SMCP Parent Could Be Forced to Cede Control After Bond Default

06 Oktober 2021 - 1:54PM

Dow Jones News

By Joshua Kirby

SMCP SAS said Wednesday that its controlling shareholder has

failed to redeem bonds exchangeable into shares in the company, and

that part of its stakeholding could be put up for sale this

month.

The French fashion group said it had been informed that majority

owner European TopSoho, a Luxembourg-based holding of Chinese

conglomerate Shandong Ruyi Technology Group, had defaulted on bonds

of 250 million euros ($290 million) due at the end of September.

Underlying the bonds are shares in SMCP representing 37% of the

company's share capital, with the exchange pledge enforceable from

Oct. 19, it said. European TopSoho owns 53% of SMCP's shares.

Bond trustee GLAS has meanwhile informed the French markets

authority that in light of the default, it is entitled to instruct

35 million SMCP voting rights, or 29% of the total, SMCP said. If

GLAS enforces the pledge from Oct. 19, it would appoint a receiver

to sell the pledged shares to a third party, the company added.

Write to Joshua Kirby at joshua.kirby@wsj.com;

@joshualeokirby

(END) Dow Jones Newswires

October 06, 2021 07:39 ET (11:39 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

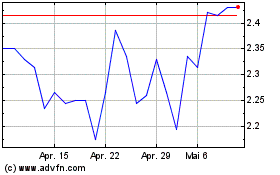

SMCP (EU:SMCP)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

SMCP (EU:SMCP)

Historical Stock Chart

Von Apr 2023 bis Apr 2024