Current Report Filing (8-k)

22 November 2021 - 11:13PM

Edgar (US Regulatory)

0001766478false00017664782021-08-062021-08-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): November 19, 2021

Angel Oak Mortgage, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maryland

|

001-40495

|

37-1892154

|

|

(State or other jurisdiction of incorporation or organization)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

3344 Peachtree Road Northeast, Suite 1725, Atlanta, Georgia 30326

(Address of Principal Executive Offices and Zip Code)

Registrant’s telephone number, including area code: (404) 953-4900

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, $0.01 par value per share

|

AOMR

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☒

Item 1.01 Entry into a Material Definitive Agreement.

On November 19, 2021, Angel Oak Mortgage, Inc., a Maryland corporation (the “Company”) and one of its subsidiaries, entered into (1) Third Amended and Restated Guaranty Agreement (the “Guaranty Agreement”) and (2) Third Amendment (the “Third Amendment”) to Amended and Restated Master Repurchase Agreement (the “Master Repurchase Agreement” and together with the Guaranty Agreement, “Amended Agreements”) with Goldman Sachs Bank USA (“Goldman Sachs”). Pursuant to the Amended Agreements, the Company, its subsidiary and Goldman Sachs agreed: (1) to permit non-owner occupied Fannie Mae and Freddie Mac eligible mortgage loans to be eligible for transactions under the Master Repurchase Agreement; (2) to adjust the pricing rate whereby upon the Company’s or its subsidiary’s repurchase of a mortgage loan, the Company or its subsidiary is required to repay Goldman Sachs the adjusted principal amount related to such mortgage loan plus accrued and unpaid interest equal to the sum of (A) the greater of (i) 0.25% and (ii) three-month LIBOR and (B) a spread generally ranging from 2.00% to 2.50% depending on the type of loan; and (3) temporarily increases the aggregate purchase price thereunder to $350.0 million until the earlier to occur of (A) December 31, 2021 and (B) the settlement date of the Angel Oak Mortgage Trust 2021-7 Mortgage-Backed Certificates, Series 2021-7 securitization, at which point the aggregate purchase price will revert to $200.0 million. A copy of the Guaranty Agreement is attached hereto as Exhibit 10.1 and incorporated herein by reference. A copy of the Third Amendment to the Master Repurchase Agreement is attached hereto as Exhibit 10.2 and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit No. Description

Exhibit 104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: November 22, 2021

|

|

|

ANGEL OAK MORTGAGE, INC.

|

|

|

|

|

|

|

|

|

|

By: /s/ Brandon Filson

|

|

|

|

|

Name: Brandon Filson

|

|

|

|

|

Title: Chief Financial Officer and Treasurer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

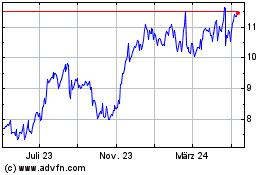

Angel Oak Mortgage REIT (NYSE:AOMR)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Angel Oak Mortgage REIT (NYSE:AOMR)

Historical Stock Chart

Von Apr 2023 bis Apr 2024