U.K. Will Fine Barclays Chief -- WSJ

21 April 2018 - 9:02AM

Dow Jones News

Test of rules holding executives responsible for their actions

lets Staley remain as CEO

By Max Colchester

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 21, 2018).

Barclays PLC said Chief Executive Jes Staley will keep his job

after British regulators concluded his attempts to unmask a

whistleblower didn't represent a "lack of integrity" and instead

chose to slap the executive with a fine.

The London-based bank said it still backed Mr. Staley, ending a

year of instability for the CEO and drawing a line under a major

unknown that has weighed on Barclays as it looks to push on from a

major restructuring. The case was also the first major test of the

new U.K. "Senior Managers Regime," a set of regulatory rules aimed

at ensuring bank executives are held responsible for their actions.

The U.K. recently bolstered rules to protect whistleblowers.

Barclays had flagged to regulators last year Mr. Staley's

attempts to reveal the identity of a whistleblower who criticized a

hire that the CEO made. Mr. Staley apologised for making the

attempts. The move prompted a yearlong probe and fears among some

investors and staff that the chief executive could be deemed unfit

to run a bank. On Friday, the bank said the U.K.'s Financial

Conduct Authority and Prudential Regulation Authority concluded

that Mr. Staley didn't act "with a lack of integrity or that he

lacks fitness and propriety to continue to perform his role."

However, Mr. Staley does face a fine and Barclays's board has

already said it would dock some of his 2016 pay over the

debacle.

Mr. Staley's total financial penalty could hit seven figures, a

person familiar with the bank said. In a statement, U.K. regulators

said they had "drafted warning notices" related to the CEO and

declined to comment on the size of a fine.

Barclays said it couldn't comment on the outcome of the probe

because Mr. Staley still has the right to challenge the fine. It

said Mr. Staley wasn't available to comment.

The end of the investigation, and the bank's support, clears the

way for Mr. Staley to focus on running the lender, which is

wrestling with a deeper problem: whether its investment bank can

generate strong profits and allay some investors' long-held

concerns that it needs to shrink drastically. That pressure

ratcheted up recently after activist Sherborne Investors Management

LP said it had taken a 5.2% stake in Barclays.

The New York Department of Financial Services is still probing

Mr. Staley and Barclays over the matter, according to a person

familiar with the matter. The probe may result in a fine, but

lawyers say a ban of Mr. Staley is unlikely given U.K. regulators'

support of him.

The investigation into Mr. Staley has proved an awkward

distraction. In the summer of 2016, Mr. Staley twice tried to

identify the source of an anonymous letter to a senior executive

that criticized the hiring of Tim Main, who was named as Barclays's

head of financial institutions group, according to people with

knowledge of the events. That letter also raised questions about

Mr. Staley's dealings with Mr. Main when they worked together at

JPMorgan Chase & Co.

Barclays commissioned its own probe and shared its findings with

U.K. regulators. The bank concluded that Mr. Staley honestly, but

mistakenly, believed that it was permissible to identify the author

of the letter.

Mr. Staley later apologized for his actions and the

whistleblower's identity was never revealed. However, investors

fretted that regulators would deem Mr. Staley unfit to run a major

bank -- an outcome that would have prompted another managerial

shuffle at a lender that has gone through four bosses in five

years.

Mr. Staley's efforts to find the source of the letter came just

as British regulators were tightening protections for

whistleblowers. Regulators had to prove they were acting on the

accusations without destabilizing one of the U.K.'s biggest

banks.

Some industry watchers question whether the watchdogs' decision

to spare Mr. Staley undermines their stated desire to protect

whistleblowers. "The magnitude of banning the sitting CEO of such a

systemically important institution made outcomes other than a fine

unlikely," said Nicholas Querée, a lawyer at Peters & Peters

Solicitors LLP. "The case does set an interesting precedent," he

added, showing executives can use their power to try to unmask a

whistleblower "and remain in a regulated post."

Barclays said a separate probe into how the bank handles

whistleblowing hasn't resulted in an enforcement action but they

will have to make some changes to the way it operates.

In recent years, Barclays has faced a series of regulatory

action. Last month the bank paid pay $2 billion in civil penalties

to resolve U.S. Justice Department claims that the U.K. lender

fraudulently sold mortgage securities that helped fuel the

financial crisis.

Write to Max Colchester at max.colchester@wsj.com

(END) Dow Jones Newswires

April 21, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

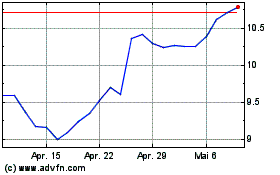

Barclays (NYSE:BCS)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Barclays (NYSE:BCS)

Historical Stock Chart

Von Apr 2023 bis Apr 2024