Campine year results 2020: 2020: Resilience in the 2nd year-half

As most manufacturing companies,

Campine did not escape the impact of the worldwide

Corona pandemic in 2020. By focusing on essential activities,

seizing some alternative sales opportunities and a good performance

in the 2nd year-half, Campine was able to close the year with a

moderate result. The pandemic had its main negative influence in

the first semester.

The demand in the Specialty

Chemicals division started declining as from April

onwards. In the 2nd quarter, we realised 25% less sales volumes

compared to a normal year. This made us decide to close the

department during the month of May. We were however successful to

compensate the volume loss completely in the 2nd semester. The main

financial impact in this division was the dramatic price reduction

for antimony products. The price of antimony metal reached a low of

5,000 $/ton in the summer as a result of a worldwide collapse in

demand. Towards yearend, we experienced an opposite evolution.

Related to continued infection issues in mines, stocks of antimony

ores, concentrates and metal started to get depleted resulting in a

fierce price uptake (see further in perspectives 2021).

The drop in demand in the Metals

Recycling division already occurred in March. Campine’s

lead alloys are mainly used for the manufacturing of car batteries,

but as the automotive industry closed down many assembly lines,

demand dropped by 50%. We were able to compensate a part of the

lowered industrial volumes by selling to metal traders. However,

during April the availability of scrap batteries became an issue as

many partners in this supply chain also had to close their doors.

We decided therefore mid-May to close our factory for 5 weeks,

during which we performed an advanced yearly maintenance. By that

time lead LME prices had declined to a low beneath € 1,500/ton.

From June onwards, the scrap battery supply chain started to

rebuild and the demand for lead slowly resumed to normal levels.

Lead LME prices started to recover and the 2nd half of the year

came off as relatively normal.

The implementation of measures to prevent the

Corona virus to spread had a severe impact on the way we used to

work and collaborate. Campine combined (and continues to use) a

wide variety of measures, such as working from home and the remote

management of customer relations, whilst continuing manufacturing

on its site in Beerse. Seen the use of hazardous materials and our

Seveso status, our employees are used to wear protective gear,

including dust masks and even full facemasks. The implementation of

additional measures related to Corona was therefore only a small

step to take.

Only a very limited number of employees got

infected with Covid-19. The contact tracing indicated however that

none of the infections occurred during their professional

activities on Campine’s premises. A proof that all preventive

measures implemented by the company were very effective.

Several investments were delayed or spread in

time, mainly because subcontractors, just like foreign suppliers of

equipment and machinery, experienced problems due to the pandemic.

Strict operational cost control was implemented throughout all

processes in all departments. A total of € 2.3 mio in expenses was

saved, amongst others by provisional closing of some departments,

using temporary unemployment for all employees, cutting marketing

expenses, reduced travel and external meetings, etc.

Financial results

Revenue

Campine realised a total revenue of € 166.9 mio

in comparison with € 192.5 mio in 2019 (-13%). This lower revenue

is mainly related to the reduced metal prices, which form the basis

of Campine sales prices and the somewhat lower sales volumes in the

Division Metals recycling.

Results

The EBITDA reached € 7.2 mio, which is 23% lower

compared to the € 9.4 mio of 2019 (excluding the € 3.9 mio refund

of the EC fine) and the EBIT ended at € 3.6 mio (37% lower than in

2019). The Net Result (EAT) for 2020 amounted to € 2.8 mio compared

to € 4.1 mio (excluding the € 3.9 mio refund of the EC fine) in

2019 (-33%).

Solvency

Our financial ratios continued to remain very

solid during 2020. With a solvency rate of 55% (equity/balance

sheet total) we have the financial resources to continue financing

our investment program.

Dividend

The board proposes to pay a dividend amounting

to € 0.975 mio based on the 2020 results. The pay out of € 0.65

gross per share is planned for June 11th 2021.

Results per Division

Metals Recycling – sales €

113.1 mio (-12%) – EBITDA € 4.8 mio (-43%)

This Division is composed of the Business Units

Lead and Metals Recovery.

We concluded the year with a sales volume of

approx. 62,600 ton, a decrease with 3% compared to 2019.

Revenue and operational result both strongly

depend on the metal prices, mainly on the lead LME price. Our

margins are under pressure when LME has a downward trend and

margins recover during upward movements. Just like all other base

and minor metals, the lead LME price decreased substantially during

the onset of the Corona pandemic. In mid-January we still enjoyed a

lead LME price level of around € 1,750/ton, but by May the price

level was already down below € 1,500/ton. After this, the lead

price started to recover to similar levels as at the start of the

year (with exception of a dip during October). The average LME

price in 2020 was about € 1,600/ton, which is about 10% lower than

in 2019.

Consequently, the revenue decreased by 12% to €

113.1 mio whereas the EBITDA lowered to € 4.8 mio (-43%) and

the EBIT reached € 2.6 mio (-57%).

Specialty Chemicals – sales €

64.6 mio (-16%) – EBITDA € 2.3 mio (+ 168%)

This division is composed of the Business Units

Antimony and Plastics.

Despite the Corona pandemic, the sales volume of

13,350 tons in the Specialty Chemicals division remained almost

equal with the 13,600 ton of the previous year 2019.

Revenue is linked to the evolution of antimony

metal prices. The average Antimony Metal Bulletin price of $

5,912/ton in 2020 was considerably lower than the average price in

2019, amounting to $ 6,722/ton. This is a decrease of 12%.

Additionally the Dollar-Euro exchange rate of 1.142 $/€ was also

lower than in 2019 (1.119 $/€). Consequently our revenue amounted

only to € 64.6 mio (‑16% vs 2019).

Notwithstanding the drastic price reduction of

antimony products, the results improved considerably: the EBITDA

reached € 2.3 mio, up from € 0.9 mio one year earlier. The EBIT

increased to € 1.1 mio compared to a loss of € –0.2 mio in 2019.

Reasons for this progress are partially related to structural

operational improvements, optimizations in purchasing and the

evolution of our sales portfolio towards more value added

products.

Perspectives for 2021

Predicting what influence the Corona pandemic

will continue to have on the business in 2021 is quite difficult.

Especially the impact on metal prices, which are crucial for

Campine’s financial performance. The price for antimony metal has

been slowly increasing since the fall of last year. The fear for

shortages on the supply side (antimony ore and concentrates) at the

start of this year, induced an explosion of the price, which

increased with 50% in less than 2 months’ time. Availability of

antimony metal and derivatives like antimony trioxide remain

scarce. For lead, the LME price remained relatively stable in 2021

so far.

Demand for products from our Specialty Chemicals

division is quite high in the first quarter of 2021. The general

recovery of the economy leads to a replenishment of stocks, which

is even further supported by the increasing prices and potential

shortages. We expect this situation to persist until the

summer.

In our Metals Recycling Division demand is

normal for the time of the year. The availability of scrap

batteries is good, supported by the lockdown measures, which

grounded many vehicles throughout the winter, causing batteries to

fail. We predict a normal continuation of the year at this

point.

In the first week of January, Campine was

granted a government subsidy of 1 mio euro for the investment in a

novel process for the recycling of antimony. This innovative

technology has meanwhile been started on an industrial scale and

the investment (totalling € 4.9 mio) will already contribute to

Campine’s result in 2021.

Some other large investments will be carried out

during 2021, but these are mostly replacement investments. Amongst

others, Campine will renew its power supply facilities and build a

new lead casting line, in which the refined lead is poured into

ingots. We expect some higher efficiencies and a small capacity

increase in our refinery. The construction of the PP plastics

recycling plant has been shifted into 2022.

EBITDA: Earnings before interests, taxes, depreciation and

amortisationEBIT: Earnings before interests and taxes also referred

to as Operating resultEAT: Earnings after tax also referred to as

Result for the year

Our auditor, Deloitte Bedrijfsrevisoren, represented by Luc Van

Coppenolle, has confirmed that the audit procedures of the

consolidated financial statements are substantially completed and

that these procedures have not revealed any material modification

that would have to be made to the accounting information, derived

from the consolidated financial statements and included in this

communiqué.

The annual financial report will be made

available for the public on April 23rd 2021 on the website of

Campine.

For further information you can contact Karin

Leysen: tel. +32 14 60 15 49 / email: Karin.Leysen@campine.com

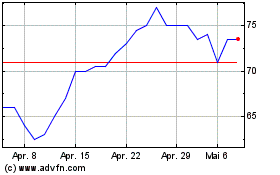

Campine NV (EU:CAMB)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Campine NV (EU:CAMB)

Historical Stock Chart

Von Apr 2023 bis Apr 2024