Ama: Stabilization transactions and partial exercise Over-allotment

Option and Liquidity provider

Stabilization transactions

and partial exercise

Over-allotment Option

and Liquidity provider

Rennes,

July 30 2021 –

Crédit Agricole Corporate and Investment Bank (“Crédit

Agricole CIB”), acting as the stabilization agent, has

exercised in part the over-allotment option, leading to the

issuance of 335,793 additional shares at the offer price, which is

€ 6.60 per share, representing a total amount of € 2,216,233.80,

including the premium.

As a result, the total number of AMA CORPORATION

PLC new shares offered in the context of its initial public

offering stands at 5,793,183 shares, bringing the size of the offer

to € 38,235,007.80.

After this issuance, AMA CORPORATION PLC share

capital comprises 22,455,815 ordinary shares.

The stabilization period that began on June 29,

2021 ended on July 30, 2021. In accordance with Article 6 of

Commission Delegated Regulation (EU) 2016/1052 of 8 March 2016,

Crédit Agricole CIB, acting as stabilizing agent, disclosed that it

had conducted stabilization transactions in the following price

ranges:

|

Execution Date |

Intermediary |

Buy/

Sell/ Transfer |

Number of

shares |

Average transaction Price (in euros) |

Lowest price/Highest price (in euros) |

Aggregate amount (in

euros) |

Stabilization trading venue |

|

2-Jul-21 |

Crédit Agricole CIB |

Buy |

25,617 |

6.60 |

6.60 / 6.60 |

169,072.20 |

Euronext Growth Paris |

|

5-Jul-21 |

Crédit Agricole CIB |

Buy |

84,130 |

6.60 |

6.60 / 6.60 |

555,258.00 |

Euronext Growth Paris |

|

6-Jul-21 |

Crédit Agricole CIB |

Buy |

1,613 |

6.60 |

6.60 / 6.60 |

10,645.80 |

Euronext Growth Paris |

|

7-Jul-21 |

Crédit Agricole CIB |

Buy |

3,292 |

6.60 |

6.60 / 6.60 |

21,727.20 |

Euronext Growth Paris |

|

8-Jul-21 |

Crédit Agricole CIB |

Buy |

14,746 |

6.60 |

6.60 / 6.60 |

97,323.60 |

Euronext Growth Paris |

|

9-Jul-21 |

Crédit Agricole CIB |

Buy |

702 |

6.60 |

6.60 / 6.60 |

4,633.20 |

Euronext Growth Paris |

|

12-Jul-21 |

Crédit Agricole CIB |

Buy |

30,387 |

6.5639 |

6.53 / 6.60 |

199,457.23 |

Euronext Growth Paris |

|

13-Jul-21 |

Crédit Agricole CIB |

Buy |

5,599 |

6.5738 |

6.54 / 6.60 |

36,806.71 |

Euronext Growth Paris |

|

15-Jul-21 |

Crédit Agricole CIB |

Buy |

19,839 |

6.5400 |

6.54 / 6.54 |

129,747.06 |

Euronext Growth Paris |

|

16-Jul-21 |

Crédit Agricole CIB |

Buy |

3,613 |

6.5400 |

6.54 / 6.54 |

23,629.02 |

Euronext Growth Paris |

|

19-Jul-21 |

Crédit Agricole CIB |

Buy |

12,885 |

6.5047 |

6.50 / 6.54 |

83,813.06 |

Euronext Growth Paris |

|

20-Jul-21 |

Crédit Agricole CIB |

Buy |

1,146 |

6.4975 |

6.48 / 6.50 |

7,446.14 |

Euronext Growth Paris |

|

21-Jul-21 |

Crédit Agricole CIB |

Buy |

1,000 |

6.4800 |

6.48 / 6.48 |

6,480.00 |

Euronext Growth Paris |

|

22-Jul-21 |

Crédit Agricole CIB |

Buy |

1,889 |

6.4706 |

6.46 / 6.48 |

12,222.96 |

Euronext Growth Paris |

|

23-Jul-21 |

Crédit Agricole CIB |

Buy |

274 |

6.4600 |

6.46 / 6.46 |

1,770.04 |

Euronext Growth Paris |

|

26-Jul 21 |

Crédit Agricole CIB |

Buy |

1,153 |

6.4587 |

6.45 / 6.46 |

7446.8811 |

Euronext Growth Paris |

|

27-Jul-21 |

Crédit Agricole CIB |

Buy |

232 |

6.5500 |

6.55 / 6.55 |

1519,6000 |

Euronext Growth Paris |

|

28-Jul-21 |

Crédit Agricole CIB |

Buy |

20 |

6.5500 |

6.55 / 6.55 |

131.0000 |

Euronext Growth Paris |

|

29-Jul-21 |

Crédit Agricole CIB |

Buy |

1,102 |

6.5427 |

6.52 / 6.55 |

7210.0554 |

Euronext Growth Paris |

|

30-Jul-21 |

Crédit Agricole CIB |

Buy |

708 |

6.5171 |

6.51 / 6.52 |

4614.1068 |

Euronext Growth Paris |

Kepler

Cheuvreux appointed as Liquidity

Provider

Guillemot Brothers Ltd., as shareholder holding

34.9% of AMA CORPORATION PLC share capital, has appointed Kepler

Cheuvreux as liquidity Provider. In the context of this liquidity

agreement Kepler Cheuvreux will act independently in order to

provide liquidity on AMA CORPORATION PLC shares.

The agreement shall enter into force on August

2, 2021 and end on December 2021, provided that it maybe tacitly

extended for a 12 month-period.

On the signing date of this agreement, Guillemot

Brothers Ltd. has transferred an amount of € 1,000,000 to Kepler

Cheuvreux for the purpose of the initial implementation of this

liquidity agreement.

About AMA

Whereas most collaborative working tools quickly

reach their limits once outside the office space, AMA allows

experts to work remotely with frontline workers using a secure

software platform associated with video tools perfectly tailored to

each business.

With nearly seven years’ experience in remote

assistance solutions, AMA helps industry and service providers of

all sizes, as well as medical establishments, to accelerate their

digital transformation. Deployed in more than 100 countries, AMA’s

assisted reality platform, XpertEye, addresses a wide range of use

cases such as remote diagnostics, inspection, planning and workflow

management. Its unique solutions for remote interactive

collaboration enable companies and institutions to increase

productivity, speed up resolution times and maximise uptime.

AMA is a fast-growing company with offices in

France, Germany, Romania, the United Kingdom, the United States,

Canada, and China (including Hong Kong). AMA has a global presence

and works across all time zones to forge close relationships with

its clients wherever they are. For more information, visit

www.amaxperteye.com.

Press contacts

Esther Duval +33 689 182 343 esther.duval@ama.bzhMarie Calleux

+33 609 685 538 ama@calyptus.net

Disclaimer:

This press release does not, and shall not, in

any circumstances constitute a public offering nor an offer to

subscribe or intended to solicit interest in contemplation of an

offer to the public.

No communication and no information in respect

of this transaction or of AMA Corporation PLC may be distributed to

the public in any jurisdiction where a registration or an approval

is required. No steps have been (or will be) taken in any

jurisdiction (other than France) where such steps would be

required. The issuance, the subscription for or the purchase of AMA

Corporation PLC’s shares may be subject to specific legal or

regulatory restrictions in certain jurisdictions. AMA Corporation

PLC assumes no responsibility for any violation of any such

restrictions by any person.

This press release is an advertisement and not a

prospectus within the meaning of Regulation (EU) 2017/1129 of the

European Parliament and the Council of 14 June 2017 (the

“Prospectus Regulation”). The prospectus approved

by the AMF is available on the AMF website (www.amf-france.org) and

the company’s website dedicated to the IPO

(www.amaxperteye.com).

The information in this press release is

provided for informational purposes only and does not purport to be

comprehensive and no person shall rely in any manner whatsoever on

the information contained herein or its accuracy, precision or

completeness. Any purchase of securities must be made solely based

on the information contained in the prospectus approved by the AMF

and published on the company’s and the AMF’s respective websites.

Potential investors are invited to read the prospectus before

making an investment decision in order to fully understand the

potential risks and benefits associated with the decision to invest

in the securities. The approval of the prospectus by the AMF should

not be understood as an endorsement of the securities offered or

admitted to trading on a regulated market.

France

In France, an offer of securities to the public

may only be made pursuant to a prospectus approved by the AMF.

European Economic Area and United

Kingdom

With respect to the member States of the

European Economic Area, other than France, and the United Kingdom,

(each, a “Relevant State”), no action has been

undertaken or will be undertaken to make an offer to the public of

the shares requiring a publication of a prospectus in any Relevant

State. Consequently, the securities cannot be offered and will not

be offered in any Relevant State (other than France), (i) to

qualified investors within the meaning of the Prospectus

Regulation, for any investor in a Relevant State, or pursuant to

Regulation (EU) 2017/1129 as part of national law under the

European Union (Withdrawal) Act 2018 (the “UK Prospectus

Regulation”), for any investor in the United Kingdom, (ii)

to fewer than 150 individuals or legal entities (other than

qualified investors as defined in the Prospectus Regulation or the

UK Prospectus Regulation, as the case may be), or (iii) in

accordance with the exemptions set out in Article 1(4) of the

Prospectus Regulation, or in the other case which does not require

the publication by AMA Corporation PLC of a prospectus pursuant to

the Prospectus Regulation, the UK Prospectus Regulation and/or

applicable regulation in these Relevant States.

United Kingdom

This press release does not constitute an offer

of the securities to the public in the United Kingdom. The

distribution of this press release is not made, and has not been

approved, by an authorized person within the meaning of Article

21(1) of the Financial Services and Markets Act 2000. As a

consequence, this press release is directed only at persons who (i)

are located outside the United Kingdom, (ii) have professional

experience in matters relating to investments and fall within

Article 19(5) of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005, as amended and (iii) are persons

falling within Article 49(2)(a) to (d) (high net worth companies,

unincorporated associations, etc.) of the Financial Services and

Markets Act 2000 (Financial Promotion) Order 2005 (the persons

mentioned under (i), (ii) and (iii) together “Relevant

Persons”). The securities of AMA Corporation PLC are

directed only at Relevant Persons and no invitation, offer or

agreements to subscribe, purchase or otherwise acquire the

securities of AMA Corporation PLC may be proposed or made other

than with Relevant Persons. Any person other than a Relevant Person

may not act or rely on this document or any provision thereof. This

press release is not a prospectus which has been approved by the

Financial Conduct Authority or any other United Kingdom regulatory

authority for the purposes of Section 85 of the Financial Services

and Markets Act 2000.

United States of America

This press release does not constitute or form a

part of any offer or solicitation to purchase or subscribe for

securities in the United States. Securities may not be offered or

sold in the United States unless they have been registered under

the U.S. Securities Act of 1933, as amended (the “U.S.

Securities Act”), or are exempt from registration. The

shares of AMA Corporation PLC have not been and will not be

registered under the U.S. Securities Act and AMA Corporation PLC

does not intend to make a public offer of its shares in the United

States.

The distribution of this press release in

certain countries may constitute a breach of applicable law. The

information contained in this document does not constitute an offer

of securities for sale in the United States of America, Canada,

Australia or Japan. This press release may not be published,

forwarded or distributed, directly or indirectly, in the United

States, Canada, Australia or Japan.

Stabilization

Crédit Agricole Corporate and Investment Bank,

acting as Stabilization Agent, may, (but is not bound under any

circumstances), until 30 July 2021 inclusive, in accordance with

the applicable laws and regulations, in particular those of the

Delegated Regulation No 2016/1052 of the European Commission of 8

March 2016 supplementing Regulation (EU) No 596/2014 of the

European Parliament European Union and the Council and concerning

the conditions applicable to buyback programs and stabilization

measures, to carry out stabilization operations in order to

stabilize or support the price of AMA Corporation PLC's shares on

the Euronext Growth market of Euronext Paris. In accordance with

Article 7 of Delegated Regulation No 2016/1052 of the European

Commission of 8 March 2016, stabilization operations may not be

carried out at a price higher than the Offer Price. Such

interventions may affect the price of the shares and may result in

the determination of a higher market price than would otherwise

prevail. Even if stabilization operations were carried out, Crédit

Agricole Corporate and Investment Bank could, at any time, decide

to discontinue such operations. The information will be provided to

the competent market authorities and to the public in accordance

with Article 6 of the abovementioned Regulation. Pursuant to the

provisions of Article 8 of the abovementioned Regulation, Crédit

Agricole Corporate and Investment Bank may make overallotments in

connection with the offer up to the number of shares covered by the

over-allotment option, plus, if applicable, a number of shares

representing 5% of the offer (excluding the exercise of the

over-allotment option).

Forward-Looking Statements

Certain information included in this press

release are not historical facts but are forward-looking

statements. These forward-looking statements are based on current

beliefs, expectations and assumptions, including, without

limitation, assumptions regarding present and future strategy of

AMA Corporation PLC and the environment in which AMA Corporation

PLC operates, and involve known and unknown risks, uncertainties

and other factors, which may cause actual results, performance or

achievements, or industry results or other events, to be materially

different from those expressed or implied by these forward-looking

statements. These risks and uncertainties include those set out and

detailed in Chapter 3 “Risk Factors” of the registration

document.

Forward-looking statements speak only as of the

date of this press release and AMA Corporation PLC expressly

disclaims any obligation or undertaking to release any update or

revisions to any forward-looking statements included in this press

release to reflect any change in expectations or any change in

events, conditions or circumstances on which these forward-looking

statements are based. Forward-looking information and statements

are not guarantees of future performances and are subject to

various risks and uncertainties, many of which are difficult to

predict and generally beyond the control of AMA Corporation PLC.

Actual results could differ materially from those expressed in, or

implied or projected by, forward-looking information and

statements.

Information to

distributors:

Solely for the purposes of the product

governance requirements contained within: (a) EU Directive

2014/65/EU on markets in financial instruments, as amended

(“MiFID II”); (b) Articles 9 and 10 of Commission

Delegated Directive (EU) 2017/593 supplementing MiFID II; and (c)

local implementing measures (together, the “MiFID II

Product Governance Requirements”), and disclaiming all and

any liability, whether arising in tort, contract or otherwise,

which any “manufacturer”(for the purposes of the MiFID II Product

Governance Requirements) may otherwise have with respect thereto,

the shares offered in the Offering (the “Offered

Shares”) have been subject to a product approval process,

which has determined that the Offered Shares are: (i) compatible

with an end target market of retail investors and investors who

meet the criteria of professional clients and eligible

counterparties, each as defined in MiFID II; and (ii) eligible for

distribution through all distribution channels as are permitted by

MiFID II (the “Target Market Assessment”).

Notwithstanding the Target Market Assessment, distributors should

note that: the price of the Offered Shares may decline and

investors could lose all or part of their investment; the Offered

Shares offer no guaranteed income and no capital protection; and an

investment in the Offered Shares is compatible only with investors

who do not need a guaranteed income or capital protection, who

(either alone or in conjunction with an appropriate financial or

other adviser) are capable of evaluating the merits and risks of

such an investment and who have sufficient resources to be able to

bear any losses that may result therefrom.

The Target Market Assessment is without

prejudice to the requirements of any contractual, legal or

regulatory selling restrictions in relation to the Offering.

For the avoidance of doubt, the Target Market

Assessment does not constitute: (a) an assessment for any

particular client of suitability or appropriateness for the

purposes of MiFID II; or (b) a recommendation to any investor or

group of investors to invest in, or purchase, or take any other

action whatsoever with respect to the Offered Shares.

Each distributor is responsible for undertaking

its own target market assessment in respect of the Offered Shares

and determining appropriate distribution channels.

Finally, this press release may be drafted both

in French and in English. The French version of this press release

shall prevail over the English version in the event of a

discrepancy.

- AMA_CP_RECAP_Stabilisation_EN

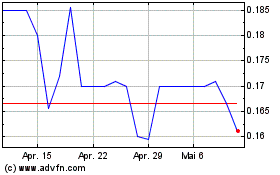

AMA (EU:ALAMA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

AMA (EU:ALAMA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024