Current Report Filing (8-k)

11 Januar 2022 - 10:16PM

Edgar (US Regulatory)

0000040729false00000407292022-01-112022-01-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

January 11, 2022

Date of Report (Date of earliest event reported)

Commission file number: 1-3754

ALLY FINANCIAL INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

38-0572512

|

|

(State or other jurisdiction of

|

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

Identification No.)

|

Ally Detroit Center

500 Woodward Ave.

Floor 10, Detroit, Michigan

48226

(Address of principal executive offices)

(Zip Code)

(866) 710-4623

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

|

ALLY

|

|

NYSE

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

A copy of a press release announcing the share-repurchase authorization and dividend declarations described under Item 8.01 below is attached as Exhibit 99.1.

The information included within Exhibit 99.1 is being furnished and is not deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section.

Item 8.01 Other Events.

On January 10, 2022, the Ally Financial Inc. (Ally) board of directors authorized the repurchase of up to $2.0 billion of Ally’s common stock from time to time beginning in the first quarter of 2022 through the fourth quarter of 2022.

The repurchase program enables Ally to acquire shares through open market purchases or privately negotiated transactions, including through a Rule 10b5-1 plan, at the discretion of management and on terms (including quantity, timing, and price) that management determines to be advisable. Actions in connection with the repurchase program will be subject to various factors, including Ally’s capital and liquidity positions, accounting and regulatory considerations (including any restrictions that may be imposed by the Federal Reserve), impacts related to the Coronavirus disease 2019 pandemic, Ally’s financial and operational performance, alternative uses of capital, the trading price of Ally’s common stock, and general market conditions. The repurchase program does not obligate Ally to acquire a specific dollar amount or number of shares and may be extended, modified, or discontinued at any time.

The Ally board of directors declared a quarterly cash dividend of $0.30 per share of the company's common stock, payable on February 15, 2022 to stockholders of record on February 1, 2022. In addition, the Ally board of directors declared a quarterly cash dividend on Ally's 4.700% Fixed-Rate Reset Non-Cumulative Perpetual Preferred Stock, Series B, of approximately $15.9 million, or $11.75 per share, payable on February 15, 2022 to stockholders of record on January 31, 2022, and a quarterly cash dividend on Ally's 4.700% Fixed-Rate Reset Non-Cumulative Perpetual Preferred Stock, Series C, of approximately $11.8 million, or $11.75 per share, payable on February 15, 2022 to stockholders of record on January 31, 2022.

Item 9.01 Exhibits.

|

|

|

|

|

|

|

|

Exhibit No.

|

Description of Exhibits

|

|

|

|

|

99.1

|

|

|

104

|

The cover page from this Current Report on Form 8-K, formatted in Inline XBRL

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ally Financial Inc.

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dated:

|

January 11, 2022

|

|

/s/ David J. DeBrunner

|

|

|

|

|

|

David J. DeBrunner

|

|

|

|

|

|

Vice President, Controller, and Chief Accounting Officer

|

|

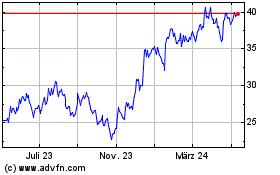

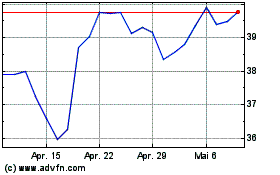

Ally Financial (NYSE:ALLY)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Ally Financial (NYSE:ALLY)

Historical Stock Chart

Von Apr 2023 bis Apr 2024