Current Report Filing (8-k)

21 Januar 2022 - 10:08PM

Edgar (US Regulatory)

0000007789

NYSE

NYSE

NYSE

false

0000007789

2022-01-19

2022-01-19

0000007789

us-gaap:CommonClassAMember

2022-01-19

2022-01-19

0000007789

us-gaap:SeriesEPreferredStockMember

2022-01-19

2022-01-19

0000007789

us-gaap:SeriesFPreferredStockMember

2022-01-19

2022-01-19

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): January 19, 2022

Associated Banc-Corp

(Exact name of registrant as specified in its charter)

|

Wisconsin

|

001-31343

|

39-1098068

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

433 Main Street Green Bay, Wisconsin 54301

|

|

(Address of principal executive offices, including zip code)

|

Registrant’s telephone number, including area code: (920) 491-7500

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading

Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, Par Value $0.01 per share

|

ASB

|

New York Stock Exchange

|

|

Depositary Shrs, each representing 1/40th intrst in a shr of 5.875% Non-Cum Perp Pref Stock Srs E

|

ASB PrE

|

New York Stock Exchange

|

|

Depositary Shrs, each representing 1/40th intrst in a shr of 5.625% Non-Cum Perp Pref Stock Srs F

|

ASB PrF

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item 5.02Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 20, 2022, Associated Banc-Corp (the “Company”) announced that Christopher J. Del Moral-Niles, Executive Vice President, Chief Financial Officer of the Company, will retire from the Company in 2022. In connection therewith, on January 19, 2022, the Company entered into an Early Retirement Agreement with Mr. Niles (the “Retirement Agreement”). For purposes of the Retirement Agreement, Mr. Niles’ “Retirement Date” will be the first day of the month following the month in which the Company appoints his successor, but in any case no earlier than March 1, 2022.

The Company will continue to pay him his regular base wages through the last day of his employment with the Company. In addition, Mr. Niles will retain all of his vested rights in the Company’s 401(k) plan, Supplemental Executive Retirement Plan and Retirement Account; he will fully participate in the current management incentive plan awards payable in February 2022, based on the Company’s 2021 performance, consistent with other participating executive officers; he will fully vest in the ordinary course in all of his equity awards scheduled to vest in February 2022 in accordance with their terms; he will receive other ordinary course employee benefits and his full financial planning reimbursement for calendar 2022; and he will have the right to participate, at his expense, in the Company’s group health insurance plan, at his own expense, in accordance with the mandates of COBRA.

If Mr. Niles does not exercise his right to revoke his acceptance of the terms of the Retirement Agreement, in consideration of his undertakings in the Retirement Agreement, the Company will pay him the Retirement Payment (as defined below), subject to and conditioned upon: (i) his not giving rise to “Cause” (as defined in the Retirement Agreement) for termination through the Retirement Date, (ii) his not voluntarily terminating his employment with the Company prior to the Retirement Date; (iii) his continuing to perform all of his duties and responsibilities in a manner acceptable to the Company through the Retirement Date, (iv) his assisting in the successful transition of his duties to his successor, and (v) after the Retirement Date, but not later than seven days following the Retirement Date, his signing a post-retirement acceptance of the Retirement Agreement, and the expiration of the applicable revocation period with respect to such acceptance. The “Retirement Payment” will be a lump sum payment of $975,000, paid in exchange for the forfeiture of any and all of Mr. Niles’ unvested equity and equity-based awards as of the retirement date. All of Mr. Niles’ outstanding vested equity awards will continue to be governed by the terms of the equity incentive plans under which they were granted, and his vested stock options will expire according to the terms of the applicable stock option award agreements and such equity incentive plans. Mr. Niles’ undertakings in the Retirement Agreement include a customary release and waiver of claims and customary post-termination non-solicit, noncompete and other covenants.

The foregoing summary of the Retirement Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Retirement Agreement attached hereto as Exhibit 10.1 and incorporated herein by reference.

Item 7.01Regulation FD Disclosure.

On January 20, 2022, the Company issued a press release announcing the retirement of Mr. Niles. A copy of the press release is being furnished herewith as Exhibit 99.1

The information furnished pursuant to this Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing by the Company under the Securities Act of 1933 or the Exchange Act.

Item 9.01Financial Statements and Exhibits.

(d) Exhibits

10.1Retirement Agreement, dated as of January 19, 2022, by and between Associated Banc-Corp and Christopher J. Del Moral-Niles

99.1Press Release, dated as of January 20, 2022

104Cover Page Interactive Date File (embedded within the Inline XBRL Document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated: January 22, 2022

|

ASSOCIATED BANC-CORP

(Registrant)

|

|

|

By: /s/ Randall J. Erickson

Name:Randall J. Erickson

Title:Executive Vice President,

General Counsel

and Corporate Secretary

|

|

|

|

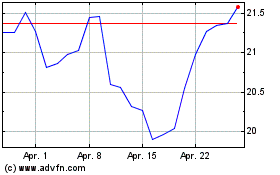

Associated Banc (NYSE:ASB)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Associated Banc (NYSE:ASB)

Historical Stock Chart

Von Apr 2023 bis Apr 2024