Schneider Electric to Buy Out IGE + XAO for Nearly $400 Million

20 Juli 2021 - 8:55AM

Dow Jones News

By Mauro Orru

Schneider Electric SE plans to file an offer to buy out software

company IGE + XAO SA for 338 million euros ($398.8 million).

The French energy-management company said Tuesday that it would

launch the offer through its subsidiary Schneider Electric

Industries SAS, which owns about 67.7% of IGE + XAO and 78.3% of

voting rights.

The offer will be for approximately 31.9% of IGE + XAO at EUR260

a share, representing a 15% premium over the latest closing price

of the company.

IGE + XAO will subsequently be delisted and will join the energy

management software division at Schneider Electric, which expects

to file the offer in September.

Write to Mauro Orru at mauro.orru@wsj.com; @MauroOrru94

(END) Dow Jones Newswires

July 20, 2021 02:55 ET (06:55 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

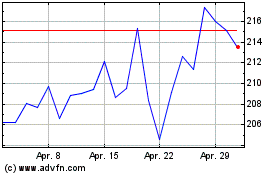

Schneider Electric (EU:SU)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Schneider Electric (EU:SU)

Historical Stock Chart

Von Apr 2023 bis Apr 2024