SAP Rises on 1Q Results, Raised 2021 Outlook

14 April 2021 - 12:08AM

Dow Jones News

By Maria Armental

SAP SE raised financial projections for the year, following a

stronger-than-expected performance in the latest period driven by

the fastest growth in new cloud business in five years, the company

said.

ADRs closed at $134.43, up 1.5% for the day, and rose 4% to $140

in extended trading on the raised outlook and first-quarter

performance.

The German software company now expects EUR9.2 billion to EUR9.5

billion in adjusted cloud revenue and EUR23.4 billion to EUR23.8

billion adjusted cloud and software revenue, compared with its

earlier view of EUR9.1 billion to EUR9.5 billion and EUR23.3

billion to EUR23.8 billion, respectively.

SAP reports on a IFRS basis and its forecast is based on

constant currencies.

The company said it still expects software licenses revenue to

decline as customers turn to the "RISE with SAP" subscription

offering and expects global demand to improve in the second half of

the year as the pandemic recedes with the vaccine rollout.

Chief Executive Christian Klein said SAP in the March quarter

saw the highest order entry growth across cloud and software in

five years and posted the strongest increase in Non-IFRS operating

profit and margin in a decade.

"In the mid term SAP's expedited shift to the cloud will

accelerate topline growth and significantly increase the resiliency

and predictability of our business," Mr. Klein said.

First-quarter profit, on a per-share basis, rose to EUR0.88

cents, or EUR1.40 as adjusted, reflecting strong contribution from

Sapphire Ventures, SAP said.

Revenue, meanwhile, fell to EUR6.35 billion, from EUR6.52

billion a year earlier.

The results beat Wall Street expectations, according to

FactSet.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

April 13, 2021 17:53 ET (21:53 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

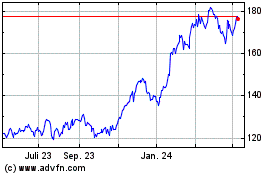

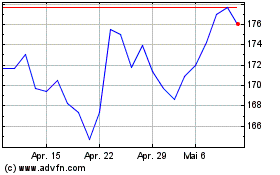

Sap (TG:SAP)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Sap (TG:SAP)

Historical Stock Chart

Von Apr 2023 bis Apr 2024