Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

10 August 2021 - 12:03PM

Edgar (US Regulatory)

Issuer Free Writing Prospectus

Filed pursuant to Rule 433

Registration No. 333-254315

August 9, 2021

ACRES

Commercial Realty Corp.

Pricing Term Sheet

$150,000,000 5.75% Senior Notes Due 2026

This pricing term sheet is qualified in its entirety by reference to the preliminary prospectus supplement dated August 9, 2021 and the accompanying

prospectus (together, the “Preliminary Prospectus”) of ACRES Commercial Realty Corp. (the “Issuer”) relating to the securities described therein. The information in this pricing term sheet supplements the Preliminary Prospectus

and updates and supersedes the information in the Preliminary Prospectus to the extent it is inconsistent with the information in the Preliminary Prospectus. Capitalized terms used and not defined herein have the meanings assigned to them in the

Preliminary Prospectus.

|

|

|

|

|

Issuer:

|

|

ACRES Commercial Realty Corp.

|

|

|

|

|

Security:

|

|

$150,000,000 5.75% Senior Notes Due 2026

|

|

|

|

|

Rating:

|

|

BBB (Egan-Jones)

|

|

|

|

|

Aggregate Principal Amount Offered:

|

|

$150,000,000

|

|

|

|

|

Trade Date:

|

|

August 9, 2021

|

|

|

|

|

Settlement Date:

|

|

August 16, 2021 (T+5)*

|

|

|

|

|

Maturity:

|

|

August 15, 2026

|

|

|

|

|

Price to Public (Issue Price):

|

|

100.00% of the principal amount

|

|

|

|

|

Coupon (Interest Rate):

|

|

5.75% per annum

|

|

|

|

|

Yield to Maturity

|

|

5.75%

|

|

|

|

|

Spread to Comparable Treasury:

|

|

+496 basis points

|

|

|

|

|

Comparable Treasury:

|

|

0.625% due July 31, 2026

|

|

|

|

|

Comparable Treasury Price and Yield

|

|

99-05+ / 0.795%

|

|

|

|

|

Interest Payment Dates:

|

|

February 15 and August 15 of each year, beginning on February 15, 2022

|

|

|

|

|

Optional Redemption:

|

|

• Prior to May 15, 2026 (three months prior to the maturity date of the Notes

(the “Par Call Date”)), “make-whole” call at the Treasury Rate + 50 basis points (calculated as though the actual maturity date of the Notes was the Par Call Date)

• On or after May 15, 2026

(three months prior to the maturity date of the Notes), par call

|

|

|

|

|

|

|

|

|

CUSIP / ISIN:

|

|

00489Q AA0 / US00489QAA04

|

|

|

|

|

Underwriting Discount:

|

|

2.00%

|

|

|

|

|

Denominations:

|

|

$2,000 and integral multiples of $1,000 in excess thereof

|

|

|

|

|

Book-Running Manager:

|

|

Raymond James & Associates, Inc.

|

|

|

|

|

Distribution:

|

|

SEC registered

|

|

|

|

|

Use of Proceeds:

|

|

The Issuer plans to use the net proceeds from the sale of the Notes, after deducting commissions and offering expenses payable by the Issuer, to redeem all $50 million aggregate principal amount of its outstanding 12.00% Senior

Unsecured Notes due 2027, which the Issuer anticipates will result in a payment of approximately $55.3 million, inclusive of all payments of principal, interest and fees. The amount and timing at which any such redemptions may be effected will

be in the Issuer’s sole discretion. Any remaining net proceeds from this offering will be used to make loan originations consistent with the Issuer’s investment policies and for general corporate purposes.

|

|

|

|

* We expect that delivery of the Senior Notes will be made to investors on

or about the fifth business day following the date of this prospectus (such settlement being referred to as “T+5”). Under Rule 15c6-1 under the Exchange Act, trades in the secondary market

are required to settle in two business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade Senior Notes prior to their delivery will be required, by virtue of the fact that the Senior Notes

initially settle in T+5, to specify an alternate settlement arrangement at the time of any such trade to prevent a failed settlement. Purchasers of the Senior Notes who wish to trade the Senior Notes prior to their date of delivery hereunder should

consult their advisors.

|

The Issuer has filed a registration statement (including a prospectus and a prospectus supplement) with the SEC for the

offering to which this communication relates. Before you invest, you should read the prospectus and the prospectus supplement in that registration statement and other documents the Company has filed with the SEC for more complete information about

the Company and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the Company, any underwriter or any dealer participating in the offering will arrange to send you the prospectus

and the prospectus supplement if you request it by calling Raymond James & Associates, Inc. at (800) 248-8863.

Any disclaimer or other notice that may appear below is not applicable to this communication and should be disregarded. Such disclaimer or notice was

automatically generated as a result of this communication being sent by Bloomberg or another email system.

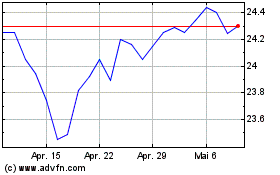

ACRES Commercial Realty (NYSE:ACR-C)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

ACRES Commercial Realty (NYSE:ACR-C)

Historical Stock Chart

Von Apr 2023 bis Apr 2024

Echtzeit-Nachrichten über ACRES Commercial Realty Corporation (New York Börse): 0 Nachrichtenartikel

Weitere Acres Commercial Realty Corp. News-Artikel