Japanese Yen Climbs Amid Omicron, Policy Tightening Concerns

17 Dezember 2021 - 2:26AM

RTTF2

The Japanese yen advanced against its major counterparts in the

Asian session on Friday, as most Asian shares fell amid concerns

over tighter monetary policy to contain inflationary pressures, as

well as economic risks from the Omicron variant.

The Bank of England lifted its key interest rate unexpectedly,

while the European Central Bank announced an end to net purchases

under the pandemic emergency purchasing programme in March.

The Fed doubled the pace of tapering of bond purchases and

signaled three interest rate hikes in 2022.

Investors seem worried about central banks adopting a more

hawkish turn to tackle high inflation.

The U.K. reported a record number of daily coronavirus cases for

the second day in a row on Thursday.

Coronavirus infections and hospitalizations are climbing in the

U.S., with a growing number of states reporting Omicron cases.

The Bank of Japan decided to scale back its pandemic related

funding measures as the economy is set to recover amid waning

supply-side constraints.

The board, governed by Haruhiko Kuroda, decided to end the

additional purchases of CP and corporate bonds at the end of March

2022 as scheduled.

From April 2022, the purchases of securities will be of the same

amount as prior to the COVID-19 pandemic, so that the amounts

outstanding of these assets will decrease gradually to the

pre-pandemic levels, namely, about JPY 2 trillion for CP and about

JPY 3 trillion for corporate bonds.

The board decided to maintain the interest rate at -0.1 percent

on current accounts that financial institutions maintain at the

central bank.

The bank will also continue to purchase a necessary amount of

Japanese government bonds without setting an upper limit so that

10-year JGB yields will remain at around zero percent.

The yen edged higher to 151.11 against the pound, 128.53 against

the euro and 123.45 against the franc, recovering from its early

lows of 151.72, 128.99 and 123.81, respectively. The next possible

resistance for the yen is seen around 149.00 against the pound,

126.00 against the euro and 120.5 against the franc.

The yen touched a 3-day high of 113.44 against the greenback,

from a low of 113.86 seen at 7:45 pm ET. The yen is likely to

challenge resistance around the 109 level.

The yen bounced off from its prior lows of 89.09 against the

loonie, 81.75 against the aussie and 77.38 against the kiwi and was

trading at 2-day highs of 88.57, 81.15 and 76.86, respectively. The

yen is seen finding resistance around 86.00 against the loonie,

79.00 against the aussie and 75.00 against the kiwi.

Looking ahead, German PPI and U.K. retail sales for November are

due at 2.00 am ET.

German Ifo business sentiment index for December and Eurozone

CPI for November will be featured in the European session.

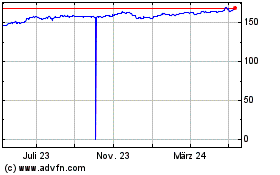

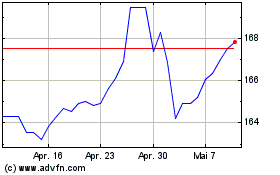

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Mär 2024 bis Apr 2024

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Apr 2023 bis Apr 2024