Illimity Ends the First Quarter of 2021 With a Net Profit of 12.6

Million Euro (+180% Over 1Q20, +86% Over 4Q20)

via InvestorWire—Chaired by Rosalba Casiraghi, the Board of

Directors of illimity Bank S.p.A. (“

illimity” or

the “

Bank”) yesterday approved the illimity

Group’s results as of March 31, 2021.

illimity reported robust results in the quarter

ended March 31, 2021, continuing the positive performance achieved

in 2020 and posting a net profit of 12.6 million

euro, its best quarterly result ever and a figure almost

three times higher than that achieved in the first quarter of 2020

(4.5 million euro) and about twice the amount reported in the

previous quarter (6.8 million euro).

Assets stood at over 4.3 billion

euro on March 31, a 5% increase over the previous quarter

and 41% up on the figure of 3 billion euro posted on March 31,

2020. The total includes net customer loans and

investments of 2.2 billion euro on March

31, 2021, a rise of 34% over the balance of 1.7 billion euro at the

corresponding date in 2020 and slightly up (by 1%) over the

previous quarter, despite the sale of positions and discounted

payoff transactions.

The rise in volumes in the quarter was driven by

the SME Division, whose net customer loans grew by

6% over the end of December 2020 (+56% compared to 31 March 2020)

to reach 869 million euro at the end of March

2021. The acceleration in the growth of the business, which began

in the second half of 2020, also continued decisively in the first

quarter of 2021, with a positive contribution arriving from all

business sectors – Factoring, Crossover and Acquisition Finance and

Turnaround – and benefiting from the strong demand for the

state-backed loans introduced by government decrees issued as part

of the pandemic crisis. The SME Division also posted

profits of approximately 3 million

euro in the quarter earned on credit revaluation

events deriving from Turnaround transactions. In the

quarter the Division posted a pre-tax profit of

4.7 million euro.

The quality of illimity’s asset

portfolio remains solid, with no significant impairment

occurring in the SME Division’s net customer loans. Total gross

organic non-performing loans as of March 31, 2021 accordingly

fell to 35.9 million euro (from 37.4 million euro

at December 31, 2020), almost all of which arising from the

business portfolio of the former Banca Interprovinciale network,

while the ratio of these to total gross organic customer

loans decreased to 3.0% at 31 March 2021 compared to 3.2%

at the end of December 2020 and 4.2% at the end of March 2020. At

the end of March 2021, loans with moratorium amounted to 49 million

euro, down significantly from the December 2020 figure of 65

million euro (and compared to a peak amount requested during 2020

of 86 million euro).

The first quarter of the year is usually

characterised by a somewhat sluggish dynamic of transactions on the

distressed loan market. As a result of this seasonality, volumes in

the DCIS Division remained more or less unchanged

over the quarter ended March 31, 2021, closing at 1.3

billion euro, also due to the effect of sale of positions

and discounted payoff transactions. On the basis of a solid

pipeline of potential transactions, which can be estimated in

around 260 million euro, a gradual acceleration is expected to be

seen this year in the division’s investment activity over the next

few months. Operating trends remained very strong with gross cash

flows exceeding expectations. The Bank continued its dynamic

management strategy on existing portfolios in this quarter too,

posting additional profits from disposals and closed

positions of 9.5 million euro. In the quarter the division

posted a pre-tax profit of 31.4 million

euro.

Total assets managed by neprix,

the illimity Group’s platform specialising in servicing distressed

corporate loans, stood at 9.0 billion euro on 31

March 31, 2021 in terms of the gross book value (“GBV”) of the

loans serviced and the real estate assets and capital goods held

for sale.

At the end of March 2021, direct

customer funding remained stable at approximately

2.4 billion euro compared to the December 2020

figure and up by 36% year on year. Within this total,

illimitybank.com’s funding reached 1.2

billion euro as of March 2021, up 7% on the previous

quarter (and +42% y/y). Funding through Raisin,

pan-European deposit platform, stood at 492 million

euro, a 20% advance quarter on quarter (+27% y/y).

Corporate customer funding on a quarterly basis declined to 719

million euro (-17% q/q, +35% y/y).

It is recalled that in December 2020 illimity

made its debut on the bond market with the issue of its first

senior preferred bond worth 300 million euro, with a maturity of

three years and a coupon of 3.375%. Overall, illimity's

total sources of funding as of March 31, 2021

stood at 3.5 billion euro, up

approximately 3% on the December 2020 figure and 47% year on

year.

Also, as the result of the above-mentioned bond

placement, liquidity consisting of cash, the net

interbank position, high-quality liquid assets and other marketable

securities – to be used to service the business growth planned for

2021 - remained at excellent levels and totalled

approximately 1 billion euro at 31 March 2021.

Alongside its solid economic and capital

results, illimity carried out two important strategic initiatives

in the first quarter of 2021. On January 1, 2021 the Bank concluded

the acquisition of an investment of 50% in HYPE, a

leading player in the Italian market for mobile-based financial

services platforms. HYPE recorded a significant growth in customer

numbers, up 26% year on year to 1.4 million. Starting this quarter,

therefore, illimity is recognising its joint

investment in HYPE in its consolidated financial

statements using the equity method, leading to a carrying

amount of 85.6 million euro as of March 31, 2021.

During the quarter illimity SGR

completed work on the launch of its inaugural fund “illimity Credit

& Corporate Turnaround”, whose first closing was announced on

April 1, 2021 at a gross amount of more than 200 million euro. It

is a contribution fund dedicated to investments in Unlikely To Pay

(“UTP”) loans due from SMEs with turnaround prospects. This launch

consolidates illimity’s market positioning in the UTP sector, a

segment where the Bank is already playing a leading role through

its investment in single name and portfolios exposures through its

DCIS and SME Divisions.

The increase in assets, together with the

effects arising from the consolidation of the investment in HYPE,

led to a rise in risk-weighted assets (RWAs),

which at the end of March 2021 stood at 3,018 million

euro, up by 6% over the figure of 2,851 million euro at

the end of 2020 and by 29% over the same period in 2020.

Lastly, CET1 capital rose to

approximately 530 million euro at the end of the

first quarter of 2021 compared to 509 million euro at the end of

December 2020 (439 million euro at March 2020), mostly as the

result of the net profit for the quarter.

These factors led the continuation of a robust

CET1 ratio, which ended March 2021 at

17.6%. On the basis of unchanged assets, the

Bank’s pro-forma CET1 ratio, meaning that including special shares

of 14.4 million euro, stood at 18.0%.

“We are very satisfied about the start of 2021.

The growth of our lending activity, the quality of our portfolios,

the scale effect that is now emerging in various areas of our

business and the resulting economic performance all confirm the

choices we have made so far,” said illimity CEO Corrado Passera.

“In recent months, very promising activities have been launched in

Open Banking (HYPE) and asset management (illimity SGR). A number

of strategic developments not initially foreseen are also emerging

and will be presented on June 22 with the update of our Strategic

Plan.”

For further information:

Investor RelationsSilvia Benzi:

+39.349.7846537 - +44.7741.464948

- silvia.benzi@illimity.com

|

Press & Communication illimity |

|

|

Isabella Falautano, Francesca D’Amico |

Sara Balzarotti, Ad Hoc Communication Advisors |

|

+39.340.1989762 press@illimity.com |

+39.335.1415584 sara.balzarotti@ahca.it |

Wire Service

Contact:InvestorWire (IW)Los Angeles,

Californiawww.InvestorWire.com212.418.1217

OfficeEditor@InvestorWire.com

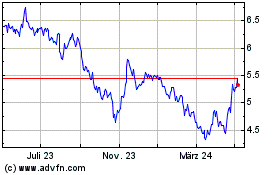

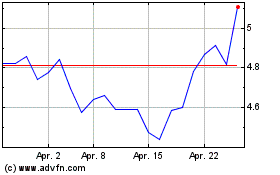

Illimity Bank (BIT:ILTY)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Illimity Bank (BIT:ILTY)

Historical Stock Chart

Von Apr 2023 bis Apr 2024