Current Report Filing (8-k)

11 August 2021 - 10:37PM

Edgar (US Regulatory)

false

0001332551

0001332551

2021-08-09

2021-08-09

0001332551

us-gaap:CommonStockMember

2021-08-09

2021-08-09

0001332551

us-gaap:SeriesCPreferredStockMember

2021-08-09

2021-08-09

0001332551

us-gaap:SeriesDPreferredStockMember

2021-08-09

2021-08-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 9, 2021

ACRES Commercial Realty Corp.

(Exact name of registrant as specified in its charter)

|

Maryland

|

|

1-32733

|

|

20-2287134

|

|

(State or other jurisdiction of

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

incorporation)

|

|

|

|

|

|

|

|

|

|

|

|

865 Merrick Avenue, Suite 200 S

|

|

|

|

|

|

Westbury, NY

|

|

|

|

11590

|

|

(Address of principal executive offices)

|

|

|

|

(Zip Code)

|

|

|

|

|

|

|

|

Registrant’s telephone number, including area code: 516-535-0015

|

|

|

|

|

|

|

|

N/A

|

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 par value per share

|

|

ACR

|

|

New York Stock Exchange

|

|

8.625% Fixed-to-Floating Series C Cumulative Redeemable Preferred Stock

|

|

ACRPrC

|

|

New York Stock Exchange

|

|

7.875% Series D Cumulative Redeemable Preferred Stock

|

|

ACRPrD

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry Into a Material Definitive Agreement.

|

On August 9, 2021, ACRES Commercial Realty Corp. (the “Company”) and ACRES Capital, LLC (the “Manager”) entered into an underwriting agreement (the “Underwriting Agreement”) with Raymond James & Associates, Inc. (the “Underwriter”), pursuant to which the Company agreed to sell $150.0 million aggregate principal amount of its 5.75% senior unsecured notes due 2026 (the “Notes”). The Company intends to use the proceeds of this offering to redeem all $50 million aggregate principal amount of its outstanding 12.00% Senior Unsecured Notes due 2027, which the Company anticipates will result in a payment of approximately $55.3 million, inclusive of all payments of principal, interest and fees. Remaining net proceeds from the offering will be used to make loan originations consistent with the Company’s investment policies and for general corporate purposes. The offering is expected to close on or about August 16, 2021, subject to customary closing conditions

The Underwriting Agreement contains certain customary representations, warranties and agreements by the Company, the Manager and the Underwriter, conditions to closing, indemnification rights and obligations of the parties and termination provisions. The foregoing description of the Underwriting Agreement is qualified in its entirety by reference to the full text thereof, a copy of which is attached hereto as Exhibit 1.1 and is incorporated herein by reference.

|

Item 7.01

|

Regulation FD Disclosure.

|

On August 9, 2021, the Company issued a press release announcing the pricing of the Notes offering. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

|

Item 9.01

|

Financial Statements and Exhibits.

|

Cautionary Statement regarding Forward-Looking Statements

This Current Report on Form 8-K contains certain forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “trend,” “will,” “continue,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “look forward” or other similar words or terms. These “forward-looking” statements include, but are not limited to, statements regarding the intended use of proceeds and the closing of the notes offering. Because such statements include risks, uncertainties and contingencies, actual results may differ materially from the expectations, intentions, beliefs, plans or predictions of the future expressed or implied by such forward-looking statements. Investors should consider the Company's investment objectives, risks, and expenses carefully before investing. Factors that can affect future results are discussed in the documents filed by the Company from time to time with the SEC. The Company undertakes no obligation to update or revise any forward-looking statement to reflect new or changing information or events after the date hereof or to reflect the occurrence of unanticipated events, except as may be required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

ACRES COMMERCIAL REALTY CORP.

|

|

|

|

|

|

|

|

Date:

|

August 11, 2021

|

|

|

|

|

|

|

|

By:

|

/s/ David J. Bryant

|

|

|

|

|

|

David J. Bryant

|

|

|

|

|

|

Chief Financial Officer

|

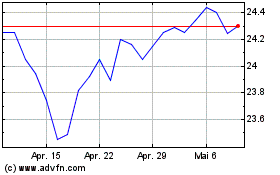

ACRES Commercial Realty (NYSE:ACR-C)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

ACRES Commercial Realty (NYSE:ACR-C)

Historical Stock Chart

Von Apr 2023 bis Apr 2024

Echtzeit-Nachrichten über ACRES Commercial Realty Corporation (New York Börse): 0 Nachrichtenartikel

Weitere Acres Commercial Realty Corp. News-Artikel