Surgery Partners, Inc. (NASDAQ:SGRY) ("Surgery Partners" or

the "Company"), a leading provider of surgical services, today

announced results for the second quarter ended June 30, 2018.

- Revenues increased 54.2% to $444.8 million

- Surgical cases increased 17.8% to 131,646

- Net loss attributable to common stockholders of $27.4

million

- Adjusted EBITDA increased 49.5% to $55.4 million

- Diluted net loss per share of $(0.57)

- Reiterates full-year 2018 guidance

Wayne DeVeydt, Chief Executive Officer of Surgery Partners,

stated, “Our second quarter results were highlighted by strong year

over year revenue and surgical case growth, as well as continued

investments in our infrastructure that position the Company for

long-term success. During the quarter, we made excellent progress

in realigning our organizational structure with our strategic and

financial goals. We are confident that these organizational and

structural changes will improve operational efficiency and energize

our team as we focus on building a strong, sustainable short stay

surgical business that can capitalize on opportunities and deliver

strong growth.”

Mr. DeVeydt continued, “Looking ahead to the balance of 2018, we

firmly believe that prioritizing investments in areas such as

physician recruitment, revenue cycle management, and procurement

will drive organic growth across our business and leave us well

positioned to make real progress towards our goal of becoming the

trusted partner of choice for operating short stay surgical

facilities across the United States. As we build out our

distinctive and scalable platform and drive a more efficient and

effective operation, we are confident our initiatives will pay

dividends in the back half of 2018 and will continue to accelerate

into 2019.”

Tom Cowhey, Chief Financial Officer of Surgery Partners,

commented, “Second quarter results were encouraging, with same

facility revenues up 3% for the quarter, driven by strong rate and

mix, as well as improving volume dynamics compared to the first

quarter of 2018. We are pleased to reiterate our full year guidance

this morning, as we anticipate building upon this positive momentum

across our business and watching our strategic initiatives manifest

in our results during the back half of the year.”

Second Quarter 2018 Results

Total revenues for the second quarter of 2018 increased 54.2%

to $444.8 million from $288.4 million for the

second quarter of 2017. Same-facility revenues for the second

quarter of 2018 increased 3.0% from the same period last year, with

a 4.5% increase in revenue per case offset by a 1.4% decrease in

same facility cases. For the second quarter of 2018, the Company’s

net loss attributable to common stockholders was $27.4 million

compared to $4.5 million for the same period last year. For

the second quarter of 2018, the Company’s Adjusted EBITDA increased

49.5% to $55.4 million compared to $37.1

million for the same period last year.

Year to Date 2018 Results

Total revenues year to date 2018 increased 50.1% to $862.1

million from $574.5 million for the same period last

year. Same-facility revenues year to date 2018 increased 1.3% from

the same period last year, with a 4.1% increase in revenue per case

offset by a 2.7% decrease in same facility cases. For year to date

2018, the Company’s net loss attributable to common stockholders

was $52.7 million compared to $7.2 million for the

same period last year. For year to date 2018, the Company’s

Adjusted EBITDA increased 32.8% to $102.5

million compared to $77.2 million for the same

period last year.

Liquidity

Surgery Partners had cash and cash equivalents

of $96.1 million at June 30, 2018 and availability

of approximately $72 million under its revolving credit

facility. Net operating cash inflow, including operating cash flow

less distributions to non-controlling interests, was $14.7

million for the second quarter of 2018. The Company’s ratio of

total net debt to EBITDA, as calculated under the Company’s credit

agreement was 7.96x at the end of the second quarter of 2018.

Guidance

The Company is maintaining the full-year 2018 guidance range

issued on the fourth quarter 2017 earnings call of revenue and

Adjusted EBITDA in excess of $1.75 billion and $240 million,

respectively. The Company continues to expect to deploy $80-100

million in capital for acquisitions in FY’18.

Conference Call Information

Surgery Partners will hold a conference call today, August

9, 2018 at 8:30 a.m. (Eastern Time). The conference call

can be accessed live over the phone by dialing 1-877-451-6152, or

for international callers, 1-201-389-0879. A replay will be

available two hours after the call and can be accessed by dialing

1-844-512-2921, or for international callers, 1-412-317-6671. The

passcode for the live call and the replay is 13682037. The replay

will be available until August 23, 2018.

Interested investors and other parties may also listen to a

simultaneous webcast of the conference call by logging onto the

Investor Relations section of the Company's website

at www.surgerypartners.com. The on-line replay will remain

available for a limited time beginning immediately following the

call.

To learn more about Surgery Partners, please visit the

company's website at www.surgerypartners.com. Surgery

Partners uses its website as a channel of distribution for

material Company information. Financial and other material

information regarding Surgery Partners is routinely

posted on the Company's website and is readily accessible.

About Surgery Partners

Headquartered in Brentwood, Tennessee, Surgery Partners is a

leading healthcare services company with a differentiated

outpatient delivery model focused on providing high quality, cost

effective solutions for surgical and related ancillary care in

support of both patients and physicians. Founded in 2004, Surgery

Partners is one of the largest and fastest growing surgical

services businesses in the country, with more than 180 locations in

32 states, including ambulatory surgery centers, surgical

hospitals, a diagnostic laboratory, multi-specialty physician

practices and urgent care facilities. For additional information,

visit www.surgerypartners.com.

Forward-Looking Statements

This press release contains forward-looking statements,

including those regarding growth and our anticipated operating

results for 2018 and other similar statements. These statements can

be identified by the use of words such as “believes,”

“anticipates,” “expects,” “intends,” “plans,” “continues,”

“estimates,” “predicts,” “projects,” “forecasts,” and similar

expressions. All forward looking statements are based on current

expectations and beliefs as of the date of this release and are

subject to risks, uncertainties and assumptions that could cause

actual results to differ materially from those discussed in, or

implied by, the forward-looking statements, including but not

limited to, the risks identified and discussed from time to time in

the Company’s reports filed with the SEC, including the Company’s

Annual Report on Form 10-K for the year ended

December 31, 2017. Except as required by law, the Company

undertakes no obligation to revise or update publicly any

forward-looking statements to reflect events or circumstances after

the date of this report, or to reflect the occurrence of

unanticipated events or circumstances.

Use of Non-GAAP Financial Measures

In addition to the results prepared in accordance with generally

accepted accounting principles in the United

States ("GAAP") provided throughout this press release,

Surgery Partners has presented the following non-GAAP financial

measures: EBITDA, Adjusted EBITDA and adjusted net (loss) income,

which exclude various items detailed in the attached

"Reconciliation of Non-GAAP Financial Measures".

These non-GAAP financial measures are not intended to replace

financial performance measures determined in accordance with GAAP.

Rather, they are presented as supplemental measures of the

Company's performance that management believes may enhance the

evaluation of the Company's ongoing operating results. These

non-GAAP financial measures are not presented in accordance with

GAAP, and the Company’s computation of these non-GAAP financial

measures may vary from those used by other companies. These

measures have limitations as an analytical tool, and should not be

considered in isolation or as a substitute or alternative to net

income or loss, operating income or loss, cash flows from operating

activities, total indebtedness or any other measures of operating

performance, liquidity or indebtedness derived in accordance with

GAAP.

In connection with the Preferred Private Placement and the

Private Sale, as previously disclosed on Form 8-K filed with the

Securities and Exchange Commission on September 1, 2017, the

Company elected to apply “pushdown” accounting with the change of

control effective August 31, 2017, by applying the guidance in

Accounting Standards Codification Topic ("ASC") 805, Business

Combinations. Accordingly, the consolidated financial statements of

the Company for periods before and after August 31, 2017 will

reflect different bases of accounting, and the financial positions

and results of operations of those periods are not comparable.

Throughout the Company's condensed consolidated financial

statements and the accompanying notes therein to be filed on August

9, 2018, periods prior to the change of control are identified as

"Predecessor" and periods after the change of control are

identified as "Successor."

SURGERY PARTNERS,

INC.SELECTED CONSOLIDATED FINANCIAL

DATA(Amounts in thousands, except shares and per

share amounts)

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

|

2018 |

|

2017 |

|

2018 |

|

2017 |

| |

|

|

|

|

|

|

|

|

| Revenues |

|

$ |

444,775 |

|

|

$ |

288,353 |

|

|

$ |

862,144 |

|

|

$ |

574,536 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

| Salaries

and benefits |

|

134,020 |

|

|

90,022 |

|

|

263,755 |

|

|

179,909 |

|

|

Supplies |

|

121,148 |

|

|

74,084 |

|

|

235,578 |

|

|

145,244 |

|

|

Professional and medical fees |

|

36,713 |

|

|

22,577 |

|

|

72,392 |

|

|

43,702 |

|

| Lease

expense |

|

21,920 |

|

|

13,674 |

|

|

43,281 |

|

|

27,300 |

|

| Other

operating expenses |

|

26,289 |

|

|

16,095 |

|

|

52,396 |

|

|

32,245 |

|

| Cost of

revenues |

|

340,090 |

|

|

216,452 |

|

|

667,402 |

|

|

428,400 |

|

| General

and administrative expenses (1) |

|

26,099 |

|

|

18,655 |

|

|

50,251 |

|

|

34,196 |

|

|

Depreciation and amortization |

|

16,685 |

|

|

11,417 |

|

|

32,434 |

|

|

22,525 |

|

| Provision

for doubtful accounts |

|

8,196 |

|

|

5,788 |

|

|

14,233 |

|

|

11,463 |

|

| Income

from equity investments |

|

(2,560 |

) |

|

(1,052 |

) |

|

(4,422 |

) |

|

(2,252 |

) |

| Loss on

disposals and deconsolidations, net |

|

3,197 |

|

|

405 |

|

|

3,244 |

|

|

1,601 |

|

|

Transaction and integration costs |

|

11,639 |

|

|

2,904 |

|

|

16,672 |

|

|

3,241 |

|

| Gain on

litigation settlement |

|

— |

|

|

(3,794 |

) |

|

— |

|

|

(3,794 |

) |

| Other

income |

|

(2,132 |

) |

|

(161 |

) |

|

(2,394 |

) |

|

(304 |

) |

| Total

operating expenses |

|

401,214 |

|

|

250,614 |

|

|

777,420 |

|

|

495,076 |

|

| Operating

income |

|

43,561 |

|

|

37,739 |

|

|

84,724 |

|

|

79,460 |

|

| Interest expense,

net |

|

(35,933 |

) |

|

(25,600 |

) |

|

(70,209 |

) |

|

(50,782 |

) |

| Income

before income taxes |

|

7,628 |

|

|

12,139 |

|

|

14,515 |

|

|

28,678 |

|

| Income tax expense |

|

3,318 |

|

|

512 |

|

|

5,080 |

|

|

2,629 |

|

| Net

income |

|

4,310 |

|

|

11,627 |

|

|

9,435 |

|

|

26,049 |

|

| Less: Net income

attributable to non-controlling interests |

|

(23,772 |

) |

|

(16,098 |

) |

|

(46,418 |

) |

|

(33,274 |

) |

| Net loss

attributable to Surgery Partners, Inc. |

|

(19,462 |

) |

|

(4,471 |

) |

|

(36,983 |

) |

|

(7,225 |

) |

| Less: Amounts

attributable to participating securities (2) |

|

(7,956 |

) |

|

— |

|

|

(15,728 |

) |

|

— |

|

| Net loss

attributable to common stockholders |

|

$ |

(27,418 |

) |

|

$ |

(4,471 |

) |

|

$ |

(52,711 |

) |

|

$ |

(7,225 |

) |

|

|

|

|

|

|

|

|

|

|

| Net loss per share

attributable to common stockholders |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.57 |

) |

|

$ |

(0.09 |

) |

|

$ |

(1.10 |

) |

|

$ |

(0.15 |

) |

| Diluted

(3) |

|

$ |

(0.57 |

) |

|

$ |

(0.09 |

) |

|

$ |

(1.10 |

) |

|

$ |

(0.15 |

) |

| Weighted average common

shares outstanding |

|

|

|

|

|

|

|

|

|

Basic |

|

48,016,264 |

|

|

48,145,729 |

|

|

48,011,593 |

|

|

48,112,909 |

|

| Diluted

(3) |

|

48,016,264 |

|

|

48,145,729 |

|

|

48,011,593 |

|

|

48,112,909 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Includes contingent acquisition compensation

expense of $0.5 million and $1.8 million for the three months ended

June 30, 2018 and 2017, respectively, and $1.0 million and $3.8

million for the six months ended June 30, 2018 and 2017,

respectively.

(2) Includes dividends accrued during the three

and six months ended June 30, 2018 for the Series A Preferred

Stock. The Series A Preferred Stock does not participate in

undistributed losses. There were no participating securities during

the three and six months ended June 30, 2017.

(3) The impact of potentially dilutive

securities for all periods presented was not considered because the

effect would be anti-dilutive in those periods.

SURGERY PARTNERS,

INC.Selected Financial and Operating

Data(Amounts in thousands, except shares and per

share amounts)

| |

|

|

|

|

|

|

|

|

| |

|

June 30,2018 |

|

December 31,2017 |

| |

|

|

|

|

| Balance Sheet

Data (at period end): |

|

|

|

|

| Cash and cash

equivalents |

|

$ |

96,069 |

|

|

$ |

174,914 |

|

| Total current

assets |

|

472,799 |

|

|

563,225 |

|

| Total assets |

|

4,583,730 |

|

|

4,622,773 |

|

| |

|

|

|

|

| Current maturities of

long-term debt |

|

53,650 |

|

|

58,726 |

|

| Total current

liabilities |

|

296,766 |

|

|

303,005 |

|

| Long-term debt, less

current maturities |

|

2,122,629 |

|

|

2,130,556 |

|

| Total liabilities |

|

2,665,664 |

|

|

2,656,041 |

|

| |

|

|

|

|

| Non-controlling

interests—redeemable |

|

320,948 |

|

|

299,316 |

|

| Redeemable preferred

stock |

|

342,648 |

|

|

330,806 |

|

| |

|

|

|

|

| Total Surgery Partners,

Inc. stockholders' equity |

|

598,047 |

|

|

654,731 |

|

| Non-controlling

interests—non-redeemable |

|

656,423 |

|

|

681,879 |

|

| Total stockholders'

equity |

|

1,254,470 |

|

|

1,336,610 |

|

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

|

2018 |

|

2017 |

|

2018 |

|

2017 |

| |

|

|

|

|

|

|

|

|

| Cash Flow

Data: |

|

|

|

|

|

|

|

|

| Net cash provided by

(used in): |

|

|

|

|

|

|

|

|

| Operating

activities |

|

$ |

39,584 |

|

|

$ |

21,601 |

|

|

$ |

69,640 |

|

|

$ |

56,471 |

|

| Investing

activities |

|

(18,408 |

) |

|

(22,570 |

) |

|

(54,822 |

) |

|

(29,195 |

) |

| Capital

expenditures |

|

(5,960 |

) |

|

(8,752 |

) |

|

(15,943 |

) |

|

(15,102 |

) |

| Payments

for acquisitions, net of cash acquired |

|

(22,305 |

) |

|

(13,888 |

) |

|

(47,894 |

) |

|

(14,163 |

) |

| Financing

activities |

|

(37,923 |

) |

|

2,037 |

|

|

(93,663 |

) |

|

(39,941 |

) |

|

Distributions to non-controlling interests |

|

(24,857 |

) |

|

(17,579 |

) |

|

(55,776 |

) |

|

(36,841 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

|

2018 |

|

2017 |

|

2018 |

|

2017 |

| |

|

|

|

|

|

|

|

|

| Other

Data: |

|

|

|

|

|

|

|

|

| Number of surgical

facilities as of the end of period |

|

124 |

|

|

103 |

|

|

124 |

|

|

103 |

|

| Number of consolidated

surgical facilities as of the end of period |

|

106 |

|

|

93 |

|

|

106 |

|

|

93 |

|

| |

|

|

|

|

|

|

|

|

| Cases |

|

131,646 |

|

|

111,758 |

|

|

256,504 |

|

|

220,587 |

|

| Revenue per case |

|

$ |

3,379 |

|

|

$ |

2,580 |

|

|

$ |

3,361 |

|

|

$ |

2,605 |

|

| Adjusted EBITDA |

|

$ |

55,400 |

|

|

$ |

37,055 |

|

|

$ |

102,477 |

|

|

$ |

77,162 |

|

| Adjusted EBITDA as a %

of revenues |

|

12.5 |

% |

|

12.9 |

% |

|

11.9 |

% |

|

13.4 |

% |

| Adjusted EPS-

Basic |

|

$ |

(0.18 |

) |

|

$ |

(0.01 |

) |

|

$ |

(0.44 |

) |

|

$ |

0.03 |

|

| Adjusted EPS-

Diluted |

|

$ |

(0.18 |

) |

|

$ |

(0.01 |

) |

|

$ |

(0.44 |

) |

|

$ |

0.03 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SURGERY PARTNERS,

INC.Supplemental

Information(Amounts in thousands, except cases and

growth rates)

| |

|

|

|

|

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

|

2018 |

|

2017 |

|

2018 |

|

2017 |

| |

|

|

|

|

|

|

|

|

| Same-facility

Information: |

|

|

|

|

|

|

|

|

| Cases (4) |

|

141,875 |

|

|

143,933 |

|

|

276,193 |

|

|

283,843 |

|

| Case growth |

|

(1.4 |

)% |

|

N/A |

|

|

(2.7 |

)% |

|

N/A |

|

| Revenue per case

(4) |

|

$ |

3,345 |

|

|

$ |

3,201 |

|

|

$ |

3,343 |

|

|

$ |

3,210 |

|

| Revenue per case

growth |

|

4.5 |

% |

|

N/A |

|

|

4.1 |

% |

|

N/A |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

(4) Same-facility revenues include revenues from our

consolidated and non-consolidated surgical facilities (excluding

facilities acquired in new markets or divested during the current

and prior periods) along with the revenues from our ancillary

services comprised of a diagnostic laboratory, multi-specialty

physician practices, urgent care facilities, anesthesia services,

optical services and specialty pharmacy services that complement

our surgical facilities in our existing markets.

| |

|

|

|

|

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

|

2018 |

|

2017 |

|

2018 |

|

2017 |

| |

|

|

|

|

|

|

|

|

| Segment

Revenues: |

|

|

|

|

|

|

|

|

| Surgical facility

services |

|

$ |

420,404 |

|

|

$ |

262,810 |

|

|

$ |

814,470 |

|

|

$ |

520,960 |

|

| Ancillary services |

|

21,592 |

|

|

22,640 |

|

|

41,936 |

|

|

47,852 |

|

| Optical services |

|

2,779 |

|

|

2,903 |

|

|

5,738 |

|

|

5,724 |

|

| Total

revenues |

|

$ |

444,775 |

|

|

$ |

288,353 |

|

|

$ |

862,144 |

|

|

$ |

574,536 |

|

| |

|

|

|

|

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

|

2018 |

|

2017 |

|

2018 |

|

2017 |

| |

|

|

|

|

|

|

|

|

| Adjusted

EBITDA: |

|

|

|

|

|

|

|

|

| Surgical facility

services |

|

$ |

75,547 |

|

|

$ |

49,946 |

|

|

$ |

142,014 |

|

|

$ |

98,187 |

|

| Ancillary services |

|

996 |

|

|

429 |

|

|

2,050 |

|

|

4,211 |

|

| Optical services |

|

691 |

|

|

883 |

|

|

1,516 |

|

|

1,659 |

|

| All other |

|

(21,834 |

) |

|

(14,203 |

) |

|

(43,103 |

) |

|

(26,895 |

) |

| Total

adjusted EBITDA |

|

$ |

55,400 |

|

|

$ |

37,055 |

|

|

$ |

102,477 |

|

|

$ |

77,162 |

|

| |

SURGERY PARTNERS,

INC.Reconciliation of Non-GAAP Financial

Measures(Amounts in thousands)

The following table reconciles Adjusted EBITDA

to income before income taxes in the reported condensed

consolidated financial information, the most directly comparable

U.S. GAAP financial measure:

| |

|

|

|

|

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

|

2018 |

|

2017 |

|

2018 |

|

2017 |

| Condensed

Consolidated Statements of Operations Data (5): |

|

|

|

|

|

|

|

|

| Income before

income taxes |

|

$ |

7,628 |

|

|

$ |

12,139 |

|

|

$ |

14,515 |

|

|

$ |

28,678 |

|

| Minus: |

|

|

|

|

|

|

|

|

| Net

income attributable to non-controlling interests |

|

23,772 |

|

|

16,098 |

|

|

46,418 |

|

|

33,274 |

|

| Plus: |

|

|

|

|

|

|

|

|

| Interest

expense, net |

|

35,933 |

|

|

25,600 |

|

|

70,209 |

|

|

50,782 |

|

|

Depreciation and amortization |

|

16,685 |

|

|

11,417 |

|

|

32,434 |

|

|

22,525 |

|

|

EBITDA |

|

36,474 |

|

|

33,058 |

|

|

70,740 |

|

|

68,711 |

|

| Plus (minus): |

|

|

|

|

|

|

|

|

|

Equity-based compensation expense |

|

2,780 |

|

|

1,435 |

|

|

4,777 |

|

|

2,069 |

|

|

Transaction, integration and acquisition costs (6) |

|

12,445 |

|

|

4,137 |

|

|

17,930 |

|

|

4,728 |

|

| Reserve

adjustments (7) |

|

— |

|

|

— |

|

|

4,779 |

|

|

— |

|

| Loss on

disposals and deconsolidations, net |

|

3,197 |

|

|

405 |

|

|

3,244 |

|

|

1,601 |

|

|

Contingent acquisition compensation expense |

|

504 |

|

|

1,814 |

|

|

1,007 |

|

|

3,847 |

|

| Gain on

litigation settlement |

|

— |

|

|

(3,794 |

) |

|

— |

|

|

(3,794 |

) |

| Adjusted

EBITDA |

|

$ |

55,400 |

|

|

$ |

37,055 |

|

|

$ |

102,477 |

|

|

$ |

77,162 |

|

|

|

(5) The above table reconciles Adjusted EBITDA to income before

income taxes as reflected in the unaudited condensed consolidated

statements of operations.

When we use the term “Adjusted EBITDA,” it is

referring to income before income taxes adjusted for: (a) net

income attributable to non-controlling interests,

(b) depreciation and amortization, (c) interest expense, net,

(d) equity-based compensation expense, (e) contingent acquisition

compensation expense, (f) transaction, integration and acquisition

costs, (g) reserve adjustments, (h) loss on disposals and

deconsolidations, net, and (i) gain on litigation settlement. We

use Adjusted EBITDA as a measure of financial performance. Adjusted

EBITDA is a key measure used by management to assess operating

performance, make business decisions and allocate resources.

Non-controlling interests represent the interests of third parties,

such as physicians, and in some cases, healthcare systems that own

an interest in surgical facilities that we consolidate for

financial reporting purposes. We believe that it is helpful to

investors to present Adjusted EBITDA as defined above because it

excludes the portion of net income attributable to these

third-party interests and clarifies for investors our portion of

Adjusted EBITDA generated by our surgical facilities and other

operations.

Adjusted EBITDA is not a measurement of

financial performance under GAAP, and should not be considered in

isolation or as a substitute for net income, operating income or

any other measure calculated in accordance with generally accepted

accounting principles. The items excluded from Adjusted EBITDA are

significant components in understanding and evaluating our

financial performance. We believes such adjustments are

appropriate, as the magnitude and frequency of such items can vary

significantly and are not related to the assessment of normal

operating performance. Our calculation of Adjusted EBITDA may not

be comparable to similarly titled measures reported by other

companies.

(6) This amount includes transaction and integration costs of

$11.6 million and $2.9 million for the three months ended

June 30, 2018 and 2017, respectively, and acquisition costs of

$0.8 million and $1.2 million for the three months ended

June 30, 2018 and 2017, respectively. This amount includes

transaction and integration costs of $16.7 million and $3.2 million

for the six months ended June 30, 2018 and 2017, respectively,

and acquisition costs of $1.2 million and $1.5 million for the six

months ended June 30, 2018 and 2017, respectively.

(7) This amount represents adjustments to

revenue in connection with applying consistent policies across the

combined company as a result of the integration of Surgery Partners

and NSH.

SURGERY PARTNERS,

INC.Reconciliation of Non-GAAP Financial

Measures(Amounts in thousands, except shares and

per share amounts)

From time to time, the Company incurs certain non-recurring

gains or losses that are normally nonoperational in nature and that

it does not consider relevant in assessing its ongoing operating

performance. When significant, Surgery Partners’ management and

Board of Directors typically exclude these gains or losses when

evaluating the Company’s operating performance and in certain

instances when evaluating performance for incentive compensation

purposes. Additionally, the Company believes that certain investors

and equity analysts exclude these or similar items when evaluating

the Company’s current or future operating performance and in making

informed investment decisions regarding the Company. Accordingly,

the Company provides adjusted net (loss) income per share

attributable to common stockholders as a supplement to its

comparable GAAP measure of net (loss) income per share attributable

to common stockholders. Adjusted net (loss) income per share

attributable to common stockholders should not be considered a

measure of financial performance under GAAP, and the items excluded

from adjusted net (loss) income per share attributable to common

stockholders are significant components in understanding and

assessing financial performance. Adjusted net (loss) income per

share attributable to common stockholders should not be considered

in isolation or as an alternative to net income per share

attributable to common stockholders as presented in the

consolidated financial statements.

The following table reconciles net income as reflected in the

consolidated statements of operations to adjusted net (loss) income

used to calculate adjusted net (loss) income per share attributable

to common stockholders:

| |

|

|

|

|

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

|

2018 |

|

2017 |

|

2018 |

|

2017 |

| |

|

|

|

|

|

|

|

|

| Consolidated

Statements of Operations Data: |

|

|

|

|

|

|

|

|

| Net Income |

|

$ |

4,310 |

|

|

$ |

11,627 |

|

|

$ |

9,435 |

|

|

$ |

26,049 |

|

| Minus: |

|

|

|

|

|

|

|

|

| Net

income attributable to non-controlling interests |

|

23,772 |

|

|

16,098 |

|

|

46,418 |

|

|

33,274 |

|

| Amounts

attributable to participating securities (8) |

|

7,956 |

|

|

— |

|

|

15,728 |

|

|

— |

|

| Plus (minus): |

|

|

|

|

|

|

|

|

|

Equity-based compensation expense |

|

2,780 |

|

|

1,435 |

|

|

4,777 |

|

|

2,069 |

|

|

Transaction, integration and acquisition costs |

|

12,445 |

|

|

4,137 |

|

|

17,930 |

|

|

4,728 |

|

| Reserve

adjustments |

|

— |

|

|

— |

|

|

4,779 |

|

|

— |

|

| Loss on

disposals and deconsolidations, net |

|

3,197 |

|

|

405 |

|

|

3,244 |

|

|

1,601 |

|

|

Contingent acquisition compensation expense |

|

504 |

|

|

1,814 |

|

|

1,007 |

|

|

3,847 |

|

| Gain on

litigation settlement |

|

— |

|

|

(3,794 |

) |

|

— |

|

|

(3,794 |

) |

| Adjusted net (loss)

income attributable to common stockholders |

|

$ |

(8,492 |

) |

|

$ |

(474 |

) |

|

$ |

(20,974 |

) |

|

$ |

1,226 |

|

|

|

|

|

|

|

|

|

|

|

| Adjusted net (loss)

income per share attributable to common stockholders |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.18 |

) |

|

$ |

(0.01 |

) |

|

$ |

(0.44 |

) |

|

$ |

0.03 |

|

| Diluted

(9) |

|

$ |

(0.18 |

) |

|

$ |

(0.01 |

) |

|

$ |

(0.44 |

) |

|

$ |

0.03 |

|

| Weighted average common

shares outstanding |

|

|

|

|

|

|

|

|

|

Basic |

|

48,016,264 |

|

|

48,145,729 |

|

|

48,011,593 |

|

|

48,112,909 |

|

| Diluted

(9) |

|

48,016,264 |

|

|

48,145,729 |

|

|

48,011,593 |

|

|

48,302,307 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(8) Includes dividends accrued during the three and six months

ended June 30, 2018 for the Series A Preferred Stock. The Series A

Preferred Stock does not participate in undistributed losses. There

were no participating securities during the three and six months

ended June 30, 2017.

(9) The impact of potentially dilutive securities for the three

months ended June 30, 2018 and 2017, and the six months ended June

30, 2018, was not considered because the effect would be

anti-dilutive in each of those periods.

Contact

Thomas F. Cowhey, Chief Financial OfficerSurgery Partners,

Inc.(615) 234-8940IR@surgerypartners.com

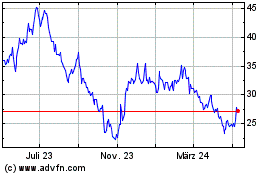

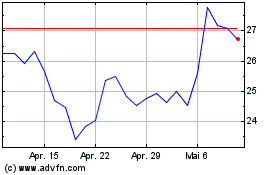

Surgery Partners (NASDAQ:SGRY)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Surgery Partners (NASDAQ:SGRY)

Historical Stock Chart

Von Apr 2023 bis Apr 2024