Pernod Ricard Fiscal Year 2021 Margins Bolstered by Cost Control, Sales Volumes; Invests in US Peer

01 September 2021 - 9:37AM

Dow Jones News

By Joshua Kirby

Cost discipline helped Pernod Ricard expand its margins in

fiscal 2021, the French drinks group said Wednesday, as it revealed

that it is taking a minority stake in a U.S. premium-focused

peer.

Pernod Ricard's operating margin expanded by 213 basis points in

the 12 months to end-June, the company said. This was driven by a

64-basis-point increase in the gross margin on stable pricing and

better absorption of fixed costs thanks to volume growth, Pernod

said.

The margin was also boosted by focusing promotional spend on

growth markets and categories, and by disciplined control of

structure costs, which are expected to increase strongly in the new

fiscal year to support future growth, it said.

Profit from recurring operations of 2.42 billion euros ($2.86

billion) was boosted by a previously-announced drawback of EUR28

million in the U.S., relating to an August court decision allowing

exporters to claim on duties already paid.

Sales growth in key markets such as the U.S., as well as China

and some European countries, helped offset a decline in travel

retail across the board, Pernod said, adding that it expects

continued sales momentum in fiscal 2022, especially in the first

quarter.

The company meanwhile said it is taking a minority stake in New

York-based drinks group Sovereign Brands, whose super-premium

portfolio includes French sparkling wine Luc Belaire and rum brand

Bumbu. Pernod didn't reveal the financial details of the

investment, but praised Sovereign Brands' history of innovation and

brand creation.

Write to Joshua Kirby at joshua.kirby@wsj.com;

@joshualeokirby

(END) Dow Jones Newswires

September 01, 2021 03:22 ET (07:22 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

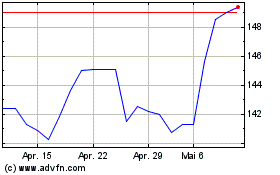

Pernod Ricard (EU:RI)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

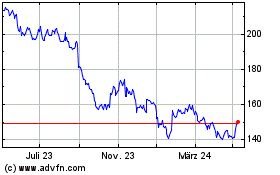

Pernod Ricard (EU:RI)

Historical Stock Chart

Von Apr 2023 bis Apr 2024