Wolters Kluwer Legal & Regulatory received a binding offer to sell its French and Spanish legal information businesses

09 Dezember 2021 - 8:45AM

Wolters Kluwer Legal &

Regulatory received a binding

offer to sell its

French and Spanish legal

information businesses

December 9, 2021 –

Wolters Kluwer Legal & Regulatory announces

today that it has entered

into exclusive discussions to sell

its legal information

businesses in

France and

Spain following receipt of a

binding offer from Karnov

Group. Thomson Reuters

has simultaneously and in conjunction received a binding

offer from Karnov Group to acquire

its Spanish legal information business.

The transaction would be

subject to antitrust

approval in Spain. Upon completion of the

transaction, Wolters Kluwer would receive

€120

million in cash for its assets.

The intended divestment by Wolters Kluwer will sharpen the Legal

& Regulatory division’s focus on businesses where it has the

strongest market positions and the best opportunities to drive

future growth. Signing of a final agreement is conditional upon

completion of the consultation with the European and French works

councils. Completion of the transaction would be conditional upon

antitrust approval in Spain and is expected during 2022. The units

to be divested will be treated as assets held for sale in Wolters

Kluwer’s 2021 accounts, but will continue to be consolidated until

completion. The use of net after tax proceeds will be determined in

2022.

The French and Spanish legal information units to be sold by

Wolters Kluwer employ approximately 650 FTEs. In 2020, the units

generated approximately €85 million (about 9% of Legal &

Regulatory division revenues) and were profitable. The units

primarily support law firms, corporations and the public sector

with information products in digital and print formats. In France,

the business includes Lamyline for legal professionals and Liaisons

Sociales for labor law and HR specialists, among other offerings

including training. In Spain, the business includes La Ley for

legal professionals, CISS for tax and HR specialists, as well as

online training services.

Wolters Kluwer Legal & Regulatory will continue to serve its

customers in France and Spain with legal and compliance software

solutions (mainly Kleos and Legisway), environmental, health &

safety and operational risk management solutions (Enablon), and

international legal information (Kluwer Law International). Wolters

Kluwer also continues to provide the French and Spanish market with

solutions for health, tax and accounting, and governance, risk and

compliance professionals.

Martin O’Malley, Executive Vice President and Managing Director

of Wolters Kluwer Legal & Regulatory said: “As we continue to

invest in our transformation from print to digital and from digital

into expert solutions and software, Wolters Kluwer Legal &

Regulatory is concentrating its investments on the businesses where

we have the best prospects for long-term growth. The businesses to

be divested are well-prepared for the digital future as part of

Karnov with high-quality products and shared technology

infrastructure. We are confident that Karnov will continue to

support the French and Spanish legal information community with

excellence.”

“For Karnov, this intended transaction is an attractive

opportunity to acquire two highly reputable businesses in which

Wolters Kluwer has invested to achieve a digital transformation,”

said Pontus Bodelsson, CEO of Karnov Group. “We plan to continue to

invest and to leverage new technologies in order to serve customers

with the high-quality products and services they value.”

Karnov Group (Nasdaq Stockholm: KAR), based primarily in Denmark

and Sweden, is a provider of legal information solutions in the

areas of legal, tax, accounting, and environmental, health and

safety. In recent years, Karnov has expanded its geographic

presence into France and Belgium, and currently employs

approximately 290 people.

About Wolters KluwerWolters

Kluwer (WKL) is a global leader in professional information,

software solutions, and services for the healthcare; tax and

accounting; governance, risk and compliance; and legal and

regulatory sectors. We help our customers make critical decisions

every day by providing expert solutions that combine deep domain

knowledge with specialized technology and services.

Wolters Kluwer reported 2020 annual revenues of €4.6 billion.

The group serves customers in over 180 countries, maintains

operations in over 40 countries, and employs approximately 19,200

people worldwide. The company is headquartered in Alphen aan den

Rijn, the Netherlands.

Wolters Kluwer shares are listed on Euronext Amsterdam (WKL) and

are included in the AEX and Euronext 100 indices. Wolters Kluwer

has a sponsored Level 1 American Depositary Receipt (ADR) program.

The ADRs are traded on the over-the-counter market in the U.S.

(WTKWY).

For more information, visit www.wolterskluwer.com, follow us on

Twitter, Facebook, LinkedIn, and YouTube.

Media

Investors/AnalystsGerbert van Genderen Stort

Meg

GeldensCorporate Communications

Investor Relationst + 31 172 641 230

t + 31 172 641

407g.van.genderen.stort@wolterskluwer.com

ir@wolterskluwer.com

Forward-looking Statements and Other Important Legal

InformationThis report contains forward-looking

statements. These statements may be identified by words such as

“expect”, “should”, “could”, “shall” and similar expressions.

Wolters Kluwer cautions that such forward-looking statements are

qualified by certain risks and uncertainties that could cause

actual results and events to differ materially from what is

contemplated by the forward-looking statements. Factors which could

cause actual results to differ from these forward-looking

statements may include, without limitation, general economic

conditions; conditions in the markets in which Wolters Kluwer is

engaged; behavior of customers, suppliers, and competitors;

technological developments; the implementation and execution of new

ICT systems or outsourcing; and legal, tax, and regulatory rules

affecting Wolters Kluwer’s businesses, as well as risks related to

mergers, acquisitions, and divestments. In addition, financial

risks such as currency movements, interest rate fluctuations,

liquidity, and credit risks could influence future results. The

foregoing list of factors should not be construed as exhaustive.

Wolters Kluwer disclaims any intention or obligation to publicly

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise.

- 2021.12.09 Wolters Kluwer received a binding offer to sell its

French and Spanish legal information businesses

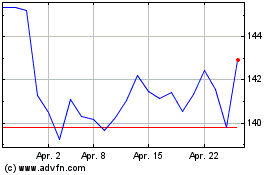

Wolters Kluwers NV (EU:WKL)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Wolters Kluwers NV (EU:WKL)

Historical Stock Chart

Von Apr 2023 bis Apr 2024