Current Report Filing (8-k)

05 Oktober 2021 - 2:59PM

Edgar (US Regulatory)

0001764046False00017640462021-10-042021-10-040001764046us-gaap:CommonStockMember2021-10-042021-10-040001764046us-gaap:SeriesAPreferredStockMember2021-10-042021-10-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (date of earliest event reported)

October 5, 2021 (October 4, 2021)

CLARIVATE PLC

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jersey, Channel Islands

|

001-38911

|

Not applicable

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Commission

File Number)

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

|

|

|

Friars House

160 Blackfriars Road

|

|

London

|

SE1 8EZ

|

|

United Kingdom

|

|

(Address of Principal Executive Offices)

|

(44) 207-433-4000

Registrant's telephone number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Ordinary shares, no par value

|

CLVT

|

New York Stock Exchange

|

|

5.25% Series A Mandatory Convertible Preferred Shares, no par value

|

CLVT PR A

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

Christie Archbold, the Chief Accounting Officer of Clarivate Plc (the “Company”) is taking a temporary leave of absence effective as of October 5, 2021.

In Ms. Archbold’s absence, Heather Matzke-Hamlin, 54, has been appointed to serve as the Company’s Chief Accounting Officer on an acting basis. Ms. Matzke-Hamlin serves on the board of directors of the Wilderness on Wheels Foundation as Treasurer and has been providing advisory and consulting services since February 2018. Prior to that, Ms. Matzke-Hamlin served as Senior Vice President, Finance of IHS Markit Ltd. (“IHS Markit”) from February 2017 until February 2018 and as Chief Accounting Officer of IHS Markit from the June 2016 merger between IHS Inc. (“IHS”) and Markit Ltd. until February 2017, and prior to that served as Senior Vice President and Chief Accounting Officer of IHS since February 2005. Earlier in her career, Ms. Matzke-Hamlin spent over nine years with PriceWaterhouseCoopers LLC (formerly PriceWaterhouse) in audit services.

In connection with her appointment as Acting Chief Accounting Officer of the Company, on October 4, 2021, the Company entered into an offer letter with Ms. Matzke-Hamlin (the “Offer Letter”). The Offer Letter provides that Ms. Matzke-Hamlin will receive an initial annual base salary of $385,000 and a target annual incentive bonus opportunity equal to 40% of her base salary under the Company’s annual incentive plan (pro-rated for 2021) and will be eligible to participate in the other benefit plans generally made available to the Company’s senior executives. In addition, the Offer Letter provides that, on or around November 15, 2021, Ms. Matzke-Hamlin will receive a one-time sign-on grant of service-based restricted share units (“RSUs”), with a grant date value equal to $231,000, which will vest, subject to Ms. Matzke-Hamlin’s service to Clarivate as either an employee or consultant, as follows: (i) 50% on March 1, 2022, (ii) 25% on March 1, 2023 and (iii) 25% on March 1, 2024.

The foregoing description is only a summary and is qualified in its entirety by reference to the full text of the Offer Letter, a copy of which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

|

|

|

|

|

|

|

|

|

|

No.

|

|

Description

|

|

10.1

|

|

|

|

104

|

|

Cover page of this Current Report on Form 8-K formatted in Inline XBRL.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

CLARIVATE PLC

|

|

|

|

|

|

Date: October 5, 2021

|

By:

|

/s/ Richard Hanks

|

|

|

Name:

|

Richard Hanks

|

|

|

Title:

|

Chief Financial Officer

|

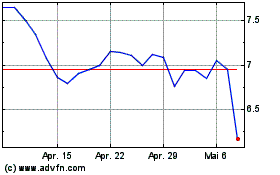

Clarivate (NYSE:CLVT)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

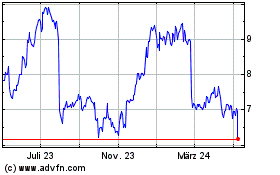

Clarivate (NYSE:CLVT)

Historical Stock Chart

Von Apr 2023 bis Apr 2024