Cnova NV - 2020 Full Year Financial Results

2020 Full Year Financial

Results

Marketplace expansion driving sustained

growth and strong profitability increase

Strong increase in profitability with EBITDA up +63%

reaching €133m and x3.6 EBIT reaching €53m

Strong +22% growth in marketplace GMV in 2020,

accelerating in H2 with +30% orders and +27% items

sold

Marketplace revenues growing fast and accelerating:

€182m (+23%), +40% in Q4

Positive cash generation and net financial debt

reduction

AMSTERDAM – February 18, 2021, 07:45 CET Cnova

N.V. (Euronext Paris: CNV; ISIN: NL0010949392) (“Cnova”) today

announced its fourth quarter and full year activity and

unaudited financial results.

2020 Highlights

In 2020, facing exceptional circumstances marked

by increasingly digitalized sales and home delivery, Cnova further

strengthened its economic model, growing fast and improving its

margins, demonstrating the relevance of its positioning as the

French ecommerce leader. The marketplace was at the heart of the

profitable growth, growing fast at +22%, now representing 44% of

the product GMV (Gross Merchandise Volume), with the number of

merchants growing +15% to 13.000, and assortment +33% to 100

million products.

Marketplace expansion contributed to a solid

+8.6% performance of the GMV and increase in traffic, which reached

a record-high 26 million unique monthly visitors in December.

Cdiscount website served more than 10m clients over the year

(+12%), with +10% members joining the loyalty program Cdiscount à

Volonté.

Cnova operated at the same time a strategic

shift in the product mix, accelerating the sales of Home, Leisure

and Beauty (+18% GMV on a full year basis) with positive impact on

margins and client repurchase rates.

Digital marketing revenues were up +31%, driving

profitability. Cnova offers marketing services to both its 1,400

suppliers and 13,000 marketplace sellers, enabling them to promote

their products and their brands in order to accelerate their

sales.

- EBITDA soared by +62.5% to €133m and EBIT was

multiplied by 3.6x to reach €53m

- The marketplace revenues went up by +23.1% and reached

€182m

- The strategic product mix move towards Home, Leisure &

Beauty brought higher margin

- Digital marketing services to marketplace sellers and suppliers

grew by +31.3%

- A strong +22% marketplace expansion accelerating in the

2nd half of the year

- GMV share went up +5.3 pts to 43.6% on a full year basis and

accelerated +6.1pts to 44.5% in H2

- Marketplace KPIs accelerated in the 2nd half of the year with

+30.0% orders (+26.1% on a full year basis) and 27.1% items sold

(+23.8% on a full year basis)

- The marketplace sales fulfilled by Cdiscount grew by +26.4% on

a full year basis to reach 32.8% of marketplace GMV

- Positive cash generation

- Strong free cash flow generation before financial expenses of

+€73m

- It was supported by a strong +€51m EBITDA improvement, a +€64m

positive change in working capital and sustained net CAPEX of

€71m

- Net financial debt reduced by €21m

- A new B2B strategic move with the development in 2020

and the launch in 2021 of a turnkey marketplace solution for

retailers and e-merchants

- Comprehensive solution including products & merchants,

technology and fulfilment services

- Access to 100 million SKUs and 13k merchant base

Financial highlights

|

Financial performance (€

millions) |

|

2020 2nd Half |

20191 2nd Half |

Change vs 2H19 |

|

2020 Full year |

20191 Full year |

Change vs 2019 |

| |

|

| Total GMV2 |

|

2,261 |

2,146 |

+5.4% |

|

4,207 |

3,899 |

+7.9% |

| Organic GMV3 |

|

2,229 |

2,106 |

+5.8% |

|

4,139 |

3,811 |

+8.6% |

|

o/w Direct sales |

|

1,038 |

1,088 |

-4.7% |

|

1,949 |

1,999 |

-2.5% |

|

o/w Marketplace |

|

832 |

679 |

+22.6% |

|

1,505 |

1,237 |

+21.6% |

|

o/w Services4 |

|

99 |

97 |

+2.3% |

|

194 |

169 |

+15.1% |

|

o/w Other Revenues5 |

|

260 |

242 |

+7.5% |

|

491 |

406 |

+20.9% |

| Total Net sales |

|

1,176 |

1,199 |

-1.9% |

|

2,225 |

2,194 |

+1.4% |

|

Organic Net sales |

|

1,150 |

1,166 |

-1.4% |

|

2,168 |

2,121 |

+2.2% |

| EBITDA6 |

|

83.4 |

62.2 |

+34.1% |

|

133.3 |

82.0 |

+62.5% |

| % of net sales |

|

7.1% |

5.2% |

+1.9pt |

|

6.0% |

3.7% |

+2.3pt |

| Operating EBIT |

|

42.2 |

26.6 |

+58.6% |

|

53.1 |

14.7 |

x3.6 |

| % of

net sales |

|

3.6% |

2.2% |

+1.4pt |

|

2.4% |

0.7% |

+1.7pt |

| Net Financial Result |

|

(28.8) |

(32.6) |

-11.7% |

|

(54.0) |

(56.6) |

-4.6% |

|

Net Profit |

|

2.3 |

(22.8) |

nm |

|

(21.4) |

(65.3) |

nm |

| |

|

|

|

|

|

|

|

|

| Free cash flow key

figures(€ millions) |

|

2020

2nd Half |

20191

2nd Half |

Change

vs 2H19 |

|

2020

Full year |

20191

Full year |

Change vs 2019 |

| |

|

| EBITDA6 |

|

83.4 |

62.2 |

+34.1% |

|

133.3 |

82.0 |

+62.5% |

| (-) non-recurring items |

|

(1.8) |

(5.6) |

-67.9% |

|

(12.5) |

(9.2) |

+35.9% |

| (-) rents7 |

|

(16.1) |

(13.1) |

+23.3% |

|

(32.0) |

(27.0) |

+18.3% |

| Cash from continuing

operations, incl. rents |

|

65.5 |

43.5 |

+50.4% |

|

88.8 |

45.8 |

+93.9% |

| Net CAPEX |

|

(33.7) |

(39.7) |

-15.1% |

|

(70.9) |

(73.7) |

-3.8% |

| Change in working capital8 |

|

167.8 |

161.7 |

+3.7% |

|

63.9 |

70.9 |

-9.8% |

| Income taxes |

|

(8.0) |

(1.6) |

nm |

|

(9.3) |

(3.3) |

nm |

|

FCF continuing operations before Net Financial

Result |

|

192.0 |

164.0 |

16.8% |

|

72.6 |

39.6 |

+83.1% |

|

|

|

|

|

|

|

|

|

|

| (Net

Financial Debt)/Net Cash9 |

|

(201.0) |

(221.5) |

+20.5 |

|

(201.0) |

(221.5) |

+20.5 |

|

Change in Net Financial Debt |

|

+172.2 |

+134.1 |

+38.1 |

|

+20.5 |

(23.1) |

+43.6 |

Emmanuel Grenier, Cnova CEO,

commented:

“In 2020, a year marked with exceptional

challenges, we managed to serve our 10 million clients with an

unlimited offer to cover all their needs, reaching record-high

customer satisfaction and strengthening our position as the French

ecommerce leader. We were also committed to using our platform to

help those in need: SMEs to maintain their activity through our

marketplace and distribution of millions of masks. 2020 also

confirmed the relevance of our strategic evolution towards a

platform model driven by our marketplace, rewarded with a solid and

profitable growth. We will push our model evolution further in 2021

with a new development phase. We recently launched a comprehensive,

turnkey marketplace solution for international retailers and

e-merchants targeting a very deep and increasing EMEA market. With

more than 100 million products, a 13,000 merchant base, a complete

fulfilment service and best-in-class technology, this is a unique

offer that will be a strategic pillar for our international growth

and profitability in the years to come.”

Operational highlights

| Business KPIs |

|

2020

2nd Half |

201910 2nd Half |

Change vs 2H19 |

|

2020

Full year |

201910 Full year |

Change vs 2019 |

| Marketplace GMV

share11 |

|

44.5% |

38.4% |

+6.1pt |

|

43.6% |

38.2% |

+5.3pt |

| Marketplace

revenues12 |

|

107.0 |

84.1 |

+27.2% |

|

181.8 |

147.7 |

+23.1% |

| Traffic (million

visits) |

|

607 |

531 |

+14.3% |

|

1,169 |

1,021 |

+14.5% |

| Number of Orders

(millions) |

|

14.1 |

16.6 |

+16.5% |

|

30.4 |

26.6 |

+14.1% |

|

o/w Marketplace13 |

|

11.1 |

8.5 |

+30.0% |

|

20.3 |

16.1 |

+26.1% |

| Items sold

(millions) |

|

29.2 |

26.4 |

+10.3% |

|

53.9 |

49.7 |

+8.5% |

|

o/w Marketplace |

|

16.8 |

13.2 |

+27.1% |

|

31.0 |

25.0 |

+23.8% |

Organic GMV posted a strong

+10.2% increase in the 4th quarter 2020 and a solid +8.6% in

2020

|

GMV |

4Q20 |

FY20 |

|

Total Organic Growth |

+10.2% |

+8.6% |

|

Marketplace Growth |

+34% |

+22% |

|

International Growth |

+90% |

> 2x |

|

Energy Growth |

+48% |

+65% |

GMV growth was:

- driven by the marketplace, which contributed +10.6 points in

the 4th quarter 2020 and +7.0 points for the full year.

International GMV doubled while B2C services (excluding Travel)

also experienced a strong growth

- boosted by a strategic evolution initiated in the 2nd quarter

towards Home, Leisure and Beauty, bringing more repurchase, loyalty

and profitability thanks to higher margins

- negatively impacted by a decreasing Travel market following

COVID-19 restrictions, both in France and abroad. Travel activity

impacted growth by -1 point

Black Friday, promoting soft and fair trade,

broke its previous year record for the 4th consecutive year.

Clients growth was very dynamic

in the 4th quarter with a +21% increase of total clients, boosted

by 1.2 million new client recruitments (+31% compared to last

year). On a full year basis, Cnova client base reached 10.3

million, an increase of +12%.

Cdiscount à Volonté (“CDAV”), Cdiscount’s

loyalty program, now encompasses 2.3 million members (+10%)

benefiting from 1.5 million SKUs available for express delivery,

+23% compared to last year.

|

Clients |

4Q20 |

FY20 |

|

Total clients |

+21% |

+12% |

|

CDAV subscriber base growth14 |

+10% |

Regarding traffic, Cnova reached a

record-high 26.2m unique monthly visitors in December 2020 and

remained #2 in France on average over the year, with a 11% growth

overall and a +12% growth on mobile. Traffic registered a total of

1.2 billion visits in 2020.

|

Traffic |

4Q20 |

FY20 |

|

Unique monthly visitors15 |

+9% |

+11% |

The marketplace was the driving

force of GMV with a +34% growth in the 4th quarter 2020 and +22% on

a full year basis.

It led to an increased marketplace GMV

share, reaching 45.0% in the 4th quarter 2020 (+7.5

points) and 43.6% on a full year basis (+5.3 pts). It benefited

from a growing GMV fulfilled by Cdiscount (+24% in the 4th quarter,

+26% on a full year basis) that represented 33% of the marketplace

GMV over the year.

|

Marketplace |

4Q20 |

FY20 |

|

Marketplace total GMV share16 |

45.0% |

43.6% |

|

Marketplace GMV share evolution |

+7.5 pts |

+5.3 pts |

|

Fulfilment marketplace GMV share17 |

+2.2 pts |

+1.6 pt |

|

Marketplace revenues18

growth |

+40% |

+23% |

Full Year financial performance

| Cnova

N.V.(€ millions) |

Full Year |

Change |

|

2020 |

2019* |

Reported |

Organic |

| GMV |

4,207.4 |

3,899.2 |

+7.9% |

+8.6% |

| Net sales |

2,224.8 |

2,194.2 |

+1.4% |

+2.2% |

| Gross

margin |

474.0 |

389.1 |

+21.8% |

|

| As a % of net sales |

21.3% |

17.7% |

+3.6

pts |

|

| SG&A |

(420.9) |

(374.4) |

+

12.4% |

|

| As a % of net sales |

18.9% |

17.1% |

+1.9

pt |

|

| Operating EBIT |

53.1 |

14.7 |

+38.4 |

|

| EBITDA |

133.3 |

82.0 |

+51.3 |

|

| As a % of net sales |

6.0% |

3.7% |

+2.3

pts |

|

| Net financial income / (expense) |

(54.0) |

(56.6) |

+2.6 |

|

|

Net profit / (loss) from cont. operations |

(15.7) |

(61.6) |

+45.9 |

|

*re-presented to take into account Haltae

(Stootie operations legal entity) financials reclassified in

discontinued activities

Net sales amounted to €2,225m

in 2020, a +2.2% organic growth compared to 2019. Net sales

recorded the impact of the acceleration of the profitable shift of

product sales towards marketplace sales, which are only recognized

for the amount of the associated commissions.

Gross margin was €474m in 2020

and accounted for 21.3% of net sales, a significant +3.6 points

improvement compared to 2019. It benefited from a strong

marketplace GMV share increase, the product mix evolution towards

more recurring and high margins products, as well as the

development of B2C and B2B monetization revenues, in particular

digital marketing19.

SG&A costs amounted to

€(421)m and accounted for 18.9% of net sales, increasing by +1.9

points. Fulfillment costs, at 8.1% of net sales (+0.6 pt),

increased due to the Cdiscount Fulfilment acceleration and the cost

related to reducing delivery times through express delivery.

Marketing costs represented 3.9% of net sales (+0.2 pt) with

optimized SEO performance that led to increased free traffic,

partly offsetting increasing media expenses to boost brand

awareness. Technology & Content costs progressed at 4.9% of net

sales (+0.8 pt) driven by B2C and B2B monetization activities

investments. General & Administrative expenses slightly

increased at 2.1% of net sales.

As a result, EBITDA experienced

a significant +€51m improvement in 2020 to reach €133m, a +63%

growth, representing 6.0% of net sales (+2.3 pts). Before IFRS16

restatements, 2020 EBITDA amounted to €101m, nearly x2 compared the

year before. EBITDA benefited from a fast marketplace growth, an

improvement of the core business profitability and increased

monetization revenues.

Operating EBIT increased by

€38m compared to 2019, with depreciation and amortization

increasing by €12.9m due to B2C and B2B monetization activities

investments.

Net financial expenses, mainly

related to installment payment solutions offered to customers

amounted to €54m, decreasing by 5% despite GMV growth thanks to

risk management improvement.

Net loss from continuing

operations significantly improved by +€46m y-o-y to reach

€(16)m with an adjusted EPS of €(0.02).

Free cash flow before financial expenses

amounted to €73m in the last twelve months. This significant

increase is relying on strong fundamentals:

- Operating profitability increased at a fast pace with a

significant positive EBITDA at €133m, up by +€51m

- Positive change in working capital of +€64m driven by inventory

rationalization and a positive impact from the growing

marketplace

Other cash operating expenses and taxes totaled

€(22)m, including €(4)m of Covid-19 impacts.

Repayment & interests on lease liabilities

(IFRS16 impact) amounted to €(32)m.

Capital expenditures were up to

€(71)m to support the implementation costs related to the strategic

shift towards the platform model and monetization initiatives.

Key Business Achievements

Enhanced customer experience and

record-high NPS

- Delivery times improved this year by 0.3 days

thanks to the increase in express delivery, the Cdiscount

Fulfilment and Cdiscount Express seller assortment enlargement as

well as improved marketplace quality control.

- Cnova also carried on its “say yes to the customer” policy,

with now 80% positive and immediate answers to

Cdiscount A Volonté customers claims and proactive preventive

actions for every abnormal event happening during the customer

journey. The goal is to reach 100% in 2021.

- It led to a significant +3 pts NPS improvement

over the year, in line with Cnova’s constant efforts over the past

years (+8 pts over 3 years).

Marketplace of products growing

double-digit, driving up revenues and profitability

- Marketplace activity accelerated during the 4th quarter,

gaining +7.5 points of GMV share to reach

45.0%, thanks to a strong +34%

GMV growth. On a full year basis, it

improved by +5.3 points, to

43.6%.

- In addition to volume growth, revenue generation grew even

faster: +40% in the 4th quarter and

+23% on a full year basis, reaching

€182m.

- Expansion of express delivery eligible marketplace

SKUs is a key driver of growth, customer satisfaction and

CDAV development and is determinant to support the product mix

re-orientation towards recurring products. CDAV eligible SKUs

reached 1.5m20, a +23% growth

thanks to Cdiscount Fulfilment and Cdiscount Express Seller

assortment enlargement.

Product mix evolution towards recurring

products building strong loyalty as well as increased

profitability

- Cnova initiated in the 2nd quarter a strategic product mix

evolution towards Home, Leisure and Beauty. These categories bring

three major advantages in the product mix: higher recurring

purchase rates, marketplace share and margins. As a consequence,

the product mix evolution aims at generating more loyalty and

repurchase on the one hand, and more profitability on the other

hand. These categories (Home, Leisure & Beauty) experienced a

strong +29% growth in the 4th quarter

(+18% on an annual basis).

- To support this product mix evolution, Cnova extended free home

delivery from March 2020, now available from €25 basket for

non-CDAV customers and €10 for CDAV customers

Dynamic digital marketing powered

by Cdiscount Ads Retail Solution

- Digital marketing revenues increased by

+42% in the 4th quarter compared to last year, and

+31% on a full year basis, reinforcing our more

profitable business model.

- It was supported by Cnova’s proprietary solution launched in

the 2nd quarter, Cdiscount Ads Retail Solution

(CARS), a 100% self-care advertising platform enabling

both sellers and suppliers to promote their products and brands.

Cnova also kept building complementary digital marketing features

to reinforce its offer, such as the launch of Google Shopping

campaign management for suppliers and marketplace sellers.

B2C services showed solid performance

despite Covid-19 negative impact on travel

- B2C services GMV amounted to

€194m, up +15% on a full year

basis

- Cdiscount Energie experienced a solid

+48% GMV growth this quarter and

+65% in on a full year basis, supported by a very

dynamic recruitment which reached a record-high number in December

(+82% yoy),

- Cdiscount Mobile achieved in December its best

month in terms of client recruitment and ended the year with a

+62% increase of customer

base.

Fast-expanding international

sales

- International GMV doubled in 2020 compared to

the previous year and brought +1.0 point of Cnova total

growth.

- The international platform encompassed 206 directly

connected websites as of end December,

+47 vs 3Q20, x4 compared to last

year, enabling delivery in 27 countries.

Launch of a turnkey marketplace solution

for EMEA retailers and e-merchants

- Developed over 2020 and launched in early 2021, Cdiscount’s

turnkey marketplace solution aims at offering 3

modular and ready-to-operate marketplace service to international

retailers and e-merchants:

- Products and merchants: access to our 100m

product catalogue and 13,000 merchant base

- Technology: front-to-back marketplace

platform

- Fulfilment: multi-marketplace fulfilment

solution, including cross-border shipping and warehouse management

solution

-

Cnova is the only player on the market to fully handle these 3

assets, at a large scale, thus offering a unique value proposition

to address a huge EMEA e-commerce market

-

First major EMEA client signed beginning of 2021

Outlook

Next year, Cnova plans to accelerate its

investments in order to further grow at a good pace while

continuing its strategic evolution towards a platform model,

improving its profitability and cash generation, with 4 clear

strategic priorities:

-

Growing the marketplace by further developing the Cdiscount

Fulfilment and Cdiscount Express Seller assortments driving

accelerated delivery time and customer satisfaction, translating

into more marketplace revenues through commissions but also

services to sellers

-

Pursuing the product mix evolution towards Home, Leisure and Beauty

to further improve repeat purchase rates, loyalty and

profitability

-

Accelerating digital marketing revenues by recruiting more

suppliers and marketplace sellers and offering them more

features

-

Rolling-out Cdiscount’s unique marketplace turnkey solution

targeting EMEA market

About Cnova N.V.

Cnova N.V., the French ecommerce leader, serves

10.3 million active customers via its state-of-the-art website,

Cdiscount. Cnova N.V.’s product offering provides its clients with

a wide variety of very competitively priced goods, fast and

customer-convenient delivery options, practical and innovative

payment solutions as well as travel, entertainment and domestic

energy services. Cnova N.V. is part of Groupe Casino, a global

diversified retailer. Cnova N.V.'s news releases are available at

www.cnova.com. Information available on, or accessible through, the

sites referenced above is not part of this press release.

This press release contains regulated

information (gereglementeerde informatie) within the meaning of the

Dutch Financial Supervision Act (Wet op het financieel toezicht)

which must be made publicly available pursuant to Dutch and French

law. This press release is intended for information purposes

only.

***

|

Cnova Investor Relations

Contact:investor@cnovagroup.com |

Media

contact:directiondelacommunication@cdiscount.comTel: +33 6

18 33 17 86 |

Appendices

Cnova N.V. Consolidated Financial

Statements(1)

| Consolidated Income

Statement |

|

2020 |

2019* |

Change |

|

Excl. IFRS 16 impact(2) |

| € millions |

|

|

2020 |

2019* |

|

Net sales |

|

2,224.8 |

2,194.2 |

+1.4% |

|

2,224.8 |

2,194.2 |

|

| Cost of sales |

|

(1,750.8) |

(1,805.1) |

-3.0% |

|

(1,750.8) |

(1,805.1) |

|

| Gross margin |

|

474.0 |

389.1 |

+21.8% |

|

474.0 |

389.1 |

|

|

% of net sales |

|

21.3% |

17.7% |

+3.6 pts |

|

21.3% |

17.7% |

|

| SG&A(3) |

|

(420.9) |

(374.4) |

+12.4% |

|

(425.0) |

(377.1) |

|

% of net sales |

|

-18.9% |

-17.1% |

+1.9

pt |

|

-19.1% |

-17.2% |

| Fulfillment |

|

(179.2) |

(163.4) |

+9.7% |

|

(182.9) |

(165.6) |

| Marketing |

|

(87.0) |

(81.5) |

+6.8% |

|

(87.0) |

(81.5) |

|

| Technology and content |

|

(108.6) |

(90.3) |

+20.3% |

|

(108.8) |

(90.5) |

|

General and administrative |

|

(46.0) |

(39.2) |

+17.3% |

|

(46.2) |

(39.5) |

|

Operating EBIT(4) |

|

53.1 |

14.7 |

+38.4 |

|

49.0 |

12.0 |

|

% of net sales |

|

2.4% |

0.7% |

+1.7 pt |

|

2.2% |

0.5% |

| Other

expenses |

|

(12.3) |

(16.5) |

-25.5% |

|

(12.4) |

(16.5) |

|

Operating profit/(loss) |

|

40.8 |

(1.9) |

+42.7 |

|

36.6 |

(4.5) |

| Net

financial income/(expense) |

|

(54.0) |

(56.6) |

-4.6% |

|

(46.0) |

(49.6) |

|

Profit/(loss) before tax |

|

(13.2) |

(58.5) |

+45.2 |

|

(9.4) |

(54.1) |

| Income tax gain/(expense) |

|

(2.5) |

(3.1) |

+0.6 |

|

(3.3) |

(6.4) |

|

Net profit/(loss) from continuing operations |

|

(15.7) |

(61.6) |

+45.9 |

|

(12.7) |

(60.6) |

|

Net profit/(loss) from discontinued operations(5) |

|

(5.7) |

(3.6) |

-2.1 |

|

(5.7) |

(3.7) |

|

| Net profit/(loss) for the

period |

|

(21.4) |

(65.3) |

+43.9 |

|

(18.5) |

(64.3) |

|

% of net sales |

|

-1.0% |

-3.0% |

|

|

-0.8% |

-2.9% |

| Attributable to Cnova equity holders

(incl. discontinued) |

|

(23.4) |

(67.2) |

+43.8 |

|

(20.9) |

(65.3) |

|

Attributable to non-controlling interests (incl. discontinued) |

|

2.0 |

0.8 |

+1.2 |

|

2.4 |

1.0 |

|

Adjusted EPS (€)(5) |

|

(0.02) |

(0.14) |

+0.12 |

|

(0.01) |

(0.14) |

*re-presented to take into account Haltae

(Stootie operations legal entity) financials reclassified in

discontinued

activities

- Unaudited financial statements

- IFRS 16, which replaces IAS 17 and the related interpretations

from January 1st, 2019, eliminates the distinction between

operating leases and finance leases: it requires recognition of an

asset (the right to use the leased item) and a financial liability

representative of discounted future rentals for virtually all lease

contracts. Operating lease expense is replaced with depreciation

expense related to the right of use and interest expense related to

the lease liability. Figures before IFRS 16 impact, considering

operating lease expense on a straight-line basis, are presented for

comparison purpose only with historical financial statements.

- SG&A: selling, general and administrative expenses.

- Operating EBIT: operating profit/(loss) before other expenses

(strategic and restructuring expenses, litigation expenses and

impairment and disposal of assets expenses).

- In accordance with IFRS5 (Non-current Assets Held for Sale and

Discontinued Operations), HALTAE (formerly Stootie)’s post-tax net

profit for the year ended 31 December 2020 and 2019 are reported

under “Net profit/(loss) from discontinued operations”

- Adjusted EPS: net profit/(loss) attributable to equity holders

of Cnova before other expenses and the related tax impacts, divided

by the weighted average number of outstanding ordinary shares of

Cnova during the applicable period.

| Consolidated Balance

Sheet |

|

2020 |

2019* |

|

Excl. IFRS 16 impact |

| At December 31 (€ millions) |

|

2020 |

2019* |

| |

|

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Cash and cash equivalents |

|

15.8 |

78.3 |

|

15.8 |

78.3 |

| Trade receivables, net |

|

167.2 |

163.8 |

|

167.2 |

163.8 |

| Inventories, net |

|

283.7 |

328.6 |

|

283.7 |

328.6 |

| Current income tax assets |

|

4.0 |

4.1 |

|

4.0 |

4.1 |

| Other current assets, net |

|

313.8 |

150.5 |

|

313.8 |

150.5 |

|

Total current assets |

|

784.6 |

725.3 |

|

784.6 |

725.3 |

| |

|

|

|

|

|

|

| Other non-current assets, net |

|

11.4 |

14.6 |

|

11.4 |

14.6 |

| Deferred tax assets |

|

45.1 |

41.7 |

|

40.8 |

38.3 |

| Right of use, net |

|

149.2 |

174.3 |

|

|

|

| Property and equipment, net |

|

28.5 |

32.8 |

|

28.5 |

32.8 |

| Intangible assets, net |

|

206.6 |

179.4 |

|

206.6 |

179.4 |

|

Goodwill |

|

122.3 |

123.0 |

|

123.6 |

124.2 |

|

Total non-current assets |

|

562.9 |

565.7 |

|

410.9 |

389.3 |

|

|

|

|

|

|

|

|

|

TOTAL ASSETS |

|

1,348.0 |

1,291.0 |

|

1,195.7 |

1,114.6 |

| |

|

|

|

|

|

|

| EQUITY AND

LIABILITIES |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Current provisions |

|

3.4 |

9.3 |

|

3.4 |

9.3 |

| Trade payables |

|

658.3 |

665.7 |

|

658.3 |

665.7 |

| Current financial debt |

|

20.1 |

308.1 |

|

20.1 |

308.1 |

| Current lease liabilities |

|

30.5 |

31.3 |

|

|

|

| Current tax liabilities |

|

83.9 |

55.0 |

|

83.9 |

55.0 |

| Other current liabilities |

|

248.4 |

216.5 |

|

249.6 |

217.1 |

|

Total current liabilities |

|

1,044.5 |

1,285.8 |

|

1,015.3 |

1,255.2 |

| |

|

|

|

|

|

|

| Non-current provisions |

|

14.9 |

16.0 |

|

14.9 |

16.0 |

| Non-current financial debt |

|

340.6 |

2.4 |

|

340.6 |

2.4 |

| Non-current lease liabilities |

|

145.2 |

165.6 |

|

|

|

| Other non-current liabilities |

|

3.7 |

2.5 |

|

14.2 |

12.3 |

| Deferred tax liabilities |

|

1.5 |

1.8 |

|

1.5 |

1.8 |

|

Total non-current liabilities |

|

505.9 |

188.3 |

|

371.2 |

32.5 |

| |

|

|

|

|

|

|

| Share capital |

|

17.2 |

17.2 |

|

17.2 |

17.2 |

| Reserves, retained earnings and

additional paid-in capital |

|

(289.9) |

(268.0) |

|

(278.8) |

(259.3) |

| Equity attributable to equity

holders of Cnova |

|

(272.7) |

(250.8) |

|

(261.5) |

(242.1) |

|

Non-controlling interests |

|

69.7 |

67.7 |

|

71.6 |

69.1 |

|

Total equity |

|

(203.0) |

(183.1) |

|

(190.0) |

(173.0) |

|

|

|

|

|

|

|

|

|

TOTAL EQUITY AND LIABILITIES |

|

1,348.0 |

1,291.0 |

|

1,195.7 |

1,114.6 |

*re-presented to take into account Haltae

(Stootie operations legal entity) financials reclassified in

discontinued activities

| Consolidated Cash Flow

Statement |

|

2020 |

2019* |

| (€ millions) |

|

| Net profit/(loss) from continuing

operations |

|

(17.7) |

(62.5) |

| Net profit/(loss), attributable to

non-controlling interests |

|

2.0 |

0.9 |

|

Net profit (loss) for the period excl. discontinued

operations |

|

(15.7) |

(61.6) |

| Depreciation and amortization

expense |

|

80.3 |

67.8 |

| (Income) expenses on share-based

payment plans |

|

0.0 |

0.0 |

| (Gains) losses on disposal of

non-current assets and impairment of assets |

|

3.9 |

6.8 |

| Other non-cash items |

|

(0.1) |

(0.0) |

| Financial expense, net |

|

54.0 |

56.6 |

| Current and deferred tax (gains)

expenses |

|

2.4 |

3.1 |

| Income tax paid |

|

(9.3) |

(3.3) |

| Change in operating working

capital |

|

59.7 |

71.0 |

|

Inventories of products |

|

44.8 |

27.5 |

|

Accounts payable |

|

0.4 |

(5.1) |

|

Accounts receivable |

|

10.6 |

12.4 |

|

Working capital non-goods |

|

3.8 |

36.1 |

| Net cash from/(used in)

continuing operating activities |

|

175.4 |

140.2 |

|

Net cash from/(used in) discontinued operating

activities |

|

(5.2) |

(5.0) |

| Purchase of property, equipment &

intangible assets |

|

(80.3) |

(82.0) |

| Purchase of non-current financial

assets |

|

(0.0) |

(3.7) |

| Proceeds from disposal of prop.,

equip., intangible assets |

|

9.5 |

8.3 |

| Movement of perimeter, net of cash

acquired |

|

- |

(0.9) |

| Investments in associates |

|

- |

- |

|

Changes in loans granted (including to related parties ) |

|

(134.9) |

(8.2) |

| Net cash from/(used in)

continuing investing activities |

|

(205.8) |

(86.4) |

|

Net cash from/(used in) discontinued investing

activities |

|

(0.6) |

(0.8) |

| Transaction with owners of

non-controlling interests |

|

- |

(2.4) |

| Changes in loans received |

|

- |

45.0 |

| Additions to financial debt |

|

120.0 |

1.9 |

| Repayments of financial debt |

|

(40.3) |

(3.1) |

| Repayments of lease liability |

|

(24.0) |

(20.0) |

| Interest paid on lease liability |

|

(8.0) |

(7.0) |

|

Interest paid, net |

|

(43.1) |

(49.2) |

| Net cash from/(used in)

continuing financing activities |

|

(4.7) |

(34.8) |

|

Net cash from/(used in) discontinued financing

activities |

|

0.0 |

0.0 |

| Effect

of changes in foreign currency translation adjustments from

discontinued operations |

|

(0.0) |

- |

| Change in cash and cash

equivalents from continuing operations |

|

(25.7) |

19.2 |

|

Change in cash and cash equivalents from discontinued

operations |

|

(5.9) |

(5.9) |

|

Cash and cash equivalents, net, at period

begin |

|

40.6 |

27.3 |

|

|

|

|

|

|

Cash and cash equivalents, net, at period end |

|

9.0 |

40.6 |

*re-presented to take into account Haltae

(Stootie operations legal entity) financials reclassified in

discontinued activities

è Excluding IFRS 16 impact

| Consolidated Cash Flow

Statement |

|

Excluding IFRS 16 impact |

| (€ millions) |

|

2020 |

2019* |

| Net profit/(loss) from continuing

operations |

|

(15.2) |

(61.6) |

| Net profit/(loss), attributable to

non-controlling interests |

|

2.4 |

1.0 |

|

Net profit (loss) for the period excl. discontinued

operations |

|

(12.7) |

(60.6) |

| Depreciation and amortization

expense |

|

52.5 |

42.0 |

| (Income) expenses on share-based

payment plans |

|

0.0 |

0.0 |

| (Gains) losses on disposal of

non-current assets and impairment of assets |

|

3.9 |

6.8 |

| Other non-cash items |

|

(0.1) |

(0.0) |

| Financial expense, net |

|

46.0 |

49.6 |

| Current and deferred tax (gains)

expenses |

|

3.3 |

6.4 |

| Income tax paid |

|

(9.3) |

(3.3) |

| Change in operating working

capital |

|

59.7 |

72.4 |

|

Inventories of products |

|

44.8 |

27.5 |

|

Accounts payable |

|

0.4 |

(5.1) |

|

Accounts receivable |

|

10.6 |

12.4 |

|

Working capital non-goods |

|

3.8 |

37.6 |

| Net cash from/(used in)

continuing operating activities |

|

143.4 |

113.3 |

|

Net cash from/(used in) discontinued operating

activities |

|

(5.2) |

(5.1) |

| Purchase of property, equipment &

intangible assets |

|

(80.3) |

(82.0) |

| Purchase of non-current financial

assets |

|

(0.0) |

(3.7) |

| Proceeds from disposal of prop.,

equip., intangible assets |

|

9.5 |

8.3 |

| Movement of perimeter, net of cash

acquired |

|

- |

(0.9) |

| Investments in associates |

|

- |

- |

|

Changes in loans granted (including to related parties ) |

|

(134.9) |

(8.2) |

| Net cash from/(used in)

continuing investing activities |

|

(205.8) |

(86.4) |

|

Net cash from/(used in) discontinued investing

activities |

|

(0.6) |

(0.8) |

| Transaction with owners of

non-controlling interests |

|

- |

(2.4) |

| Changes in loans received |

|

- |

45.0 |

| Additions to financial debt |

|

120.0 |

1.9 |

| Repayments of financial debt |

|

(40.3) |

(3.1) |

| Repayments of lease liability |

|

- |

- |

| Interest paid on lease liability |

|

- |

- |

|

Interest paid, net |

|

(43.1) |

(49.2) |

| Net cash from/(used in)

continuing financing activities |

|

36.6 |

(7.7) |

|

Net cash from/(used in) discontinued financing

activities |

|

0.0 |

0.0 |

| Effect

of changes in foreign currency translation adjustments from

discontinued operations |

|

(0.0) |

- |

| Change in cash and cash

equivalents from continuing operations |

|

(25.7) |

19.2 |

|

Change in cash and cash equivalents from discontinued

operations |

|

(5.9) |

(5.9) |

|

Cash and cash equivalents, net, at period

begin |

|

40.6 |

27.3 |

|

|

|

|

|

|

Cash and cash equivalents, net, at period end |

|

9.0 |

40.6 |

*re-presented to take into account Haltae

(Stootie operations legal entity) financials reclassified in

discontinued activities

|

Upcoming Event |

|

|

|

Thursday, February 18, 2021 at 16:00 CET / 10:00 EDT |

Cnova Full Year 2020 Financial ResultsConference Call &

Webcast |

|

Conference Call and Webcast connection

details |

|

|

|

Conference Call Dial-In Numbers: |

|

France |

+33170710159 PIN: 68611031# |

|

UK |

+442071943759 PIN: 68611031# |

|

USA |

+1 6467224916 PIN: 68611031# |

|

|

|

|

Webcast: |

|

https://onlinexperiences.com/Launch/QReg/ShowUUID=A2B8A253-8320-4A8C-BBBE-7C3EC1DF7A34 |

|

|

|

|

An archive of the conference call will be available for 3 months at

cnova.com. |

|

|

1 Re-presented to take into account Haltae

(Stootie operations legal entity) financials reclassified in

discontinued activities

2 Gross merchandise volume (GMV) is defined as

product sales + other revenues + marketplace business volumes +

services GMV + taxes and is calculated based on approved and sent

orders

3 Organic growth: figures include showroom sales

and services but exclude technical goods and home category sales

made in Casino Group’s hypermarkets and supermarkets, as well as

hygienic masks sold to Groupe Casino (total exclusion impact of

respectively +0.1 pt and +0.7 pt GMV growth in 4Q20 and 2020).

4 Including travel, energy, ticketing,

beauty

5 Including pro, international, 1001pneus, CB4X

revenues, vouchers, fulfilment revenues & marketing digital

6 Operating profit/(loss) from ordinary

activities (EBIT) adjusted for operating depreciation &

amortization

7 Including rental expense, i.e. repayments of

lease liabilities and interest paid on lease liabilities

8 Including other non-cash items & items

bridging income statement non-recurring items to cash non-recurring

items

9 Net financial debt excluding Neosys Put for

€2.4m at end 2019 and €0.7m at end June and end December 2020

10 Re-presented to take into account Haltae

(Stootie operations legal entity) financials reclassified in

discontinued activities

11 Calculated as marketplace GMV (see

p. 2) divided by total product GMV (marketplace GMV + Direct

sales GMV – see p.2)

12 Includes marketplace commissions after price

discounts, marketplace subscription fee, as well as revenues from

services to sellers (marketing services, financial services, …)

13 Mixed baskets including both marketplace and

direct sales products were also considered as marketplace

baskets

14 Subscriber base on 31/12/2020

15 According to latest Médiamétrie studies (December 2020)

16 Calculated as Marketplace GMV (see p. 2) divided by total

product GMV (Marketplace GMV + Direct sales GMV – see p.2)

17 Calculated as Marketplace GMV generated through merchants

benefiting from Cdiscount’s fulfilment services divided by total

Marketplace GMV

18 Includes marketplace commissions after price discounts,

marketplace subscription fee, as well as revenues from services to

sellers (marketing services, financial services, …)

19 Includes both revenues from marketing services to suppliers

and marketing services to marketplace sellers (the latter being

also included in total marketplace revenues)

20 At end December 2020

- 2021 02 18 Cnova NV PR 2020 Earnings

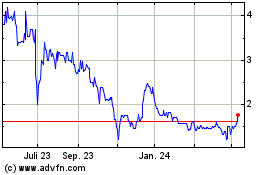

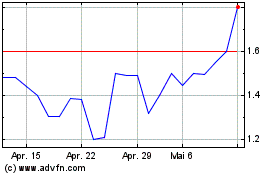

Cnova NV (EU:CNV)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Cnova NV (EU:CNV)

Historical Stock Chart

Von Apr 2023 bis Apr 2024