Maersk Cuts Profit Forecast as Shipping Slump Deepens

07 August 2018 - 8:18PM

Dow Jones News

By Costas Paris

A.P. Moeller-Maersk A/S, the world's biggest cargo carrier,

warned Tuesday its earnings would be weaker than expected this year

due to rising fuel prices, soft freight rates and escalating trade

tensions.

Maersk, which moves about 18% of all containers and is

considered a barometer of global trade, said it expects its core

profit this year to come in at $3.5 billion to $4.2 billion,

compared with previous guidance of between $4 billion and $5

billion.

The Danish freight carrier's warning comes after German rival

Hapag-Lloyd AG warned investors in June of weaker earnings this

year. Analysts expect lower results for the top operators, which

had briefly emerged from deep losses in 2017.

Maersk said its profit will be hit by a 28% increase in its fuel

bill and a 1.2% decline in average freight rates.

The company's shares tumbled after the warning, but quickly

recovered to close up 6.4% in Copenhagen trading. Analysts said the

profit warning was no surprise and pointed to Maersk's recent moves

to cut costs, including suspending unprofitable sailings from Asia

to the Americas.

Container shipping moves 98% of the world's manufactured goods,

but freight rates are about half of break-even levels across major

trade routes. Rates have declined despite a wave of consolidation

over the past two years that has resulted in only about a half

dozen global operators.

"The operators are less, but competition continues to eat us all

up because of rampant overcapacity," said a senior executive of a

European box-ship operator who asked not to be named. "Price wars

and undercutting is more fierce than ever."

With its previous 2018 guidance, Maersk was expecting an

underlying annual profit above the $365 million booked last year,

but without citing any numbers it now forecasts "a positive

underlying profit."

"We continue to encounter very high [fuel] prices, which we have

not been able to get fully compensated for in freight rates,

leading to an adjustment in our expectations for the full-year

2018." Maersk Chief Executive Soren Skou said.

Maersk said growing uncertainties from rising trade tensions

between the U.S., China and Europe are also weighing on its

results.

Rival carrier Overseas Orient Container Line, which recently was

acquired by Cosco Shipping Holdings Co., reported last week that

deteriorating global freight rates would likely push the company

into the red in the first half of the year. Another operator, Ocean

Network Express, lost $120 million in the second quarter as it

struggled to put its joint-venture business between Japan's three

big shipping lines into motion.

Container shipping prices have been trending upward in recent

weeks, particularly on trade from Asia to North America. But Drewry

Shipping Consultants Ltd. says prices for trade between Asia and

Europe, an important part of Maersk's network, are down from a year

ago.

Global shipping lines, which move $4 trillion worth of products

each year, stand to feel the effects of recent trade tariffs on $34

billion worth of Chinese products imported in the U.S., with

Beijing slapping similar levies on U.S. imports.

The moves affect engines, medical equipment, semiconductors and

other products that account for about 6% of total China-U.S

container trade capacity, according to the Journal of Commerce.

"Right now it only gets worse for shipping from the escalating

trade war, " said Peter Sand, chief shipping analyst at BIMCO, an

industry group. "Huge amounts of uncertainty is added."

Maersk has said the initial round of tariffs is expected to have

a small impact on its business, but "a continued escalation could

result in severe consequences for global trade."

Write to Costas Paris at costas.paris@wsj.com

(END) Dow Jones Newswires

August 07, 2018 14:03 ET (18:03 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

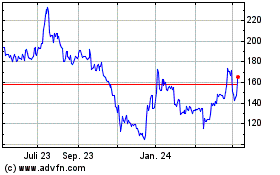

Hapag-Lloyd (TG:HLAG)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

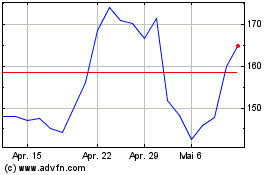

Hapag-Lloyd (TG:HLAG)

Historical Stock Chart

Von Apr 2023 bis Apr 2024