+4.2% increase in revenue

Robust growth in adjusted EBITDA to €345

million (+15.4%) and adjusted EBITDA margin to 26.0% (+260

bps)

Strong business recovery in Q2: +14.8% vs.

Q2 2020

2021 Adjusted EBITDA target raised

Regulatory News:

Verallia (Paris:VRLA):

Highlights

- H1 2021 revenue up +4.2% to €1,328 million (+7.7% at

constant exchange rates and scope)(1) vs. H1 2020

- In Q2 2021, strong revenue growth of +14.8% to €723

million (+17.6% at constant exchange rates and scope)

vs. Q2 2020

- Increase in adjusted EBITDA to €345 million in H1 2021,

from €299 million in H1 2020 (+15.4%)

- Sharp increase in adjusted EBITDA margin to 26.0% in

H1 2021 (+260 bps)

- Net income(2) of €133 million versus €79 million in H1

2021

- Reduction in net debt leverage to 1.9x adjusted EBITDA

for the last 12 months, against 2.1x as of 31 March 2021

- Verallia proceeded with two share buybacks during the

first half for €109 million and therefore holds 1.7% of

the share capital (after cancelling 1.6 million

shares)

(1) Revenue growth at constant exchange rates and scope

excluding Argentina was +5.6% in H1 2021 compared with H1 2020. (2)

Net income for H1 2021 includes an amortisation expense for

customer relations, recognised upon the acquisition of

Saint-Gobain’s packaging business in 2015, of €22 million (net of

taxes). Excluding this expense, the net income would be €155

million. This expense was €22 million in H1 2020.

“After a first quarter still adversely affected by the health

restrictions, the reopening of Cafés, Hotels and Restaurants in the

second quarter allowed Verallia to record robust organic revenue

growth over the six-month period. Adjusted EBITDA rose sharply in

the first half, with a full contribution from the Group’s three

main pillars for improvement – namely the increase in business

activity (operational lever), positive spread and mix, and improved

industrial efficiency (PAP). In view of these solid results,

Verallia can raise its adjusted EBITDA forecasts for 2021,"

commented Michel Giannuzzi, Chairman and CEO of

Verallia.

Revenue

Revenue breakdown by region

In € million

H1 2021

H1 2020

% Change

Of which is

organic

growth (i)

Southern and Western Europe

927.9

880.3

+5.4%

+5.5%

Northern and Eastern Europe

257.9

283.3

-9.0%

-5.6%

Latin America

141.9

111.0

+27.9%

+58.9%

Group Total

1,327.7

1,274.6

+4.2%

+7.7%

(i) Revenue growth at constant exchange rates and scope. Revenue

growth at constant exchange rates is calculated by applying the

average exchange rates of the comparative period to revenue for the

current period of each Group entity, expressed in its reporting

currency. Revenue growth at constant exchange rates and scope

excluding Argentina was +5.6% in H1 2021 compared with H1 2020.

Revenue in the first half of 2021 totalled €1,328

million, a 4.2% increase on a reported basis

compared with the same period in the previous year.

The impact of exchange rates was -3.5% in H1 2021 (-€45

million), mostly linked to the depreciation of the Argentine peso

and Brazilian real, and to a lesser extent, the depreciation of the

Ukrainian hryvnia and the Russian rouble.

At constant scope and exchange rates, revenue grew

+7.7% in the first half of the year (+5.6% excluding

Argentina). This was due to a strong performance in the second

quarter, with organic growth of +17.6% (+15.2% excluding

Argentina). After a slow start to the year, still adversely

affected by numerous lockdowns, business trends improved

dramatically in the second quarter, which saw a strong recovery in

all countries. The gradual reopening of the on-trade channel

(HoReCa - Hotels, Restaurants and Cafés) during the second quarter

of 2021 contributed significantly to growth.

All product categories posted strong sales in the second quarter

compared with last year, except for food jars, which were

particularly buoyant in 2020 during the lockdowns in the second

quarter. Spirits rebounded sharply in the second quarter as exports

to Asia and the United States picked up.

An increase in sales prices at the start of the year and an

excellent product mix at Group level also boosted first-half

revenue.

By region, revenue for H1 2021 breaks down as follows:

- Southern and Western Europe saw

revenue grow by +5.4% on a reported basis and +5.5% at constant

exchange rates and scope in H1 2021. All countries and product

categories recorded growth in the first half, except food jars.

Sales of spirits rocketed after being hit hard in the first half of

2020. Sales of still wine and beer also recorded strong growth.

Sparkling wines picked up thanks to Italy and brisk sales of

Prosecco rosé. Sales prices remained stable in the region.

- In Northern and Eastern Europe,

revenue on a reported basis was down -9.0% compared with H1 2020,

which had proved more resilient than in Southern and Western

Europe. The decrease was smaller at constant exchange rates and

scope, at -5.6%; exchange rates’ fluctuations had a negative impact

of -3.4% due to the depreciation of the Ukrainian hryvnia and the

Russian rouble. The fall in volumes in the first half was mainly

concentrated in the first quarter, as volumes improved in the

second quarter across all product categories. Sales prices also

remained stable in the region.

- In Latin America, the Group reaped

the benefits of having increased capacities in 2020. Revenue rose

sharply: +27.9% increase on a reported basis and +58.9% excluding

the effect of local currency depreciation (+51.7% organic growth

excluding Argentina). Over the six months, volumes increased in all

countries and product categories, except food jars. In addition,

previous increases in selling prices in the region – particularly

in Argentina in response to local hyperinflation – were another

contributing factor.

Adjusted EBITDA

Breakdown of adjusted EBITDA by region

In € million

H1 2021

H1 2020

Southern and Western Europe

Adjusted EBITDA (i)

231.8

195.8

Adjusted EBITDA margin

25.0%

22.2%

Northern and Eastern Europe

Adjusted EBITDA (i)

58.3

68.9

Adjusted EBITDA margin

22.6%

24.3%

Latin America

Adjusted EBITDA (i)

54.6

33.9

Adjusted EBITDA margin

38.5%

30.6%

Group Total

Adjusted EBITDA (i)

344.7

298.7

Adjusted EBITDA margin

26.0%

23.4%

(i) Adjusted EBITDA is calculated based on operating profit

adjusted for depreciation, amortisation and impairment,

restructuring costs, acquisition and M&A costs,

hyperinflationary effects, management share ownership plans,

subsidiary disposal‐related effects and contingencies, plant

closure costs and other items.

Adjusted EBITDA increased by +15.4% in H1 2021 (and

+20.8% at constant exchange rates and scope) to €345

million. The unfavourable exchange rates effect amounted

to -€16 million, mainly due to the depreciation of Latin American

currencies as well as the depreciation of the Ukrainian hryvnia and

the Russian rouble.

Verallia generated a positive spread1 in all regions,

with prices remaining stable in Europe and increasing in Latin

America to offset cost inflation. A particularly favourable product

mix and a net reduction in production costs of €21 million (or 2.7%

of cash production costs) also made a significant contribution to

the improvement in adjusted EBITDA. These positive developments

largely offset the slight dip in activity attributed to continued

destocking in the context of five furnace repairs and the

successful start-up of two new furnaces (in Spain and Italy) during

the first half.

The adjusted EBITDA margin increased to 26.0% from

23.4% in H1 2020.

By region, adjusted EBITDA for H1 2021 breaks down as

follows:

- Southern and Western Europe

reported an adjusted EBITDA of €232 million (vs €196 million in H1

2020) and a margin of 25.0%, up from 22.2%. This solid performance

was due to the positive spread on sales and the excellent

contribution of the product mix. The region’s industrial

performance was also good, despite the difficulties encountered by

France in Q1 due to social movements linked to the transformation

plan, which affected production.

- In Northern and Eastern Europe,

adjusted EBITDA was €58 million (vs €69 million in H1 2020), taking

its margin to 22.6%, compared with 24.3% previously. This fall is

due to the decline in volumes associated with a strong negative

exchange rates’ impact and maintenance costs linked to the

rebuilding of two furnaces.

- In Latin America, adjusted EBITDA

amounted to €55 million (vs €34 million in H1 2020), representing a

margin of 38.5% compared with 30.6% previously. This excellent

performance is due to the strong growth in sales volumes in a

highly dynamic market, combined with a positive spread and solid

industrial performance. In addition, Brazil benefited from the

positive impact of the Brazilian Supreme Federal Court’s decision

on the ICMS tax.

The increase in net income to €133 million is

mainly the result of the improvement in adjusted EBITDA, that is

more than compensating for the increase in the net financial

expense and in the income taxes. The net income includes an

amortisation expense for customer relations, recognised upon the

acquisition of Saint-Gobain’s packaging business in 2015 of €22

million (net of taxes). Excluding this expense, the net income

would be €155 million. This expense was €22 million in H1

2020.

The booked capital expenditure stood at €109

million, compared with €92 million in H1 2020. These

investments consist of €98 million of recurring investments (i.e.

7.4% of consolidated revenue), compared with €64 million in H1

2020, and €11 million of strategic investments (vs €27 million in

H1 2020).

Operating cash flow2 came in higher at €212

million, compared with €138 million in H1 2020, thanks to the

growth in adjusted EBITDA and the significant improvement in

working capital requirement. Based on number of days’ sales

compared with 30 June 2020, inventories remained at a very low

level while late payments continue to be well managed (stable at a

very low level).

Very solid balance sheet

Verallia improved its net debt ratio in the first half: net

debt amounted to €1,266 million at 30 June 2021 after

two share buybacks by the Group for €109 million (in March and June

2021). This corresponds to a net debt ratio of 1.9x adjusted

EBITDA for the last 12 months, compared with 2.1x at 31 March

2021, down from 2.5x at 30 June 2020.

In addition, Verallia decided not to extend its additional

credit facility of €250 million (RCF2), implemented in April

2020.

Lastly, to diversify its funding sources and in line with its

ESG strategy unveiled in January 2021, on 14 May 2021 Verallia

successfully placed its inaugural “Sustainability‐Linked” bond

issue for a total of €500 million, maturing in seven years and

with a coupon of 1.625%. The net proceeds of the issue were used to

repay some of the Group’s debt. This landmark transaction allows

Verallia to (i) diversify its funding sources by tapping the bond

market, (ii) extend the average maturity of its debt, and (iii)

strengthen visibility of its sustainability commitment.

The Group still had significant liquidity3 of €848

million as of 30 June 2021.

Share buyback

On 9 June 2021, Verallia repurchased 1.6 million shares for

€48.8 million. This coincided with the sale by Apollo4 of its stake

of around 10% in Verallia via an accelerated private placement. The

shares were cancelled on 24 June 2021 (see below).

In addition, on 5 March 2021, the Group also participated in an

accelerated private placement of Apollo by acquiring 2.1 million

shares for €60 million. These repurchased shares have been and will

be used to cover employee share ownership programmes (the sixth of

which ended on 24 June 2021 – see below) and Group performance

share plans.

Results of voting at the Annual General

Shareholders' Meeting of 15 June 2021

With a quorum of more than 85%, the Annual General Shareholders'

Meeting of the Company on 15 June 2021 adopted, with approval rates

ranging from 84.8% to 99.9%, all the resolutions put to the

vote.

The Annual General Shareholders' Meeting also voted for a cash

dividend of €0.95 per share, with an ex-dividend date of 1 July

2021 and a payment date of 5 July 2021.

Success of the 2021 employee

shareholding offer

Almost 3,200 employees (i.e. 41% of eligible persons worldwide)

took part in the Group’s sixth employee shareholding offer at a

unit subscription price of €25.525. In France, the operation was

well received, with nearly 75% of eligible employees

subscribing.

As a result, employee shareholders now hold 3.54% of Verallia’s

share capital, directly and through Verallia’s FCPE (corporate

mutual fund). The percentage of employee shareholders is

approximately 41%.

On 24 June 2021, following this transaction (which was

oversubscribed), the Company issued 616,364 new ordinary shares

representing 0.5% of the share capital and voting rights. To

counter the dilutive effect of this transaction, the Company

simultaneously reduced its share capital by cancelling 1.6 million

treasury shares acquired under the share buyback programme6.

2021 Outlook

Provided there are no new widespread Covid lockdowns, the strong

business performance in the first half of 2021 means that

Verallia’s net sales should reach around €2.6 billion with volumes

in 2021 returning to 2019 level.

Verallia also expects 2021 adjusted EBITDA to increase

significantly on the previous year. The adjusted EBITDA should be

higher than initially expected at around €675 million (compared

with €650 million forecast in February 2021).

About Verallia – At Verallia, our purpose is to

re-imagine glass for a sustainable future. We want to redefine how

glass is produced, reused and recycled, to make it the world’s most

sustainable packaging material. We are joining forces with our

customers, suppliers and other partners across the value chain to

develop new, healthy and sustainable solutions for all.

With around 10,000 employees and 32 glass production facilities

in 11 countries, we are the European leader and the world's

third-largest producer of glass packaging for beverages and food

products. We offer innovative, customised and environmentally

friendly solutions to over 10,000 businesses around the world.

In 2020, Verallia produced more than 16 billion glass bottles

and jars and posted revenue of €2.5 billion. Verallia is listed on

compartment A of the regulated market of Euronext Paris (Ticker:

VRLA – ISIN: FR0013447729) and is included in the following

indices: SBF 120, CAC Mid 60, CAC Mid & Small et CAC

All-Tradable.

For more information, visit www.verallia.com

Follow us on LinkedIn , Twitter , Facebook and YouTube

The consolidated financial statements of the Verallia Group for

the financial year ended 30 June 2021, which were subject to a

limited review by the Group’s Statutory Auditors, were approved by

the Board of Directors on 28 July 2021 and will be available on

www.verallia.com.

An analysts’ conference call will be held on Thursday, 29 July

2021 at 9.00 am (CET) via an audio webcast service (live and

replay) and the results presentation will be available on

www.verallia.com.

Financial calendar

- 07 October 2021: Digital

Investor Day – Press release and virtual presentation at 3.00 pm

(CET).

- 28 October 2021: Financial results

for Q3 2021 – Press release before the market opening

and conference call/presentation at 9.00 am (CET) on that day.

Disclaimer

Certain information included in this press release does not

constitute historical data but constitutes forward-looking

statements. These forward-looking statements are based on current

beliefs, expectations and assumptions, including, without

limitation, assumptions regarding Verallia's present and future

business strategies and the economic environment in which Verallia

operates, and involve known and unknown risks, uncertainties and

other factors, which may cause actual results, performance or

achievements, or industry results or other events, to be materially

different from those expressed or implied by these forward-looking

statements. These risks and uncertainties include those discussed

and identified in Chapter 3 “Risk Factors” in the Universal

Registration Document approved by the AMF, available on the

Company’s website (www.verallia.com) and the AMF’s website

(www.amf-france.org). These forward-looking information and

statements are not guarantees of future performances.

This press release includes only summary information and does

not purport to be comprehensive.

Personal data protection

You can unsubscribe from our press release distribution list at

any time by sending your request to the following email address:

investors@verallia.com. Press releases will still be available to

access via the website https://www.verallia.com/en/investors/.

Verallia SA, as data controller, processes personal data for the

purpose of implementing and managing its internal and external

communication. This processing is based on legitimate interests.

The data collected (last name, first name, professional contact

details, profiles, relationship history) is essential for this

processing and is used by the relevant departments of the Verallia

group and, where applicable, its subcontractors. Verallia SA

transfers personal data to its service providers located outside

the European Union, who are responsible for providing and managing

technical solutions related to the aforementioned processing.

Verallia SA ensures that the appropriate guarantees are obtained in

order to supervise these data transfers outside of the European

Union. Under the conditions defined by the applicable regulations

for the protection of personal data, you may access and obtain a

copy of the data concerning you, object to the processing of this

data and request for it to be rectified or erased. You also have a

right to restrict the processing of your data. To exercise one of

these rights, please contact the Group Financial Communication

Department at investors@verallia.com. If, after having contacted

us, you believe that your rights have not been respected or that

the processing does not comply with data protection regulations,

you may submit a complaint to CNIL (Commission nationale de

l'informatique et des libertés — French regulatory body).

APPENDICES

Key figures

In € million

H1 2021

H1 2020

Revenue

1,327.7

1,274.6

Reported growth

+4.2%

-4.1%

Organic growth

+7.7%

-0.9%

of which Southern and Western Europe

927.9

880.3

of which Northern and Eastern Europe

257.9

283.3

of which Latin America

141.9

111.0

Cost of sales

(1,006.0)

(1,002.9)

Selling, general and administrative

expenses

(86.9)

(80.1)

Acquisition-related items

(29.9)

(30.4)

Other operating revenue and expenses

2.2

(27.1)

Operating profit

207.1

134.1

Net financial income (expense)

(32.3)

(19.5)

Profit (loss) before tax

174.8

114.6

Income tax

(43.5)

(35.3)

Share of net profit (loss) of

associates

1.2

0.0

Net profit (loss) for the year

(i)

132.5

79.3

Earnings per share

€1.07

€0.64

Adjusted EBITDA (ii)

344.7

298.7

Group Margin

26.0%

23.4%

of which Southern and Western Europe

231.8

195.8

Southern and Western Europe margin

25.0%

22.2%

of which Northern and Eastern Europe

58.3

68.9

Northern and Eastern Europe margin

22.6%

24.3%

of which Latin America

54.6

33.9

Latin America margin

38.5%

30.6%

Net debt at the end of the

period

1,266.2

1,475.7

Last 12 months adjusted EBITDA

671.7

601.1

Net debt/last 12 months adjusted

EBITDA

1.9x

2.5x

Total capex (iii)

109.4

91.5

Cash conversion (iv)

68.3%

69.4%

Change in operating working capital

(23.7)

(69.0)

Operating cash flow (v)

211.6

138.2

Strategic investments (vi)

11.2

27.2

Recurring investments (vii)

98.2

64.4

(i) Net income for H1 2021 includes an amortisation expense for

customer relations, recognised upon the acquisition of

Saint-Gobain’s packaging business in 2015, of €22 million (net of

taxes). Excluding this expense, the net income would be €155

million. This expense was €22 million in H1 2020. (ii) Adjusted

EBITDA is calculated on the basis of operating profit adjusted for

depreciation, amortisation and impairment, restructuring costs,

acquisition and M&A costs, hyperinflationary effects,

management share ownership plans, subsidiary disposal-related

effects and contingencies, plant closure costs and other items.

(ii) Capex (capital expenditure) represents purchases of property,

plant and equipment and intangible assets necessary to maintain the

value of an asset and/or adapt to market demand or to environmental

and health and safety constraints, or to increase the Group’s

capacity. It excludes the purchase of securities. (iv) Cash

conversion represents adjusted EBITDA less capex, divided by

adjusted EBITDA. (v) Operating cash flow represents adjusted EBITDA

less capex, plus changes in operating working capital requirement

including changes in payables to fixed asset suppliers. (vi)

Strategic investments represent the acquisitions of strategic

assets that significantly enhance the Group's capacity or its scope

(for example, the acquisition of plants or similar facilities,

greenfield or brownfield investments), including the building of

additional new furnaces. From 2021 onwards, they will also include

investments related to the implementation of the plan to reduce CO2

emissions. (vii) Recurring investments represent acquisitions of

property, plant and equipment and intangible assets necessary to

maintain the value of an asset and/or adapt to market demands and

to environmental, health and safety requirements. It mainly

includes furnace renovation and maintenance of IS machines.

Change in revenue by type in € million

during H1 2021

In € million

Revenue H1 2020

1,274.6

Volumes

+44.6

Price/Mix

+53.3

Exchange rates

(44.8)

Revenue H1 2021

1,327.7

Change in adjusted EBITDA by type in €

million during H1 2021

In € million

Adjusted EBITDA H1 2020 (i)

298.7

Activity contribution

(6.0)

Spread price-mix/costs

+45.4

Net productivity

+21.3

Exchange rates

(16.0)

Other

+1.4

Adjusted EBITDA H1 2021 (i)

344.7

(i) Adjusted EBITDA is calculated based on operating profit

adjusted for depreciation, amortisation and impairment,

restructuring costs, acquisition and M&A costs,

hyperinflationary effects, management share ownership plans,

subsidiary disposal‐related effects and contingencies, plant

closure costs and other items.

Comparison between Q1 and

Q2

In € million

Q1

Q2

2021

2020

2021

2020

Revenue

604.9

644.8

722.9

629.9

Reported growth

-6.2%

+14.8%

Organic growth

-2.0%

+17.6%

Adjusted EBITDA

151.7

151.3

193.0

147.4

Adjusted EBITDA margin

25.1%

23.5%

26.7%

23.4%

Reconciliation of operating profit to

adjusted EBITDA

In € million

H1 2021

H1 2020

Operating profit

207.1

134.1

Depreciation and amortisation (i)

136.2

139.6

Restructuring costs (ii)

(2.7)

19.1

IAS 29 Hyperinflation (Argentina)

(iii)

(0.7)

0.7

Management share ownership plan and

associated costs

4.4

1.8

Other

0.4

3.4

Adjusted EBITDA

344.7

298.7

(i) Includes depreciation and amortisation of intangible assets

and property, plant and equipment, amortisation of intangible

assets acquired through business combinations and impairment of

property, plant and equipment, including those linked to the

transformation plan implemented in France in 2020. (ii) Corresponds

mainly to the transformation plan in France. (iii) The Group has

applied IAS 29 (Hyperinflation) since the second half of 2018.

Reconciliation of Cash conversion to

adjusted EBITDA

In € million

H1 2021

H1 2020

Adjusted EBITDA

344.7

298.7

Capex

(109.4)

(91.5)

Cash flows (adjusted EBITDA -

Capex)

235.3

207.2

Cash conversion

68.3%

69.4%

Adjusted EBITDA and Cash conversion are alternative performance

indicators within the meaning of AMF position no. 2015-12.

Adjusted EBITDA and cash conversion are not standardised

accounting measures that meet a single, generally accepted

definition as per IFRS. They must not be considered as a substitute

for operating income and cash flow from operating activities which

are measures defined by IFRS, or as a measure of liquidity. Other

issuers may calculate adjusted EBITDA and Cash conversion

differently from the definition used by the Group.

Financial structure

In € million

Nominal amount

or max. drawable

amount

Nominal rate

Final

maturity

30 June

2021

Sustainability-Linked Bond (i)

500

1.625%

14 May 28

496.8

Term Loan A (i)

1,000

Euribor +1.50%

07 Oct. 24

993.9

Revolving credit facility 1

500

Euribor +1.10%

07 Oct. 24

-

Commercial Papers Neu CP

400

149.2

Other borrowings (ii)

123.5

Total borrowings

1,763.4

Cash and cash equivalents

(497.2)

Net borrowings

1,266.2

(i) Excluding accrued interest. (ii) o/w IFRS16 leasing

(€53.6m), local debts (€31.4m), factoring recourse (€14.4m), margin

call on commodities derivatives (€15.6m).

IAS 29: Hyperinflation in

Argentina

Since the second half of 2018, the Group has applied IAS 29 in

Argentina. The adoption of this standard requires the restatement

of non‐monetary assets and liabilities and of the income statement

to reflect changes in purchasing power in the local currency,

leading to a gain or loss on the net monetary position included in

the finance costs.

Financial information of the Argentinian subsidiary is converted

into euros using the closing exchange rate for the relevant

period.

In H1 2021, the net impact on revenue was +€2.1 million.

The hyperinflation impact has been excluded from Group adjusted

EBITDA as shown in the table “Reconciliation of operating profit to

adjusted EBITDA”.

Consolidated income

statement

In € million

H1 2021

H1 2020

Revenue

1,327.7

1,274.6

Cost of sales

(1,006.0)

(1,002.9)

Selling, general and administrative

expenses

(86.9)

(80.1)

Acquisition-related items

(29.9)

(30.4)

Other operating revenue and expenses

2.2

(27.1)

Operating profit

207.1

134.1

Net financial income (expense)

(32.3)

(19.5)

Profit (loss) before tax

174.8

114.6

Income tax

(43.5)

(35.3)

Share of net profit (loss) of

associates

1.2

0.0

Net profit (loss) for the year

(i)

132.5

79.3

Attributable to shareholders of the

Company

130.9

76.0

Attributable to non-controlling

interests

1.6

3.3

Basic earnings per share (in €)

1.07

0.64

Diluted earnings per share (in

€)

1.07

0.64

(i) Net income for H1 2021 includes an amortisation expense for

customer relations, recognised upon the acquisition of

Saint-Gobain’s packaging business in 2015, of €22 million (net of

taxes). Excluding this expense, the net income would be €155

million. This expense was €22 million in H1 2020.

Consolidated balance

sheet

In € million

30 June 2021

31 Dec. 2020

ASSETS

Goodwill

533.9

529.7

Other intangible assets

402.4

430.9

Property, plant and equipment

1,321.7

1,288.5

Investments in associates

3.2

2.0

Deferred tax

38.0

27.1

Other non-current assets

32.7

30.8

Non-current assets

2,331.9

2,309.0

Inventories

358.4

386.9

Trade receivables and other current

assets

292.0

158.7

Current tax receivables

0.8

5.0

Cash and cash equivalents

497.2

476.2

Current assets

1,148.4

1,026.8

Total Assets

3,480.3

3,335.8

EQUITY & LIABILITIES

Share capital

413.3

416.7

Consolidated reserves

137.8

121.6

Equity attributable to

shareholders

551.1

538.3

Non-controlling interests

44.3

39.5

Equity

595.4

577.8

Non-current financial liabilities and

derivatives

1,566.3

1,569.1

Provisions for pensions and other employee

benefits

127.1

134.0

Deferred tax

163.7

146.0

Provisions and other non-current financial

liabilities

21.8

24.1

Non-current liabilities

1,878.9

1,873.2

Current financial liabilities and

derivatives

197.1

185.7

Current portion of provisions and other

non-current financial liabilities

33.7

59.8

Trade payables

398.1

367.5

Current tax liabilities

36.2

21.8

Other current liabilities

340.9

250.0

Current liabilities

1,006.0

884.8

Total Equity and Liabilities

3,480.3

3,335.8

Consolidated cash flow

statement

In € million

H1 2021

H1 2020

Net profit (loss) for the year

132.5

79.3

Depreciation, amortisation and impairment

of assets

136.2

139.6

Interest expense on financial

liabilities

17.1

18.6

Change in inventories

29.9

4.9

Change in trade receivables, trade

payables & other receivables & payables

(17.3)

(23.4)

Current tax expense

61.5

40.0

Taxes paid

(36.9)

(16.5)

Changes in deferred taxes and

provisions

(48.8)

13.8

Other

11.9

3.6

Net cash flows from operating

activities

286.1

259.9

Acquisition of property, plant and

equipment and intangible assets

(109.4)

(91.5)

Increase (decrease) in debt on fixed

assets

(38.7)

(50.4)

Other

(1.7)

(0.4)

Net cash flows from (used in) investing

activities

(149.8)

(142.3)

Capital increase (reduction)

15.7

20.1

Dividends paid

-

-

Increase (decrease) in treasury stock

(109.2)

-

Transactions with shareholders

(93.5)

20.1

Transactions with non-controlling

interests

(1.2)

(0.6)

Increase (reduction) in bank overdrafts

and other short-term borrowings

14.3

(129.9)

Increase in long-term debt

501.9

201.2

Reduction in long-term debt

(515.6)

(13.1)

Financial interest paid

(21.1)

(13.4)

Change in gross debt

(20.5)

44.8

Net cash flows from (used in) financing

activities

(115.2)

64.3

Increase (reduction) in cash and cash

equivalents

21.1

181.9

Impact of changes in foreign exchange

rates on cash and cash equivalents

(0.1)

(12.9)

Opening cash and cash

equivalents

476.2

219.2

Closing cash and cash

equivalents

497.2

388.2

GLOSSARY

Activity category: corresponds to

the sum of the volumes variations plus or minus changes in

inventories variation.

Organic growth: corresponds to

revenue growth at constant exchange rates and scope. Revenue growth

at constant exchange rates is calculated by applying the average

exchange rates of the comparative period to revenue for the current

period of each Group entity, expressed in its reporting

currency.

Adjusted EBITDA: This is a non-IFRS

financial measure. It is an indicator for monitoring the underlying

performance of businesses adjusted for certain expenses and/or

non-recurring items liable to distort the company’s performance.

The Adjusted EBITDA is calculated based on operating profit

adjusted for depreciation, amortisation and impairment,

restructuring costs, acquisition and M&A costs,

hyperinflationary effects, management share ownership plans,

subsidiary disposal-related effects and contingencies, plant

closure costs and other items.

Capex: Short for “capital

expenditure”, this represents purchases of property, plant and

equipment and intangible assets necessary to maintain the value of

an asset and/or adapt to market demand or to environmental and

health and safety constraints, or to increase the Group’s capacity.

It excludes the purchase of securities.

Recurring investments: Recurring

Capex represent acquisitions of property, plant and equipment and

intangible assets necessary to maintain the value of an asset

and/or adapt to market demands and to environmental, health and

safety requirements. It mainly includes furnace renovation and

maintenance of IS machines.

Strategic investments: Strategic

investments represent the acquisitions of strategic assets that

significantly enhance the Group's capacity or its scope (for

example, the acquisition of plants or similar facilities,

greenfield or brownfield investments), including the building of

additional new furnaces. From 2021 onwards, they will also include

investments related to the implementation of the plan to reduce CO2

emissions.

Cash conversion: refers to the

ratio between cash flow and adjusted EBITDA. Cash flow refers to

adjusted EBITDA less Capex.

The segment Southern and Western

Europe comprises production plants located in France, Spain,

Portugal and Italy. It is also denominated as “SWE”.

The segment Northern and Eastern

Europe comprises production plants located in Germany,

Russia, Ukraine and Poland. It is also denominated as “NEE”.

The segment Latin America comprises

production plants located in Brazil, Argentina and Chile.

Liquidity: calculated as the Cash +

Undrawn Revolving Credit Facilities – Outstanding Neu Commercial

Paper.

Amortisation of intangible assets acquired

through business combinations: Corresponds to the

amortisation of customer relations recorded during the acquisition

of the Saint-Gobain packaging business in 2015 (initial gross value

of €740 million over a useful life of 12 years).

1 Spread represents the difference between (i) the increase in

sales prices and mix applied by the Group after passing the

increase in its production costs on to these prices, if required,

and (ii) the increase in its production costs. The spread is

positive when the increase in sales prices applied by the Group is

greater than the increase in its production costs. The increase in

production costs is recorded by the Group at constant production

volumes and before production gap and the impact of the Performance

Action Plan (PAP). 2 Operating cash flow represents adjusted EBITDA

less capex, plus changes in operating working capital requirement

including changes in payables to fixed asset suppliers. 3

Calculated as the Cash + Undrawn Revolving Credit Facilities –

Outstanding Neu Commercial Paper. 4 Acting through Horizon

Investment Holdings S.à.r.l., a company owned by Horizon Parent

Holdings S.à.r.l., itself owned by AIF VIII Euro Leverage, L.P., an

investment fund managed by an affiliate of Apollo Global

Management, Inc. 5 This represents a discount of approximately 20%

compared with the average Verallia share price on the Euronext

Paris regulated market over the 20 trading days prior to 30 April

2021. 6 Capital increase for a total nominal amount of

€2,083,310.32 and a share premium of €13,646,298.96. The 616,364

new ordinary shares immediately qualify for dividends, have the

same rights and obligations as shares outstanding, and have equal

rights to any dividends distributed, with no restrictions or

conditions. Capital reduction by cancelling 1,600,000 own shares

acquired on 11 June 2021 under the share buyback programme. The

Company’s share capital following the completion of these capital

increase and capital reduction operations is €413,337,438.54. It is

composed of 122,289,183 ordinary shares with a par value of €3.38

each.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210728005923/en/

Media contacts Verallia –

Florence de Nadaï – florence.de-nadai@ext.verallia.com

Brunswick - Benoit Grange, Hugues Boëton, Tristan Roquet

Montegon - verallia@brunswickgroup.com - +33 1 53 96 83

83

Verallia Investor Relations

contact Alexandra Baubigeat Boucheron -

alexandra.baubigeat-boucheron@verallia.com

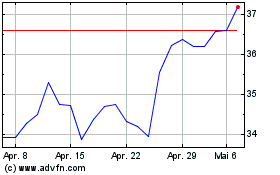

VERALLIA (EU:VRLA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

VERALLIA (EU:VRLA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024