Please replace the release with the following corrected version

due to multiple numerical changes in the first table under

"Highlights" and Table 8.

The corrected release reads:

CADENCE BANCORPORATION REPORTS RECORD SECOND

QUARTER 2018 RESULTS AND INCREASE IN QUARTERLY DIVIDEND

Cadence Bancorporation (NYSE:CADE) (“Cadence”) today announced

net income for the quarter ended June 30, 2018 of $48.0 million, or

$0.57 per diluted common share (“per share”), compared to $38.8

million, or $0.46 per share, in the first quarter of 2018, and

$29.0 million, or $0.35 per share, in the second quarter of 2017.

Tangible book value per share(1) increased $0.53, or 4.3%, to

$12.85 per share for the second quarter of 2018, compared to $12.32

per share as of March 31, 2018. On July 20, 2018, the Board of

Directors of Cadence declared a 20% increase in the quarterly cash

dividend to $0.15 per share of common stock, representing an

annualized dividend of $0.60 per share.

“We are very pleased to report to you another consecutive

quarter of strong organic growth and record earnings for second

quarter of 2018,” stated Paul B. Murphy, Jr., Chairman and Chief

Executive Officer of Cadence Bancorporation. “Our performance for

the first half of the year has exceeded expectations with

annualized, double digit growth in the balance sheet and earnings

trending favorably. We have been fortunate to operate in attractive

markets with extraordinary bankers, focused on doing a great job

for clients and driving our financial results. We were excited to

announce our merger with State Bank in May and are well underway in

the integration planning to ensure a successful combination. I

believe this strategically compelling deal, combining two great

companies, will add to our attractive story in the future.”

(1) Considered a non-GAAP financial measure. See Table 7

“Reconciliation of Non-GAAP Financial Measures” for a

reconciliation of our non-GAAP measures to the most directly

comparable GAAP financial measure.

Highlights:

- Second quarter of 2018 net income was

$48.0 million, representing an increase of $9.1 million, or 23.6%,

compared to the first quarter of 2018 and an increase of $19.0

million, or 65.6%, compared to second quarter of 2017.

- On a per-share basis, net income was

$0.57 per share for the second quarter of 2018, compared to $0.46

per share for the first quarter of 2018, and $0.35 per share for

the second quarter of 2017.

- Annualized returns on average assets,

common equity and tangible common equity(1) for the second quarter

of 2018 were 1.72%, 14.16% and 18.58%, respectively, compared to

1.44%, 11.73% and 15.52%, respectively, for the first quarter of

2018, and 1.19%, 9.29% and 12.63%, respectively, for the second

quarter of 2017.

- A summary of non-routine items in the

second quarter of 2018 are included in the table below. See Table 8

– Non-Routine Income/Expense for more information related to

non-routine items and comparative period information.

After-tax Increase(Decrease) in

(In thousands, except per share

data)

Income/Expense

EPS

ROA

ROTCE

Noninterest income (non-routine) $ 3,058 $ 0.03 0.08

% 0.91 % Noninterest expense (non-routine) (3,066 )

(0.03 ) (0.08 ) (0.91 ) Tax expense - Timing of legacy loan bad

debt deduction for tax 5,991

0.07

0.21

2.32

Total $ 5,983 $

0.07

0.21

%

2.32

%

- Loans were $9.0 billion as of June 30,

2018, an increase of $328.8 million, or 3.8%, as compared to $8.6

billion at March 31, 2018, and an increase of $1.3 billion, or

16.3%, as compared to $7.7 billion at June 30, 2017.

- Core deposits (total deposits excluding

brokered) were $8.7 billion as of June 30, 2018, up $451.1 million,

or 5.5%, from March 31, 2018, and up $1.5 billion, or 20.8%, from

June 30, 2017.

- Total revenue for the second quarter of

2018 was $120.1 million, up 3.4% from the linked quarter and up

13.9% from the same period in 2017 driven by strong loan, core

deposit, and spread income growth due to a favorably positioned,

asset-sensitive balance sheet benefiting from rising short-term

rates.

- Our fully tax-equivalent net interest

margin (“NIM”) for the second quarter of 2018 was 3.66%, an

increase from 3.64% for the first quarter of 2018 and a decrease

from 3.71% for the second quarter of 2017, reflecting our asset

sensitivity. Our NIM excluding recovery accretion for

acquired-impaired loans was 3.64% for the second quarter of 2018,

up 2 bp from 3.62% in the first quarter of 2018 and up 13 bp from

3.51% in the second quarter of 2017.

- The efficiency ratio(1) for the second

quarter of 2018 was 52.0%, an improvement from both linked and

prior quarter efficiency ratios of 53.4% and 53.3%, respectively.

The improvement in the efficiency ratio reflects ongoing focus on

managing expenses and expanding revenue. Second quarter 2018

revenues increased $4.0 million over first quarter 2018 and $14.7

million over second quarter 2017. The second quarter of 2018

included non-routine revenues and expenses, including a $4.9

million pre-tax gain on the sale of the assets of our insurance

company, $1.8 million net loss on sales of securities, $1.2 million

of secondary offering expenses, $0.8 million of acquisition related

costs and $1.1 million of expenses related to the sale of the

assets of our insurance company. Excluding these non-routine

revenues and expenses, the adjusted efficiency ratio(1) was 50.7%

for the second quarter of 2018. This compares to an adjusted

efficiency ratio of 50.2% and 53.1% for the first quarter of 2018

and second quarter of 2017, respectively. See Table 8 – Non-Routine

Income/Expense for more information related to non-routine

items.

- Total nonperforming assets declined

21.9% during the second quarter 2018, a decrease of $15.9 million

to $56.8 million, or 0.6% of total loans, OREO and other NPAs.

Total nonperforming assets have dropped $84.6 million, or 59.8%,

from $141.4 million, or 1.8% of total loans, OREO and other NPAs,

as of June 30, 2017.

(1) Considered a non-GAAP financial measure. See Table 7

“Reconciliation of Non-GAAP Financial Measures” for a

reconciliation of our non-GAAP measures to the most directly

comparable GAAP financial measure.

Balance Sheet:

Cadence continued its solid growth during the quarter with total

assets reaching $11.3 billion as of June 30, 2018, an increase of

$306.1 million, or 2.8%, from March 31, 2018, and an increase of

$1.5 billion, or 15.2%, from June 30, 2017.

Loans at June 30, 2018 were $9.0 billion, an increase of

$328.8 million, or 3.8%, from March 31, 2018, and an increase of

$1.3 billion, or 16.3%, from June 30, 2017. Average loans for the

second quarter of 2018 were $8.8 billion, an increase of $404.9

million, or 4.8%, from first quarter of 2018, and an increase of

$1.2 billion, or 15.7%, from second quarter of 2017. Increases in

loans reflect continued demand primarily in our specialized and

general C&I portfolios compared to linked quarter and in our

specialized, general C&I and residential portfolios compared to

prior year.

Total deposits at June 30, 2018 were $9.3 billion, an

increase of $282.1 million, or 3.1%, from March 31, 2018, and an

increase of $1.4 billion, or 17.7%, from June 30, 2017. Average

total deposits for the second quarter of 2018 were $9.1 billion, an

increase of $123.0 million, or 1.4%, from first quarter of 2018,

and an increase of $1.2 billion, or 15.0%, from second quarter of

2017.

- Deposit increases reflect growth in

core deposits, specifically with success in expanding commercial

deposit relationships and treasury management services.

- Noninterest bearing deposits as a

percent of total deposits were 22.9%, compared to 22.6% at March

31, 2018 and 23.4% at June 30, 2017.

- The year-over-year core deposit growth

supported a $93.8 million reduction in brokered deposits since June

30, 2017. As of June 30, 2018, brokered deposits totaled $649.3

million, or 7.0% of total deposits, down from 9.0% of total

deposits at March 31, 2018 and down from 9.4% of total deposits at

June 30, 2017, respectively.

Shareholders’ equity was $1.4 billion at June 30, 2018,

an increase of $32.9 million from March 31, 2018, and an increase

of $85.9 million from June 30, 2017.

- Tangible common shareholder’s equity(1)

was $1.1 billion at June 30, 2018, an increase of $44.5 million

from March 31, 2018, and an increase of $100.5 million from June

30, 2017. Tangible book value per share(1) increased $0.53, or

4.3%, to $12.85 per share for the second quarter of 2018, compared

to $12.32 per share as of March 31, 2018, driven by strong earnings

growth and goodwill recovery due to the sale of the assets of our

insurance company.

- In June 2018, Cadence paid a $0.125 per

common share dividend totaling $10.5 million.

- In November 2017, February 2018 and May

2018, Cadence completed secondary offerings whereby its controlling

stockholder, Cadence Bancorp LLC, sold 10,925,000, 9,200,000 and

20,700,000 of Cadence Bancorporation shares, respectively, reducing

its ownership in Cadence to 76.6%, 65.6% and 40.9%, respectively.

All proceeds from these transactions were received by Cadence

Bancorp LLC and did not impact Cadence Bancorporation’s equity or

outstanding shares.

(1) Considered a non-GAAP financial measure. See Table 7

“Reconciliation of Non-GAAP Financial Measures” for a

reconciliation of our non-GAAP measures to the most directly

comparable GAAP financial measure.

Asset Quality:

Credit quality metrics reflected continued improvement in

the energy portfolio and general credit stability in the second

quarter of 2018.

- Net-charge offs for the quarter ended

June 30, 2018 were $2.2 million, compared to $0.4 million for the

three months ended March 31, 2018 and $1.8 million for the three

months ended June 30, 2017. Annualized net-charge offs as a percent

of average loans for the quarter ended June 30, 2018 were 0.10%,

compared to 0.06%, for the full year of 2017. Total second quarter

2018 charge-offs of $3.7 million and recoveries of $1.5 million

were primarily due to two seasoned energy credits that have been in

active resolution.

- NPAs totaled $56.8 million, or 0.6%, of

total loans, OREO and other NPAs as of June 30, 2018, compared to

$72.7 million, or 0.8%, as of March 31, 2018, and down from $141.4

million, or 1.8%, as of June 30, 2017.

- The allowance for credit losses (“ACL”)

was $90.6 million, or 1.01% of total loans, as of June 30, 2018, as

compared to $91.5 million, or 1.06% of total loans, as of March 31,

2018 and $93.2 million, or 1.21% of total loans, as of June 30,

2017. The year-over-year decline in the ACL as a percentage of

total loans resulted primarily from the reduction in non-performing

loans and related valuation reserves (largely from the energy

portfolio) and improved environmental factors in the energy sector

over the past year.

Total Revenue:

Total revenue for the second quarter of 2018 was $120.1 million,

up 3.4% from the linked quarter and up 13.9% from the same period

in 2017. The revenue increases were primarily a result of both

strong loan growth during the period and meaningful increases in

net interest margins.

Net interest income for the second quarter of 2018 was

$95.4 million, an increase of $4.3 million, or 4.7%, from the first

quarter of 2018 and an increase of $13.0 million, or 15.8%, from

the same period in 2017, reflecting strong growth in our earning

assets combined with increases in net interest margin.

- Our fully tax-equivalent net interest

margin (“NIM”) for the second quarter of 2018 was 3.66% as compared

to 3.64% for the first quarter of 2018 and 3.71% for the second

quarter of 2017. The linked quarter increase in NIM is primarily a

result of our asset sensitive balance sheet and earning asset

yields increasing more significantly than our funding costs in the

recent rising rate environment. Our NIM excluding recovery

accretion for acquired-impaired loans was 3.64%, 3.62% and 3.51%

for the second quarter of 2018, first quarter of 2018 and second

quarter of 2017 respectively.

- Earning asset yields for the second

quarter of 2018 were 4.75%, up 24 basis points from 4.51% in the

first quarter of 2018, and up 30 basis points from 4.45% in the

second quarter of 2017, driven by increases in loan yields.

- Over 71% of our loan portfolio is

floating rate and has benefited from the short-term rate increases

during the periods.

- Yield on loans, excluding

acquired-impaired loans, increased meaningfully to 5.04% for the

second quarter of 2018, as compared to 4.81% and 4.36% for the

first quarter of 2018 and second quarter of 2017,

respectively.

- Total accretion for acquired-impaired

loans was $5.6 million in the second quarter of 2018, essentially

flat from the first quarter of 2018 and down $4.9 million from the

second quarter of 2017. The year-over-year decline in accretion was

due to recovery timing. Recovery accretion was $0.6 million, $0.4

million and $4.5 million for the second quarter of 2018, first

quarter of 2018 and second quarter of 2017, respectively.

- Total loan yields increased to 5.16%

for the second quarter of 2018 versus 4.94% for the first quarter

of 2018 and 4.74% for the second quarter of 2017.

- Total cost of funds for the second

quarter of 2018 was 118 basis points versus 94 basis points in the

linked quarter and 81 basis points in the second quarter of 2017.

- Total cost of deposits for the second

quarter of 2018 was 98 basis points versus 75 basis points in the

linked quarter and 59 basis points in the second quarter of 2017,

due primarily to rising interest rates as well as approximately

$1.2 billion in our “Up CD” product that reset on April 1, 2018

based on the semi-annual reset schedule with the index rate

increasing 50 basis points from the first quarter of 2018. This

increase in Up CD rates accounted for 8 basis points of the

quarterly increase in cost of deposits. Over $600 million of the Up

CDs are scheduled to mature by year end 2018.

Noninterest income for the second quarter of 2018 was

$24.7 million, a decrease of $0.3 million, or 1.2%, from the first

quarter of 2018, and an increase of $1.7 million, or 7.3%, from the

same period of 2017.

- Total service fees and revenue for the

second quarter of 2018 were $21.4 million, a decrease of $2.5

million, or 10.5%, from the first quarter of 2018, and a decrease

of $0.7 million, or 3.4%, from the same period of 2017. The second

quarter of 2018 decrease compared to the linked quarter was driven

by the decrease in insurance revenue due to the sale of the assets

of our insurance company. Compared to the prior year’s quarter,

decreases in trust services revenue, insurance revenue and mortgage

banking revenue were partially offset by increases in

credit-related fees and investment advisory revenue.

- Total other noninterest income for the

second quarter of 2018 was $3.3 million, an increase of $2.2

million from the first quarter of 2018, and an increase of $2.4

million from the same period of 2017. The increase from linked

quarter was largely a result of the $4.9 million pre-tax gain on

sale of the assets of our insurance company, offset by a $1.8

million loss from the sale of certain securities within tax-exempt

investment securities portfolio. See Table 8 – Non-Routine

Income/Expense for more information related to non-routine

items.

Noninterest expense for the second quarter of 2018 was

$62.4 million, an increase of $0.5 million, or 0.8%, from $61.9

million for the first quarter of 2018, and an increase of $6.3

million, or 11.2%, from $56.1 million during the same period in

2017. The linked quarter included an increase of $0.9 million in

salaries and benefits, offset by decreases in consulting and

professional fees and legal expenses. The increase in expenses from

the prior year’s quarter was due to a $3.6 million growth in

salaries and benefits driven by business growth and related

incentives, $1.2 million in consulting and professional fees and

other expenses related to the May 2018 secondary offering, $1.1

million in expenses related to the sale of the assets of our

insurance company and $0.8 million in other expenses specific to

acquisition related costs. Adjusted noninterest expenses(1) of

$59.3 million for the second quarter of 2018 was up slightly from

$58.3 million in the first quarter of 2018 and up 5.8% from the

second quarter of 2017 total of $56.1 million. See Table 8 –

Non-Routine Income/Expense for information related to non-routine

items.

Our efficiency ratio(1) for the second quarter of 2018

was 52.0%, as compared to the first quarter of 2018 and second

quarter of 2017 ratios of 53.4% and 53.3%, respectively. The

improvement in the efficiency ratio reflects ongoing focus on

managing expenses and expanding revenue. The second quarter of 2018

included non-routine revenues and expenses. Excluding these

non-routine revenues and expenses, the adjusted efficiency ratio(1)

was 50.7% for the second quarter of 2018. This compares to an

adjusted efficiency ratio of 50.2% and 53.1% for the first quarter

of 2018 and second quarter of 2017, respectively. See Table 8 –

Non-Routine Income/Expense for more information related to

non-routine items.

(1) Considered a non-GAAP financial measure. See Table 7

“Reconciliation of Non-GAAP Financial Measures” for a

reconciliation of our non-GAAP measures to the most directly

comparable GAAP financial measure.

Taxes:

The effective tax rate for the quarter ended June 30, 2018 was

14.9% as compared to 22.0% in the first quarter of 2018 and 31.9%

in the second quarter of 2017. The decreased rate in the second

quarter of 2018 was due primarily to a one-time bad debt deduction

related to the legacy loan portfolio. Our annualized effective tax

rate for 2018 is currently expected to be approximately 21.1%.

Quarterly Dividend:

On July 20, 2018, the Board of Directors of Cadence declared a

20% increase in the quarterly cash dividend to the amount of $0.15

per share of common stock, representing an annualized dividend of

$0.60 per share. The dividend will be paid on September 17, 2018 to

holders of record of the Class A common stock on September 4,

2018.

Supplementary Financial Tables

(Unaudited):

Supplementary Financial Tables (Unaudited) are included in this

release following the customary disclosure information.

Second Quarter 2018 Earnings Conference

Call:

Cadence Bancorporation executive management will host a

conference call to discuss second quarter 2018 results on Monday,

July 23, 2018, at 12:00 p.m. CT / 1:00 p.m. ET. Slides to be

presented by management on the conference call can be viewed by

visiting www.cadencebancorporation.com and selecting “Events &

Presentations” then “Event Calendar”.

Conference Call Access:

To access the conference call, please dial one of the following

numbers approximately 10-15 minutes prior to the start time to

allow time for registration, and use the Elite Entry Number

provided below.

Dial in (toll free): 1-888-317-6003

International dial in: 1-412-317-6061 Canada (toll free):

1-866-284-3684 Participant Elite Entry Number: 3865570

For those unable to participate in the live presentation, a

replay will be available through August 6, 2018. To access the

replay, please use the following numbers:

US Toll Free: 1-877-344-7529

International Toll: 1-412-317-0088 Canada Toll Free: 1-855-669-9658

Replay Access Code: 10121734 End Date: August 6, 2018

Webcast Access:

A webcast of the conference call as well as the slides to be

presented by management can be viewed by visiting

www.cadencebancorporation.com and selecting “Events &

Presentations” then “Event Calendar”.

About Cadence Bancorporation

Cadence Bancorporation (NYSE:CADE) is an $11.3 billion in assets

regional bank holding company headquartered in Houston, Texas.

Through its affiliates, Cadence operates 65 locations in Alabama,

Florida, Texas, Mississippi and Tennessee, and provides

corporations, middle-market companies, small businesses and

consumers with a full range of innovative banking and financial

solutions. Services and products include commercial and business

banking, treasury management, specialized lending, commercial real

estate, foreign exchange, wealth management, investment and trust

services, financial planning, retirement plan management, business

and personal insurance, consumer banking, consumer loans,

mortgages, home equity lines and loans, and credit cards. Clients

have access to leading-edge online and mobile solutions,

interactive teller machines, and 56,000 ATMs. The Cadence team of

1,200 associates is committed to exceeding customer expectations

and helping their clients succeed financially. Cadence Bank, N.A.,

and Linscomb & Williams are subsidiaries of Cadence

Bancorporation.

Cautionary Statement Regarding Forward-Looking

Information

This communication contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These forward-looking statements reflect our current views

with respect to, among other things, future events and our results

of operations, financial condition and financial performance. These

statements are often, but not always, made through the use of words

or phrases such as “may,” “should,” “could,” “predict,”

“potential,” “believe,” “will likely result,” “expect,” “continue,”

“will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,”

“projection,” “would” and “outlook,” or the negative version of

those words or other comparable words of a future or

forward-looking nature. These forward-looking statements are not

historical facts, and are based on current expectations, estimates

and projections about our industry, management’s beliefs and

certain assumptions made by management, many of which, by their

nature, are inherently uncertain and beyond our control.

Accordingly, we caution you that any such forward-looking

statements are not guarantees of future performance and are subject

to risks, assumptions and uncertainties that are difficult to

predict. Although we believe that the expectations reflected in

these forward-looking statements are reasonable as of the date

made, actual results may prove to be materially different from the

results expressed or implied by the forward-looking statements.

Such factors include, without limitation, the “Risk Factors”

referenced in our Registration Statement on Form S-3 filed with the

Securities and Exchange Commission (SEC), other risks and

uncertainties listed from time to time in our reports and documents

filed with the SEC, including our Annual Reports on Form 10-K and

Quarterly Reports on Form 10-Q, and the following factors: business

and economic conditions generally and in the financial services

industry, nationally and within our current and future geographic

market areas; economic, market, operational, liquidity, credit and

interest rate risks associated with our business; lack of seasoning

in our loan portfolio; deteriorating asset quality and higher loan

charge-offs; the laws and regulations applicable to our business;

our ability to achieve organic loan and deposit growth and the

composition of such growth; increased competition in the financial

services industry, nationally, regionally or locally; our ability

to maintain our historical earnings trends; our ability to raise

additional capital to implement our business plan; material

weaknesses in our internal control over financial reporting;

systems failures or interruptions involving our information

technology and telecommunications systems or third-party servicers;

the composition of our management team and our ability to attract

and retain key personnel; the fiscal position of the U.S. federal

government and the soundness of other financial institutions; the

composition of our loan portfolio, including the identify of our

borrowers and the concentration of loans in energy-related

industries and in our specialized industries; the portion of our

loan portfolio that is comprised of participations and shared

national credits; and the amount of nonperforming and classified

assets we hold. Cadence can give no assurance that any goal or plan

or expectation set forth in forward-looking statements can be

achieved and readers are cautioned not to place undue reliance on

such statements. The forward-looking statements are made as of the

date of this communication, and Cadence does not intend, and

assumes no obligation, to update any forward-looking statement to

reflect events or circumstances after the date on which the

statement is made or to reflect the occurrence of unanticipated

events or circumstances, except as required by applicable law.

About Non-GAAP Financial Measures

Certain of the financial measures and ratios we present,

including “efficiency ratio,” “adjusted efficiency ratio,”

“adjusted noninterest expenses,” “adjusted operating revenue,”

“tangible common equity ratio,” “tangible book value per share” and

“return on average tangible common equity” and “pre-tax,

pre-provision net earnings,” are supplemental measures that are not

required by, or are not presented in accordance with, U.S.

generally accepted accounting principles (GAAP). We refer to these

financial measures and ratios as “non-GAAP financial measures.” We

consider the use of select non-GAAP financial measures and ratios

to be useful for financial and operational decision making and

useful in evaluating period-to-period comparisons. We believe that

these non-GAAP financial measures provide meaningful supplemental

information regarding our performance by excluding certain

expenditures or assets that we believe are not indicative of our

primary business operating results or by presenting certain metrics

on a fully taxable equivalent basis. We believe that management and

investors benefit from referring to these non-GAAP financial

measures in assessing our performance and when planning,

forecasting, analyzing and comparing past, present and future

periods.

These non-GAAP financial measures should not be considered a

substitute for financial information presented in accordance with

GAAP and you should not rely on non-GAAP financial measures alone

as measures of our performance. The non-GAAP financial measures we

present may differ from non-GAAP financial measures used by our

peers or other companies. We compensate for these limitations by

providing the equivalent GAAP measures whenever we present the

non-GAAP financial measures and by including a reconciliation of

the impact of the components adjusted for in the non-GAAP financial

measure so that both measures and the individual components may be

considered when analyzing our performance. A reconciliation of

non-GAAP financial measures to the comparable GAAP financial

measures is included at the end of the financial statement tables

(Table 7).

Table 1 - Selected Financial

Data

As of and for the Three Months Ended (In

thousands, except share and per share data)

June 30,2018

March 31,2018

December 31,2017

September 30,2017

June 30,2017

Statement of Income Data:

Interest income $ 123,963 $ 113,093 $ 108,370 $ 99,503 $ 99,375

Interest expense 28,579 21,982 20,459

18,340 16,991 Net interest income 95,384 91,111 87,911

81,163 82,384 Provision for credit losses 1,263 4,380

(4,475 ) 1,723 6,701 Net interest income after

provision 94,121 86,731 92,386 79,440 75,683 Noninterest income -

service fees and revenue 21,395 23,904 22,405 23,014 22,144 - other

noninterest income 3,277 1,079 3,251 4,110 845 Noninterest expense

62,435 61,939 66,371 56,530

56,134 Income before income taxes 56,358 49,775 51,671 50,034

42,538 Income tax expense 8,384 10,950 36,980

17,457 13,570 Net income $ 47,974 $ 38,825 $ 14,691 $

32,577 $ 28,968

Period-End Balance Sheet Data:

Investment securities $ 1,049,710 $ 1,251,834 $ 1,262,948 $

1,198,032 $ 1,079,935 Total loans, net of unearned income 8,975,755

8,646,987 8,253,427 8,028,938 7,716,621 Allowance for credit losses

90,620 91,537 87,576 94,765 93,215 Total assets 11,305,528

10,999,382 10,948,926 10,502,261 9,811,557 Total deposits 9,331,055

9,048,971 9,011,515 8,501,102 7,930,383 Noninterest-bearing

deposits 2,137,407 2,040,977 2,242,765 2,071,594 1,857,809

Interest-bearing deposits 7,193,648 7,007,994 6,768,750 6,429,508

6,072,574 Borrowings and subordinated debentures 471,453 471,335

470,814 572,683 499,266 Total shareholders’ equity 1,389,956

1,357,103 1,359,056 1,340,848 1,304,054

Average Balance Sheet Data:

Investment securities $ 1,183,055 $ 1,234,226 $ 1,228,330 $

1,169,182 $ 1,099,307 Total loans, net of unearned income 8,848,820

8,443,951 8,226,294 7,867,794 7,650,048 Allowance for credit losses

93,365 89,097 94,968 94,706 90,366 Total assets 11,218,432

10,922,274 10,586,245 10,024,871 9,786,355 Total deposits 9,135,359

9,012,390 8,635,473 8,139,969 7,940,421 Noninterest-bearing

deposits 2,058,255 2,128,595 2,170,758 1,982,784 1,845,447

Interest-bearing deposits 7,077,104 6,883,795 6,464,715 6,157,185

6,094,974 Borrowings and subordinated debentures 595,087 444,557

502,428 484,798 510,373 Total shareholders’ equity 1,358,770

1,342,445 1,348,867 1,320,884 1,251,217

Table 1 (Continued) - Selected

Financial Data

As of and for the Three Months Ended (In

thousands, except share and per share data)

June 30,2018

March 31,2018

December 31,2017

September 30,2017

June 30,2017

Per Share Data:(3) Earnings Basic $ 0.57 $ 0.46 $

0.18 $ 0.39 $ 0.35 Diluted 0.57 0.46 0.17 0.39 0.35 Book value per

common share 16.62 16.23 16.25 16.03 15.59 Tangible book value (1)

12.85 12.32 12.33 12.10 11.64 Weighted average common shares

outstanding Basic 83,625,000 83,625,000 83,625,000 83,625,000

81,918,956 Diluted 84,792,657 84,674,807 84,717,005 83,955,685

81,951,795 Cash dividends declared $ 0.125 $ 0.125 $ — $ — $ —

Dividend payout ratio 21.93 % 27.17 % — % — % — %

Performance

Ratios: Return on average common equity (2) 14.16 % 11.73 %

4.32 % 9.78 % 9.29 % Return on average tangible common equity (1)

(2) 18.58 15.52 5.71 13.04 12.63 Return on average assets (2) 1.72

1.44 0.55 1.29 1.19 Net interest margin (2) 3.66 3.64 3.59 3.52

3.71 Efficiency ratio (1) 52.00 53.35 58.44 52.20 53.27 Adjusted

efficiency ratio (1) 50.74 50.22 55.57 52.74 53.15

Asset Quality

Ratios: Total nonperforming assets ("NPAs") to total loans and

OREO and other NPAs 0.63 % 0.84 % 0.85 % 1.51 % 1.82 % Total

nonperforming loans to total loans 0.44 0.60 0.58 0.96 1.36 Total

ACL to total loans 1.01 1.06 1.06 1.18 1.21 ACL to total

nonperforming loans ("NPLs") 230.60 175.30 183.62 122.66 88.81 Net

charge-offs to average loans (2) 0.10 0.02 0.13 0.01 0.09

Capital Ratios: Total shareholders’ equity to assets 12.29 %

12.34 % 12.41 % 12.77 % 13.29 % Tangible common equity to tangible

assets (1) 9.78 9.65 9.71 9.95 10.27 Common equity tier 1 (CET1)

10.56 10.42 10.57 10.79 10.92 Tier 1 leverage capital 10.74 10.57

10.68 11.12 11.00 Tier 1 risk-based capital 10.93 10.79 10.94 11.17

11.31 Total risk-based capital 12.71 12.63 12.81 13.18 13.41

_____________________

(1) Considered a non-GAAP financial

measure. See Table 7 "Reconciliation of Non-GAAP Financial

Measures" for a reconciliation of our non-GAAP measures to the most

directly comparable GAAP financial measure.

(2) Annualized.

(3) As of the completion of a secondary

offering on May 22, 2018, 34,175,000 of our outstanding shares are

owned by our parent-holding company Cadence Bancorp, LLC.

Table 2 - Average

Balances/Yield/Rates

For the Three Months Ended June 30, 2018

2017 Average Income/

Yield/ Average Income/

Yield/ (In thousands) Balance Expense

Rate Balance Expense Rate

ASSETS

Interest-earning assets: Loans, net of

unearned income(1) Originated and ANCI loans $ 8,606,253 $ 108,130

5.04 % $ 7,348,932 $ 79,904 4.36 % ACI portfolio 242,567

5,610 9.28 301,116 10,525 14.02 Total loans

8,848,820 113,740 5.16 7,650,048 90,429 4.74 Investment securities

Taxable 838,842 5,518 2.64 688,464 4,178 2.43 Tax-exempt(2)

344,213 3,547 4.13 410,843 5,208 5.08

Total investment securities 1,183,055 9,065 3.07 1,099,307 9,386

3.42 Federal funds sold and short-term investments 452,074 1,269

1.13 312,287 688 0.88 Other investments 55,909

634 4.55 50,064 695 5.57 Total interest-earning

assets 10,539,858 124,708 4.75 9,111,706 101,198 4.45

Noninterest-earning assets: Cash and due from banks 80,000

59,220 Premises and equipment 62,711 65,392 Accrued interest and

other assets 629,228 640,403 Allowance for credit losses

(93,365 ) (90,366 ) Total assets $ 11,218,432 $ 9,786,355

LIABILITIES AND STOCKHOLDERS' EQUITY Interest-bearing

liabilities: Demand deposits $ 4,712,302 $ 11,700 1.00 % $

4,232,497 $ 6,354 0.60 % Savings deposits 189,567 133 0.28 186,307

119 0.26 Time deposits 2,175,235 10,497 1.94

1,676,170 5,298 1.27 Total interest-bearing deposits

7,077,104 22,330 1.27 6,094,974 11,771 0.77 Other borrowings

459,678 3,785 3.30 375,681 2,896 3.09 Subordinated debentures

135,409 2,464 7.30 134,692 2,324 6.92

Total interest-bearing liabilities 7,672,191 28,579 1.49 6,605,347

16,991 1.03

Noninterest-bearing liabilities: Demand deposits

2,058,255 1,845,447 Accrued interest and other liabilities

129,216 84,344 Total liabilities 9,859,662 8,535,138

Stockholders' equity 1,358,770 1,251,217 Total

liabilities and stockholders' equity $ 11,218,432 $ 9,786,355 Net

interest income/net interest spread 96,129 3.26 % 84,207

3.42 % Net yield on earning assets/net interest margin

3.66 % 3.71 %

Taxable equivalent adjustment:

Investment securities (745 ) (1,823 ) Net interest

income $ 95,384 $ 82,384 _____________________

(1) Nonaccrual loans are included in

loans, net of unearned income. No adjustment has been made for

these loans in the calculation of yields.

(2) Interest income and yields are

presented on a fully taxable equivalent basis using a tax rate of

21% for the three months ended June 30, 2018, and a tax rate of 35%

for the three months ended June 30, 2017.

For the Three Months EndedJune

30, 2018

For the Three Months EndedMarch

31, 2018

Average Income/ Yield/

Average Income/ Yield/ (In

thousands) Balance Expense Rate

Balance Expense Rate ASSETS

Interest-earning assets: Loans, net of unearned

income(1) Originated and ANCI loans $ 8,606,253 $ 108,130 5.04 % $

8,189,448 $ 97,168 4.81 % ACI portfolio 242,567 5,610

9.28 254,503 5,623 8.96 Total loans 8,848,820 113,740

5.16 8,443,951 102,791 4.94 Investment securities Taxable 838,842

5,518 2.64 827,227 5,118 2.51 Tax-exempt(2) 344,213

3,547 4.13 406,999 4,134 4.12 Total investment

securities 1,183,055 9,065 3.07 1,234,226 9,252 3.04 Federal funds

sold and short-term investments 452,074 1,269 1.13 515,017 1,529

1.20 Other investments 55,909 634 4.55 48,986

389 3.22 Total interest-earning assets 10,539,858 124,708

4.75 10,242,180 113,961 4.51

Noninterest-earning assets:

Cash and due from banks 80,000 92,878 Premises and equipment 62,711

62,973 Accrued interest and other assets 629,228 613,341 Allowance

for credit losses (93,365 ) (89,097 ) Total assets $

11,218,432 $ 10,922,275

LIABILITIES AND STOCKHOLDERS' EQUITY

Interest-bearing liabilities: Demand deposits $ 4,712,302 $

11,700 1.00 % $ 4,795,114 $ 9,025 0.76 % Savings deposits 189,567

133 0.28 179,662 114 0.26 Time deposits 2,175,235

10,497 1.94 1,909,019 7,491 1.59 Total

interest-bearing deposits 7,077,104 22,330 1.27 6,883,795 16,630

0.98 Other borrowings 459,678 3,785 3.30 309,323 2,956 3.88

Subordinated debentures 135,409 2,464 7.30

135,233 2,396 7.19 Total interest-bearing liabilities

7,672,191 28,579 1.49 7,328,351 21,982 1.22

Noninterest-bearing

liabilities: Demand deposits 2,058,255 2,128,595 Accrued

interest and other liabilities 129,216 122,884 Total

liabilities 9,859,662 9,579,830

Stockholders' equity

1,358,770 1,342,445 Total liabilities and stockholders'

equity $ 11,218,432 $ 10,922,275 Net interest income/net interest

spread 96,129 3.26 % 91,979 3.29 % Net yield on

earning assets/net interest margin 3.66 % 3.64 %

Taxable equivalent adjustment: Investment securities

(745 ) (868 ) Net interest income $ 95,384 $ 91,111

_____________________

(1) Nonaccrual loans are included in

loans, net of unearned income. No adjustment has been made for

these loans in the calculation of yields.

(2) Interest income and yields are

presented on a fully taxable equivalent basis using a tax rate of

21%.

Table 3 – Loan Interest Income

Detail

For the Three Months Ended, (In

thousands)

June 30,2018

March 31,2018

December 31,2017

September 30,2017

June 30,2017

Loan Interest Income Detail Interest income on loans,

excluding ACI loans $ 108,130 $ 97,168 $ 89,762 $ 84,321 $ 79,904

Scheduled accretion for the period 5,016 5,192 5,348 5,550 6,075

Recovery income for the period 594 431 2,797

290 4,450 Accretion on acquired credit impaired (ACI)

loans 5,610 5,623 8,145 5,840

10,525 Loan interest income $ 113,740 $ 102,791 $ 97,907 $ 90,161 $

90,429 Loan yield, excluding ACI loans 5.04 % 4.81 % 4.47 %

4.41 % 4.36 % ACI loan yield 9.28 8.96 12.21

8.27 14.02 Total loan yield 5.16 % 4.94

% 4.72 % 4.55 % 4.74 %

Table 4 - Allowance for Credit

Losses

For the Three Months Ended (In

thousands)

June 30,2018

March 31,2018

December 31,2017

September 30,2017

June 30,2017

Balance at beginning of period $ 91,537 $ 87,576 $ 94,765 $

93,215 $ 88,304 Charge-offs (3,650 ) (812 ) (2,860 ) (581 ) (2,879

) Recoveries 1,470 393 146 408

1,089

Net (charge-offs) recoveries (2,180 )

(419 ) (2,714 ) (173 ) (1,790 ) Provision for

(reversal of) credit losses 1,263 4,380 (4,475

) 1,723 6,701

Balance at end of period $

90,620 $ 91,537 $ 87,576 $ 94,765 $ 93,215

Table 5 -Noninterest Income

For the Three Months Ended (In

thousands)

June 30,2018

March 31,2018

December 31,2017

September 30,2017

June 30,2017

Noninterest Income Investment advisory

revenue $ 5,343 $ 5,299 $ 5,257 $ 5,283 $ 5,061 Trust services

revenue 4,114 5,015 4,836 4,613 4,584 Service charges on deposit

accounts 3,803 3,960 3,753 3,920 3,784 Credit-related fees 3,807

3,577 3,372 3,306 2,741 Insurance revenue 417 2,259 1,470 1,950

1,828 Bankcard fees 1,915 1,884 1,833 1,803 1,862 Mortgage banking

revenue 650 577 687 965 1,213 Other service fees earned

1,346 1,333 1,197 1,174 1,071

Total

service fees and revenue 21,395 23,904

22,405 23,014 22,144 Securities (losses) gains, net

(1,813 ) 12 16 1 (244 ) Other 5,090 1,067

3,235 4,109 1,089

Total other noninterest

income 3,277 1,079 3,251 4,110

845

Total noninterest income $ 24,672 $ 24,983 $

25,656 $ 27,124 $ 22,989

Table 6 -Noninterest Expense

For the Three Months Ended (In

thousands)

June 30,2018

March 31,2018

December 31,2017

September 30,2017

June 30,2017

Noninterest Expenses Salaries and

employee benefits $ 38,268 $ 37,353 $ 35,162 $ 35,007 $ 34,682

Premises and equipment 7,131 7,591 7,629 7,419 7,180 Intangible

asset amortization 715 792 1,085 1,136 1,190 Net cost of operation

of other real estate owned 112 (52 ) 1,075 453 427 Data processing

2,304 2,365 2,504 1,688 1,702 Consulting and professional fees

2,545 2,934 4,380 2,069 1,502 Loan related expenses 645 255 810 532

757 FDIC insurance 1,223 955 939 889 954 Communications 703 704 857

650 675 Advertising and public relations 575 341 683 521 499 Legal

expenses 468 2,627 2,626 612 508 Other 7,746 6,074

8,621 5,554 6,058

Total noninterest

expenses $ 62,435 $ 61,939 $ 66,371 $ 56,530 $ 56,134

Table 7 - Reconciliation of Non-GAAP

Financial Measures

As of and for the Three Months Ended (In

thousands)

June 30,2018

March 31,2018

December 31,2017

September 30,2017

June 30,2017

Efficiency ratio Noninterest expenses

(numerator) $ 62,435 $ 61,939 $ 66,371 $ 56,530 $ 56,134 Net

interest income $ 95,384 $ 91,111 $ 87,911 $ 81,163 $ 82,384

Noninterest income 24,672 24,983 25,656

27,124 22,989 Operating revenue (denominator) $ 120,056 $

116,094 $ 113,567 $ 108,287 $ 105,373 Efficiency ratio 52.00

% 53.35 % 58.44 % 52.20 % 53.27 %

Adjusted efficiency ratio Noninterest expenses $ 62,435 $

61,939 $ 66,371 $ 56,530 $ 56,134 Less: Merger related expenses 756

— — — — Less: Secondary offerings expenses 1,165 1,365 1,302 — —

Less: Other non-routine expenses(1) 1,145 2,278

1,964 — — Adjusted noninterest expenses

(numerator) $ 59,369 $ 58,296 $ 63,105 $ 56,530 $ 56,134 Net

interest income $ 95,384 $ 91,111 $ 87,911 $ 81,163 $ 82,384

Noninterest income 24,672 24,983 25,656 27,124 22,989 Less: Gain on

sale of insurance assets 4,871 — — 1,093 — Less: Securities

(losses) gains, net (1,813 ) 12 16 1

(244 ) Adjusted noninterest income 21,614

24,971 25,640 26,030 23,233 Adjusted operating

revenue (denominator) $ 116,998 $ 116,082 $ 113,551 $ 107,193 $

105,617 Adjusted efficiency ratio 50.74 % 50.22 %

55.57 % 52.74 % 53.15 %

Tangible common

equity ratio Shareholders’ equity $ 1,389,956 $ 1,357,103 $

1,359,056 $ 1,340,848 $ 1,304,054 Less: Goodwill and other

intangible assets, net (315,648 ) (327,247 )

(328,040 ) (329,124 ) (330,261 ) Tangible common

shareholders’ equity 1,074,308 1,029,856

1,031,016 1,011,724 973,793 Total assets 11,305,528

10,999,382 10,948,926 10,502,261 9,811,557 Less: Goodwill and other

intangible assets, net (315,648 ) (327,247 )

(328,040 ) (329,124 ) (330,261 ) Tangible assets $

10,989,880 $ 10,672,135 $ 10,620,886 $ 10,173,137 $ 9,481,296

Tangible common equity ratio 9.78 % 9.65 %

9.71 % 9.95 % 10.27 %

Tangible book value per

share Shareholders’ equity $ 1,389,956 $ 1,357,103 $ 1,359,056

$ 1,340,848 $ 1,304,054 Less: Goodwill and other intangible assets,

net (315,648 ) (327,247 ) (328,040 )

(329,124 ) (330,261 ) Tangible common shareholders’ equity $

1,074,308 $ 1,029,856 $ 1,031,016 $ 1,011,724 $ 973,793 Common

shares issued 83,625,000 83,625,000 83,625,000

83,625,000 83,625,000 Tangible book value per share $

12.85 $ 12.32 $ 12.33 $ 12.10 $ 11.64

Return on average tangible

common equity Average common equity $ 1,358,770 $ 1,342,445 $

1,348,867 $ 1,320,884 $ 1,251,217 Less: Average intangible assets

(323,255 ) (327,727 ) (328,697 )

(329,816 ) (330,977 ) Average tangible common shareholders’

equity $ 1,035,515 $ 1,014,718 $ 1,020,170 $ 991,068 $ 920,240 Net

income $ 47,974 $ 38,825 $ 14,691 $ 32,577 $ 28,968 Return on

average tangible common equity 18.58 % 15.52 %

5.71 % 13.04 % 12.63 %

Pre-tax, pre-provision net

earnings Income before taxes $ 56,358 $ 49,775 $ 51,671 $

50,034 $ 42,538 Plus: Provision for credit losses 1,263

4,380 (4,475 ) 1,723 6,701 Pre-tax,

pre-provision net earnings $ 57,621 $ 54,155 $ 47,196 $ 51,757 $

49,239 _____________________

(1) Other non-routine expenses for

the second quarter 2018 were $1.1 million and included expenses

related to the sale of the assets of our insurance company. This

compares to $2.3 million and $2.0 million for the first quarter of

2018 and fourth quarter of 2017, respectively, each representing

legal costs associated with litigation related to a pre-acquisition

matter of a legacy acquired bank that has been resolved.

Table 8 – Non-Routine

Income/Expense

For the Three Months Ended

June 30, 2018 March 31, 2018 June

30, 2017

After-tax

Increase(Decrease) in

After-tax

Increase(Decrease) in

After-tax

Increase(Decrease) in

(In thousands, except per share data) Income/

Expense

EPS ROA ROTCE

Income/

Expense

EPS ROA ROTCE

Income/

Expense

EPS ROA ROTCE

Noninterest income (non-routine)

Gain on

sale of assets of insurance subsidiary $ 4,871 $ — $ — Securities

(losses) gains, net (1,813 ) 12 (244 ) Total

3,058 $ 0.03 0.08 % 0.91 % 12 $ — — % — % (244 ) $ — (0.01 )% (0.07

)%

Noninterest expense (non-routine) Expenses related to

sale of assets of insurance company (1,145 ) — — Secondary offering

expenses (1,165 ) (1,365 ) — Merger related costs (756 ) — — Legacy

litigation — (2,278 ) — Total (3,066 ) (0.03 )

(0.08 ) (0.91 ) (3,643 ) (0.03 ) (0.10 ) (1.10 ) — — — —

Tax

expense Timing of legacy loan bad debt deduction for tax

5,991 0.07 0.21 2.32 — —

— — — — — —

Total $ 5,983

$ 0.07 0.21 % 2.32 % $ (3,631 ) $ (0.03 )

(0.10 )% (1.10 )% $ (244 ) $ — (0.01 )% (0.07

)%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180723005194/en/

Cadence BancorporationMedia:Danielle Kernell,

713-871-4051danielle.kernell@cadencebank.comorInvestor

relations:Valerie Toalson, 713-871-4103 or

800-698-7878vtoalson@cadencebancorporation.com

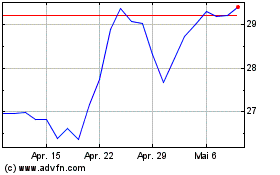

Cadence Bank (NYSE:CADE)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Cadence Bank (NYSE:CADE)

Historical Stock Chart

Von Apr 2023 bis Apr 2024