LVMH: Growth continues at the same pace

Paris, October 12, 2021

LVMH Moët Hennessy Louis Vuitton, the world’s

leading luxury products group, recorded revenue of 44.2 billion

euros in the first nine months of 2021, up 46% compared to 2020.

Organic revenue growth over the period was 40% compared to 2020.

Compared to 2019, organic growth over the first nine months of 2021

was 11%, with trends in the third quarter (+ 11%) comparable to

those of the first half, both by activity and by region. The

Fashion & Leather Goods business group, which reached record

levels over the period, recorded organic growth of 38% compared to

the third quarter of 2019, identical to that recorded over the

first six months of the year. The United States and Asia continued

to see double-digit growth.

Revenue by business group:

|

Euro millions |

9 months 2020 |

9 months 2021 |

Change

2021/2020First 9

monthsPublished

Organic* |

Change 2021/2019First 9

monthsOrganic |

|

Wines & Spirits |

3 349 |

4 251 |

+ 27 % |

+ 30 % |

+ 10 % |

|

Fashion & Leather Goods |

13 934 |

21 315 |

+ 53 % |

+ 57 % |

+ 38 % |

|

Perfumes & Cosmetics |

3 674 |

4 668 |

+ 27 % |

+ 30 % |

- 2 % |

|

Watches & Jewelry |

2 266 |

6 160 |

x 2.7 |

+ 49 % |

+ 4 % |

|

Selective Retailing |

7 176 |

7 795 |

+ 9 % |

+ 13 % |

- 23 % |

|

Other activities and eliminations |

(51) |

(12) |

- |

- |

- |

|

Total LVMH |

30 348 |

44 177 |

+ 46 % |

+ 40 % |

+ 11 % |

* with comparable structure and exchange rates. The structural

impact for the Group compared to the first nine months of 2020 was

+10%, largely linked to the consolidation for the first time of

Tiffany & Co. The currency effect was -4%.

The Wines

& Spirits business group

recorded organic revenue growth of 30% in the first nine months of

2021 compared to the same period of 2020 and 10% compared to 2019.

Champagne volumes were up 7% compared to the first nine months of

2019. Growth was particularly strong in the United States and

Europe, which notably benefited over the summer from the reopening

of restaurants and the gradual recovery of tourism. Hennessy cognac

performed well with a 4% increase in volumes compared to 2019 while

being limited by supply constraints. China and the United States

experienced a strong rebound. The third quarter marked the

integration for the first time of the prestigious Champagne Maison

Armand de Brignac, in which LVMH has taken a 50% stake.

The Fashion & Leather Goods

business group recorded organic revenue growth of 57% in the first

nine months of 2021 compared to the same period of 2020 and 38%

compared to 2019. Growth in the third quarter of 2021 remained

exceptional compared to the third quarter of 2020, which marked a

return to growth after a declining first half of 2020. Louis

Vuitton, which is celebrating the 200th anniversary of the birth of

its founder, performed remarkably well, driven by constant

innovation and by the quality of its products. Christian Dior

showed exceptional momentum. The latest fashion shows

in Athens and Paris, highlighting the inspiring collections of

Maria Grazia Chiuri, received an outstanding reception. Following

its enormous success in Paris, London and Shanghai, the Christian

Dior, Designer of Dreams exhibition opened in New York. At Fendi,

Kim Jones' first collection was successfully rolled out in stores.

Celine enjoyed strong growth in its ready-to-wear and leather goods

lines created by Hedi Slimane. Loewe and Marc Jacobs also performed

very well.

The Perfumes & Cosmetics

business group recorded organic revenue growth of 30% over the

first nine months of 2021 compared to the same period of 2020. On

an organic basis, revenue was down 2% compared to the first nine

months of 2019. In an environment marked by a limited recovery in

international travel and the closure of many points of sale, the

major brands continued to be selective in their distribution, limit

promotions and grow online sales via their own websites. Christian

Dior benefitted from the huge success of the new Miss Dior Eau de

Parfum and Sauvage Elixir. The continued growth of the Collection

Privée, as well as the Prestige and Capture Totale skincare lines

also contributed to the rapid progress of the Maison. Guerlain

enjoyed an excellent performance, driven by its Abeille Royale and

Orchidée Impériale skincare lines. Maison Francis Kurkdjian

benefitted from the successful launch of the Aqua Cologne Forte

trio and the continued success of Rouge 540.

The Watches & Jewelry

business group recorded organic revenue growth of 49% in the first

nine months of 2021 compared to the same period of 2020 and 4%

compared to 2019 (excluding Tiffany, which was consolidated for the

first time in 2021). Driven by the growing success of its iconic

products, Tiffany enjoyed a remarkable performance, particularly in

its major market, the United States. Bvlgari rolled out its new

line of High Jewelry, Magnifica, and celebrated its Serpenti

creations at the Metamorphosis exhibition in Milan. Chaumet, the

first jeweler to have invested in 1812 on the legendary Place

Vendôme in Paris, launched a new High Jewelry collection, Torsade,

inspired by the movement of the frieze adorning the column of the

Place. In watchmaking, TAG Heuer successfully launched a limited

Super Mario edition of its smart watch for gaming enthusiasts.

In Selective

Retailing, organic revenue was up 13% compared to

the first nine months of 2020 and down 23% compared to the same

period of 2019. Sephora returned to its 2019 level of activity

despite the tough commercial environment, marked by the closure of

several stores during part of the year. Online revenue showed

strong growth throughout the world. In addition to its own stores,

Sephora expanded its distribution in the United States with its

first Beauty spaces within Kohl's department stores. After signing

a partnership with the European online platform Zalando, Sephora

acquired the British online distributor Feelunique, which

specializes in prestige beauty. The expansion of its network

continued in Asia, particularly in China. DFS remained heavily

constrained by the very limited recovery in international travel to

most destinations. La Samaritaine, which reopened in June following

an ambitious renovation, is enjoying a promising start.

OUTLOOK

Within the context of a gradual exit from the

health crisis, the Group is confident in the continuation of the

current growth; it will maintain a strategy focused on continuously

strengthening the desirability of its brands, by relying on the

authenticity and quality of its products, the excellence of their

distribution and the reactivity of its organization.

LVMH is counting on the dynamic nature of its

brands and the talent of its teams to further strengthen its global

leadership position in luxury goods once again in 2021.

Apart from the items mentioned in this press

release, there were no events or changes during the quarter and as

of today's date that could significantly affect the Group's

financial structure.Regulated information related to this press

release and presentation are available on www.lvmh.com.

ANNEX

LVMH – Revenue by business group and by quarter

|

2021 Revenue

(Euro

millions) |

|

2021 |

Wines & Spirits |

Fashion & Leather Goods |

Perfumes & Cosmetics |

Watches & Jewelry |

Selective Retailing |

Other activities and eliminations |

Total |

|

First quarter |

1 510 |

6 738 |

1 550 |

1 883 |

2 337 |

(59) |

13 959 |

|

Second quarter |

1 195 |

7 125 |

1 475 |

2 140 |

2 748 |

23 |

14 706 |

|

First half |

2 705 |

13 863 |

3 025 |

4 023 |

5 085 |

(36) |

28 665 |

|

Third quarter |

1 546 |

7 452 |

1 642 |

2 137 |

2 710 |

25 |

15 512 |

|

First nine months |

4 251 |

21 315 |

4 668 |

6 160 |

7 795 |

(12) |

44 177 |

|

2021 Revenue (organic

growth compared to the same period of 2020) |

|

2021 |

Wines & Spirits |

Fashion & Leather Goods |

Perfumes & Cosmetics |

Watches & Jewelry |

Selective Retailing |

Other activities and eliminations |

Total |

|

First quarter |

+ 36 % |

+ 52 % |

+ 18 % |

+ 35 % |

- 5 % |

- |

+ 30 % |

|

Second quarter |

+ 55 % |

x 2.2 |

+ 67 % |

x 2.2 |

+ 31 % |

- |

+ 84 % |

|

First half |

+ 44 % |

+ 81 % |

+ 37 % |

+ 71 % |

+ 12 % |

- |

+ 53 % |

|

Third quarter |

+ 10 % |

+ 24 % |

+ 19 % |

+ 18 % |

+ 15 % |

- |

+ 20 % |

|

First nine months |

+ 30 % |

+ 57 % |

+ 30 % |

+ 49 % |

+ 13 % |

- |

+ 40 % |

|

2021 Revenue (organic

growth compared to the same period of 2019) |

|

2021 |

Wines & Spirits |

Fashion & Leather Goods |

Perfumes & Cosmetics |

Watches & Jewelry |

Selective Retailing |

Other activities and eliminations |

Total |

|

First quarter |

+ 17 % |

+ 37 % |

- 4 % |

+ 1 % |

- 30 % |

- |

+ 8 % |

|

Second quarter |

+ 7 % |

+ 40 % |

- 1 % |

+ 9 % |

- 19 % |

- |

+ 14 % |

|

First half |

+ 12 % |

+ 38 % |

- 3 % |

+ 5 % |

- 25 % |

- |

+ 11 % |

|

Third quarter |

+ 7 % |

+ 38 % |

0 % |

+ 1 % |

- 19 % |

- |

+ 11 % |

|

First nine months |

+ 10 % |

+ 38 % |

- 2 % |

+ 4 % |

- 23 % |

- |

+ 11 % |

|

2020 Revenue

(Euro

millions) |

|

2020 |

Wines & Spirits |

Fashion & Leather Goods |

Perfumes & Cosmetics |

Watches & Jewelry |

Selective Retailing |

Other activities and eliminations |

Total |

|

First quarter |

1 175 |

4 643 |

1 382 |

792 |

2 626 |

(22) |

10 596 |

|

Second quarter |

810 |

3 346 |

922 |

527 |

2 218 |

(26) |

7 797 |

|

First half |

1 985 |

7 989 |

2 304 |

1 319 |

4 844 |

(48) |

18 393 |

|

Third quarter |

1 364 |

5 945 |

1 370 |

947 |

2 332 |

(3) |

11 955 |

|

First nine months |

3 349 |

13 934 |

3 674 |

2 266 |

7 176 |

(51) |

30 348 |

|

2019 Revenue

(Euro

millions) |

|

|

2019 |

Wines & Spirits |

Fashion & Leather Goods |

Perfumes & Cosmetics |

Watches & Jewelry |

Selective Retailing |

Other activities and eliminations |

Total |

|

First quarter |

1 349 |

5 111 |

1 687 |

1 046 |

3 510 |

(165) |

12 538 |

|

Second quarter |

1 137 |

5 314 |

1 549 |

1 089 |

3 588 |

(133) |

12 544 |

|

First half |

2 486 |

10 425 |

3 236 |

2 135 |

7 098 |

(298) |

25 082 |

|

Third quarter |

1 433 |

5 448 |

1 676 |

1 126 |

3 457 |

176* |

13 316 |

|

First nine months |

3 919 |

15 873 |

4 912 |

3 261 |

10 555 |

(122) |

38 398 |

* Includes all Belmond revenue for the period from April to

September 2019.

LVMH

LVMH Moët Hennessy Louis Vuitton is represented

in Wines and Spirits by a portfolio of brands that includes Moët

& Chandon, Dom Pérignon, Veuve Clicquot Ponsardin, Krug,

Ruinart, Mercier, Château d’Yquem, Domaine du Clos des Lambrays,

Château Cheval Blanc, Colgin Cellars, Hennessy, Glenmorangie,

Ardbeg, Belvedere, Woodinville, Volcán de Mi Tierra, Chandon,

Cloudy Bay, Terrazas de los Andes, Cheval des Andes, Cape Mentelle,

Newton, Bodega Numanthia, Ao Yun, Château d'Esclans and Château du

Galoupet. Its Fashion and Leather Goods division includes Louis

Vuitton, Christian Dior Couture, Celine, Loewe, Kenzo, Givenchy,

Fendi, Emilio Pucci, Marc Jacobs, Berluti, Loro Piana, RIMOWA,

Patou. LVMH is present in the Perfumes and Cosmetics sector with

Parfums Christian Dior, Guerlain, Parfums Givenchy, Kenzo Parfums,

Perfumes Loewe, Benefit Cosmetics, Make Up For Ever, Acqua di

Parma, Fresh, Fenty Beauty by Rihanna and Maison Francis Kurkdjian.

LVMH's Watches and Jewelry division comprises Bvlgari, Tiffany

& Co, TAG Heuer, Chaumet, Dior Watches, Zenith, Fred and

Hublot. LVMH is also active in selective retailing as well as in

other activities through DFS, Sephora, Le Bon Marché, La

Samaritaine, Groupe Les Echos, Cova, Le Jardin d’Acclimatation,

Royal Van Lent, Belmond and Cheval Blanc hotels.

“This document may contain certain forward

looking statements which are based on estimations and forecasts. By

their nature, these forward looking statements are subject to

important risks and uncertainties and factors beyond our control or

ability to predict, in particular those described in LVMH’s

Universal Registration Document which is available on the website

(www.lvmh.com). These forward looking statements should not be

considered as a guarantee of future performance, the actual results

could differ materially from those expressed or implied by them.

The forward looking statements only reflect LVMH’s views as of the

date of this document, and LVMH does not undertake to revise or

update these forward looking statements. The forward looking

statements should be used with caution and circumspection and in no

event can LVMH and its Management be held responsible for any

investment or other decision based upon such statements. The

information in this document does not constitute an offer to sell

or an invitation to buy shares in LVMH or an invitation or

inducement to engage in any other investment activities.”

LVMH CONTACTS

|

Analysts and investorsChris HollisLVMH+ 33 1 44 13

21 22 |

MediaJean-Charles TréhanLVMH+ 33 1 44 13 26

20 |

|

MEDIA CONTACTS |

|

|

FranceAymeric Granet Brune Diricq / Charlotte

MarinéPublicis Consultants+ 33 1 44 82 47 20 |

FranceMichel Calzaroni / Olivier Labesse / Hugues

Schmitt / Thomas Roborel de ClimensDGM Conseil+ 33 1 40 70 11

89 |

|

ItalyMichele Calcaterra, Matteo SteinbachSEC and

Partners+ 39 02 6249991 |

UKHugh Morrison, Charlotte McMullenMontfort

Communications+ 44 7921 881 800 |

|

USNik Deogun / Blake SonnensheinBrunswick Group+ 1

212 333 3810 |

ChinaDaniel JeffreysDeluxewords+ 44 772 212 6562+

86 21 80 36 04 48 |

- LVMH - 2021 Third Quarter Revenue

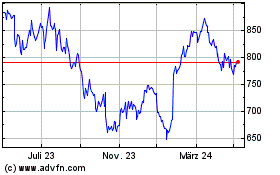

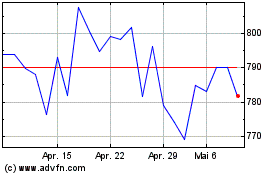

Lvmh Moet Hennessy Louis... (BIT:1MC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Lvmh Moet Hennessy Louis... (BIT:1MC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024