BELIEVE: H1 2021 Results

Very dynamic H1 supported by its

attractive business model and favourable structural trends in the

digital music industryRevenue growth: +39% in Q2

and +33% in H1 2021FY 2021 guidance uplifted on

the back of solid growth prospects

Paris, September 15, 2021 –

Believe (Ticker: BLV, ISIN: FR0014003FE9), one of the world’s

leading global digital music companies, published today its interim

results for the period ended June 30 (H1 2021) today.

Denis Ladegaillerie, Founder and

CEO, said: “Believe has experienced strong revenue growth

in H1 2021. While we benefit from structural market growth

trends, this growth is also the reflect of our unparalleled appeal

to a new generation of independent digital artists looking for

go-to-market solutions and a wide range of expertise. Throughout

the period, we kept investing on our cutting-edge platform to

capture further growth and drive geographic expansion. As

highlighted by our FY2021 guidance upward revision, we are on the

right track to reinforce our development and continue to pursue our

objective of profitable growth while achieving our mission to help

build a better, more diverse, more respectful, more transparent and

fairer future for all artists.”

|

in € million |

H1 2020 |

H1 2021 |

Change YoY |

Organic change1 |

| Group Revenues |

196 |

260 |

+33% |

+30% |

|

Premium Solutions |

181 |

243 |

+34% |

+30% |

|

Automated Solutions |

15 |

17 |

+17% |

+26% |

| Adjusted EBITDA pre central

platform |

19 |

35 |

+86% |

|

| In % of revenues |

9.5% |

13.3% |

+380bps |

|

|

Premium Solutions |

16 |

32 |

+100% |

|

|

Automated Solutions |

3 |

3 |

-2% |

|

| Central Platform |

-25 |

-28 |

+14% |

|

| Group's Adjusted

EBITDA |

-6 |

7 |

|

|

| In

% of revenues |

-2.8% |

2.7% |

+550bps |

|

| Operating income /

loss (EBIT) |

-17 |

-14 |

|

|

| Net cash from operating activities |

-4 |

-22 |

|

|

| Free cash flow |

-20 |

-35 |

|

|

NB: the Group uses alternative performance

indicators - not defined by IFRS - described in appendix 1 (page

4)

In H1 2021, Believe has further deployed its

unique and long-term proprietary technology solutions enabling

independent artists and labels to benefit from the latest

innovations and accelerate their careers. More recently this

included an innovative partnership with Spotify on the

Discovery Mode platform, the launch of the

Signed By programme for the TuneCore platform2

(which is presented as Automated Solutions in financial reporting)

and a partnership with YouTube for the launch of

Shorts, positioning us as one of the first

partners of the leading video streaming service for this mobile

phone feature enabling artists to further engage their communities.

Believe also continued to grow its roster over the period

confirming its unparalleled appeal to a new generation of artists

looking for digital solutions and expertise and the continuous rise

of independent and local artists and labels in the industry.

RevenuesH1 2021

revenues grew by 33% to reach €260 million (versus €196

million in H1 2020), mainly reflecting strong organic growth (+30%)

and a positive perimeter effect (+3%). Overall, the Group

benefitted from the favourable structural trends in the digital

music industry and from its positioning on the fastest growing

markets leveraging its increased investment in sales and marketing

over the past 24 months.

After a solid performance in Q1 2021

(+26%), revenue growth accelerated in Q2 2021 with

revenues reaching €136 million, representing a 39% year-over-year

increase compared to Q2 2020. This increase reflected a 36% organic

growth at constant rate and a perimeter effect of 4%, driven by the

acquisition of DMC label in Turkey in July 2020. The growth

acceleration witnessed in Q2 2021 in comparison with Q1 2021 (€124

million, up 26% compared to Q1 2020) was driven by the recovery of

digital sales activities linked to add-funded streaming services

that were particularly affected by the Covid-19 pandemic in 2020

and by the growth and performance of Believe’s roster.

Revenues by geography: growth in all

geographies

|

in € million |

H1 2020 |

H1 2021 |

Change YoY |

| Asia-Pacific /

Africa |

33 |

56 |

+69% |

| Rest of Europe |

52 |

75 |

+44% |

| Americas |

27 |

37 |

+37% |

| France |

36 |

43 |

+21% |

| Germany |

47 |

48 |

+1% |

|

Total revenues |

196 |

260 |

+33% |

Revenues in Asia Pacific and

Africa grew strongly at 69% compared to last year and

represented 22% of group revenues. This steep increase was driven

by the market growth and the roll-out and strengthening of premium

services in several countries in the region in 2020 and early

2021.

Rest of Europe (excluding

France and Germany) reported revenue growth of 44% and represented

29% of total revenues. The level of activity was dynamic across the

region and particularly strong in Russia where the Group is ramping

up its activities. Revenues were also heightened by the

integration of DMC label in Turkey following its acquisition in

July 2020.

Americas grew by 37% and

represented 14% of total revenues, reflecting solid take up of

activity in Latin America.

In France, revenues increased

by 21%, driven by the strong performance of artist services

activities and further growth in artist and label solutions. In

Germany, revenues were impacted by ongoing

reorganization of the activities to optimize digital solutions and

reduce exposure to physical sales. France and Germany respectively

represented 17% and 18% of group revenues.

Revenues by segment

In terms of segment, Premium

Solutions revenues amounted to €243 million in H1 2021, a

year-over-year organic increase of 30% versus H1 2020. Premium

Solutions benefitted from the market growth and additional market

share gains driven by reinforced investment in sales and marketing

since 2019. The market growth was particularly strong in Q2 thanks

to the recovery of digital sales activities linked to add-funded

streaming services.Automated Solutions amounted to

€17 million and grew by 17% in H1 2021 compared to last year,

including a negative forex impact related to the US dollar, the

reporting currency of TuneCore. Organic growth was 26% at constant

rate. The increase was driven by the addition of new subscribers,

the TuneCore expansion in new geographies (Brazil, Russia, Africa

and Southeast Asia) and the recovery in advertising spending from

advertisers, a key driver of the revenue pool of the automated

platform.

Adjusted EBITDA

In line with the strong organic growth,

Adjusted EBITDA pre central platform costs3 almost

doubled in H1 2021 to reach €35 million (versus €19 million in H1

2020). The increase was primarily driven by the strong growth

witnessed in Premium Solutions, while Automated Solutions remained

stable year-over year due to the sharp increase in technology and

the development of new services directly recorded in the segment.

Overall, the Adjusted EBITDA margin pre central platform costs

amounted to 13%, strongly recovering from H1 2020 level (9%) and

almost bridging the gap with historical annual level (16% in full

year 2018 and 2019). The Group controlled its costs during the

period but continued to strongly invest in sales and marketing in

both segments.

The Group’s Adjusted EBITDA

returned to positive territory to reach €7 million in H1 2021

compared to a loss of €(6) million in H1 2020,

notwithstanding a slight increase in central platform investment

during the first half of 2021. However, central platform costs were

lower as a % of total revenues at 11% in H1 2021 versus 12% in H1

2020. Believe maintained its investment in central platform, which

grew mainly due to full-year effects after significant build-up in

2019 and 2020. As a result, Adjusted EBITDA margin reached 2.7% in

H1 2021 compared to -2.8% in H1 2020 and 1.7% in full year

2020.

Operating loss (EBIT) EBIT

amounted to €(14) million in H1 2021. Excluding the €5 million of

costs related to the initial public offering completed in June

2021, EBIT improved by €8 million year-over-year, almost halving

the loss compared to H1 2020.

Free cash flow

Free cash flow was negative €35 million in H1

2021, reflecting a higher level of renewals with large label

customers through new longer-term deals and the increase in artists

services and solutions activities. This drove a negative variation

of the working capital, resulting in a decrease in net cash from

operating activities. The rate of renewals with large labels

through longer-term deals was particularly high in H1 2021 and is

anticipated to stabilize in H2 2021. Capex which mostly consist in

capitalized R&D amounted to €13 million, slightly below last

year level.

Environmental, Social & Governance

The Board also approved the corporate social

responsibility strategy proposed by the CSR committee. It also

defined key quantitative and qualitative indicators which will be

monitored closely and annually reported. Based on an analysis of

Believe’s challenges, four strategic priorities have been

identified and form the foundation of the Group’s social

responsibility initiatives throughout the world:

- Developing diverse & local talent in local markets

first

- Cultivating talent for the digital era

- Building trusting relationships through respect,

fairness and transparency

- Empowering our community to have a long term positive

impact

FY 2021 outlook and organic growth guidance

update

Based on Believe H1 and Q2 revenue growth, the

Group expects to exceed its annual organic growth expectations

(initially set in IPO documentation at c. 20% in comparison with

2020) and now anticipates an organic growth of at least 23% for

2021. Revenues in the next two quarters are expected to grow at a

lower rate than in Q2 2021, as the recovery in digital services

activities related to the add-funded streaming started improving in

Q3 2020 and returned to previous trends towards the end of the

year. Besides Believe anticipates a decrease in physical sales in

H2 2021. As stated in the IPO documentation, Believe still does not

expect a significant impact on 2021 revenues of the potential

external growth transactions that it is working on.

As a result of higher organic growth

expectations, the Group also anticipates reporting an adjusted

EBITDA margin for 2021 slightly above 2020 level (versus initial

expectation to be in line with 2020 level: 1.7%). As Believe will

continue to substantially invest in its commercial and marketing

development and central platform to support the strong growth of

its businesses, the margin expansion in full year 2021 in

comparison with 2020 is anticipated to remain moderate.

Webcast:

We will host a webcast

https://edge.media-server.com/mmc/p/ynw5jaca and conference call

including a live question and answer session starting at 6:30 p.m.

CET today. Denis Ladegaillerie, our Founder and CEO, and Xavier

Dumont, our Chief Operating Officer and Chief Financial Officer,

will present interim results and answer questions addressed in the

call or submitted through the webcast. All information related to

the interim results are available on our investor website: Believe

- Investors Website - Financials

Conference call details:France, Paris:+33

(0)176700794 - United Kingdom, London: +44 (0) 2071 928000 -

United States, New York: +16315107495

Conference ID: 8179503

Next financial event:3 November 2021: Third

quarter 2021 revenues - Press release to be issued after market

close

Investor RelationsEmilie

MEGEL

investors@believe.comTel: +33 1 53093391

- Cell: + 33 6

07099860

Press Relations Brunswick

believe@brunswickgroup.com

Corporate Communication

equipe.believe@agenceproches.com

Appendix

1. Use of Alternative Performance

Indicators

To supplement our financial information presented in accordance

with IFRS, we use the following non GAAP financial measures:

- Adjusted EBITDA is calculated based on operating income (loss)

before depreciation, amortization and impairment, share-based

payments (IFRS 2), other operating income and expense; and included

the share of net income (loss) of equity-accounted companies –

Reconciliation table available in interim financial report

- Free cash flow corresponds to net cash from operating

activities after net capex

2. Quarterly revenues by division

|

in € million |

Q1 2020 |

Q1 2021 |

Change |

Organic at constant rate |

| Premium Solutions |

91 |

116 |

27% |

24% |

| Automated Solutions |

7 |

9 |

14% |

24% |

|

Total revenues |

98 |

124 |

26% |

24% |

|

in € million |

Q2 2020 |

Q2 2021 |

Change |

Organic at constant rate |

| Premium Solutions |

91 |

127 |

41% |

37% |

| Automated Solutions |

7 |

9 |

21% |

29% |

|

Total revenues |

98 |

136 |

39% |

36% |

3. Revenue breakdown between digital and non-digital

sales

|

|

Q1 2020 |

Q2 2020 |

H1 2020 |

Q1 2021 |

Q2 2021 |

H1 2021 |

| Digital sales |

90% |

90% |

90% |

90% |

92% |

91% |

|

Non-digital sales |

10% |

10% |

10% |

10% |

8% |

9% |

About BelieveBelieve is one of

the world’s leading digital music companies. Believe’s mission is

to develop independent artists and labels in the digital world by

providing them the solutions they need to grow their audience at

each stage of their career and development. Believe’s passionate

team of digital music experts around the world leverages the

Group’s global technology platform to advise artists and labels,

distribute and promote their music. Its 1,370 employees in more

than 50 countries aim to support independent artists and labels

with a unique digital expertise, respect, fairness and

transparency. Believe offers its various solutions through a

portfolio of brands including TuneCore, Nuclear Blast, Naïve,

Groove Attack and AllPoints. Believe is listed on compartment A of

the regulated market of Euronext Paris (Ticker: BLV, ISIN:

FR0014003FE9).www.believe.com

Forward Looking statement This

press release contains forward-looking statements regarding the

prospects and growth strategies of Believe and its subsidiaries

(the “Group”). These statements include statements relating to the

Group’s intentions, strategies, growth prospects, and trends in its

results of operations, financial situation and liquidity. Although

such statements are based on data, assumptions and estimates that

the Group considers reasonable, they are subject to numerous risks

and uncertainties and actual results could differ from those

anticipated in such statements due to a variety of factors,

including those discussed in the Group’s filings with the French

Autorité des Marchés Financiers (AMF) which are available on the

website of Believe(www.believe.com). Prospective information

contained in this press release is given only as of the date

hereof. Other than as required by law, the Group expressly

disclaims any obligation to update its forward-looking statements

in light of new information or future developments.Some of the

financial information contained in this press release is not IFRS

(International Financial Reporting Standards) accounting

measures.

1 Organic change accounts for revenue growth at a like-for-like

perimeter and at constant exchange rate. The change in perimeter

only concerned Premium Solutions in H1 2021, no perimeter impact in

Automated Solutions. Organic growth at current rate amounted to

29%.

2 TuneCore platform is an independent distributor of digital

music and market leader in the DIY segment fully owned by Believe

and constitutes the Automated Solutions segment.

3 Central platform costs account for the costs that cannot be

allocated by division

- 2021-09-15-Believe H1 2021-ENG

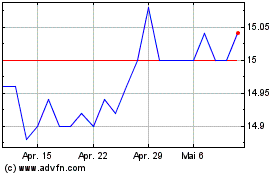

Believe (EU:BLV)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Believe (EU:BLV)

Historical Stock Chart

Von Apr 2023 bis Apr 2024