Vopak and BlackRock's GEPIF successfully completed the acquisition of three industrial terminals from Dow on the U.S. Gulf Co...

02 Dezember 2020 - 7:00AM

Vopak and BlackRock's GEPIF successfully completed the acquisition

of three industrial terminals from Dow on the U.S. Gulf Coast

Vopak and BlackRock's GEPIF successfully completed the

acquisition of three industrial terminals from Dow on the U.S. Gulf

Coast

Rotterdam, the Netherlands, 2 December 2020

Royal Vopak and BlackRock's Global Energy & Power

Infrastructure Fund (GEPIF) successfully completed the earlier

announced acquisition of three industrial terminals from Dow (NYSE:

DOW) on the U.S. Gulf Coast. This acquisition was announced

on 14 September 2020.Dow had selected the new 50/50 joint

venture of Royal Vopak and BlackRock's GEPIF to acquire three major

industrial terminals on the U.S. Gulf Coast for the amount of USD

620 million. The name of the new joint venture is Vopak Industrial

Infrastructure Americas, LLC, which has a diversified set of

infrastructure assets, in three locations, with each situated

alongside an active Dow production complex.Vopak Industrial

Infrastructure Americas has entered into long-term service

agreements with Dow, for storage and infrastructure services. Dow

expects Vopak's terminal expertise and capabilities will deliver

additional operational efficiencies and opportunities for growth.

The total capacity of the three terminals is 852,000 cubic meters

(cbm). The Freeport, Texas, terminal has 53 tanks (140,000 cbm) for

storage of chemicals. The St. Charles, Louisiana, terminal has 73

total tanks (409,000 cbm) for storage of chemicals. The Plaquemine,

Louisiana, terminal has 30 tanks (303,000 cbm) for storage of

chemicals and refined products. The involved assets include 16.4

hectares of expansion land, 36 vessel berths, multiple pipeline

connections, rail and truck racks. About Vopak Royal

Vopak is the world’s leading independent tank storage company. We

store vital products with care. With over 400 years of history and

a focus on sustainability, we ensure safe, clean and efficient

storage and handling of bulk liquid products and gases for our

customers. By doing so, we enable the delivery of products that are

vital to our economy and daily lives, ranging from chemicals, oils,

gases and LNG to biofuels and vegoils. We are determined to develop

key infrastructure solutions for the world’s changing energy

systems, while simultaneously investing in digitalization and

innovation. Vopak is listed on the Euronext Amsterdam and is

headquartered in Rotterdam, the Netherlands. For more information,

please visit www.vopak.com. About BlackRockBlackRock’s

purpose is to help more and more people experience financial

well-being. As a fiduciary to investors and a leading provider of

financial technology, our clients turn to us for the solutions they

need when planning for their most important goals. As of September

30, 2020, the firm managed approximately $7.81 trillion in assets

on behalf of investors worldwide. For additional information on

BlackRock, please visit www.blackrock.com | Twitter: @blackrock |

www.linkedin.com/company/blackrock. For further information

please contact: Vopak Press Liesbeth Lans, Manager

External Communication, Telephone : +31 (0)10 4002777, e-mail:

global.communication@vopak.comVopak analysts and investors

Laurens de Graaf, Head of Investor Relations Telephone : +31 (0)10

4002776, e-mail: investor.relations@vopak.com

BlackRockCurtis Chou, Corporate

Communications Telephone: +1 646-231-1031, e-mail:

curtis.chou@blackrock.com

- Download full press release

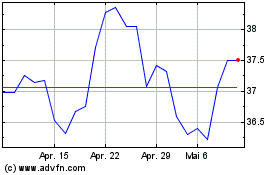

Koninklijke Vopak (EU:VPK)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

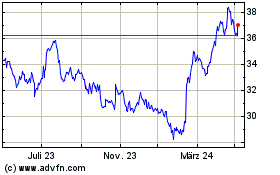

Koninklijke Vopak (EU:VPK)

Historical Stock Chart

Von Apr 2023 bis Apr 2024