U.S. Dollar Falls After Trump's Speech

31 Januar 2018 - 4:58AM

RTTF2

The U.S. dollar declined against its major counterparts on

Wednesday, after U.S. President Donald Trump outlined policies on

trade, immigration, infrastructure and national security in his

first State of the Union address.

Trump was optimistic over strength of the U.S. economy and tax

reduction measures and he urged Congress to pass a $1.5 trillion

infrastructure spending plan.

Trump said that America has "turned the page on decades of

unfair trade deals that sacrificed our prosperity and shipped away

our companies, our jobs and our nation's wealth."

President Trump reiterated his offer of a path to citizenship to

1.8 million undocumented immigrants and made case to scale back

legal immigration and build border wall.

The Federal Reserve's latest two-day monetary policy meeting

concludes later today, with economists widely expecting the

benchmark rate to remain unchanged at a range between 1.25-1.50

percent.

Some economists expect the central bank to raise its economic

assessment at Fed Chair Janet Yellen's final meeting.

The greenback weakened to a 6-day low of 0.9308 against the

franc, from a high of 0.9359 hit at 9:30 pm ET. If the greenback

declines further, it may target support around the 0.92 area.

Reversing from an early high of 109.09 against the yen, the

greenback edged down to 108.60. The next possible support for the

greenback is seen around the 106.00 level.

Data from the Cabinet Office showed that Japan's consumer

confidence held steady at the start of the year.

The seasonally adjusted consumer confidence index came in at

44.7 in January, the same reading as in December.

The greenback hit a 5-day low of 1.4213 against the pound,

following a high of 1.4136 hit at 9:30 pm ET. On the downside, 1.45

is possibly seen as the next support level for the greenback.

Having advanced to 1.2397 against the euro at 6:30 pm ET, the

greenback reversed direction and dropped to a 5-day low of 1.2463.

The greenback is seen finding support around the 1.26 level.

Data from Destatis showed that Germany's retail sales declined

unexpectedly in December.

Retail sales fell 1.9 percent year-on-year in December, in

contrast to November's 4.3 percent increase.

The greenback dropped to a 4-1/2-month low of 1.2272 against the

loonie and a weekly low of 0.7403 against the kiwi, from its early

highs of 1.2348 and 0.7327, respectively. Continuation of the

greenback's downtrend may see it challenging support around 1.20

against the loonie and 0.76 against the kiwi.

The greenback eased back to 0.8101 against the aussie, reversing

from an early high of 0.8046. The greenback is poised to challenge

support around the 0.82 area.

Data from the Australian Bureau of Statistics showed that

Australia's consumer prices climbed 0.6 percent on quarter in the

fourth quarter of 2017.

That was shy of expectations for 0.7 percent, although it was

unchanged from the three months prior.

Looking ahead, German jobless rate and Swiss economic sentiment

index for January, Eurozone jobless rate for December and advanced

consumer prices for January are due in the European session.

At 8:15 am ET, ADP private payrolls data for January is due.

In the New York session, Canada GDP data for November and

industrial product price index for December, as well as U.S.

pending home sales for the same month are set for release.

At 2:00 pm ET, the Fed announces decision on interest rates.

Economists widely expect the benchmark rate to remain unchanged at

a range between 1.25-1.50 percent.

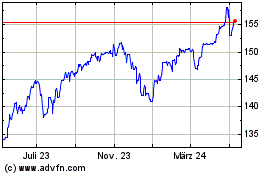

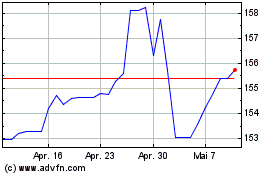

US Dollar vs Yen (FX:USDJPY)

Forex Chart

Von Mär 2024 bis Apr 2024

US Dollar vs Yen (FX:USDJPY)

Forex Chart

Von Apr 2023 bis Apr 2024