Adidas-Backed Spinnova Prices IPO with Initial Market Capitalization of EUR390 Million

23 Juni 2021 - 4:01PM

Dow Jones News

By Ian Walker

Finnish sustainable textile material company Spinnova Oyj has

priced its initial public offering, implying a market

capitalization of 390 million euros ($465.8 million) when it starts

trading on the Nasdaq Helsinki First North Growth Market.

Spinnova has set its pricing at EUR7.61 a share. The company has

raised EUR100 million of new money as part of its IPO, which could

increase to EUR115 million if an over-allotment option is exercised

by Carnegie Investment Bank AB, which is acting as stabilizing

manager.

Trading in the company's shares is expected to start on June

24.

Spinnova Oyj said earlier this month that Adidas AG had agreed

to invest EUR3 million in the company's initial public offering. It

said at the time that Spinnova has a continuing collaboration with

Adidas and the investment secures access to significant volumes of

Spinnova materials in the future.

Spinnova has developed technology to make textile fiber out of

wood or waste, such as leather, textile or food waste, without

harmful chemicals.

It said its patented Spinnova fiber creates zero waste and side

streams or microplastics, and involves minimal CO2 emissions and

water use.

The company's cornerstone investors include certain funds

managed by entities owned by Aktia Bank PLC, certain funds managed

by WIP Asset Management Ltd, certain funds managed by DnB Fund

Management, Ilmarinen Mutual Pension Insurance Company, certain

funds managed by Pareto Asset Management, certain funds managed by

Sp-Fund Management Company Ltd and adidas Ventures BV.

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

June 23, 2021 09:47 ET (13:47 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

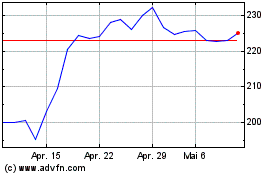

Adidas (TG:ADS)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

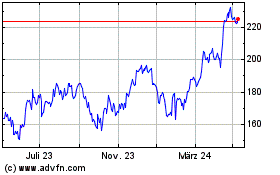

Adidas (TG:ADS)

Historical Stock Chart

Von Apr 2023 bis Apr 2024