TUI Launches Discounted Share-Placing; Summer, Winter Pipeline Strong -- Update

06 Oktober 2021 - 8:23AM

Dow Jones News

By Sabela Ojea

TUI AG said Wednesday that it intends to raise proceeds of

around 1.1 billion euros ($1.28 billion) via a discounted

share-placing to reduce its debt position.

The London-listed company also said its U.K. winter bookings are

performing strongly since the latest government travel update. For

the overall winter, bookings at this stage are 54% above 2018-2019

levels. Summer bookings are up by around 1.1 million since its

third-quarter update, to 5.2 million, it added.

The Germany-based travel group said it is offering 523.5 million

new registered shares at subscription, noting that each share is

priced at EUR2.15. The share price represents a discount to a

theoretical ex-rights price of 35.1%.

TUI also said its largest shareholder, Unifirm Ltd., will

exercise all subscription rights attributable to its shareholding

at the subscription price and to subscribe directly for new

shares.

"The company intends to use the net proceeds of the offering to

reduce interest costs and net debt by reducing current drawings,"

it said, noting that its KfW facility would be reduced by EUR375.0

million to zero. Its current drawings under the cash facility would

also be reduced by the remaining net proceeds of EUR724.5 million

to EUR762.0 million, the company said.

Write to Sabela Ojea at sabela.ojea@wsj.com; @sabelaojeaguix

(END) Dow Jones Newswires

October 06, 2021 02:08 ET (06:08 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

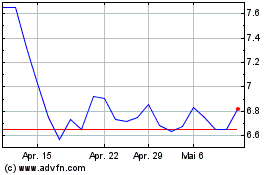

Tui (TG:TUI1)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

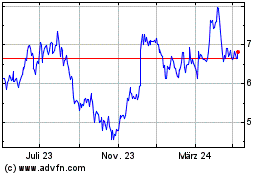

Tui (TG:TUI1)

Historical Stock Chart

Von Apr 2023 bis Apr 2024