Imperial Brands Says Fiscal Year 2021 Net Revenue Grew Around 1%

06 Oktober 2021 - 8:53AM

Dow Jones News

By Anthony O. Goriainoff

Imperial Brands PLC said Wednesday that it expects to report

that fiscal 2021 net revenue brew by around 1% on an organic,

constant-currency basis, and that this is driven by a continued

strong pricing in tobacco.

The FTSE 100-listed tobacco company--which houses the Davidoff,

Gauloises and JPS cigarette brands as well as a number of vapor and

heated-tobacco products--said that for the year ended Sept. 30 it

expects to report adjusted organic operating profit growth in line

with the board's guidance of low to mid-single digit

constant-currency growth. The company said that this will reflect

the significantly reduced losses in Next Generation Products, or

NGP, and an increased distribution profit.

The company said reported second-half revenue from NGP is

expected to be at a similar level to the first half, and that this

is a reflection of the effect of market exits as it focuses on

categories and markets with the best potential for sustainable

growth.

"Full-year adjusted operating cash conversion is expected to be

in line with expectations with the unwind of the temporary Logista

cash benefits in fiscal 2020 resulting in a working capital

outflow," the company said.

Write to Anthony O. Goriainoff at

anthony.orunagoriainoff@dowjones.com

(END) Dow Jones Newswires

October 06, 2021 02:38 ET (06:38 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

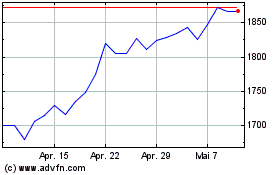

Imperial Brands (LSE:IMB)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Imperial Brands (LSE:IMB)

Historical Stock Chart

Von Apr 2023 bis Apr 2024