Safran Sees Income Margin, Revenue Growth Through 2025

02 Dezember 2021 - 9:12AM

Dow Jones News

By Olivia Bugault

Safran SA said Thursday ahead of its capital markets day

starting later today that it expects profit margin and revenue to

grow through 2025, while it also disclosed other mid-term

targets.

The French defense-and-aerospace company said it expects its

recurring operating income margin to reach 16% to 18% by 2025. The

target would represent "more than 5 points margin expansion from

2021, mainly driven by growth in services across all divisions," it

said. Its propulsion division is expected to have the highest

margin, with an expected recurring operating margin of more than

20% by 2025.

Meanwhile, Safran expects its organic revenue growth to reach at

least 10% at a compound annual growth rate from 2021 to 2025, with

civil aftermarket activities growing around 15%, it said.

It also said that in 2023, it expects to resume its "historical

practice" of distributing 40% of its earnings to shareholders

through dividend, and that the board of directors will review this

dividend practice beyond 2023.

"A portfolio review, conducted after three years of experience

since their acquisition, concluded that 70% of the former Zodiac

Aerospace businesses are core and 30% under assessment," Safran

said. Safran acquired Zodiac Aerospace in 2018.

Further divestments and bolt-on acquisitions are also considered

after the portfolio review, it said.

Write to Olivia Bugault at olivia.bugault@wsj.com

(END) Dow Jones Newswires

December 02, 2021 02:57 ET (07:57 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

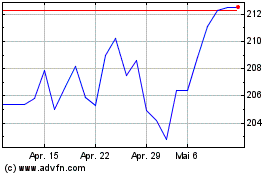

Safran (EU:SAF)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

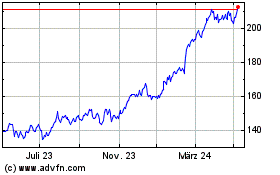

Safran (EU:SAF)

Historical Stock Chart

Von Apr 2023 bis Apr 2024