- Annual sales of €95.5 million, +8.2% in actual terms and +10.0%

at constants exchange rates

- EBITDA of €20.6 million, representing 21.6% of sales

- Cash position and cash equivalents of €30.7 million at end-June

2021

- Divestment of the Group’s Romanian and Japanese

subsidiaries

- Proposal to pay €5.5 million in arrears following a fourth

URSSAF audit pertaining to tax on the promotion of medical

devices

Regulatory News:

Amplitude Surgical (Paris:AMPLI) (ISIN: FR0012789667, Ticker:

AMPLI, eligible for PEA-PME equity savings plans), a leading French

player on the surgical technology market for lower-limb

orthopedics, announces its 2020-21 annual results.

Olivier Jallabert, Amplitude Surgical’s CEO, commented:

“Amplitude Surgical’s activity was impacted, during a large part of

last financial year and on most of its markets, by the public

health situation associated with COVID-19, and notably the adoption

of restrictions on access to operating rooms. Nevertheless, the

Group’s activity increased by 10.0% at constant exchange rates

compared with the previous year, which saw an almost total shutdown

in activity from mid-March 2020. Despite a difficult context, good

cost control enabled us to maintain EBITDA at 21.6% of sales, an

improvement on the previous year. The Group also has a solid cash

position for the coming year. However, uncertainty associated with

the COVID-19 pandemic does not enable us to issue any guidance for

our 2021-22 financial year at this stage”.

2020-21 key events:

- On November 3, 2020, the Valance Judicial Court rejected

Amplitude SAS’ request to invalidate the €5.8 million adjustment in

its dispute with URSSAF (employee and employer social security

contribution collection agency) pertaining to tax on the promotion

of medical devices for the period from July 1, 2014 to June 30,

2017. Amplitude decided to appeal this decision;

- On November 10, 2020, Amplitude Surgical announced the

acquisition of a majority stake in the Group’s share capital by PAI

Partners.

Apax Partners, Olivier Jallabert and certain other of the

Company’s managers and senior executives divested 20,889,437

Amplitude Surgical shares and undertook the contribution in kind of

4,121,120 Amplitude Surgical shares to Auroralux SAS, a company

controlled by PAI Partners, i.e. a total of 25,010,557 Amplitude

Surgical shares representing approximately 52.3% of the Company’s

share capital, at a price of €2.15 per share.

On December 7, 2020, Auroralux sent the AMF stock market

authority the draft information document and draft simplified

public tender offer for 22,649,678 Amplitude Surgical shares at a

price of €2.15 per share.

Amplitude Surgical sent the AMF, also on December 7, 2020, its

draft response to the Auroralux simplified public tender offer for

the Company’s shares at €2.15 per share.

On January 5, 2021, the AMF issued a compliance notice regarding

the simplified public tender offer tabled by Auroralux for

Amplitude Surgical’s shares at €2.15 per share. The offer period

ran from January 7 to January 27, 2021, inclusive.

At the closing of the offer, Auroralux SAS held 34,906,476

Amplitude Surgical shares representing a similar number of voting

rights, i.e. 73.02% of the share capital and voting rights.

Auroralux SAS currently holds 35,699,024 Amplitude Surgical shares

representing a similar number of voting rights, i.e. 74.68% of the

share capital and voting rights.

- Within the framework of the change in control of Amplitude

Surgical with the investment of PAI Partners, on November 10, 2020

the Company issued a bond of €110 million subscribed by Tikehau and

proceeded with the early repayment of the 2014 and 2016 bonds whose

outstanding amount was €96.6 million (excluding accrued interest)

at June 30, 2020.

Financial summary – actual exchange rates:

€ million - IFRS

2020-21

2019-20

Δ

Sales

95.5

88.3

8.2%

Gross margin

71.2

64.1

11.1%

as a % of sales

74.6%

72.6%

+200 bps

Sales & Marketing costs

34.8

32.3

7.7%

General & Administrative costs

12.5

10.1

23.3%

Research & Development costs

3.3

4.1

-18.8%

EBITDA

20,6

17.6

17,1%

as a % of sales

21.6%

19.9%

+170 bps

Recurring operating profit/loss

0.2

-6.1

Non-recurring operating income and

expenses

-2.5

3.2

Operating profit/loss

-2.3

-2.8

Financial profit/loss

-10.5

-8.5

Net profit/loss - Group share

-14.1

-14.2

Net financial debt

116.1

107.8

Net cash position - end of

period

30.7

36.6

EBITDA of €20.6 million, representing 21.6% of sales

Over its 2020-21 financial year to June 30, 2021, Amplitude

Surgical recorded sales of €95.5 million, up 8.2% in actual terms

and 10.0% at constant currency. Activity was significantly impacted

on most of the Group’s markets from October 2020 by the situation

associated with COVID-19, with restrictions on access to operating

rooms resulting in the postponement of scheduled surgical

procedures. However, the impact was smaller for the Group than it

was following the almost total shutdown of all activity in the

final quarter of the previous year.

Knee and Hip activity generated sales of €82.7 million, +5.3% on

the previous year at constant currency.

Novastep, innovative solutions for foot and ankle surgery,

recorded growth of 53.5% at constant currency, with sales totaling

€12.8 million. Novastep’s activity accounted for 13.4% of total

Group sales.

In terms of the distribution of activity by geographical

region:

- In France, annual sales totaled €62.4 million, up 13.0%

- The Group’s international activity generated sales of €33.1

million, a slight increase of 0.2% in actual terms and 5.2% at

constant currency. The Group’s subsidiaries recorded growth of

10.5% at constant currency to €25.2 million.

Activity with the Group’s distributors fell by 9.6% to €7.9

million.

The gross margin was 74.6%, an improvement of 200 bps compared

with the previous year’s level thanks to a more positive country

mix and further work on the optimization of the Group’s production

tools.

The Group’s operating expenses totaled €50.6 million, up 8.8% on

the previous year as a result of the increase in marketing

expenditure associated with the higher level of activity and

further quality control and regulatory spending.

At June 30, 2021, Amplitude Surgical had a workforce of 443

staff, compared with 436 at end-June 2020; personnel costs were up

8.2% compared with the 2019-20 financial year, which was impacted

by subsidies associated with partial activity due to the public

health crisis in some of the Group’s countries.

Group EBITDA was thus €20.6 million, or 21.6% of sales, an

improvement on the previous year.

There was a Recurring Operating Profit of €0.2 million in

2020/2021, versus a loss of €6.1 million in 2019/2020, thanks to a

higher level of activity and further controls over operating

expenses. The Operating Result was a loss of €2.3 million, compared

with a loss of €2.8 million in 2019-20, a year impacted by the

reversal of a provision with respect to “Taxation on Medical

Devices” of €8.6 million and the depreciation of R&D projects

for €2.7 million.

The Financial Result was -€10.5 million, which primarily

consisted of an interest expense of €9.9 million.

The Net Result (Group share) was a loss of €14.1 million, versus

a net loss of €14.2 million a year earlier.

Financial structure: cash position of €30.7 million at

end-June 2021

Net cash flow generated by operating activity totaled €2.3

million, versus €12.4 million in 2019-20. The change in Working

Capital Requirements led to cash burn of €3.4 million, with the

higher level of activity compared to the previous year resulting in

higher client receivables and inventory levels, while in 2019/20

the change in Working Capital Requirements had resulted in positive

cash flow of €6.9 million.

Investments totaled €9.2 million, down on the previous year’s

figure of €9.6 million.

At end-June 2021, the Group thus had a cash position and cash

equivalents of €30.7 million. The Group’s Net Financial Debt was

€116.1 million, giving gearing (Net Financial Debt over

Shareholders’ Equity) of 2.04, compared with 1.52 at end-June

2020.

Events since June 30, 2021

- On July 23, 2021, the Group divested 100% of its Amplitude

Ortho SRL subsidiary (Romania) to GBG MLD SRL, the distributor of

the Group’s products in Moldova. The divested company will continue

to market the Group’s products on the Romanian market as a

distributor.

- With its growth failing to meet expectations, on August 13,

2021 the Group divested 80% of its Matsumoto Amplitude Inc.

subsidiary (Japan) to Mr. Takeshi Matsumoto, who already held 20%

of this subsidiary through his company Matsumoto Medical. Following

this divestment, the subsidiary’s new shareholders initiated its

winding-up.

- On September 21, 2021, the Group received a letter of

adjustment from URSSAF following a fourth audit pertaining to tax

on the promotion of medical devices for the period from July 1,

2017 to June 30, 2020. This letter of adjustment requests repayment

of social contribution arrears of €5.5 million, a sum already

provisioned in the Groups accounts in previous financial years. As

with its previous disputes, the Group will formulate its

observations and ask the Valance Judicial Court to invalidate the

adjustment.

2021-22 outlook

The 2019-20 and 2020-21 financial years were significantly

impacted by the COVID-19 pandemic. For the 2021-22 financial year,

there is therefore uncertainty regarding the pace at which activity

will return to a stable situation, notably given the diversity of

the geographical markets covered by the Group and their various

public health situations. These elements could have an impact on

the 2021-22 financial year. Because of this uncertainty, Amplitude

Surgical is currently unable to publish its annual targets.

Next press release

Q1 2021-22 sales, on Thursday November 18, 2021, after

market.

About Amplitude Surgical

Founded in 1997 in Valence, France, Amplitude Surgical is a

leading French player on the global surgical technology market for

lower-limb orthopedics. Amplitude Surgical develops and markets

high-end products for orthopedic surgery covering the main

disorders affecting the hip, knee and extremities, and notably foot

and ankle surgery. Amplitude Surgical develops, in close

collaboration with surgeons, numerous high value-added innovations

in order to best meet the needs of patients, surgeons and

healthcare facilities. A leading player in France, Amplitude

Surgical is developing abroad through its subsidiaries and a

network of exclusive distributors and agents distributing its

products in more than 30 countries. Amplitude Surgical operates on

the lower-limb market through the intermediary of its Novastep

subsidiaries in France and the United States. At June 30, 2021,

Amplitude Surgical had a workforce of 443 employees and recorded

sales of nearly 95.5 million euros.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211020005727/en/

Amplitude Surgical Dimitri Borchtch CFO

finances@amplitude-surgical.com +33 (0)4 75 41 87 41

NewCap Investor Relations Mathilde Bohin/Thomas Grojean

amplitude@newcap.eu +33 (0)1 44 71 94 94

NewCap Media Relations Nicolas Merigeau

amplitude@newcap.eu +33 (0)1 44 71 94 98

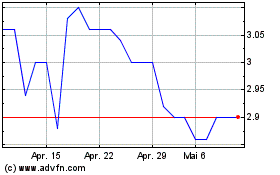

Amplitude Surgical (EU:AMPLI)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Amplitude Surgical (EU:AMPLI)

Historical Stock Chart

Von Apr 2023 bis Apr 2024