $1.2762, down slightly from $1.2771 late

Friday in New York.

What's moving markets

Stocks in the U.K. and the rest of Europe have been selling off

on fears about potential contagion from Turkey's problems,

especially in the banking sector.

The country's central bank on Monday made policy moves

(http://www.marketwatch.com/story/turkeys-central-bank-fails-to-soothe-investors-2018-08-13)

that failed to alleviate concerns among investors. It pledged to

provide "all the liquidity the banks need" in a statement. It also

said banks would be able to borrow foreign-exchange deposits from

the central bank at a one-month maturity and one-week

maturities.

Analysts said Turkey's reluctance to raise interest rates stood

out.

See:Turkish lira hits fresh low as Erdogan's currency crisis

echoes through markets

(http://www.marketwatch.com/story/turkish-lira-hits-fresh-low-as-erdogans-currency-crisis-echoes-through-stock-markets-2018-08-12)

What are strategists saying?

"The central bank has said it will take 'all necessary measures'

to ensure financial stability and will take steps to ensure

liquidity is provided. But in stopping short of actually raising

rates, we must question if the central bank has the arsenal to

combat this currency rout and avoid a financial crisis in Turkey,"

said Neil Wilson, chief market analyst for Markets.com, in a

note.

"As well as banks, we note that travel and tourism stocks with

exposure to Turkey, like Thomas Cook, TUI and easyJet, were among

the heavier fallers today," Wilson added.

Stocks in focus

Shares in TUI AG finished down 2.9%, while easyJet PLC (EZJ.LN)

managed to shake off early losses, ending higher by 0.1%.

Over on the mid-cap FTSE 250, Thomas Cook Group PLC's stock

(TCG.LN) closed down by 2.5%.

Shares in Paddy Power Betfair PLC dropped 1.9% after the

gambling company was downgraded to sell from neutral by Citigroup

analysts, who reportedly cited factors such as disappointment with

its online business and its Australian unit.

(END) Dow Jones Newswires

August 13, 2018 12:12 ET (16:12 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

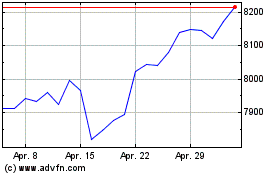

FTSE 100

Index Chart

Von Mär 2024 bis Apr 2024

FTSE 100

Index Chart

Von Apr 2023 bis Apr 2024