VGP Trading Update: Surge in VGP’S New Contracted Rental Income Doubles Development Activity

19 November 2021 - 7:00AM

VGP Trading Update: Surge in VGP’S New Contracted Rental Income

Doubles Development Activity

19

November 2021, 7:00am, Antwerp,

Belgium: VGP NV (‘VGP’ or ‘the Group’), a European

provider of high-quality logistics and semi-industrial real estate,

today published a trading update for the first ten months of

2021:

- Record

operating performance underpinned by strong client-led demand

- €63.4 million

signed and renewed lease agreements (versus €34.6 million for

10M’20), bringing total annualized rental income to €240.5 million

(+29.8% year-to-date)

- 1,619,000 m2

under construction – 2.2x the level of Oct 2020 – representing

€100.0 million in additional annual rent once fully built and let

(currently 80.7% pre-let)

- 427,000 m2

added to the completed portfolio, now at 2.87 million m2 (98.8%

let)

- Expansion of

land bank despite significant consumption secures future growth

- 3.17 million m2

of new land positions bought and a further 4.21 million m2

committed subject to permits

- Total land bank

acquired and committed has grown to 10.49 million m2 (+37.1%

year-to-date) which provides 4.69 million m2 of future lettable

area

- Agreement in

principle with Allianz Real Estate in respect of setting up a

fourth joint venture with an investment capacity of €2.8 billion

and first closing anticipated in 2022

VGP’s Chief Executive Officer, Jan Van

Geet, said: “The year 2021 is turning into a record year

in many respects as e-commerce demand continues to go through a

structural shift and adjustments to business supply chains increase

demand for warehouse space. We have achieved our best-ever new

leases signed and square meters under construction whilst

maintaining a high pre-let level of 80.7%.”

Jan Van Geet continued: " I am most delighted

that we have managed to further expand our land bank. The level of

elevated construction activity consumed a significant amount of our

existing land bank, yet even on a net-basis we managed to continue

to increase it – since December 2020 by 2.84 million m2 – as we

have managed to secure several more iconic land positions during

the last few months. These include positions in Vienna, Budapest

and San Sebastián, and an extension of our existing park in

Bratislava, that will drive our Group’s future prospects and

growth. VGP further expanded its footprint across Europe as we have

acquired a first land position in Serbia and will open our first

office in France, allowing us to serve more businesses and

communities across Europe. We are also expanding our renewable

energy business with now 145.4 MWp in solar roof projects installed

or in the pipeline.”

Jan Van Geet concluded: “In addition to our outstanding

operating performance, the increasing engagement with our clients

is a strong proof point of our successful strategy as we remain

committed to using our resources to drive sustainable solutions to

support our employees, clients and the communities we serve. Our

expanding balance sheet and growing capital base allows us to

expand our client-led construction activities and keep

income-generating assets on our balance sheet longer. Our newly

announced joint venture with Allianz Real Estate will, once

operational, provide us with the ability to continue to recycle our

capital expenditures and re-invest into new development

opportunities”

OPERATING HIGHLIGHTS –

10M 2021

Strong lease activity

reflects significant

client demand

- Signed and

renewed rental income of €63.4 million driven by €58.5 million of

new leases (€5.9 million on behalf of the Joint Ventures1) and €4.9

million of renewals (all on behalf of the Joint Ventures). Lease

agreements in the amount of €3.3 million were terminated

- Annualized

committed leases as of October 2021 (including Joint Ventures at

100%) of €240.5 million (vs €185.2 million at Dec-20) of which

€149.6 million related to the Joint Ventures

- Our commercial

teams are experiencing significant demand. Based on already signed

letters of intent for additional future lease contracts, we expect

the current pace to continue into the coming period as clients

respond to consumer desire for convenience. Changing consumption

trends across the physical and digital space are fundamentally

impacting and changing the nature of demand from our clients

- The new leases

signed are typically long-term (increasing our weighted average

lease term of the total portfolio from 8.5 years in Dec 2020 to 8.7

years today) and indexed annually to inflation

Development activities

- Delivery of 16

projects during the first ten months of 2021 adding 427,000 m2 of

lettable area representing € 21.1 million of annualized leases;

these buildings are 98.4% let. It is expected that circa 100,000 m²

of additional lettable area will be delivered prior to the year-end

(100% pre-let)

- A total of 58

projects under construction which will create 1,619,000 m2 of

future lettable area representing € 100.0 million of annualised

leases once fully built and let (80.7% pre-let)

- Whilst

construction costs have trended upward, this has been offset

through higher rental prices and lower yields

- The significant

investments into our organizational structure over the last few

years – the Group today has circa 350 employees, with local

technical expertise available across the Group and in all of our

markets – have enabled the Group to swiftly gear-up for the current

surge in demand without impacting timelines and quality of our

construction pipeline

- Geographical

split of parks under construction, based on square meters: 46% are

located in Germany, 12% Spain, 12% in Czech Republic, 9% Slovakia,

7% Romania, 6% the Netherlands, 4% Hungary, 3% Latvia, 2% Italy and

1% Austria

Expanding land bank

with strategic geographic spread

- During the first

ten months of 2021 in total 3,165,000 m2 of land was acquired

representing a development potential of 1,320,000 m2 and a further

4,205,000 m2 of land plots were committed, pending permits, which

have a development potential of 1,770,000 m2 of future lettable

area, bringing the total owned and committed land bank to

10,490,000 m2 (+37.1% year-to-date), supporting 4,685,000 m2 of

future lettable area

- A further

3,230,000 m² of new land plots have been identified and secured

which are under due diligence and have a development potential of

1,470,000 m² of future lettable area. This brings the land bank of

owned, committed and secured to 13,720,000 m2 supporting 6,155,000

m2 of future lettable area

- From an asset

value perspective, the land bank is predominantly Western

European-based but on the bases of square meters the land bank is

well spread across the countries in which we operate

- Our team

continues to find additional – increasingly brownfield – sites for

future development, and we are working with planning authorities on

the most effective and sustainable utilization and regeneration of

such sites in order to reduce our impact on the environment

Expansion of the Group’s

European footprint

- The Group

further expanded its European footprint with the acquisition of a

first land plot in Serbia, where a 1.1 million m2 land position was

acquired near Belgrade Airport. The main focus will now be on the

development of this location as several, primarily Western European

manufacturing companies have expressed interest

- The Group will

open its first office in France (Lyon). In the coming period the

focus will be on identifying suitable development locations

- Other

continental European countries, including Sweden and Greece, remain

in focus for potential future expansion

Renewable Energy

- A total solar

power generation capacity of 62.8MWp is currently installed or

under construction through 54 roof-projects. This is being realised

through a €32.3 million investment to date. In addition, the

currently identified pipeline equates to an additional power

generation capacity of 82.6 MWp

Agreement in principle with Allianz Real Estate

regarding setup of fourth

joint venture2

- Agreement in

principle with Allianz Real Estate has been reached in respect of

setting up a fourth 50:50 joint venture between the two partners.

This new Joint Venture is replacing the investment capacity of the

First Joint Venture – which has reached its investment capacity at

€2 billion – and covers the same countries

- The new joint

venture will have an investment target of €2.8 billion and follows

a similar structure as the first two joint ventures with VGP

servicing the new joint venture as its asset, property and

development manager

- A first closing

with the new joint venture is anticipated in the course of

2022

Capital and liquidity position

- In September

2021 VGP received a €21.1 million profit-distribution from the

First Joint Venture

- In respect of

the expansion of the Second Joint Venture, it is anticipated that a

further closing will occur during the first half of 2022. This

third closing is anticipated to generate proceeds of circa €

120-130 million3

- The newly

announced joint venture with Allianz Real Estate will provide the

Group with the ability to continue recycle its capital expenditures

whilst simultaneously finance the build-out of the existing

pipeline and acquire new land positions. A first closing with the

new joint venture is anticipated in the course of 2022

- The Group

believes that it is important to maintain a strong capital position

and continually evaluates its capital markets options to finance

the investment pipeline and any opportunistic investment

opportunities as they arise

Outlook

- The Group looks

confidently at the last few weeks of 2021 and into 2022

- Client demand

and supply constraints are supporting rents and occupancy, and

underlying real estate fundamentals are expected to continue to

support a strong positive near-term valuation outlook and sustained

long-term demand

- Based on the

strong leasing activities as reported over the last few months and

indications of interest received for the coming period, development

activities are expected to continue to operate at elevated levels

well into 2022

- Longer term

development activities will continue to be driven by client-led

demand and our ability to meet these opportunities

CONTACT DETAILS FOR INVESTORS AND MEDIA

ENQUIRIES

|

Martijn Vlutters (VP – Business Development & Investor

Relations) |

Tel: +32 (0)3 289 1433 |

|

Petra Vanclova (External Communications) |

Tel: +42 0 602 262 107 |

|

Anette NachbarBrunswick Group |

Tel: +49 152 288 10363 |

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking

statements. Such statements reflect the current views of management

regarding future events, and involve known and unknown risks,

uncertainties and other factors that may cause actual results to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements. VGP is providing the information in this press release

as of this date and does not undertake any obligation to update any

forward-looking statements contained in this press release in light

of new information, future events or otherwise. The information in

this announcement does not constitute an offer to sell or an

invitation to buy securities in VGP or an invitation or inducement

to engage in any other investment activities. VGP disclaims any

liability for statements made or published by third parties and

does not undertake any obligation to correct inaccurate data,

information, conclusions or opinions published by third parties in

relation to this or any other press release issued by VGP.

ABOUT VGP

VGP is a pan-European developer, manager and

owner of high-quality logistics and semi-industrial real estate.

VGP operates a fully integrated business model with capabilities

and longstanding expertise across the value chain. The company has

a development land bank (owned or committed) of 10.49 million m²

and the strategic focus is on the development of business parks.

Founded in 1998 as a Belgian family-owned real estate developer in

the Czech Republic, VGP with a staff of circa 350 employees owns

and operates assets in 12 European countries directly and through

several 50:50 joint ventures. As of June 2021, the Gross Asset

Value of VGP, including the joint ventures at 100%, amounted to €

4.48 billion and the company had a Net Asset Value (EPRA NTA) of €

1.51 billion. VGP is listed on Euronext Brussels (ISIN:

BE0003878957).

For more information, please visit:

http://www.vgpparks.eu

1 Joint Ventures means either and each of (i)

the First Joint Venture i.e. VGP European Logistics S.à.r.l., the

50:50 joint venture between VGP and Allianz and (ii) the Second

Joint Venture i.e. VGP European Logistics 2 S.à.r.l., the 50:50

joint venture between VGP and Allianz, and (iii) the Third Joint

Venture i.e. VGP Park München GmbH, the 50:50 joint venture between

VGP and Allianz, and (iv) LPM Joint Venture, i.e. LPM Holding B.V.,

the 50:50 joint venture between VGP and Roozen Landgoederen Beheer2

Whilst the new joint venture will be the fifth joint venture

entered into by the Group, it will be the fourth joint venture

together with Allianz Real Estate3 Subject to final agreement

between the joint venture partners in terms of the transferred

income generating assets and pricing

- VGP - Trading update 19 November 2021 (EN)

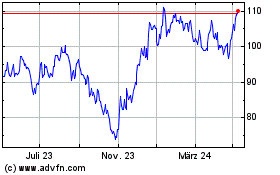

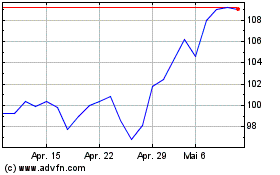

VGP NV (EU:VGP)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

VGP NV (EU:VGP)

Historical Stock Chart

Von Apr 2023 bis Apr 2024