Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

28 Mai 2021 - 9:38PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13A-16

OR 15D-16 UNDER THE SECURITIES EXCHANGE ACT

OF 1934

Dated May 28, 2021

Commission File Number: 001-10086

VODAFONE GROUP

PUBLIC LIMITED COMPANY

(Translation of registrant’s name into English)

VODAFONE HOUSE, THE CONNECTION, NEWBURY, BERKSHIRE,

RG14 2FN, ENGLAND

(Address of principal executive offices)

Indicate by check mark whether the

registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

THIS REPORT ON FORM 6-K SHALL BE

DEEMED TO BE INCORPORATED BY REFERENCE IN EACH OF THE REGISTRATION STATEMENT ON FORM F-3 (FILE NO. 333-240163), THE REGISTRATION STATEMENT

ON FORM S-8 (FILE NO. 333-81825) AND THE REGISTRATION STATEMENT ON FORM S-8 (FILE NO. 333-149634) OF VODAFONE GROUP PUBLIC LIMITED COMPANY

AND TO BE A PART THEREOF FROM THE DATE ON WHICH THIS REPORT IS FURNISHED, TO THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY

FILED OR FURNISHED.

CAPITALIZATION AND INDEBTEDNESS

The following table sets out our called up share capital and the borrowings

and indebtedness of Vodafone Group Plc, its consolidated subsidiaries and share of joint ventures, referred to as the “Group”,

at March 31, 2021.

|

|

|

At March 31,

|

|

|

|

|

2021

|

|

|

|

|

€

|

|

|

|

|

(in millions)

|

|

|

Borrowings and Indebtedness

|

|

|

|

|

|

Short-term borrowings

|

|

|

8,488

|

|

|

Short-term derivative financial instruments*

|

|

|

91

|

|

|

Total short-term borrowings

|

|

|

8,579

|

|

|

|

|

|

|

|

|

Long-term borrowings

|

|

|

59,272

|

|

|

Long-term derivative financial instruments*

|

|

|

3,919

|

|

|

Total long-term borrowings

|

|

|

63,191

|

|

|

|

|

|

|

|

|

Total borrowings and indebtedness

|

|

|

71,770

|

|

|

|

|

|

|

|

|

Capital

|

|

|

|

|

|

Called up share capital (28,816,835,778 ordinary shares allotted, issued and fully paid)

|

|

|

4,797

|

|

|

Treasury shares held (592,642,309 shares)

|

|

|

(6,172

|

)

|

|

Additional paid-in capital

|

|

|

150,812

|

|

|

Accumulated losses

|

|

|

(121,587

|

)

|

|

Accumulated other comprehensive income

|

|

|

27,954

|

|

|

Total non-controlling interests

|

|

|

2,012

|

|

|

|

|

|

|

|

|

Total equity and shareholders’ funds

|

|

|

57,816

|

|

|

|

|

|

|

|

|

Total Capitalization and Indebtedness

|

|

|

129,586

|

|

* Certain mark to market adjustments on financing instruments are included within derivative financial instruments, a component of trade and other payables

|

(1)

|

At March 31, 2021, the Group had contingent indebtedness relating to outstanding guarantees, performance

bonds and other contingent indebtedness items totaling €2,728 million. This primarily includes Vodafone Group Plc’s US$1.8

billion (€1.5 billion) guarantee of the Group’s 50% share of a US$3.5 billion loan, which forms part of the Group’s overall

joint venture investment in TPG Telecom Ltd, and INR42.5 billion (€0.5 billion) in relation to the secondary pledge over shares owned

by Vodafone Group in Indus Towers Ltd.

|

|

(2)

|

At March 31, 2021, the Group had cash and cash equivalents of €5,821 million, short-term

investments of €4,007 million, cash collateral of €3,107 million and €3,151 million of mark to market adjustments on financing

instruments recorded in trade and other receivables, resulting in total net borrowings and indebtedness of €55,684 million.

|

|

(3)

|

The share buyback program announced on March 19, 2021 to repurchase 256,822,895 ordinary shares

completed on May 18, 2021 (52,682 shares purchased at March 31, 2021). A further share buyback program was announced on May 19, 2021

to repurchase up to 268,237,246 ordinary shares (up to €340 million) of which 39,950,225 shares have been repurchased at the

date of this filing.

|

|

(4)

|

Other than the share buyback mentioned in footnote 3 above and changes due to movements in foreign exchange

rates and the financial performance for the period to date, there has been no material change in the capitalization and indebtedness of

the Group since March 31, 2021.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorised.

|

|

VODAFONE GROUP

|

|

|

PUBLIC LIMITED COMPANY

|

|

|

(Registrant)

|

|

|

|

|

|

Dated May 28, 2021

|

By:

|

/s/ Jamie Stead

|

|

|

|

Name: Jamie Stead

|

|

|

|

Title: Group Treasury Director

|

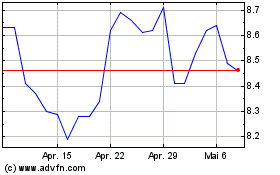

Vodafone (NASDAQ:VOD)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

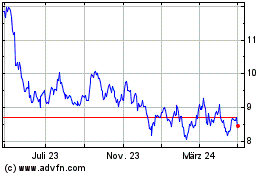

Vodafone (NASDAQ:VOD)

Historical Stock Chart

Von Apr 2023 bis Apr 2024