Philip Morris Raises Offer for Vectura to $1.42 Billion

09 August 2021 - 8:43AM

Dow Jones News

By Ian Walker

Philip Morris International Inc. said Monday that it has

increased its offer for Vectura Group PLC to 1.02 billion pounds

($1.42 billion), trumping Friday's offer from Carlyle Europe

Partners V for the U.K. pharmaceutical company.

Under the new offer accepting shareholders of Vectura will get

165 pence a share in cash, up from Philip Morris's previous offer

of 150 pence a share and Carlyle's offer of 155 pence Friday.

On Friday, Vectura said that it had agreed a new GBP958 million

takeover by Murano Bidco Ltd., a new company indirectly controlled

by funds managed by Carlyle Europe Partners V, and withdrew its

recommendation for Philip Morris' proposal.

At the time Vectura, which specializes in inhaled medicines,

said the Carlyle bid offers better value to shareholders than

Philip Morris's and also puts the company in a better position to

meet its current strategy.

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

August 09, 2021 02:30 ET (06:30 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

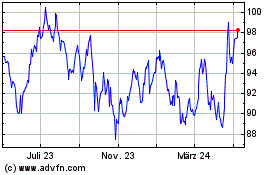

Philip Morris (NYSE:PM)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

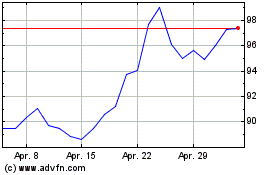

Philip Morris (NYSE:PM)

Historical Stock Chart

Von Apr 2023 bis Apr 2024