- Closing of a private placement with qualified French and

international investors for €7.8 million

- Proceeds of the issue mainly intended to accelerate the

commercial ramp-up of the latest generation of robots

- Concomitant sale of 1.358.911 existing shares held by

Seventure Partners, for an amount of €1.7 million

Regulatory News:

BALYO (FR0013258399, Mnémonique: BALYO, éligible PEA-PME)

(Paris:BALYO), (the "Company"), announces today the success

of a capital increase with cancellation of the preferential

subscription right by placement of a final amount of €6.1 million

to qualified French and international investors (the "Primary

Offering"), carried-out by accelerated construction of an order

book.

Concurrently with the Primary Offer, funds managed by Seventure

Partners (together, the "Selling Shareholder"), historical

shareholder of the Company since 2010, have sold 1,358,911 existing

shares, at the same price as the Primary Offer, i.e. an amount of

€1.7 million (the "Secondary Offer" and together with the

Primary Offer, the "Offer"). The funds managed by Seventure

Partners will continue to support the development and growth of the

Company. In this respect, they have committed to holding their

residual stake for a minimum period of 15 months from the date of

completion of the transaction.

Bryan, Garnier & Co Limited1 is acting as Sole Global

Coordinator, Lead Manager and Bookrunner of the transaction.

The Primary Offering resulted in the issuance of 4.885.089 new

ordinary shares, representing 16.7% of the Company's current share

capital, at a price per share of €1.25 (including share premium),

representing a total fundraising of €6,106,361.25 (including share

premium).

Following the Primary Offering, the share capital of the Company

is now composed of 33,675,587 shares with a par value of €0.08

each. Based on the Company's cash position (€6.4 million as at 30

June 2021) and its forecasted expenses, the amount raised in the

transaction should enable the Company to achieve its strategic

objectives.

"We would like to thank the new investors who have joined

us and those who have reaffirmed their support for this

transaction. These new resources provide us with the necessary

means to accelerate the commercialization of our offer and to meet

the growing demand from international customers who wish to improve

their logistics performance," said Pascal Rialland, Chairman and

CEO of BALYO.

Reminder of the reasons for the Primary Offer

The proceeds of the Primary Offering are primarily intended to

provide the Company with additional resources to finance sales and

marketing expenses to accelerate the commercial ramp-up of the

latest generation of robots in 2022 as well as additional R&D

expenses related to the implementation of the the roadmap of new

solutions. The funds raised will also be used for working capital

related to the expected growth as well as the general financing

needs of the Company, for a smaller portion, less than 20%, within

the framework of the latter allocation. The Company also specifies

that its available cash position prior to the launch of the

transaction is sufficient to cover its financing needs for the year

2021.

Main terms of the Offer

A total number of 4,885,089 new ordinary shares, with a par

value of €0.08 each, were issued to qualified investors within the

meaning of Article 2(e) of Regulation (EU) No. 2017/1129 of 14 June

2017, as referred to in 1° of Article L.411-2-1 of the French

Monetary and Financial Code, in accordance with the 15th resolution

of the Combined General Meeting of the Company dated 20 May

2021.

In addition, 1,358,911 existing shares held by funds managed by

Seventure Partners, representing 4.72% of the Company's current

share capital, were sold to these qualified investors.

The new shares, representing 16.7% of the Company's current

share capital, on a non-diluted basis, prior to the completion of

the Primary Offering (i.e., a dilution of 14.5%), were issued by

decision (i) of the Board of Directors for implementation of the

delegation of authority which has been granted by the 15th

resolution approved by the Combined Shareholders' Meeting of the

Company on 20 May 2021, and (ii) of the Chief Executive Officer as

of 14 October 2021

The issue price of the new and sold shares was set at €1.25 per

share, representing a discount of 7.68% to the closing price of the

BALYO share on 14 October 2021, i.e. €1.354, and by 9.81% in

relation to the volume-weighted average price of BALYO shares on

the regulated market of Euronext Paris for the last three trading

days prior to its determination (i.e. from 11 to 13 October 2021

inclusive), i.e. €1.386, in accordance with the 15th resolution of

the Company's Combined General Meeting of 20 May 2021.

By way of illustration, a shareholder holding 1% of BALYO's

share capital prior to the launch of the Primary Offering will now

hold a 0.85% stake.

The share capital of the Company will be composed of 33,675,587

shares following settlement-delivery.

To the best of the Company's knowledge, the shareholder

structure before and after the completion of the Offer is as

follows:

BALYO shareholding

Before Offering

After Offering (incl.

Seventure sale)

Number of shares

% of capital

Number of shares

% capital

Members of the Board of

Directors

Pascal RIALLAND

1,000

0.0%

1,000

0.0%

Fabien BARDINET

74,392

0.3%

74,392

0.2%

BPI FRANCE INVESTISSEMENT

5,053,950

17.6%

5,053,950

15.0%

LINDE Material Handling GmbH

1,809,976

6.3%

1,809,976

5.4%

Founders

Thomas Duval

851,000

3.0%

851,000

2.5%

Raul Bravo

874,928

3.0%

874,928

2.6%

Other shareholders

HYSTER-YALE GROUP

1,216,545

4.2%

1,216,545

3.6%

Seventure Partners SA

2,371,685

8.2%

1,012,774

3.0%

Financière Arbevel SAS

992,944

3.4%

1,552,944

4.6%

SSUG PIPE RAIF

-

0.0%

2,000,000

5.9%

Free float

15,544,078

54.0%

19,228,078

57.1%

TOTAL

28,790,498

100.0%

33,675,587

100.0%

Admission to trading of the new shares

The new shares will rank for dividend immediately and will be

admitted to trading on the regulated market of Euronext Paris under

the same ISIN code FR0013258399 BALYO. Settlement and delivery of

the new shares and their admission to trading on the regulated

market of Euronext Paris are expected to take place within 3

business days from the closing of the private placement.

The information presented in this press release is provided

following the completion of the placement of the shares by

accelerated bookbuilding, which is now closed, but remains subject

to the correct execution of the settlement-delivery operations,

which are the subject of the placement agreement referred to

below.

Pursuant to the provisions of 1° of Article L.411-2 of the

French Monetary and Financial Code and Article 1.4 of Regulation

(EU) 2017/1129 of the European Parliament and of the Council of 14

June 2017, the Offer has not given rise and will not give rise to

the preparation of a prospectus subject to the approval of the

Autorité des marchés financiers (the "AMF").

Abstention and lock-up commitments

The Company has signed an abstention agreement for a period of

180 days from the settlement-delivery date of the Offer, subject to

customary exceptions, thus limiting the Company's ability to issue

new shares during this period.

Seventure Partners has signed a lock-up agreement for all the

shares held by the funds it manages and not sold during the Offer,

for a period of 15 months from the date of settlement-delivery of

the Offer, subject to certain customary exceptions.

Risk factors

The public's attention is drawn to the risk factors relating to

the Company and its business, presented in section 3 of the

Universal Registration Document approved on April 27, 2021 by the

AMF, available free of charge on the Company's website

(balyo.fr/investors). The occurrence of some or all of these risks

could have an adverse effect on the Company's business, financial

condition, results, development or prospects. The risk factors

presented in the said Universal Registration Document are identical

as of the date of this press release. In particular, the Company

states that orders placed and payments made by LINDE Material

Holding (LHM) are 100% in line with order commitment targets for

2021 previously communicated.

In addition, investors are invited to take into account the

following risks specific to the issue: (i) the market price of the

Company’s shares may fluctuate and may fall below the subscription

price of the shares issued, (ii) the volatility and liquidity of

the Company’s shares may fluctuate significantly, (iii) disposals

of the Company’s shares may take place in the market and may have

an adverse impact on the Company’s share price, and (iv) the

Company’s shareholders may see potentially significant dilution as

a result of any future capital increases that may become necessary

to finance the Company.

About BALYO

Humans around the World deserve enriching, creative jobs. At

BALYO, we believe that pallet movements in DC and manufacturing

sites should be left to fully autonomous robots. To execute this

ambition, BALYO transforms standard forklifts into intelligent

robots thanks to its breakthrough Driven by Balyo™ technology. Our

leading geo guidance navigation system enables robots to locate

their position and navigate autonomously inside buildings - without

the need for any additional infrastructure. To accelerate the

material handling market conversion to autonomy, BALYO has entered

into two global partnerships with KION (Linde Material Handling's

parent company) and Hyster-Yale Group. A full range of globally

available robots has been developed for virtually all traditional

warehousing applications; Tractor, Pallet, Stackers, Reach and

VNA-robots. BALYO and its subsidiaries in Boston and Singapore

serve clients in the Americas, Europe and Asia-Pacific. The company

has been listed on EURONEXT since 2017 and its sales revenue

reached €21.7 million in 2020. For more information, visit

https://www.balyo.com/

Disclaimer

This press release contains forward-looking statements that

relate to the Company’s objectives. While the Company considers

such forward-looking statements to be reasonable, such

forward-looking statements are based solely on the current

expectations and assumptions of the Company’s management and

involve risk and uncertainties, which may result in different

outcomes than those contained in the forward-looking

statements.

This press release and the information contained herein are only

for information purposes and do not constitute an offer to sell or

subscribe to, or a solicitation of an offer to buy or subscribe to,

shares in the Company in any country, including France.

The distribution of this press release may be subject to legal

or regulatory restrictions in certain jurisdictions. Any person who

comes into possession of this press release must inform him or

herself of and comply with any such restrictions, and as the case

may be, to abide by such restrictions. This press release does not,

and will not, constitute an offer nor an invitation to solicit the

interest of public in France.

This announcement is an advertisement and not a prospectus

within the meaning of regulation (EU) 2017/1129 of the European

Parliament and of the Council of 14 June 2017 (the “Prospectus

Regulation”).

In France, the offering of the Company’s securities as described

above will be carried exclusively through an offer to the benefit

of qualified investors, as defined in Article 2(1)(e) of the

Prospectus Regulation and in accordance with article L. 411-2(1) of

the French Monetary and Financial code (code monétaire et

financier) and applicable regulatory provisions. No prospectus will

require to be approved or subject to approval from the AMF

(Autorité des Marchés Financiers).

With respect to Member States of the European Economic Area

other than France (the “Member States”), no action has been taken

or will be taken to permit a public offering of the securities

referred to in this press release requiring the publication of a

prospectus in any Member State. Therefore, such securities may not

be and shall not be offered in any Member State (other than France)

other than in accordance with the exemptions of Article 1(4) of the

Prospectus Regulation or, otherwise, in cases not requiring the

publication by BALYO of a prospectus under Article 3 of the

Prospectus Regulation and/or the applicable regulations in such

Member State.

In the United Kingdom, this press release has been prepared on

the basis that any offering of the Company’s securities in the

United Kingdom will benefit from an exemption under Regulation (EU)

2017/1129, which is part of UK law under the European Union

(Withdrawal) Act 2018 (the “UK Prospectus Regulation”), regarding

the obligation to publish a prospectus for offerings of the

Company’s securities. This press release is not a prospectus within

the meaning of the UK Prospectus Regulation.

This press release and the information it contains are being

distributed to and are only intended for persons who are (i)

investment professionals falling within Article 19(5) of the

Financial Services and Markets Act 2000 (Financial Promotion) Order

2005, as amended (the “Order”), (ii) high net worth entities and

other such persons falling within Article 49(2)(a) to (d) of the

Order (“high net worth companies”, “unincorporated associations”,

etc.) or (iii) other persons to whom an invitation or inducement to

participate in investment activity (within the meaning of Section

21 of the Financial Services and Market Act 2000) may otherwise

lawfully be communicated or caused to be communicated (all such

persons in (i), (ii) and (iii) together being referred to as

“Relevant Persons”).

This press release is only being distributed to Relevant Persons

and any person who is not a Relevant Person should not act or rely

on this press release or any of its contents. Any invitation, offer

or agreement to subscribe, purchase or otherwise acquire securities

to which this press release relates will only be engaged with

Relevant Persons.

This press release and the information it contains are not

intended to be distributed, directly or indirectly, in the United

States of America and do not, and will not constitute an offer to

subscribe for or sell, nor the solicitation of an offer to

subscribe for or buy, securities of BALYO in the United States of

America. Securities may not be offered or sold in the United States

of America absent from registration or an exemption from

registration under the U.S. Securities Act of 1933, as amended (the

“U.S. Securities Act”), it being specified that the securities of

BALYO have not been and will not be registered within the U.S.

Securities Act. BALYO does not intend to register securities or

conduct a public offering in the United States of America.

This press release may not be published, forwarded or

distributed, directly or indirectly, in the United States of

America, Canada, Japan or Australia. The information contained in

this document does not constitute an offer of securities for sale

in the United States of America, Canada, Japan or Australia.

1 Acting through Bryan Garnier Securities SAS.

This press release is not intended for

publication or distribution in the United States, Canada, Japan or

Australia.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211014006178/en/

BALYO Frank Chuffart investors@balyo.com

NewCap Financial Communication and Investor Relations

Thomas Grojean / Louis-Victor Delouvrier Tel: +33 1 44 71 98 53

balyo@newcap.eu

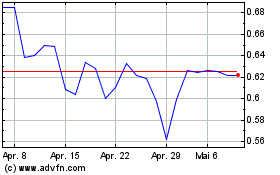

Balyo (EU:BALYO)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Balyo (EU:BALYO)

Historical Stock Chart

Von Apr 2023 bis Apr 2024