- A limited impact on net income from the health crisis: -

€ 0.7m

- A sound financial position: net debt of € 4.32m for

total equity of € 9.33m.

- 2021 outlook

- Plant Advanced Technologies PAT is confident that it will meet

its growth targets.

- Deployment of a marketing strategy focused on adopting a

product catalog and indirect distribution.

- Continuing internal research to prepare for the launch of new

disruptive products.

- All subsidiaries have excellent visibility for their

businesses.

Regulatory News:

PAT SA INCOME STATEMENT HIGHLIGHTS AT DECEMBER 31,

2020

(Parent company financial statements - The annual financial

statements presented below are not consolidated and concern

exclusively the parent company PAT SA. In consequence, they do not

include the subsidiaries StratiCELL, Cellengo (wholly-owned), PAT

Zerbaz (99%-held), Temisis (98%-held) and Couleurs de Plantes

(66%-held).

(€ thousands)

2020

2020*

2019

Revenue

1,256

1,256

1,172

Grants

148

148

250

Research Tax Credit

819

898

794

Operating profit / (loss)

(1,596)

(1,952)

(1,548)

Net financial income /

(expense)

(56)

(57)

(57)

Net exceptional results

169

169

261

Net income

(664)

(940)

(541)

*Like-for-like: excluding the partial contribution of assets

(apport partiel d'actif) of the subsidiary CELLENGO at July 31 with

retroactive effect on January 1, 2020.

On April 27, 2021, the Board of Directors approved the separate

parent company financial statements for the period ended December

31, 2020 of Plant Advanced Technologies PAT SA. The Statutory

Auditors completed their audit of these financial statements and

issued their report as required by law.

PAT reported a net loss of k€ 664 in 2020 compared to a loss of

k€ 541 in 2019.

- Annual revenue rose 7% to k€ 1,256, up from k€ 1,172 in

2019).

- Purchases increased in the period reflecting the increasing

business activity of the subsidiary, PAT Zerbaz on a full-year

basis in 2020. Based in the island of La Réunion, the subsidiary is

specialized in the discovery of active ingredients and rare plant

molecules sourced from the tropical biodiversity.

- Staff expenses amounted to k€ 1,833 at 12/31/2020 compared to

k€ 1,889 one year earlier. This amount represents 60% of the

company’s expenses (compared to 69% in 2019) Decrease reflects the

transfer of researchers to the subsidiary Cellengo.

- The level of investments remains high and is destined notably

to support the growth of PAT Zerbaz’s research activities.

- Net financial expense remained stable at k€ 56 at December 31,

2020.

- The operating loss for the period amounted to k€ 1,596 compared

to k€ 1,548 in 2019 and includes a Research and Innovation Tax

Credit in the amount of k€ 819.

BALANCE SHEET HIGHLIGHTS AT DECEMBER 31, 2020

ASSETS (€ thousands)

EQUITY AND LIABILITIES (€

thousands)

2020

2019

2020

2019

Fixed assets

11,624

9,965

Shareholders’ equity

9,337

10,003

Inventory, receivables and other

assets

2,841

2,310

Financial debt and provisions

4,325

2,943

Cash and cash equivalents

291

1,533

Trade and other payables

797

637

TOTAL

14,815

13,888

TOTAL

14,815

13,888

PAT contributed the assets (k€ 1,512) and the liabilities (k€

59) to the capital of its new subsidiary Cellengo on July 31, 2020

for a net amount of k€ 1,453 retroactive effect on January 1, 2020.

Plant Advanced Technologies PAT obtained a French government-backed

loan in the first half in the amount of € 1.2 million that was

supplemented in the second half by loans from the French public

investment bank, BPI, namely in the form of Covid-relief aid “Prêt

Rebond” and Innovation funding, plus a k€ 200 loan in November

2020.

For the record, Temisis, PAT’s subsidiary carried out a capital

increase in the amount of €1.6 million based on a pre-money

valuation of € 40 million. After the completion of this rights

issue, PAT retains 98.46% of its subsidiary’s share capital.

PAT has a solid financial position with net debt of € 4 million

at 31 December 2020 and shareholders’ equity of € 9.3 million.

OUTLOOK

2020 was marked by the COVID-19 pandemic. In this unprecedented

context, all PAT customers remained loyal and certain projects

delayed during this period are expected to be back on track in

2021.

This new distribution partnership with CLARIANT in the cosmetics

sector has started to show results by registering significant

orders at the beginning of this year.

For all other PAT subsidiaries (PAT Zerbaz, Cellengo, Temisis,

Straticell and Couleurs de Plantes) visibility remains excellent

for 2021 in terms of business development, R&D and strategic

partnerships.

On that basis, Plant Advanced Technologies PAT is confident that

it will meet its growth targets for 2021.

The Company also reaffirms its continuing commitment to its

roadmap for:

- Maintaining efforts to contain costs and preserve cash;

- Deploying its marketing strategy focused on adopting a product

catalog and indirect distribution.

- Continuing internal research and collaborative efforts to

prepare for the launch of new products

Finally, concerning the work on SARS-CoV-2, tests are currently

underway for several active ingredients. PAT is investigating the

research of original antiviral molecules, complementary to the

current vaccination strategies.

A CAPITAL INCREASE AND GRANT OF RESTRICTED STOCK FOR ORDINARY

SHARES TO PLANT ADVANCED TECHNOLOGIES PAT EMPLOYEES AND SELECTED

SUBSIDIARIES

On April 25, 2019, pursuant to the delegations of authority

granted by the 17th resolution of the extraordinary general meeting

of June 28, 2017, the Board of Directors decided to implement a

Restricted Stock Unit Plan (attribution d'actions gratuites) for

employees of PAT and selected subsidiaries.

On April 26, 2021, Mr. Jean-Paul Fèvre, Chairman-CEO of Plant

Advanced Technologies PAT duly noted the corresponding capital

increase and formally completed the transaction.

- Amount of the capital increase of April 26, 2021: €4,808 with

the creation of 4,808 shares

- Price of the newly created shares: € 22.00 (opening share price

on April 26, 2021)

- The share capital increased in consequence from € 1,085,906 to

€ 1,090,714, divided by 1,090,714 shares of one euro per

share.

Pursuant to the above, the number of voting rights and shares

making up the share capital of Plant Advanced Technologies PAT

totals: 1,090,714.

The purpose of this grant is to promote the retention and

long-term contribution to the results of Plant Advanced

Technologies PAT by all concerned employees.

FINANCIAL CALENDAR

The reporting scope for financial information will change in

2021. The first consolidated financial statements of Plant Advanced

Technologies PAT will be published by June 30, 2021.

Forum Midcap Partners May 12, 2021 Publication of 2020

consolidated annual results by June 30, 2021. SFAF analyst meeting

by June 30, 2021 Annual General Meeting before July 31, 2021

About PAT www.plantadvanced.com

Plant Advanced Technologies PAT is specialized in the

identification, optimization and production of rare new active

plant compounds or cosmetics, pharmaceutical, nutraceutical and

fine chemicals markets. PAT possesses unique plant-based expertise

with a portfolio of worldwide patents (PAT Target Binding® and

Plant Milking®)

Plant Advanced Technologies is listed on Euronext Growth™-

Paris

ISIN : FR0010785790 - Ticker: ALPAT

Reuters ALPAT.PA - Bloomberg : ALPAT : FP

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210505005934/en/

PAT – Investor Relations - Louis-Nicolas Vallas +33 6 20

64 32 86 - investisseur@plantadvanced.com FIN’EXTENSO –

Media Relations - Isabelle Aprile - +33 6 17 38 61 78 -

i.aprile@finextenso.fr

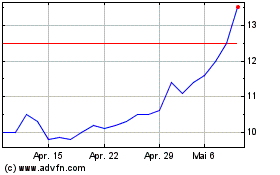

Plant Advanced Technolog... (EU:ALPAT)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Plant Advanced Technolog... (EU:ALPAT)

Historical Stock Chart

Von Apr 2023 bis Apr 2024