|

Third Quarter

Results

2021

|

Non-Operating Results

|

Net financial results (R$ million)

|

3Q21¹

|

2Q21

|

% ∆

|

3Q19

|

% ∆

|

|

|

|

|

|

|

|

|

Net financial expense

|

(900.9)

|

(793.1)

|

13.6%

|

(302.4)

|

197.9%

|

|

Derivative financial instruments

|

7.3

|

(10.8)

|

n.a.

|

135.3

|

-94.6%

|

|

Foreign currency exchange, net

|

(1,485.1)

|

2,279.5

|

n.a.

|

(941.4)

|

57.8%

|

|

Net financial results

|

(2,378.7)

|

1,475.6

|

n.a.

|

(1,108.5)

|

114.6%

|

¹Excludes convertible debentures expenses given

stock price at the end of the quarter was higher than strike price.

Net financial expenses resulted in

a net loss of R$900.9 million, mainly due to the interest accrual on loans and lease liabilities in the

quarter.

Derivative

financial instruments resulted in a net gain of R$7.3 million in 3Q21 mostly due to a fuel hedge gain recorded during the period.

As of September 30, 2021, Azul has hedged

10% of its expected fuel consumption for the next twelve months by using mostly heating oil derivatives.

Foreign currency exchange, net. Azul

recorded a non-cash foreign currency loss of R$1.5 billion in 3Q21 due to the 8.7% end of period depreciation of the Brazilian real against

US dollar from June 30 to September 30, 2021, resulting in an increase in loans and lease liabilities denominated in foreign currency.

Liquidity and Financing

Azul ended the quarter with R$5.3 billion

in immediate liquidity, including cash and cash equivalents, accounts receivable and short-term investments, essentially flat compared

to 2Q21, even after paying over R$1.5 billion in leases, loans and deferral repayments, and capital expenses.

This immediate liquidity represented 65.8% of our last twelve months’ revenue. Total liquidity including deposits, maintenance reserves,

and long-term investments and receivables was R$8.3 billion as of September 30, 2021. This does

not include spare parts or other unencumbered assets like TudoAzul and Azul Cargo.

Accounts receivable increased 38.8% or R$462.1

million compared to June 30, 2021, mostly due to the encouraging recent booking trends and a reduction in the factoring of credit card

receivables enabled by our high cash balance. In Brazil, credit card receivables are mainly related to tickets that have already been

flown and bear no cardholder credit risk. Therefore, there are usually no holdbacks and receivables are easy to advance as needed by paying

a small interest.

|

Liquidity (R$ million)

|

3Q21

|

2Q21

|

% ∆

|

3Q20

|

% ∆

|

|

Cash and cash equivalents

|

3,633.3

|

4,339.1

|

-16.3%

|

1,435.7

|

153.1%

|

|

Short-term investments

|

1.2

|

1.0

|

12.5%

|

133.5

|

-99.1%

|

|

Accounts receivable

|

1,652.7

|

1,190.6

|

38.8%

|

868.5

|

90.3%

|

|

Immediate liquidity

|

5,287.2

|

5,530.7

|

-4.4%

|

2,437.8

|

116.9%

|

|

Cash as % of LTM revenues

|

65.8%

|

90.4%

|

-24.6 p.p.

|

33.6%

|

+32.2 p.p.

|

|

Long-term investments and receivables

|

1,085.5

|

1,026.5

|

5.7%

|

1,097.4

|

-1.1%

|

|

Security deposits and maintenance reserves

|

1,948.1

|

1,667.3

|

16.8%

|

2,398.5

|

-18.8%

|

|

Total Liquidity

|

8,320.7

|

8,224.6

|

1.2%

|

5,933.7

|

40.2%

|

We have no significant debt repayments in

the next two years and have no restricted cash.

|

Third Quarter

Results

2021

|

|

Non-aircraft debt amortization as of September

30th, 2021 (R$ million)¹

|

¹ Excludes

convertible debentures expenses given stock price at the end of the quarter was higher than strike price.

Gross debt increased 8.2% or R$1.7 billion

compared to June 30, 2021, mostly due to the 8.7% end of period depreciation of the Brazilian real, offset by loans and lease repayments

of R$789.7 million in the quarter.

As of September 30, 2021, Azul’s average

debt maturity excluding lease liabilities and convertible debentures was 3.4 years, with an average interest rate of 6.9%. Average interest

rate on local and dollar-denominated obligations were 9.1% and 6.4%, respectively.

|

Loans and financing (R$ million)¹

|

3Q21

|

2Q21

|

% ∆

|

3Q20

|

% ∆

|

|

|

|

|

|

|

|

|

Operating lease liabilities

|

13,053.4

|

12,080.1

|

8.1%

|

12,016.9

|

8.6%

|

|

Finance lease liabilities

|

942.0

|

847.9

|

11.1%

|

1,116.1

|

-15.6%

|

|

Other aircraft loans and financing

|

1,192.2

|

1,127.2

|

5.8%

|

1,346.8

|

-11.5%

|

|

Loans and financing

|

6,882.2

|

6,338.0

|

8.6%

|

3,825.6

|

79.9%

|

|

Currency hedges

|

-

|

-

|

n.a.

|

1.5

|

n.a.

|

|

% of non-aircraft debt in local currency

|

20%

|

22%

|

-1.5 p.p.

|

40%

|

-19.6 p.p.

|

|

% of total debt in local currency

|

7%

|

8%

|

-0.6 p.p.

|

9%

|

-2.4 p.p.

|

|

|

|

|

|

|

|

|

Gross debt

|

22,069.8

|

20,393.2

|

8.2%

|

18,306.8

|

20.6%

|

¹ Considers the effect of hedges on debt. Excludes convertible debentures expenses given stock price at the end of the quarter was

higher than strike price.

The table below presents additional information

related to our leases as of September 30, 2021:

|

(R$ million)

|

3Q21

|

2Q21

|

% ∆

|

3Q19

|

% ∆

|

|

|

|

|

|

|

|

|

Operating leases

|

|

|

|

|

|

|

Payments made

|

663.0

|

296.1

|

123.9%

|

484.4

|

36.9%

|

|

Weighted average remaining lease term

|

7.9

|

8.1

|

-1.6%

|

7.6

|

3.9%

|

|

|

|

|

|

|

|

|

Finance leases

|

|

|

|

|

|

|

Payments made

|

49.6

|

23.6

|

110.0%

|

102.6

|

-51.6%

|

|

Weighted average remaining lease term

|

4.8

|

5.0

|

-4.0%

|

4.5

|

6.8%

|

|

Third Quarter

Results

2021

|

Azul’s key financial ratios and debt

maturity are presented below:

|

Key financial ratios (R$ million)

|

3Q21

|

2Q21

|

% ∆

|

3Q20

|

% ∆

|

|

|

|

|

|

|

|

|

Cash1

|

6,372.6

|

6,557.3

|

-2.8%

|

3,535.2

|

80.3%

|

|

Gross debt²

|

22,069.8

|

20,393.2

|

8.2%

|

18,306.8

|

20.6%

|

|

Net debt²

|

15,697.2

|

13,835.9

|

13.5%

|

14,771.6

|

6.3%

|

¹ Includes cash and cash equivalents,

short-term and long-term investments and receivables.

² Excludes convertible debentures given stock

price at the end of the quarter was higher than strike price.

Fleet and Capital Expenditures

As of September

30, 2021, Azul had a total passenger operating fleet of 160 aircraft and a passenger contractual fleet of 179 aircraft, with an average

aircraft age of 6.8 years excluding Azul Conecta. At the end of 3Q21, the 19 aircraft not included in our operating fleet consisted of

9 aircraft subleased to TAP, 3 subleased to Breeze, 1 subleased to Minas Gerais, 2 Cessna aircraft in process of entering service

and 4 aircraft in the process of exiting the fleet.

|

Passenger Contractual fleet1

|

|

|

|

|

|

|

|

|

Aircraft

|

3Q21

|

2Q21

|

% ∆

|

3Q20

|

% ∆

|

|

Airbus widebody

|

12

|

12

|

0.0%

|

10

|

20.0%

|

|

Airbus narrowbody

|

47

|

46

|

2.2%

|

44

|

6.8%

|

|

Embraer E2

|

9

|

9

|

0.0%

|

5

|

80.0%

|

|

Embraer E1

|

56

|

58

|

-3.4%

|

63

|

-11.1%

|

|

ATRs

|

39

|

39

|

0.0%

|

39

|

0.0%

|

|

Cessna

|

16

|

14

|

14.3%

|

14

|

14.3%

|

|

Total

|

179

|

178

|

0.6%

|

175

|

2.3%

|

|

Aircraft under operating leases

|

151

|

150

|

0.7%

|

148

|

2.0%

|

¹ Includes 13 subleased aircraft.

|

Passenger Operating Fleet

|

|

|

|

|

|

|

|

|

Aircraft

|

3Q21

|

2Q21

|

% ∆

|

3Q20

|

% ∆

|

|

Airbus widebody

|

11

|

11

|

0.0%

|

10

|

10.0%

|

|

Airbus narrowbody

|

47

|

46

|

2.2%

|

43

|

9.3%

|

|

Embraer E2

|

9

|

9

|

0.0%

|

5

|

80.0%

|

|

Embraer E1

|

47

|

49

|

-4.1%

|

44

|

6.8%

|

|

ATRs

|

33

|

33

|

0.0%

|

33

|

0.0%

|

|

Cessna

|

13

|

13

|

0.0%

|

13

|

0.0%

|

|

Total

|

160

|

161

|

-0.6%

|

148

|

8.1%

|

Capex

Capital expenditures

totaled R$143.0 million in 3Q21, compared to R$70.2 million in 3Q20 and R$354.1 million in 3Q19, mostly due to engine overhauls

and acquisition of spare parts. Capital expenditures decreased 59.6% compared to 3Q19.

|

(R$ million)

|

3Q21

|

3Q20

|

% ∆

|

3Q19

|

% ∆

|

|

Aircraft related

|

34.0

|

31.9

|

6.9%

|

129.5

|

-73.7%

|

|

Maintenance and checks

|

44.8

|

-

|

n.a.

|

133.0

|

-66.3%

|

|

Other

|

16.0

|

12.2

|

30.5%

|

69.5

|

-77.0%

|

|

Intangible Assets

|

48.2

|

26.1

|

84.7%

|

22.0

|

118.6%

|

|

CAPEX

|

143.0

|

70.2

|

103.8%

|

354.1

|

-59.6%

|

|

Third Quarter

Results

2021

|

Environmental, Social and Governance (“ESG”)

Responsibility

The table below presents Azul’s key

ESG information according to the Sustainability Accounting Standards Board (SASB) standard for the airline industry:

.

¹ Excludes Azul Conecta

|

Third Quarter

Results

2021

|

Conference Call Details

Thursday, November 11th, 2021

10:00 a.m. (EST) | 12:00 p.m. (Brasília time)

USA: +1 412 717-9627

Brazil: +55 11 4090 1621 or +55 11 4210-1803

Verbal Code: Azul

Webcast: www.voeazul.com.br/ir

Replay:

+55 11 3193-1012

Code: 8622178#

About Azul

Azul S.A. (B3: AZUL4, NYSE: AZUL), the largest

airline in Brazil by number of flight departures and cities served, offers more than 800 daily flights to over 130 destinations. With

a passenger operating fleet of more than 160 aircraft and more than 12,000 crewmembers, Azul has a network of more than 200 non-stop routes.

In 2020 Azul was awarded best airline in the world by TripAdvisor, the first time a Brazilian Flag Carrier ranked number one in the Traveler’s

Choice Awards. For more information visit www.voeazul.com.br/ir.

Contact:

|

Investor Relations

Tel: +55 11 4831 2880

invest@voeazul.com.br

|

Media Relations

Tel: +55 11 4831 1245

imprensa@voeazul.com.br

|

|

Third Quarter

Results

2021

|

Balance Sheet –

IFRS

|

(R$ million)

|

September 30, 2021

|

September 30, 2020

|

December 31, 2020

|

|

Assets

|

17,778.0

|

13,926.3

|

15,794.5

|

|

Current assets

|

6,771.7

|

3,605.3

|

5,417.4

|

|

Cash and cash equivalents

|

3,633.3

|

1,435.7

|

3,064.8

|

|

Short-term investments

|

1.2

|

133.5

|

91.8

|

|

Trade and other receivables

|

1,566.1

|

729.6

|

875.4

|

|

Sublease receivables

|

86.6

|

138.9

|

123.5

|

|

Inventories

|

519.6

|

376.4

|

402.6

|

|

Security deposits and maintenance reserves

|

389.8

|

461.8

|

318.5

|

|

Taxes recoverable

|

133.0

|

27.5

|

133.7

|

|

Derivative financial instruments

|

79.6

|

79.2

|

79.2

|

|

Prepaid expenses

|

172.2

|

75.2

|

136.4

|

|

Other current assets

|

190.3

|

147.3

|

191.6

|

|

Non-current assets

|

11,006.3

|

10,321.1

|

10,377.0

|

|

Long-term investments

|

878.6

|

892.1

|

854.5

|

|

Sublease receivables

|

206.9

|

205.4

|

189.5

|

|

Security deposits and maintenance reserves

|

1,558.3

|

1,936.7

|

1,235.6

|

|

Derivative financial instruments

|

221.7

|

315.5

|

349.1

|

|

Prepaid expenses

|

16.5

|

20.7

|

18.2

|

|

Taxes recoverable

|

-

|

282.5

|

-

|

|

Other non-current assets

|

358.5

|

203.9

|

149.5

|

|

Property, equipment and right of use assets

|

6,420.3

|

5,313.2

|

6,410.4

|

|

Intangible assets

|

1,345.5

|

1,151.3

|

1,170.3

|

|

Liabilities and equity

|

17,778.0

|

13,926.3

|

15,794.5

|

|

Current liabilities

|

11,436.0

|

10,841.6

|

10,212.6

|

|

Loans and financing

|

749.9

|

1,050.3

|

858.3

|

|

Current maturities of lease liabilities

|

3,371.8

|

2,611.8

|

2,272.3

|

|

Accounts payable

|

2,178.9

|

2,906.4

|

2,396.5

|

|

Air traffic liability

|

3,031.3

|

2,270.1

|

2,488.9

|

|

Reimbursement to clients

|

145.5

|

-

|

221.3

|

|

Salaries, wages and benefits

|

584.7

|

411.8

|

400.4

|

|

Insurance premiums payable

|

5.3

|

13.3

|

52.4

|

|

Taxes payable

|

60.4

|

31.2

|

55.3

|

|

Federal tax installment payment program

|

59.0

|

15.1

|

13.4

|

|

Derivative financial instruments

|

79.8

|

195.0

|

173.8

|

|

Provisions

|

850.0

|

1,060.1

|

853.8

|

|

Other current liabilities

|

319.5

|

276.7

|

426.3

|

|

Non-current liabilities

|

24,287.9

|

16,951.0

|

19,730.6

|

|

Loans and financing

|

9,646.3

|

4,122.1

|

6,502.2

|

|

Long-term obligations under lease liabilities

|

10,623.7

|

10,521.2

|

10,248.5

|

|

Accounts payable

|

627.5

|

-

|

323.1

|

|

Reimbursement to clients

|

85.0

|

-

|

-

|

|

Derivative financial instruments

|

178.6

|

229.5

|

247.3

|

|

Federal tax installment payment program

|

322.3

|

112.1

|

108.5

|

|

Provision

|

2,175.9

|

1,765.7

|

1,988.7

|

|

Other non-current liabilities

|

628.6

|

200.5

|

312.4

|

|

Equity

|

(17,945.9)

|

(13,866.4)

|

(14,148.7)

|

|

Issued capital

|

2,290.9

|

2,246.4

|

2,267.0

|

|

Capital reserve

|

1,941.1

|

1,941.0

|

1,947.9

|

|

Treasury shares

|

(6.6)

|

(13.2)

|

(13.2)

|

|

Accumulated other comprehensive income (loss)

|

0.7

|

(6.8)

|

0.7

|

|

Accumulated losses

|

(22,172.0)

|

(18,033.7)

|

(18,351.1)

|

|

Third Quarter

Results

2021

|

Cash Flow Statement – IFRS

|

(R$ million)

|

3Q21

|

3Q20

|

% ∆

|

|

|

|

|

|

|

Cash flows from operating activities

|

|

|

|

|

Net loss for the period

|

(2,196.3)

|

(1,226.3)

|

79.1%

|

|

Total non-cash adjustments

|

|

|

|

|

Depreciation and amortization

|

349.3

|

445.9

|

-21.7%

|

|

Unrealized derivatives

|

(263.2)

|

(179.9)

|

46.3%

|

|

Exchange (gain) and losses in foreign currency

|

1,625.6

|

366.9

|

343.0%

|

|

Interest expenses on assets and liabilities

|

859.4

|

540.0

|

59.1%

|

|

Related parties

|

-

|

(83.0)

|

n.a.

|

|

Deferred income tax and social contribution

|

-

|

24.6

|

n.a.

|

|

Provisions

|

(31.1)

|

142.2

|

n.a.

|

|

Result of lease agreements modification

|

(0.7)

|

(665.1)

|

-99.9%

|

|

Impairment and other

|

(3.4)

|

35.8

|

n.a.

|

|

Changes in operating assets and liabilities

|

|

|

|

|

Trade and other receivables

|

(441.9)

|

(72.4)

|

510.1%

|

|

Sublease receivables

|

18.7

|

154.2

|

-87.9%

|

|

Security deposits and maintenance reserves

|

(109.7)

|

(68.2)

|

60.9%

|

|

Prepaid expenses

|

(19.6)

|

(11.6)

|

68.8%

|

|

Other assets

|

(221.7)

|

156.6

|

n.a.

|

|

Derivatives

|

(0.3)

|

67.2

|

n.a.

|

|

Accounts payable

|

(116.7)

|

140.2

|

n.a.

|

|

Salaries, wages and employee benefits

|

34.8

|

32.2

|

8.3%

|

|

Air traffic liability

|

475.8

|

445.4

|

6.8%

|

|

Provision taxes, civil and labor risks

|

(42.4)

|

(24.9)

|

70.4%

|

|

Other liabilities

|

119.4

|

0.3

|

42105.7%

|

|

Interest paid

|

(105.7)

|

(11.5)

|

820.0%

|

|

Income tax and social contribution paid

|

-

|

-

|

n.a.

|

|

Net cash provided (used) by operating activities

|

(69.8)

|

208.5

|

n.a.

|

|

|

|

|

|

|

Cash flows from investing activities

|

|

|

|

|

Short-term investment

|

(0.1)

|

(68.5)

|

-99.8%

|

|

Cash received on sale of property and equipment

|

-

|

45.7

|

n.a.

|

|

Acquisition of subsidiary, net of cash acquired

|

-

|

(13.0)

|

n.a.

|

|

Acquisition of intangible

|

(48.2)

|

(26.1)

|

84.7%

|

|

Acquisition of property and equipment

|

(94.8)

|

(44.1)

|

115.1%

|

|

Net cash generated (used in) investing activities

|

(143.1)

|

(106.0)

|

35.0%

|

|

|

|

|

|

|

Cash flows from financing activities

|

|

|

|

|

Loans and financing

|

|

|

|

|

Proceeds

|

57.7

|

94.6

|

-39.0%

|

|

Repayment

|

(47.1)

|

(113.7)

|

-58.6%

|

|

Other

|

(60.0)

|

-

|

n.a.

|

|

Repayment of lease debt

|

(634.5)

|

(208.4)

|

204.5%

|

|

Capital increase

|

0.5

|

1.3

|

-58.3%

|

|

Treasury shares

|

(6.6)

|

-

|

n.a.

|

|

Sales and leaseback

|

-

|

(5.8)

|

n.a.

|

|

Net cash generated used in financing activities

|

(690.0)

|

(232.0)

|

197.4%

|

|

|

|

|

|

|

Exchange gain (loss) on cash and cash equivalents

|

197.1

|

(1.1)

|

n.a.

|

|

|

|

|

|

|

Net increase in cash and cash equivalents

|

(705.8)

|

(130.7)

|

440.2%

|

|

|

|

|

|

|

Cash and cash equivalents at the beginning of the period

|

4,339.1

|

1,566.4

|

177.0%

|

|

Cash and cash equivalents at the end of the period

|

3,633.3

|

1,435.7

|

153.1%

|

|

Third Quarter

Results

2021

|

Glossary

Aircraft

Utilization

Average number of block hours per day per aircraft operated.

Available Seat Kilometers (ASK)

Number of aircraft seats multiplied

by the number of kilometers flown.

Completion Factor

Percentage of

accomplished flights.

Cost per ASK (CASK)

Operating expenses divided by available seat kilometers.

Cost per ASK ex-fuel (CASK ex-fuel)

Operating expenses

divided by available seat kilometers excluding fuel expenses.

EBITDA

Earnings before interest, taxes, depreciation,

and amortization.

Load Factor

Number of passengers as a percentage

of number of seats flown (calculated by dividing RPK by ASK).

Revenue Passenger Kilometers (RPK)

One-fare paying passenger transported

one kilometer. RPK is calculated by multiplying the number of revenue passengers by the number of kilometers flown.

Passenger Revenue per Available

Seat Kilometer (PRASK)

Passenger revenue divided by available

seat kilometers (also equal to load factor multiplied by yield).

Revenue per ASK (RASK)

Operating revenue divided by available seat kilometers.

Stage Length

The average number of kilometers flown per flight.

Trip Cost

Average cost of each flight calculated by dividing total operating expenses by total number of departures.

Yield

Average amount paid per passenger

to fly one kilometer. Usually, yield is calculated as average revenue per revenue passenger kilometer, or cents per RPK.

|

Third Quarter

Results

2021

|

This press release includes estimates and

forward-looking statements within the meaning of the U.S. federal securities laws. These estimates and forward-looking statements are

based mainly on our current expectations and estimates of future events and trends that affect or may affect our business, financial condition,

results of operations, cash flow, liquidity, prospects and the trading price of our preferred shares, including in the form of ADSs. Although

we believe that these estimates and forward-looking statements are based upon reasonable assumptions, they are subject to many significant

risks, uncertainties and assumptions and are made in light of information currently available to us. In addition, in this release, the

words “may,” “will,” “estimate,” “anticipate,” “intend,” “expect,”

“should” and similar words are intended to identify forward-looking statements. You should not place undue reliance on such

statements, which speak only as of the date they were made. Azul is not under the obligation to update publicly or to revise any forward-looking

statements after we distribute this press release because of new information, future events or other factors. Our independent public auditors

have neither examined nor compiled the forward-looking statements and, accordingly, do not provide any assurance with respect to such

statements. In light of the risks and uncertainties described above, the future events and circumstances discussed in this release might

not occur and are not guarantees of future performance. Because of these uncertainties, you should not make any investment decision based

upon these estimates and forward-looking statements.

In this press release, we present EBITDA,

which is a non-IFRS performance measure and is not a financial performance measure determined in accordance with IFRS and should not be

considered in isolation or as alternatives to operating income or net income or loss, or as indications of operating performance, or as

alternatives to operating cash flows, or as indicators of liquidity, or as the basis for the distribution of dividends. Accordingly, you

are cautioned not to place undue reliance on this information.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date:

November 11, 2021

Azul S.A.

By: /s/ Alexandre Wagner Malfitani

Name: Alexandre Wagner Malfitani

Title: Chief Financial Officer

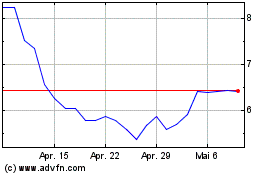

Azul (NYSE:AZUL)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Azul (NYSE:AZUL)

Historical Stock Chart

Von Apr 2023 bis Apr 2024