Abertis Will Ask for Shareholder Authorization to Sell Hispasat

08 Februar 2018 - 12:32PM

Dow Jones News

By Alberto Delclaux

Abertis Infraestructuras SA (ABE.MC) will propose selling its

57% stake in Hispasat to Red Electrica Corp SA (REE.MC) at its

annual shareholder's meeting on March 13, the Spanish toll-road

operator said Thursday.

Even if shareholders approve the proposal, the sale would still

hinge on Red Electrica following through on earlier interest it

expressed in buying Hispasat, a satellite operator. Abertis would

accept an offer of at least 656 million euros ($809.1 million) for

the 57% stake in Hispasat, it said, adding that the sale would also

require government authorization.

Abertis is itself the subject of a bidding war between Italian

infrastructure group Atlantia SpA (ATL.MI) and Hochtief AG

(HOT.XE), which is controlled by Spanish construction company

Actividades de Construccion y Servicios SA (ACS.MC).

The stake in Hispasat is one of the main hurdles in the bidding

war, as both bids are awaiting government authorization with

respect to Hispasat, which is considered a strategically important

national asset.

Further complicating matters, Abertis agreed in May to buy a 34%

stake in Hispasat from Eutelsat Communications (ETL.FR) in a deal

that still hasn't received government approval. Abertis said

Thursday that it will propose to shareholders that Red Electrica

assume the obligation to buy the stake.

Write to Alberto Delclaux at alberto.delclaux@dowjones.com

(END) Dow Jones Newswires

February 08, 2018 06:17 ET (11:17 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

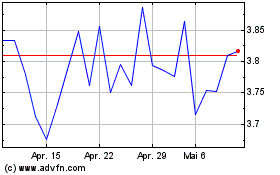

Eutelsat Communications (EU:ETL)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

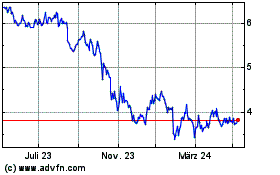

Eutelsat Communications (EU:ETL)

Historical Stock Chart

Von Apr 2023 bis Apr 2024

Echtzeit-Nachrichten über Eutelsat Communications (Euronext): 0 Nachrichtenartikel

Weitere Eutelsat Communic. News-Artikel