Pound Falls As U.K. Jobless Rate Increases

21 Februar 2018 - 6:35AM

RTTF2

The pound weakened against its key counterparts in early

European deals on Wednesday, following a data showing an uptick in

U.K. jobless rate in the fourth quarter.

Data from the Office for National Statistics showed that the ILO

unemployment rate rose by 0.1 percentage points to 4.4 percent in

three months to December. In the same period of last year, the rate

was 4.8 percent.

The rate was forecast to remain unchanged at 4.3 percent.

The number of unemployed rose by 46,000 from the September

quarter to 1.47 million.

Further undermining the currency was risk aversion, as European

stocks tracked Wall Street lower in the wake of a rising dollar,

disappointing results from Walmart and climbing bond yields on

expectations of a faster pace of interest rate increases from the

Federal Reserve.

The currency traded mixed in the Asian session. While it rose

against the yen and the franc, it held steady against the euro.

Against the greenback, it declined.

Pulling away from an early near a 2-week high of 150.93 against

the yen, the pound edged down to 149.78. The pound is poised to

challenge support around the 147.00 level.

Data from the Ministry of Economy, Trade and Industry showed

that Japan's all industry activity growth halved in December.

The all industry activity index rose 0.5 percent month-on-month

in December, following November's 1 percent increase. Nonetheless,

this was the third consecutive increase in activity and bigger than

the expected 0.4 percent rise.

The pound slipped to a 1-week low of 1.3930 against the dollar,

from a high of 1.4008 seen at 7:30 pm ET. Further downtrend for the

pound is likely to see it finding support around the 1.38 mark.

The U.K. currency reversed from an early high of 1.3119 against

the Swiss franc, dropping to 1.3061. If the pound extends drop,

1.28 is seen as its next support level.

Having advanced to 0.8806 against the euro at 2:30 am ET, the

pound reversed direction and fell to 0.8847. The pound is seen

finding support around the 0.90 mark.

Flash data from IHS Markit showed that Eurozone private sector

growth continued to rise at a steep pace in February, albeit with

the rate of expansion cooling from the near 12-year high in

January.

The composite output index dropped to 57.5 from 58.8 in the

previous month. The score was forecast to fall to 58.4.

Looking ahead, Markit's U.S. manufacturing PMI for February and

existing home sales for January are scheduled for release in the

New York session.

The Bank of England Governor Mark Carney, Deputy Governor Ben

Broadbent and policy makers Andy Haldane and Silvana Tenreyro will

testify on inflation and the economic outlook before the Treasury

Select Committee at 9:15 am ET.

At 2:00 pm ET, the Fed minutes from January 30-31 meeting are

due.

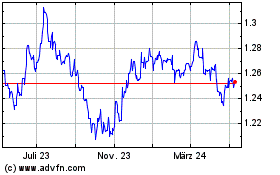

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

Von Mär 2024 bis Apr 2024

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

Von Apr 2023 bis Apr 2024