Algoma Central Corporation Reports Operating Results for the 2021 First Quarter

05 Mai 2021 - 3:13PM

Business Wire

Algoma Central Corporation (“Algoma” or “the Company”) (TSX:

ALC), a leading provider of marine transportation services, today

announced its results for the quarter ended March 31, 2021. (All

amounts reported below are in thousands of Canadian dollars, except

for per share data and where the context dictates otherwise.)

First quarter 2021 business highlights include:

- A net loss for the quarter of $22,416, which is a reduction of

5% compared to a loss of $23,626 reported for the prior year.

- Global Short Sea Shipping segment earnings of $1,444 compared

to a loss of $2,187 in 2020. Freight rates and volumes continued to

rebound significantly in the mini bulker sector, driving a major

improvement in the results for the segment.

- Domestic Dry-Bulk segment revenues increased 16% to $24,552

compared to $21,095 in the prior year as the business unit was able

to take advantage of the extended navigation season and generally

milder winter conditions. Despite the increased revenues, operating

earnings for the segment were down 12% as winter maintenance and

dry-docking costs increased this year compared to 2020, when

maintenance activities were reduced and some costs were deferred to

later in the year in response to uncertainty associated with the

outbreak of COVID-19.

- Segment earnings for Product Tankers improved to $224 compared

to a loss in the prior year quarter of $1,546 due to lower dry-dock

spending; however, revenues were lower by 25% as the impact of

lower wholesale demand for gasoline products resulted in reduced

fleet utilization compared to 2020.

- The Ocean Self-Unloader segment completed its sole 2021

dry-docking at quarter-end, returning the vessel to on-hire status

in April. The dry-docking was completed earlier in the year than

originally planned in anticipation of continuing improvement in

volumes for the Pool over the course of the year. Earnings for the

segment were up modestly.

- Payment of the previously authorized $2.65 Special Dividend on

January 12, 2021 was followed by a 31% increase in the regularly

dividend to 17¢ per common share beginning with the March 1st

dividend.

EBITDA, which includes our share of joint venture EBITDA, for

the quarter ended March 31, 2021 was $6,651 a decrease of 13%

compared to the prior year. EBITDA deteriorated slightly compared

to 2020 primarily because increased winter maintenance spending in

Domestic Dry-Bulk offset modestly improved results in other

businesses. EBITDA is determined as follows:

For the periods ended March 31

2021

2020

Net loss

$

(22,416

)

$

(23,626

)

Depreciation and amortization

21,270

22,843

Interest and taxes

(4,787

)

(3,540

)

Foreign exchange gain

(210

)

(1,283

)

Gain on disposal of assets

(508

)

(273

)

EBITDA

$

(6,651

)

$

(5,879

)

"We have posted a solid first quarter for 2021,” said Gregg

Ruhl, President and CEO of Algoma Central Corporation, "despite

continued uncertainty about the pace of economic recovery from the

pandemic. It is especially heartening to see the solid recovery

shown in our Global Short Sea segment, as it was hit hard in 2020

by the economic fallout of COVID-19. A special recognition goes out

to our technical teams for their success completing significant

maintenance and improvement works this winter that will yield

immediate efficiencies and long-term sustainability for our fleet.

We look forward to the arrival of our newest and most efficient

Equinox class bulker, the Captain Henry Jackman, which left China

last week and will begin trading in July.” Mr. Ruhl concluded.

Outlook

We expect continued modest normalization in our Great Lakes and

Oceans dry-bulk business. While we do not expect to repeat the

strong grain volumes we saw in Domestic Dry-Bulk in 2020 in the

current year, we are expecting higher salt volumes and improvement

in the iron ore and aggregate businesses. Our Ocean Self-Unloader

fleet has completed its only scheduled dry-docking for 2021 and

should therefore be on-hire to the Pool for the balance of the year

and benefit from any improvement in Pool revenues. We do remain

cautious, however, regarding the outlook for the Product Tanker

business. A drop in utilization resulting from a general reduction

in gasoline product volumes is expected to continue for the balance

of the year. The extension of lock-downs in the key Ontario market

this Spring is likely to result in a delay before the fleet can

return to normal levels of utilization. Meanwhile, continuation of

the current rate environment in international markets would be very

positive for the Global Short Sea Shipping segment and we expect to

be able to take advantage of improved conditions in the purchase

and sale markets.

The cost environment will be more difficult in 2021 as the

Company makes significant investments in training and developing

its next generation of shipboard employees.

For the periods ended March 31

2021

2020

Revenue

$

77,599

$

85,097

Operating expenses

(80,989

)

(85,333

)

Selling, general and administrative

(8,510

)

(8,383

)

Depreciation and amortization

(17,493

)

(18,814

)

Operating loss

(29,393

)

(27,433

)

Interest expense

(5,317

)

(4,991

)

Interest income

27

186

Foreign currency gain (loss)

53

242

(34,630

)

(31,996

)

Income tax expense

10,742

9,633

Net loss from investments in joint

ventures

1,472

(1,263

)

Net Earnings

$

(22,416

)

$

(23,626

)

Basic earnings per share

$

(0.59

)

$

(0.62

)

Diluted earnings per share

$

(0.59

)

$

(0.62

)

For the periods ended March 31

2021

2020

Domestic Dry-Bulk

Revenue

$

24,552

$

21,095

Operating earnings

(29,686

)

(26,408

)

Product Tankers

Revenue

18,217

24,425

Operating earnings

224

(1,546

)

Ocean Self-Unloaders

Revenue

32,496

36,377

Operating earnings

4,369

3,650

Corporate and Other

Revenue

2,334

3,200

Operating loss

(4,300

)

(3,129

)

The MD&A for the quarter ended March 31, 2021 includes

further details. Full results for the quarter ended March 31, 2021

can be found on the Company’s website at

www.algonet.com/investor-relations and on SEDAR at

www.sedar.com.

Normal Course Issuer Bid

On March 19, 2021, the Company renewed its normal course issuer

bid with the intention to purchase, through the facilities of the

TSX, up to 1,890,457 of its Common Shares ("Shares") representing

approximately 5% of the 37,800,943 Shares which were issued and

outstanding as at the close of business on March 8, 2021 (the

“NCIB”). No shares have been purchased to date under this NCIB.

Cash Dividends

The Company’s Board of Directors has authorized payment of a

quarterly dividend to shareholders of $0.17 per common share to be

paid on June 1, 2021 to shareholders of record on May 18, 2021.

2021 Annual General & Special Meeting of

Shareholders

We would like to remind all shareholders that Algoma’s Annual

General and Special Meeting of Shareholders will be held in a

virtual-only format via a live webcast available at

www.virtualshareholdermeeting.com/ALC2021, on Wednesday, May

5, 2021 at 11:30 a.m. (EDT). Registered shareholders and duly

appointed proxyholders will have an equal opportunity to attend,

participate and vote at this virtual Meeting from any location.

Non-registered (beneficial) shareholders who have not duly

appointed themselves as proxyholders may also attend the Meeting

virtually and ask questions but will not be able to vote. Guests

will be able to attend virtually and listen to the Meeting but will

not be able to vote or ask questions during the Meeting. A summary

of the information shareholders will need in order to attend,

participate and vote at the Meeting is provided in the How to Vote

section of our Management Information Circular.

Use of Non-GAAP Measures

There are measures included in this press release that do not

have a standardized meaning under generally accepted accounting

principles (GAAP). The Company includes these measures because it

believes certain investors use these measures as a means of

assessing financial performance. EBITDA is a non-GAAP measure that

does not have any standardized meaning prescribed by IFRS and may

not be comparable to similar measures presented by other companies.

Please refer to the Management’s Discussions and Analysis for the

quarter ended March 31, 2021 for further information regarding

non-GAAP measures.

About Algoma Central

Algoma owns and operates the largest fleet of dry and liquid

bulk carriers operating on the Great Lakes - St. Lawrence Waterway,

including self-unloading dry-bulk carriers, gearless dry-bulk

carriers, cement carriers, and product tankers. Algoma also owns

ocean self-unloading dry-bulk vessels operating in international

markets and a 50% interest in NovaAlgoma, which owns and operates a

diversified portfolio of dry-bulk fleets serving customers

internationally.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210505005647/en/

Gregg A. Ruhl President & CEO 905-687-7890

Peter D. Winkley Chief Financial Officer 905-687-7897

Or visit www.algonet.com or www.sedar.com

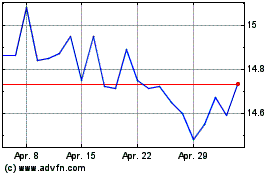

Algoma Central (TSX:ALC)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Algoma Central (TSX:ALC)

Historical Stock Chart

Von Apr 2023 bis Apr 2024