Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

27 Juli 2021 - 3:04PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form 6-K

Report

of Foreign Private Issuer

Pursuant

to Rules 13a-16 or 15d-16 under

the

Securities Exchange Act of 1934

Dated

July 27, 2021

Commission

File Number: 001-10086

VODAFONE

GROUP

PUBLIC

LIMITED COMPANY

(Translation

of registrant’s name into English)

VODAFONE

HOUSE, THE CONNECTION, NEWBURY, BERKSHIRE, RG14 2FN, ENGLAND

(Address

of principal executive offices)

Indicate by

check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by

check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

If “Yes”

is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-____.

This Report

on Form 6-K contains a Stock Exchange Announcement dated 27 July 2021 entitled ‘RESULTS OF ANNUAL GENERAL MEETING’.

VODAFONE

GROUP PLC

RESULTS

OF ANNUAL GENERAL MEETING

Results

of Annual General Meeting

The Annual

General Meeting of Vodafone Group Plc was held at The Pavilion, Vodafone House, The Connection, Newbury, Berkshire, RG14 2FN on Tuesday

27 July 2021 at 10.00 am.

The results

of polls on all 23 resolutions were as follows:

|

|

|

Resolution

|

|

Total

votes validly cast

|

|

|

Percentage

of

relevant

shares in

issue (%)

|

|

|

For

|

|

|

For

(% of

shares

voted)

|

|

|

Against

|

|

|

Against

(%

of shares

voted)

|

|

|

Votes

withheld

|

|

|

1.

|

|

To

receive the Company’s accounts, the strategic report and reports of the Directors and the auditor for the year ended 31 March 2021.

|

|

|

17,132,724,181

|

|

|

|

61.60

|

|

|

|

17,125,806,638

|

|

|

|

99.96

|

|

|

|

6,917,543

|

|

|

|

0.04

|

|

|

|

23,915,195

|

|

|

2.

|

|

To

elect Olaf Swantee as a Director.

|

|

|

17,130,076,272

|

|

|

|

61.59

|

|

|

|

17,095,470,221

|

|

|

|

99.80

|

|

|

|

34,606,051

|

|

|

|

0.20

|

|

|

|

26,435,255

|

|

|

3.

|

|

To

re-elect Jean-François van Boxmeer as a Director.

|

|

|

17,131,196,388

|

|

|

|

61.59

|

|

|

|

16,235,434,377

|

|

|

|

94.77

|

|

|

|

895,762,011

|

|

|

|

5.23

|

|

|

|

25,534,309

|

|

|

4.

|

|

To

re-elect Nick Read as a Director.

|

|

|

17,131,339,238

|

|

|

|

61.59

|

|

|

|

17,088,602,622

|

|

|

|

99.75

|

|

|

|

42,736,616

|

|

|

|

0.25

|

|

|

|

25,271,692

|

|

|

5.

|

|

To

re-elect Margherita Della Valle as a Director.

|

|

|

17,131,587,069

|

|

|

|

61.59

|

|

|

|

17,084,011,783

|

|

|

|

99.72

|

|

|

|

47,575,286

|

|

|

|

0.28

|

|

|

|

24,992,962

|

|

|

6.

|

|

To

re-elect Sir Crispin Davis as a Director.

|

|

|

17,130,152,964

|

|

|

|

61.59

|

|

|

|

17,009,929,952

|

|

|

|

99.30

|

|

|

|

120,223,012

|

|

|

|

0.70

|

|

|

|

26,432,593

|

|

|

7.

|

|

To

re-elect Michel Demaré as a Director.

|

|

|

17,129,962,222

|

|

|

|

61.59

|

|

|

|

17,061,166,726

|

|

|

|

99.60

|

|

|

|

68,795,496

|

|

|

|

0.40

|

|

|

|

26,647,135

|

|

|

8.

|

|

To

re-elect Dame Clara Furse as a Director.

|

|

|

17,130,989,026

|

|

|

|

61.59

|

|

|

|

17,094,737,047

|

|

|

|

99.79

|

|

|

|

36,251,979

|

|

|

|

0.21

|

|

|

|

25,620,151

|

|

|

9

|

|

To

re-elect Valerie Gooding as a Director.

|

|

|

17,130,841,063

|

|

|

|

61.59

|

|

|

|

16,872,817,032

|

|

|

|

98.49

|

|

|

|

258,024,031

|

|

|

|

1.51

|

|

|

|

25,768,550

|

|

|

10.

|

|

To

re-elect Maria Amparo Moraleda Martinez as a Director.

|

|

|

17,131,017,933

|

|

|

|

61.59

|

|

|

|

16,466,110,256

|

|

|

|

96.12

|

|

|

|

664,907,677

|

|

|

|

3.88

|

|

|

|

25,591,305

|

|

|

11.

|

|

To

re-elect Sanjiv Ahuja as a Director.

|

|

|

RESOLUTION

WITHDRAWN

|

|

|

12.

|

|

To

re-elect David Nish as a Director.

|

|

|

17,125,461,561

|

|

|

|

61.57

|

|

|

|

17,056,275,299

|

|

|

|

99.60

|

|

|

|

69,186,262

|

|

|

|

0.40

|

|

|

|

31,110,498

|

|

|

13.

|

|

To

declare a final dividend of 4.50 eurocents per ordinary share for the year ended 31 March 2021.

|

|

|

17,146,267,777

|

|

|

|

61.64

|

|

|

|

17,016,928,924

|

|

|

|

99.25

|

|

|

|

129,338,853

|

|

|

|

0.75

|

|

|

|

10,335,481

|

|

|

14.

|

|

To

approve the Annual Report on Remuneration contained in the Remuneration Report of the Board for the year ended 31 March 2021.

|

|

|

17,131,306,675

|

|

|

|

61.59

|

|

|

|

16,729,088,541

|

|

|

|

97.65

|

|

|

|

402,218,134

|

|

|

|

2.35

|

|

|

|

25,262,861

|

|

|

15.

|

|

To

reappoint Ernst & Young LLP as the Company’s auditor until the end of the next general meeting at which accounts are

laid before the Company.

|

|

|

17,142,233,659

|

|

|

|

61.63

|

|

|

|

16,713,626,165

|

|

|

|

97.50

|

|

|

|

428,607,494

|

|

|

|

2.50

|

|

|

|

14,379,508

|

|

|

16.

|

|

To

authorise the Audit and Risk Committee to determine the remuneration of the auditor.

|

|

|

17,140,202,508

|

|

|

|

61.62

|

|

|

|

16,873,583,470

|

|

|

|

98.44

|

|

|

|

266,619,038

|

|

|

|

1.56

|

|

|

|

16,372,690

|

|

|

17.

|

|

To

authorise the Directors to allot shares

|

|

|

17,134,515,551

|

|

|

|

61.60

|

|

|

|

16,058,241,382

|

|

|

|

93.72

|

|

|

|

1,076,274,169

|

|

|

|

6.28

|

|

|

|

22,070,445

|

|

|

18.

|

|

To

authorise the Directors to dis-apply pre-emption rights.

|

|

|

17,109,183,719

|

|

|

|

61.51

|

|

|

|

16,767,989,818

|

|

|

|

98.01

|

|

|

|

341,193,901

|

|

|

|

1.99

|

|

|

|

47,381,780

|

|

|

19.

|

|

To

authorise the Directors to dis-apply pre-emption rights up to a further 5 per cent for the purposes of financing an acquisition or

other capital investment.

|

|

|

17,120,134,729

|

|

|

|

61.55

|

|

|

|

16,370,746,771

|

|

|

|

95.62

|

|

|

|

749,387,958

|

|

|

|

4.38

|

|

|

|

36,451,703

|

|

|

20.

|

|

To

authorise the Company to purchase its own shares.

|

|

|

17,135,194,625

|

|

|

|

61.61

|

|

|

|

16,843,308,960

|

|

|

|

98.30

|

|

|

|

291,885,665

|

|

|

|

1.70

|

|

|

|

21,372,240

|

|

|

21.

|

|

To

approve the adoption of new articles of association.

|

|

|

17,113,903,563

|

|

|

|

61.53

|

|

|

|

17,080,074,901

|

|

|

|

99.80

|

|

|

|

33,828,662

|

|

|

|

0.20

|

|

|

|

42,680,690

|

|

|

22.

|

|

To

authorise political donations and expenditure.

|

|

|

17,119,587,463

|

|

|

|

61.55

|

|

|

|

16,817,937,876

|

|

|

|

98.24

|

|

|

|

301,649,587

|

|

|

|

1.76

|

|

|

|

33,749,912

|

|

|

23.

|

|

To

authorise the Company to call general meetings (other than AGMs) on a minimum of 14 clear days’ notice.

|

|

|

17,125,163,856

|

|

|

|

61.57

|

|

|

|

16,158,288,221

|

|

|

|

94.35

|

|

|

|

966,875,635

|

|

|

|

5.65

|

|

|

|

30,879,790

|

|

The

number of Ordinary Shares in issue on 23 July 2021 (excluding shares held in Treasury) was 27,814,578,745. Shareholders are entitled

to one vote per share. A vote withheld is not a vote in law and is not counted in the calculation of the proportion of votes validly

cast.

Resolutions

1 to 17 (inclusive) and 22 were passed as Ordinary Resolutions. Resolutions 18 to 21 (inclusive) and 23 were passed as Special Resolutions.

In accordance

with Listing Rule 9.6.2, a copy of Resolutions 21 to 23 (inclusive), passed as Special Business at the Annual General Meeting, have

been submitted to the Financial Conduct Authority via the National Storage Mechanism and will shortly be available for inspection at:

https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

Other

matters

Following

conclusion of the Annual General Meeting, the below changes to the composition of the Board and its Committees were effective:

|

|

-

|

Olaf

Swantee was appointed as a Non-Executive Director and became a member of the Audit and Risk

Committee;

|

|

|

-

|

Sanjiv

Ahuja retired as a Non-Executive Director and member of the Audit and Risk Committee; and

|

|

|

-

|

Renee

James retired as a Non-Executive Director and member of the Nominations and Governance and

Remuneration Committees.

|

For further

information:

|

Vodafone

Group

|

|

|

|

|

|

Media Relations

|

Investor Relations

|

|

www.vodafone.com/media/contact

|

ir@vodafone.co.uk

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorised.

|

|

VODAFONE GROUP

|

|

|

PUBLIC LIMITED COMPANY

|

|

|

(Registrant)

|

|

Dated: July 27, 2021

|

By:

|

/s/ R E S MARTIN

|

|

|

|

Name: Rosemary E S Martin

|

|

|

|

Title: Group General Counsel and Company Secretary

|

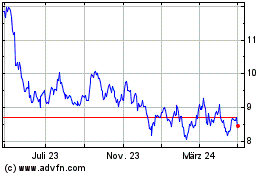

Vodafone (NASDAQ:VOD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

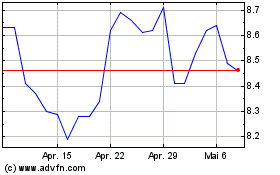

Vodafone (NASDAQ:VOD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024