SMCP - Default under the bonds exchangeable into SMCP shares issued by European TopSoho

06 Oktober 2021 - 1:02PM

SMCP - Default under the bonds exchangeable into SMCP shares issued

by European TopSoho

Press release - Paris, 6 October 2021

Default under the bonds

exchangeable into SMCP shares issued by European

TopSoho

SMCP has been informed that GLAS, in its

capacity as Trustee under the bonds exchangeable into SMCP shares

issued in September 2018 by European TopSoho S.à r.l., has notified

European TopSoho S.à r.l., the majority shareholder of SMCP with

53% of the share capital, of the occurrence of a default under its

EUR 250 million bonds exchangeable into SMCP shares following the

failure to redeem these bonds at their maturity date on September

21, 2021 and at the end of the grace period which was open until

September 30, 2021 (inclusive) to remedy this default. To SMCP’s

knowledge, the total number of the SMCP shares underlying these

bonds and pledged represents 37% of the Company's capital and the

pledge can be enforced as from 19 October 2021.

In addition, the Company has taken note of the

declaration of crossing of threshold filed with the French

Financial Markets Authority (Autorité des marchés financiers) by

GLAS, in its capacity as Trustee under the bonds1. As part of this

declaration, GLAS indicates, following the notification of default

referred to above, that it is now entitled to instruct 34,938,220

voting rights of the Company corresponding to 29% of the voting

rights of the Company attached to part of the pledged shares (it

being specified that the ownership of these shares has not been

transferred to GLAS). GLAS has also indicated that it is

considering enforcing the pledge over SMCP shares as from 19

October 2021, which would result in particular in (i) the temporary

taking of possession of the pledged shares up to 29% of the share

capital and (ii) the appointment of a receiver in charge of selling

the pledged shares to a third party. GLAS has indicated that in

case of enforcement of the pledge, it would contemplate the

appointment of three directors at the Board of directors of

SMCP.

European TopSoho S.à r.l. has initiated legal

proceedings notably against GLAS, in its capacity as Trustee under

the bonds, and indicated that it is actively considering its

options in relation to the current situation.

SMCP reminds that this situation does not affect

its own financings and operations. Value creation for all of the

Group's stakeholders (shareholders, employees and other partners)

is at the heart of the company's strategy. SMCP and its teams

remain fully committed to the implementation of the One Journey

strategic plan to 2025.

ABOUT SMCP

SMCP is a global leader in the accessible luxury

market with four unique Parisian brands: Sandro, Maje, Claudie

Pierlot and Fursac. Present in 43 countries, the Group comprises a

network of over 1,600 stores globally and a strong digital presence

in all its key markets. Evelyne Chetrite and Judith Milgrom founded

Sandro and Maje in Paris, in 1984 and 1998 respectively, and

continue to provide creative direction for the brands. Claudie

Pierlot and Fursac were respectively acquired by SMCP in 2009 and

2019. SMCP is listed on the Euronext Paris regulated market

(compartment A, ISIN Code FR0013214145, ticker: SMCP).

CONTACTS

| |

|

|

INVESTORS/PRESS

|

|

| |

|

|

SMCP

|

BRUNSWICK |

|

Mathilde

Magnan |

Hugues Boëton |

|

|

Tristan Roquet Montegon |

|

+33 (0) 1 55 80 51 00

|

+33 (0) 1 53 96 83 83 |

|

mathilde.magnan@smcp.com |

smcp@brunswickgroup.com |

1 See Declaration 221C2610 dated 5 October 2021, available on

the French Financial Markets Authority’s website

- Press Release - SMCP - Default under the bonds exchangeable

into SMCP shares issued by European TopSoho

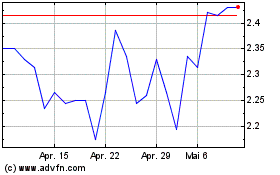

SMCP (EU:SMCP)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

SMCP (EU:SMCP)

Historical Stock Chart

Von Apr 2023 bis Apr 2024