- End of stabilization operations with partial exercise of the

over-allotment option

- Total amount of the offering increased to EUR 70.4

million

- Implementation of a liquidity contract with NATIXIS ODDO

BHF

Regulatory News:

This document may not be distributed, directly

or indirectly, in the United States, Canada, Australia or

Japan.

AFYREN, a greentech company that offers manufacturers

natural and low-carbon products produced using a technology based

on natural micro-organisms (Paris:ALAFY) (ISIN code: FR- 0014005AC9

mnemonic: ALAFY), has received notification that Joh. Berenberg,

Gossler & Co. KG (Kommanditgesellschaft) (limited

partnership)(“Berenberg”), registered with the Commercial Register

(Handelsregister) of the Local Court (Amtsgericht) of Hamburg under

HRA 42659, acting as Stabilisation Manager in the context of the

first admission to trading of ordinary shares of AFYREN on Euronext

Growth Paris, has undertaken stabilization activities in relation

to the first admission to trading on Euronext Growth Paris of the

following securities:

Issuer:

AFYREN

Securities:

Ordinary shares with a par value of EUR

0.02.

(ISIN: FR0014005AC9)

Offering Size:

8,286,359 ordinary shares (excluding the

overallotment option)

Offer Price:

EUR 8.02 per ordinary share

Market:

Euronext Growth (Paris)

Stabilisation Manager:

Joh. Berenberg, Gossler & Co. KG

(“Berenberg”)

Notification of details of stabilisation transactions in

accordance with Article 6 (2) DelReg (EU) 2016/1052

Pursuant to Article 6, paragraph 2, of Commission Delegated

Regulation (EU) 2016/1052, AFYREN, on the basis of the information

disclosed by Berenberg, hereby communicates that Berenberg has

carried out, during the time period from 1 October 2021 until and

including 29 October 2021, stabilisation measures as further

specified below:

Execution Date

Intermediary

Stabilisation Trading Venue

Buy / Sell

Lowest price (in EUR)

Highest price (in EUR)

Weighted average price (in EUR)

Aggregate amount (in EUR)

Daily total of shares

01.10.2021

Berenberg

Euronext Growth (Paris)

Buy

7.3500

8.0200

7.7421

596,854.40

77,092

04.10.2021

Berenberg

Euronext Growth (Paris)

Buy

7.1400

7.8800

7.4878

112,256.79

14,992

05.10.2021

Berenberg

Euronext Growth (Paris)

Buy

6.9900

7.6300

7.2297

55,964.79

7,741

06.10.2021

Berenberg

Euronext Growth (Paris)

Buy

6.8200

7.5500

7.3845

205,325.36

27,805

07.10.2021

Berenberg

Euronext Growth (Paris)

Buy

7.1300

7.6000

7.5585

164,102.89

21,711

08.10.2021

Berenberg

Euronext Growth (Paris)

Buy

7.3600

7.6100

7.5788

113,500.81

14,976

11.10.2021

Berenberg

Euronext Growth (Paris)

Buy

7.5500

7.8000

7.7744

103,788.34

13,350

12.10.2021

Berenberg

Euronext Growth (Paris)

Buy

7.5000

7.9000

7.8725

118,575.12

15,062

13.10.2021

Berenberg

Euronext Growth (Paris)

Buy

7.7500

7.9400

7.9309

109,667.98

13,828

14.10.2021

Berenberg

Euronext Growth (Paris)

Buy

7.6800

7.9500

7.8775

113,341.62

14,388

15.10.2021

Berenberg

Euronext Growth (Paris)

Buy

7.7100

7.9800

7.9671

131,703.78

16,531

18.10.2021

Berenberg

Euronext Growth (Paris)

Buy

7.8300

7.9800

7.9720

110,555.90

13,868

19.10.2021

Berenberg

Euronext Growth (Paris)

Buy

7.8200

7.9800

7.9427

107,798.43

13,572

20.10.2021

Berenberg

Euronext Growth (Paris)

Buy

7.8200

8.0200

7.9958

115,859.40

14,490

21.10.2021

Berenberg

Euronext Growth (Paris)

Buy

7.9500

8.0200

8.0106

49,177.22

6,139

22.10.2021

Berenberg

Euronext Growth (Paris)

Buy

7.8500

8.0200

7.9828

16,723.99

2,095

25.10.2021

Berenberg

Euronext Growth (Paris)

Buy

7.9200

8.0200

7.9790

9,606.69

1,204

26.10.2021

Berenberg

Euronext Growth (Paris)

Buy

7.9400

8.0200

8.0103

29,758.09

3,715

27.10.2021

Berenberg

Euronext Growth (Paris)

Buy

7.9400

8.0200

8.0100

35,724.71

4,460

28.10.2021

Berenberg

Euronext Growth (Paris)

Buy

7.9900

8.0200

8.0164

9,395.27

1,172

29.10.2021

Berenberg

Euronext Growth (Paris)

Buy

8.0200

8.0200

8.0200

4,114.26

513

Notification of the end of stabilization measures in

accordance with Article 6 (3) DelReg (EU) 2016/1052

The stabilisation period, which began on 1 October 2021, ended

on 30 October 2021. During this stabilisation period, stabilisation

was carried out in respect of a total number of 298,704 shares in a

price range between EUR 6.8200 (lowest price) and EUR 8.0200

(highest price) solely on Euronext Growth (Paris).

Further details regarding all stabilisation transactions carried

out during the stabilisation period can be found on AFYREN’s

website dedicated to the IPO (https://www.afyren-finance.com/).

Notification of the exercise of the partial exercise of the

Greenshoe-Option in accordance with Article 8 lit. f) DelReg (EU)

2016/1052

In addition, on 30 October 2021, Berenberg acting as stabilizing

agent, acting on its own and on behalf of the Joint Global

Coordinators, exercised in part the over-allotment option to

purchase 490,473 existing shares from the Selling Shareholders at

the initial public offering price of €8.02 per share corresponding

to a total amount of approximately €3.9 million.

As a result, the total number of AFYREN shares sold in its

initial public offering amounts to 8,776,832 shares, including

8,286,359 new ordinary shares and 490,473 existing shares, bringing

the total offering size to €70.4 million

After the exercise of the over-allotment option, AFYREN’s public

float amounts to 16.36% of its total share capital.

Following the offering and the exercise of the over-allotment

option, AFYREN’s share capital will be held as follows:

Shareholders1

After the Exercise of the

Over-Allotment Option

Number of shares

% of share capital and voting

rights

AFY Partners

4 412 425

17.13%

Nicolas Sordet

375 294

1.46%

Jérémy Pessiot

702 794

2.73%

Régis Nouaille

1 558 250

6.05%

Sofinnova Industrial Biotech I

3 313 273

12.86%

Hedgescope Ltd

2 879 950

11.18%

Sofimac Partners

1 219 415

4.73%

Other

3 263 544

12.67%

Mirova

2 164 802

8.40%

BPI

1 657 271

6.43%

Public

4 215 006

16.36%

TOTAL

25 762 024

100.00%

1 On a non-diluted basis

This press release is issued also on behalf of Berenberg

pursuant to Article 6, paragraph 2, of Commission Delegated

Regulation (EU) 2016/1052.

Implementation of a Liquidity Contract with NATIXIS ODDO

BHF

AFYREN announces having appointed NATIXIS and ODDO BHF SCA to

implement a liquidity contract, starting on 1st November 2021, for

a period of one year tacitly renewable.

This contract complies with the decision of the Autorité des

marchés financiers (AMF) n°2021-01 of June, 22 2021 related to the

establishing of liquidity contracts on shares as accepted market

practice and the standard contract of the Association française des

marchés financiers (AMAFI).

This contract with NATIXIS ODDO BHF aims at improving Company’s

shares trading on the regulated market of Euronext Paris.

The following resources have been allocated to the liquidity

account:

The execution of the liquidity contract may be suspended upon

occurrence of the following events or conditions:

- when all conditions provided in Article 5 of the AMF Decision

n°2021-01 June 22, 2021 are met;

- if the share is listed outside the thresholds authorized by the

Company’s Shareholders’ Meeting;

- upon the Company request.

The liquidity contract may be terminated at any time and without

prior notice by AFYREN, at any time by NATIXIS and/or ODDO BHF SCA

subject to fifteen (15) calendar days' notice.

About AFYREN

To meet the growing need for manufacturers to address global

warming and reduce the use of petroleum derivatives in their

production chains, AFYREN produces biomolecules derived from the

recycling of non-food biomass, widely used in the human and animal

nutrition, flavours and fragrances, life sciences, material

sciences and lubricant sectors. This renewable carbon production is

part of a sound circular economy process achieved through the use

of globally patented fermentation technologies developed on the

basis of ten years of research. Founded in 2012 and managed by

Nicolas Sordet and Jérémy Pessiot, AFYREN had 33 employees at its

sites in Lyon, Clermont-Ferrand and Carling Saint-Avold at the end

of December 2020. AFYREN is the winner of the 2030 Global

Innovation Competition in the "Plant proteins and plant chemistry"

category and was selected in the French Tech120 in January 2020 and

2021. In 2018, AFYREN embarked on the construction of its

industrial-scale plant AFYREN NEOXY, which takes the form of a

joint venture with the SPI fund for industrial projects companies

managed by Bpifrance. AFYREN NEOXY will oversee the first

industrial-scale production of AFYREN natural organic acids in the

Grand Est region.

For more information: afyren.com

Warning

This announcement does not, and shall not, in any circumstances

constitute a public offering or an invitation to the public in

connection with any offer in France, United Kingdom, United States,

Canada, Australia, Japan or any other country.

No communication and no information in respect of this

transaction or of AFYREN may be distributed to the public in any

jurisdiction where a registration or approval is required.

This announcement is not a prospectus within the meaning of

Regulation (EU) 2017/1129 of the European Parliament and the

Council of 14 June 2017 (the “Prospectus Regulation”). The

prospectus approved by the AMF is available on the AMF website

(www.amf-france.org/) and the company’s website dedicated to the

IPO (https://www.afyren-finance.com/).

The distribution of this announcement is not made, and has not

been approved, by an authorized person (“authorized person”) within

the meaning of Article 21(1) of the Financial Services and Markets

Act 2000. As a consequence, this announcement is directed only at

persons who (i) are located outside the United Kingdom, (ii) have

professional experience in matters relating to investments and fall

within Article 19(5) (“investment professionals”) of the Financial

Services and Markets Act 2000 (Financial Promotions) Order 2005 (as

amended) and (iii) are persons falling within Article 49(2)(a) to

(d) (high net worth companies, unincorporated associations, etc.)

of the Financial Services and Markets Act 2000 (Financial

Promotion) Order 2005 (all such persons together being referred to

as “Relevant Persons”). This announcement is not a prospectus which

has been approved by the Financial Conduct Authority or any other

United Kingdom regulatory authority for the purposes of Section 85

of the Financial Services and Markets Act 2000.

Securities may not be offered or sold in the United States

unless they have been registered under the U.S. Securities Act of

1933, as amended (the “U.S. Securities Act”), or are exempt from

registration. AFYREN does not intend to make a public offer of its

shares in the United States.

The distribution of this document in certain countries may

constitute a breach of applicable law. The information contained in

this document does not constitute an offer of securities for sale

in Canada, Australia or Japan. This announcement may not be

published, forwarded or distributed, directly or indirectly, in the

United States, Canada, Australia or Japan.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211101005386/en/

AFYREN Finance Department Maxime Cordonnier

investisseurs@afyren.com

Investor Relations NewCap Theo Martin Tel: +331 44

71 94 94 afyren@newcap.eu

Media Relations NewCap Nicolas Merigeau Tel: +331

44 71 94 98 afyren@newcap.eu

Alter’Com Conseil Estelle Monraisse Tel: +331 60 41 81 52

estelle@altercom-conseil.fr

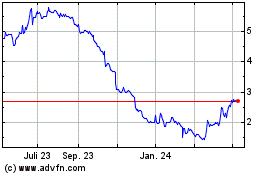

Afyren (EU:ALAFY)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

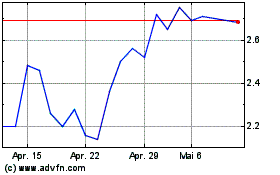

Afyren (EU:ALAFY)

Historical Stock Chart

Von Apr 2023 bis Apr 2024