Pound Depreciates On New Covid-19 Variant Concerns

26 November 2021 - 9:19AM

RTTF2

The pound fell against its most major counterparts in the

European session on Friday, as the emergence of the South African

variant sparked growth concerns, prompting traders to reduce their

expectations about the possibility of the Bank of England rate hike

in December.

Traders are assigning only a 55 percent probability of 15

basis-point rate hike at the December meeting, down from odds of 75

percent seen on Thursday.

Global markets fell, as investors worry about the spread of new

COVID-19 variant and its impact on the global economy.

Several countries, including the U.K. tightened restrictions on

travel from the southern African region due to the variant of

concern.

The U.K. has temporarily suspended flights from six African

countries and imposed quarantine on travelers arriving in the

U.K.

UK Health Secretary Sajid Javid said that the variant pose great

concern and is likely to be more transmissible as well as vaccine

resistant.

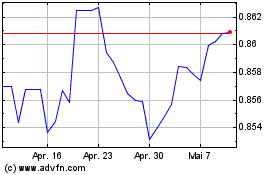

The pound touched a 10-day low of 0.8477 versus the euro, down

from yesterday's close of 0.8406. The pound may locate support

around the 0.86 level.

The pound weakened to 1.2319 against the franc, its lowest level

since November 12. If the pound falls further, it may test support

around the 1.21 level.

The pound dropped to its weakest level since October 7 against

the yen, at 151.08. The pound is likely to challenge support around

the 149.00 level.

The pound dipped to more than an 11-month low of 1.3278 against

the greenback around 3:05 am ET, but it has since rebounded to

1.3341. The pair had closed yesterday's deals at 1.3318.

Euro vs Sterling (FX:EURGBP)

Forex Chart

Von Mär 2024 bis Apr 2024

Euro vs Sterling (FX:EURGBP)

Forex Chart

Von Apr 2023 bis Apr 2024