Capital Markets Day 2021: Reaching Its Previous Mid-term Objectives One Year in Advance, Verallia Sets New Ambitious Goals With Its 2022-2024 Strategic Roadmap

07 Oktober 2021 - 2:00PM

Business Wire

Regulatory News:

Verallia (Paris:VRLA), the leading European and third-largest

global producer of glass containers for food and beverages, is

hosting today at 2.00pm CET its virtual Capital Markets Day to

announce its updated strategic roadmap with new objectives running

into 2024. The new plan, which includes ambitious environmental and

financial goals, will be presented by Group Chairman and CEO Michel

Giannuzzi and other members of the Executive Committee.

Having weathered the COVID-19 crisis and delivered a strong

financial and industrial performance since its 2019 IPO, Verallia

is opening a new chapter that builds on its successful last

strategic plan. This roadmap comprises four key pillars:

- Pursue disciplined growth: Improving customer experience

to grow the business; achieving a positive inflation spread; and

seeking actively value-accretive acquisitions or new

greenfield/brownfield projects.

- Increase operational excellence: Addressing unsafe

behaviors to achieve zero accident; ongoing implementation of

Performance Action Plans to reduce production cash cost by more

than 2% annually; and deploying Verallia Industrial Management

system.

- Invest wisely for a sustainable future: Improving

working conditions; reducing CO2 emissions and energy consumption;

increasing Process Control by leveraging Data Analytics and

Artificial Intelligence.

- Anchor a strong entrepreneurial culture: Strengthening

Corporate Purpose and Values across the organization; increasing

accountability, speed and agility; improving learning ability; and

reinforcing the talent pool with increased diversity.

Verallia Chairman and CEO Michel Giannuzzi said:

“Verallia can benefit from significant market opportunities

including premiumization and plastic substitution that both favour

glass, in a growing demand environment, and market consolidation

prospects. Benefiting from strong leadership positions with a large

and diversified customer base in its own key markets and

geographies, Verallia is perfectly positioned to capture these

opportunities. To this end, we have updated our strategy that

combines the constant pursuit of disciplined growth and operational

excellence with increased investment in sustainability and the

reinforcement of our already strong entrepreneurial culture.

Reflecting our determination to make Verallia a leader in its

industry, we have also upgraded our environmental commitments to

reach carbon neutrality and contribute meaningfully to the

limitation of global warming.”

Responding to the environmental challenges the planet is facing

and changing consumption patterns, Verallia unveiled in October

2020 its purpose to "re-imagine glass for a sustainable

future" and set out its ESG roadmap in January 2021,

with several important targets. Today Verallia takes the further

step of setting new ambitious goals aligned with the objective of

limiting global warming to 1.5°C set by the Science Based

Targets Initiative (SBTi):

- 46% reduction by 2030 of Scope 1 & 2 emissions in

absolute terms (base year 2019)1

- Scope 3 emissions maintained below 40%of total emissions

in 2030

- Net Zero in 2050 for Scope 1 & 2 emissions

The Group has also set new Mid-term Financial targets for the

years 2022-2024:

2022-2023-2024

Assumptions

Organic Sales Growth2

+4-6% CAGR

- From ca half volume and half price/mix

- Moderate inflation in raw material and energy costs after

2022

Adj. EBITDA margin

28%-30% in 2024

- Positive price/cost spread

- Net PAP > 2% of production cash cost (i.e. > €35m per

annum)

Cum. Free Cash Flow3

ca €900m over 3 years

- Recurring and strategic Capex @ ca 10% of sales,

- including CO2-related capex and 3 new furnaces by 2024

Earnings per Share

(excl. PPA4)

ca €3 in 2024

- Average cost of financing (pre-tax) @ ca 2%

- Effective tax rate @ ca 27%

Shareholder Return

Policy

Dividend / share growth > 10%

per annum +

Accretive share buy-backs

- Net income growth > 10% per annum

- Investment grade trajectory (leverage < 2x)

About Verallia – At Verallia, our purpose is to

re-imagine glass for a sustainable future. We want to redefine how

glass is produced, reused and recycled, to make it the world’s most

sustainable packaging material. We are joining forces with our

customers, suppliers and other partners across the value chain to

develop new, healthy and sustainable solutions for all. With around

10,000 employees and 32 glass production facilities in 11

countries, we are the European leader and the world's third-largest

producer of glass packaging for beverages and food products. We

offer innovative, customised and environmentally friendly solutions

to over 10,000 businesses around the world. In 2020, Verallia

produced more than 16 billion glass bottles and jars and posted

revenue of €2.5 billion. Verallia is listed on compartment A of the

regulated market of Euronext Paris (Ticker: VRLA – ISIN:

FR0013447729) and is included in the following indices: SBF 120,

CAC Mid 60, CAC Mid & Small et CAC All-Tradable. For more

information, visit www.verallia.com Follow us on LinkedIn , Twitter

, Facebook and YouTube

***

Verallia will hold today at 2:00 p.m. CET a virtual investor and

analyst conference. Live webcast link:

https://channel.royalcast.com/landingpage/verallia/20211007_1/ The

presentation will be available on www.verallia.com at the end of

the event.

Disclaimer

Certain information included in this press release does not

constitute historical data but constitutes forward-looking

statements. These forward-looking statements are based on current

beliefs, expectations and assumptions, including, without

limitation, assumptions regarding Verallia's present and future

business strategies and the economic environment in which Verallia

operates, and involve known and unknown risks, uncertainties and

other factors, which may cause actual results, performance or

achievements, or industry results or other events, to be materially

different from those expressed or implied by these forward-looking

statements. These risks and uncertainties include those discussed

and identified in Chapter 3 “Risk Factors” in the Universal

Registration Document approved by the AMF, available on the

Company’s website (www.verallia.com) and the AMF’s website

(www.amf-france.org). These forward-looking information and

statements are not guarantees of future performances.

This press release includes only summary information and does

not purport to be comprehensive.

1 Target to be validated by SBT initiative. 2 At constant FX and

excluding changes in perimeter. 3 Defined as the Operating Cash

Flow - Other operating impact - Interest paid & other financing

costs - Cash Tax. 4 Earnings excl. amortization expense for

customer relations (PPA) recognized upon the acquisition from

Saint-Gobain, of ca €0.38 / share (net of taxes).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211007005467/en/

Media contacts Brunswick

- Benoit Grange, Hugues Boëton, Tristan Roquet Montegon

verallia@brunswickgroup.com - +33 1 53 96 83 83

Verallia Investor Relations

contact Alexandra Baubigeat Boucheron -

alexandra.baubigeat-boucheron@verallia.com

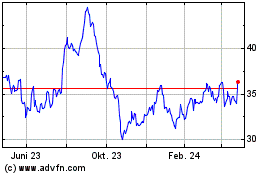

VERALLIA (EU:VRLA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

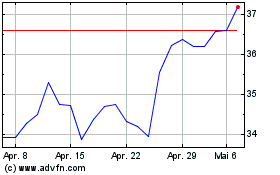

VERALLIA (EU:VRLA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024