- H1 2021 revenue up 43% to €3.7 million

- Sharp increase in gross margin to 61.2%, vs. 55.7% in H1

2020

- 24% improvement in net loss vs. H1 2020

Regulatory News:

IMPLANET (Paris:ALIMP) (Euronext Growth: ALIMP, FR0013470168,

eligible for PEA-PME equity savings plans), a medical technology

company specializing in vertebral and knee-surgery implants,

announces its results for the first half of the year to June 30,

2021, as approved by the Board of Directors on September 21,

2021.

Ludovic Lastennet, IMPLANET’s CEO, said: “The recentering

of our operations initiated in 2020 pertaining to our Spine

activity, combined with the upturn observed during the first half

of the year, illustrate the relevance of our strategic focus.

Despite the still limited impact of OSD’s activity, given its

acquisition date, we have been able to improve our gross margin

over the period while continuing to rationalize our fixed costs.

Combining IMPLANET and OSD’s expertise has brought its first

benefits with the signing of a contract with one of the major

players in the spinal implant sector in Germany, ulrich medical®.

Although the public health situation is not facilitating the return

to normal surgical activity, the first results of this partnership

should materialize during the second half of this year and confirm

the return to growth that has already begun”.

In € thousands - IFRS - Simplified income

statement

H1 2021

H1 2020

Change %

Revenue

3,718

2,595

43%

Cost of goods sold

-1,442

-1,148

26%

Gross margin

2,276

1,446

57%

Gross margin %

61.2%

55.7%

+5.5 pp

Recurring operating costs

-3,990

-3,339

20%

Recurring operating profit/loss

-1,714

-1,892

9%

Other non-recurring operating

income/expenses

0

-148

n/a

Operating profit/loss

-1,714

-2,040

16%

Financial profit/loss

-120

-370

67%

Net profit/loss net

-1,834

-2,410

24%

*Unaudited data

H1 2021 revenue

In the first half of 2021, IMPLANET generated revenue of €3.72

million, up 43% (vs. €2.59 million in H1 2020).

Thanks to the strategic acquisition of Orthopaedic & Spine

Development (“OSD”)1 in the first half of 2021, Spine

activity saw strong growth of 71% compared with H1 2020, with sales

totaling €2.58 million. Activity was also up 8% compared with H1

2019. Despite the still significant impact of the health crisis

since the start of the year, MADISON activity was up by 5% compared

with H1 2020.

Gross margin and operating

profit

Over the first half of 2021, the gross margin improved by 5.5

percentage points to €2.28 million, compared with €1.44 million in

H1 2020.

Recurring operating expenses increased by €0.65 million over the

period compared with the first half of 2020, primarily because of

OSD costs of €0.30 million booked for the period from May 19, 2021

to June 30, 2021, as well as the resumption in activity and the end

of partial work measures. Despite this increase, operating costs

recorded a decrease of 27 percentage points, representing 107% of

H1 2021 revenue compared with 134% in 2020. This improvement marks

the continuation of the constant efforts to rationalize fixed

costs.

Other non-recurring operating expenses in the first half of 2020

correspond to the costs incurred during the divestment of the

Company’s Knee activity. There was thus a 16% improvement in the

operating loss to -€1.71 million in H1 2021 from -€2.04 million in

H1 2020.

Once the financial result is taken into account, the net loss

was €1.83 million over the six months to June 30, 2021, a 24%

improvement compared with the loss of 2.41 million recorded in the

first half of 2020.

Cash position

As of June 30, 2021, IMPLANET had cash and cash equivalents of

€0.37 million (versus €1.14 million on December 31, 2020). As a

reminder, in January 2021 the Company signed a bond financing

program with Nice & Green for a total of €5.0 million. As of

the date of this press release, €2.85 million was still available

and to be subscribed to by Nice & Green.

2021 outlook

Thanks to the integration of OSD in May 2021, IMPLANET now has a

comprehensive range of innovative products for spine surgery. The

two structures’ geographical complementarity also offers

international development prospects for the entire range.

In the second half of 2021, activity should accelerate notably

thanks to:

- The postponement of the first Madison surgical procedures in

the United States, within the framework of the strategic

partnership with KICo;

- The first spine surgical procedures following the exclusive

agreement for the distribution of GLOBUS MEDICAL’s REFLECT® range

to 15 French university centers specializing in pediatric spine

surgery;

- The first deliveries of JAZZ implants and OSD cervical plates

to ulrich medical® within the framework of the distribution

contract signed in June.

Reminder of H1 2021

highlights

- Agreement for the acquisition of OSD, which specializes in

developing, manufacturing and marketing implants for spine

surgery;

- Clearance for the MADISONTM total knee prosthesis obtained from

the TGA (Therapeutic Goods Administration) enabling the product to

be marketed in Australia;

- Signing of a strategic partnership with ulrich medical® for the

distribution of JAZZ® implants and the OSD cervical plate;

- Exclusive distribution contract with GLOBUS MEDICAL to market

the latter’s Scoliosis Correction System to 15 French university

centers specialized in pediatric spine surgery in order to increase

our market share.

The Half Year financial report as of 30 June 2021 is available

on IMPLANET’s website and on the AMF website.

Upcoming financial event:

- Q3 2021 revenue, on October 12, 2021 after

market close

About IMPLANET

Founded in 2007, IMPLANET is a medical technology company that

manufactures high-quality implants for orthopedic surgery. Its

activity revolves around two product ranges, a comprehensive

innovative solution for improving the treatment of spinal

pathologies (JAZZ® and OSD), as well as the MADISON implant for

first-line prosthetic knee surgery. Implanet’s tried-and-tested

orthopedic platform is based on the traceability of its products.

Protected by four families of international patents, JAZZ® has

obtained 510(k) regulatory clearance from the Food and Drug

Administration (FDA) in the United States, the CE mark in Europe

and ANVISA approval in Brazil. IMPLANET employs 29 staff and

recorded sales of €6.0 million in 2020. For further information,

please visit www.implanet.com. Based near Bordeaux in France,

IMPLANET opened a US subsidiary in Boston in 2013. In May 2021,

IMPLANET acquired Orthopaedic & Spine Development (OSD), which

specializes in developing, manufacturing and marketing implants for

spine surgery and offers a product range that complements the

latest generation JAZZ® implant (thoraco-lumbar screws, cages and

cervical plates). IMPLANET is listed on the Euronext Growth market

in Paris.

The Company would like to remind readers that the table for

monitoring the equity line (OCA, BSA) and the number of shares

outstanding is available on its website:

http://www.implanet-invest.com/suivi-des-actions-80

1 Since May 19 2021, Spine activity includes revenue recorded by

OSD, i.e. €0.52 million.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210921005644/en/

IMPLANET Ludovic Lastennet, CEO David Dieumegard, CFO

Tel.: +33 (0)5 57 99 55 55 investors@Implanet.com

NewCap Investor Relations Mathilde Bohin Nicolas Fossiez

Tel.: +33 (0)1 44 71 94 94 Implanet@newcap.eu

NewCap Media Relations Nicolas Merigeau Tel.: +33 (0)1 44

71 94 94 Implanet@newcap.eu

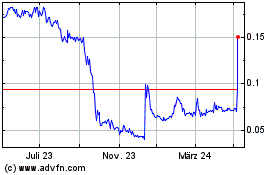

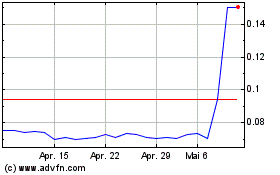

Implanet (EU:ALIMP)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Implanet (EU:ALIMP)

Historical Stock Chart

Von Apr 2023 bis Apr 2024